Gold Price Forecast: Run-Of-The-Mill Midst Elections Uncertainty

There are only a few more days left until the 59th quadrennial presidential election take place, which means that President Trump and his Democratic counter candidate Joe Biden are in their final week of the electoral race. Globally, precious metals investors are uncertain on how to determine whether the election results will significantly impact precious metals prices and if the people’s choice will be a rewarding one for gold.

Nevertheless, major forthcoming market moves will occur, and gold will remain the ultimate winner, regardless of who wins the elections. In a year such as 2020, we can’t attribute market reactions only according to the candidate that wins the elections. Besides the President and the obvious elephant in the room in the form of COVID-19, many other fundamentals need to be considered for precious metals.

Namely, in my previous analyses, I’ve made quite a few comments on the current factors that support and determine the precious metals market outlook, and there’s little to add on top of that, as nothing significant happened so far this week. But, whatever happened, was in tune with what we’ve predicted earlier, and the current silence of gold actually provides us with several insights.

We are aware that gold sustains its momentum for the fourth day in a row – that is, at least based on what’s happening in today’s pre-market trading.

So, does that seems boring to you? Indeed, since everything remains evidently the same. How about informative? Well, it does tell us more than it meets the eye.

As I’ve discussed in one of the previous analyses, due to the looming presidential elections in the U.S, we’re living in ambiguous times. Because of that, gold should get a significant boost. After all, it’s a safe-haven metal. Or, at least it’s perceived as one.

Despite this theoretical tendency, gold is either unwilling to move higher, or the current prices are already the “boosted” ones. Nevertheless, both are bearish pieces of information as they indicate that once the post-election dust settles, gold is likely to lose its current boost. Perhaps the additional decline will be triggered due to the lack of uncertainty.

