Gold Price Forecast: Gold's Potential Upside

Last week's trading saw gold once again forming its high in Monday's session, here doing so with the tag of the 1898.00 figure (December, 2020 contract). From there, a sharp decline was seen into Thursday's session, with the metal dropping all the way down to a low of 1850.00 - before bouncing off the same into midday on Friday.

Gold, Short-Term

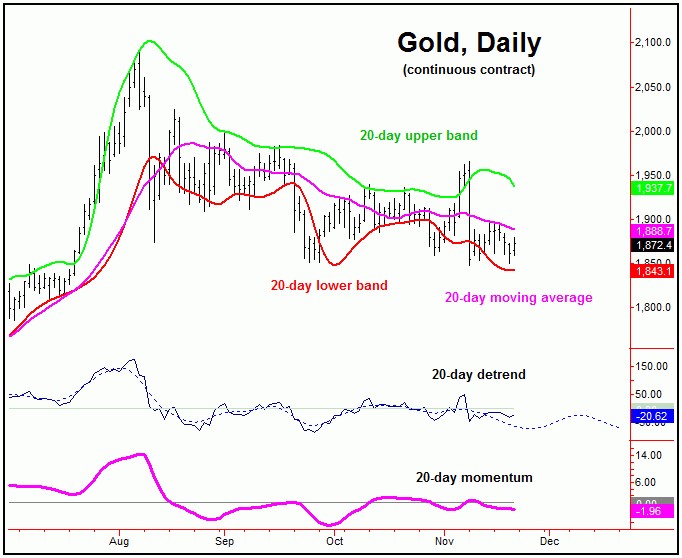

One of the smaller cycles that we track is the nominal 20-day wave, which is at or into bottoming range, and is shown below:

With the action seen on Friday, there is the potential that this wave bottomed out with the recent tag of the 1850.00 figure. Having said that, this is too early to confirm, thus leaving the door open to a potential lower low before its next trough is set in place. If lower lows are still out there, then key support looks to be around the 1833 figure for the December contract, which is plus or minus a few points in either direction.

Going further with the above, from whatever low that is seen with this 20-day wave, a pretty decent short-term rally phase should be seen on the next swing up, one which takes gold back to its 20-day moving average, at minimum.

Having said that, in looking at this 20-day chart, of note is that the upward phases of this wave will normally make a tag (or at least a hard try at) the upper 20-day cycle band. That band is currently at the 1937 figure, but is declining daily. Thus, this gives us some ideal of the upside potential for the short-term, once this wave turns higher.

Short-Term Patterns

Until proven otherwise, the current assumption is that the next rally phase with the aforementioned 20-day cycle will end up as countertrend, holding below the 1966.10 swing top. This is due to the left-translated peak with the larger 72-day cycle, which is shown below:

In terms of time, the last trough for this 72-day wave was projected for late- September, which is where it bottomed - doing so with the 9/24/20 tag of the 1851.00 figure. Its next low - if made on schedule - is projected for mid-to-late December, and is now the next odds-on favorite timeframe to bottom the larger swing down.

With the above said and noted, we are looking for a short-term rally in the days ahead, coming from the 20-day cycle, though - due to the position of the larger 72-day wave - the probabilities tend to favor that rally to end up as countertrend, giving way to a drop back to or below the lows into mid-to-late December.

Gold's (Mid-Term) Upside Potential

Even with the decline seen off the early-August peak, our analysis shows that the larger bull market is still intact for gold, and is expected to remain so into at least next year, though, potentially, into the 2022 timeframe or beyond.

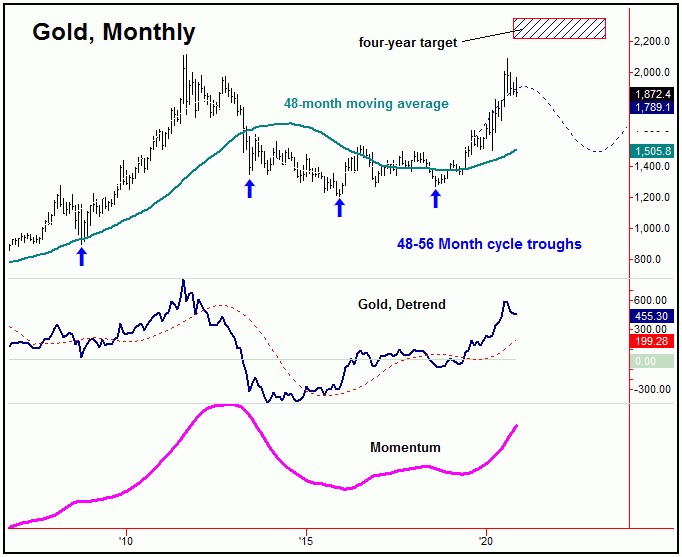

As for the upside price potential going forward, we only need to look at our four-year cycle for gold, which is shown again on the chart below:

The above chart shows our four-year wave, which is next projected to trough around the year 2023. Going further, both the momentum and detrend indicators are pushing higher at the present time, meaning that the upward phase of this wave is still intact.

Going further with the above, our detrend indicator can also provide longer-term trend signals for gold. That is, the best long-term buy signals for the metal come when the detrend moves above its red dashed 'trigger' line - something which last came back in June of 2019.

As mentioned in past months, there is an open cyclic target from this four-year cycle to the 2212.00 - 2340.56 region for gold. With that, we have some idea of upside potential in the coming months. The downside 'risk' appears to be to the mid-1700's, and thus - with the low-end four-year target to the 2200's, there is nearly a 3 to 1 upside potential vs. downside risk in the coming months.

With the above said and noted, we are continuing to favor buying opportunities into weakness, in the anticipation of an eventual push into our four-year target zone in the months ahead - though we anticipate the move to be a rocky ride.

The Bottom Line

The overall bottom line is that the short-term trend is bottoming, with the next decent rally phase due to materialize soon - and coming from the 20-day cycle. Until proven otherwise, that move would be favored to end up as countertrend, giving way to lower lows - before re-attempting a bottom for the larger swing. For the mid-term picture, the overall assumption is that gold is headed to an eventual test of the 2200-2350 region going forward, before the next long-term peak is set in place - which is expected from our largest tracked wave, the four-year component. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/