Gold Price Forecast - Taking A Cue from Rhodium, But Not The One You Think

Rhodium, that’s hardly a metal on everyone’s radar screen. Yet even a tiny market can send valuable signals important to precious metals investors. And that’s the case with this little-known metal. Its performance been making palladium look like a laggard – so, what’s the message to take out here?

And no, it’s not connected to coronavirus in any way.

Many people never heard of it and it’s hardly a surprise. You know that palladium and platinum markets are tiny compared to silver, which in turn, is small compared to gold’s market. Well, rhodium’s market is about a tenth of the size of palladium or platinum. Rhodium isn’t traded on exchanges and the market for coins and bars is very, very small. Rhodium is mined as a byproduct of platinum and nickel and its mainly used in autocatalysts. There are other applications as well (Swarovski jewelry is often rhodium-plated for instance).

The most interesting thing about rhodium is how much it rallied recently.

This month, without a major shift in its supply or demand, rhodium soared to its new all-time high above $10,000, greatly outperforming other precious metals and almost every other asset. It’s not very far above its July 2008 high, so rhodium prices are very vulnerable to a sudden selloff. The situation will become bearish only after the breakout to new highs is invalidated, but given the parabolic nature of rhodium’s rally, the move higher looks very unsustainable.

The drop that followed the 2008 top was extremely sharp so everyone invested in rhodium right now might want to consider moving their capital somewhere else.

The demand coming from Asia is big, but this doesn’t justify the near-vertical price rally. This demand wasn’t absent just a year ago and yet rhodium was not skyrocketing as it is right now. Rhodium seems to be in a price bubble that’s likely to pop.

There are very interesting implications for the precious metals market in general as well. You see, one of the trading tips in general that is particularly useful on the PM market is that the tiny and most volatile parts of a given market tend to behave very specifically. Juniors, for instance, tend to outperform senior mining stocks in the final parts of upswings. Rhodium, being the tiny part of the PM market, could be showing us that what we see in the precious metals marker right now, is a medium-term top.

That’s the theory, but did this theory work in 2008, when rhodium topped?

You bet it did.

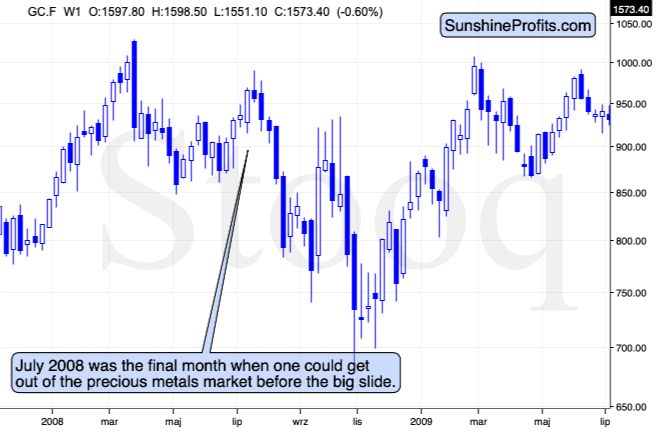

Rhodium topped in July, 2008 and that was when gold formed the final high before one of the sharpest and biggest plunges of the past decades. In case of silver and mining stocks, it was the beginning of THE sharpest decline of the recent decades.

There are very few analogies that could be more bearish than the one that rhodium is now featuring.

Actually, given the fact that volume on which the 2008 top formed and volume on which gold topped recently are relatively similar (gold volume spiked in both cases), the above analogy is confirmed. Additional confirmation comes from the fact that in both: 2008 and 2020, gold tried to rally to the previous highs, and failed to reach them. In 2008, rhodium soared during this second attempt, and this is exactly the case right now. The analogy is clear and extremely bearish.

Summary

We have explored interesting parallels between the rhodium spike in 2008 and the one unfolding currently. Set against the backdrop of gold performance then, it carries a warning for gold bulls now. Gold is moving higher and rhodium is soaring- now, just like it did back in 2008. As that preceded a sizable gold drop then, it sends a bearish message now.

The following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,