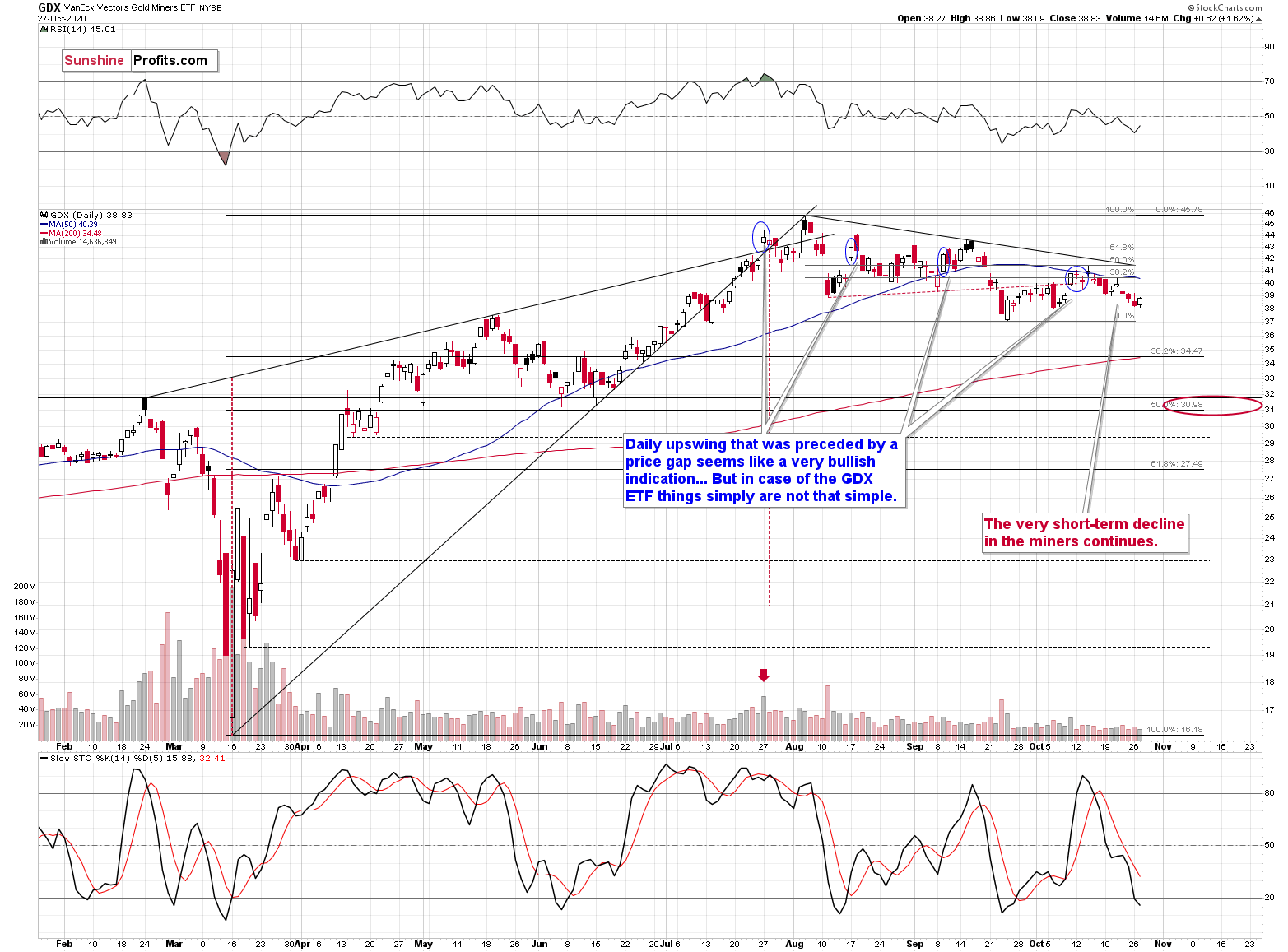

In the meantime, by being weak relative to gold, miners continue with their bearish indications. Gold did pretty much nothing over the last three days (not counting yesterday’s upswing). And how did miners respond?

Overall, miners declined. Yes, they moved higher yesterday, but they are still visibly below their October 22nd closing price, whereas gold closed practically at the same level yesterday.

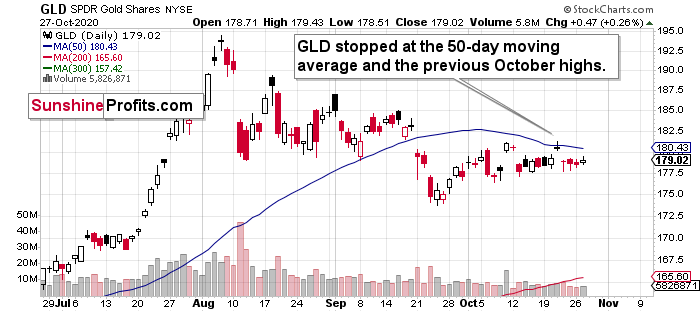

To make the apples-to-apples comparison, let’s focus on the way GDX reacted to GLD’s movement. The former ETF represents the gold miners, and the latter – of course – gold. The useful characteristic of the GLD ETF here is that its closing time is precisely the same as the closing time for the GDX ETF. This is not the case with gold’s continuous futures contracts.

The GLD ETF closed at $178.83 on October 22nd, and it closed at $179.02 yesterday. In other words, it moved higher very insignificantly (about 0.11%).

During the same time, the GDX ETF moved from $39.19 to $38.83 – it declined by about 0.92%. This move is not gargantuan either, but it’s notable, and most importantly the direction of both moves is opposite.

This means that miners continue to be weak relative to gold, which means the bearish implications of this link remains intact. Moreover, given today’s pre-market move lower in gold, it seems likely that miners’ yesterday’s upswing will soon be erased as well.

To sum things up, even though prices moved higher in previous months, the following weeks are possibly not the best time for jumping on the bullish bandwagon. As many times before, what’s profitable initially is rarely the thing that pays off in the long-run. As silver often moves in close relation to the yellow metal, forecasting gold’s rally without a bigger decline first is likely to be misleading.

The times when gold is lastingly trading well above the 2011 highs will come again, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing, and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up for our FREE gold newsletter for daily updates. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,