Gold Price Forecast - The Upcoming Gold Move And Its Euro Signal

As the drive to end lockdowns and reopen presses ahead, risk on assets rally in anticipation of the V-shaped recovery into the Promised Land. What about price and demand for gold, can it suffer a short-term setback in this environment? How low could the yellow metal sink as it bottoms out?

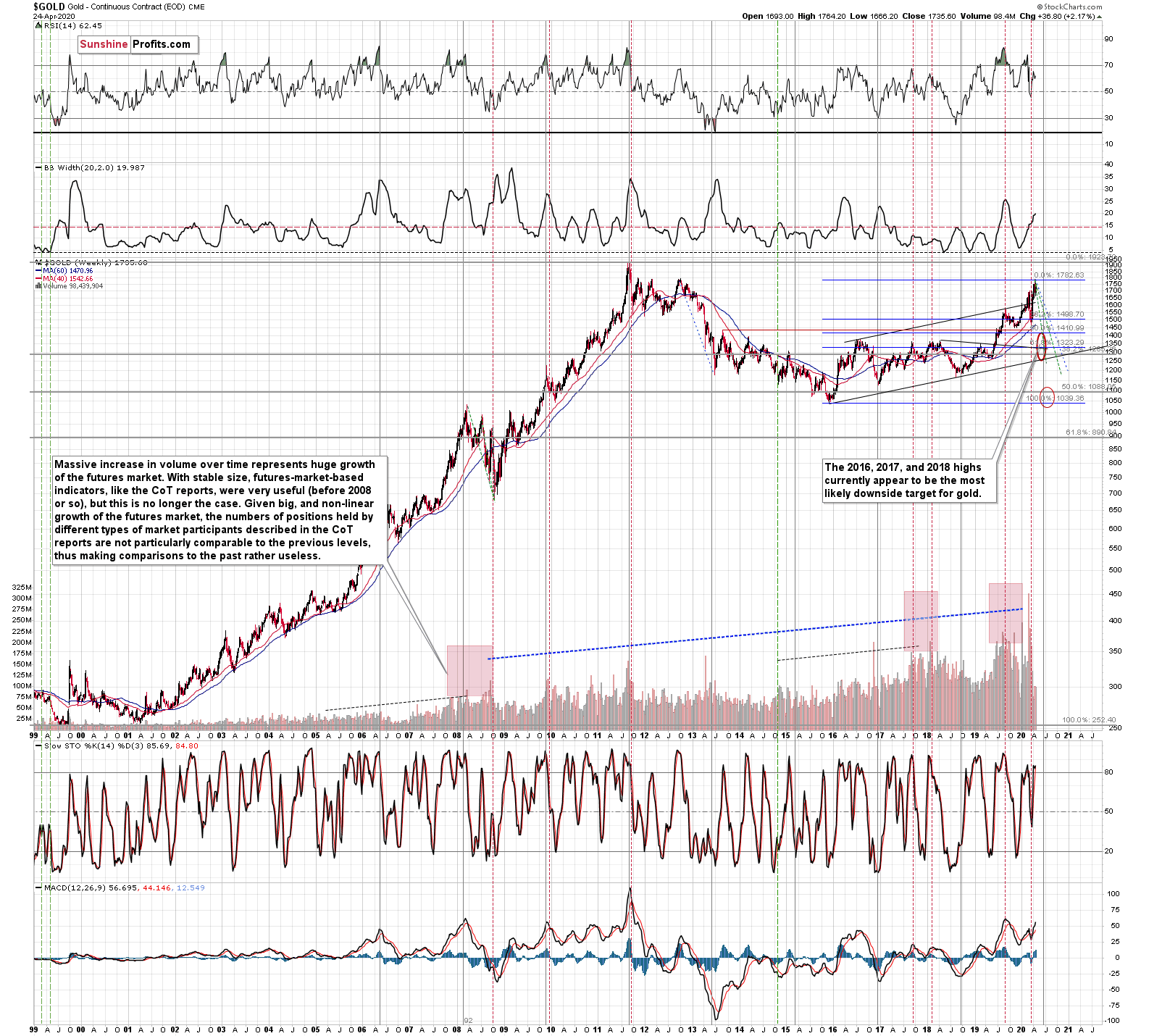

Our current (and it might change in the following days) estimate is that gold would decline to the 2016, 2017, and 2018 lows – slightly below $1,400. Why? Because this level is confirmed by several major highs, which makes it the strongest support that’s below the previous 2020 lows.

Moreover, back in 2008, gold bottomed about 8% below its initial September bottom. The recent bottom in gold was about $1,451. If the history repeats itself, gold could decline to 92% x $1,451 = about $1,335.

In 2008, gold also declined by about 27% from its previous high. If the history repeats itself here, and gold topped yesterday (which seems quite likely), we can see gold’s bottom at 73% x $1,789 = about $1,306.

The 2016, 2017, and 2018 highs are the strongest gold support that we have close to the above-mentioned price levels. Gold’s fundamental situation is even better now than it was in 2008, so we think that looking for the support above the above-mentioned 2008-based price levels is more appropriate than basing it the above-mentioned gold trading tips. The 2016, 2017, and 2018 highs fulfill this requirement.

This means that gold would be likely to bottom between about $1,350 and $1,380.

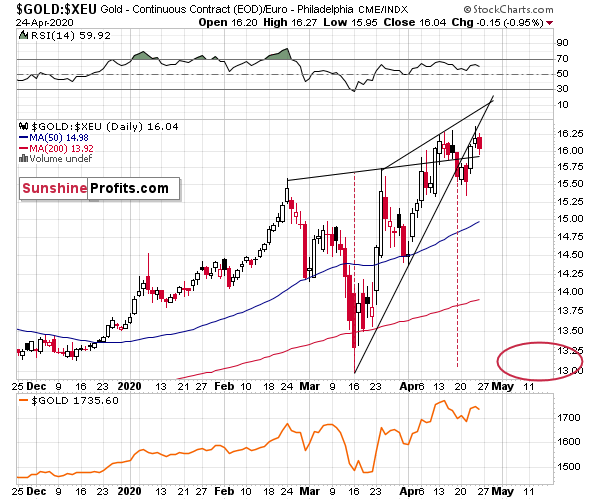

In other news, gold just invalidated its breakout above the previous highs in terms of the euro, and it also broke below the rising support line, which by itself is a lower border of the rising wedge pattern.

That’s a very bearish sign as it means that gold is likely to continue to magnify USD’s rallies as it declines.

As you can see, despite last week’s rally, gold was unable to get back above the rising resistance line. Instead, gold topped at this line and at its previous April highs.

Interestingly, the vertex of the rising wedge pattern is today, suggesting that perhaps we’ll see some kind of price extreme within the next several hours. This means that perhaps today’s weakness in both: gold and the USD Index will be at least to some extent reversed and we’ll see gold make another attempt to move higher. The latter would could result in either the final high, or a local high. Either way, the gold price in terms of the euro would be likely to decline shortly thereafter.

Before summarizing, we would like to reply to one of the questions that we recently received. It was about the potential appeal of gold in times when people have to focus on getting the means to survive. After all, one can’t eat gold, and it provides little protection from cold or rain… Here’s our take:

Some people have to raise cash to meet their basic needs, but at the same time, some people are thinking hard how to save their millions of dollars from significant inflation that’s likely to follow the current massive “money-printing programs”. Some people are somewhere in between. And some people will aim to speculate on every short-term move that the three previous groups generate regardless of the real situation in the world.

The actions of the latter group imply that in the short run, gold can do pretty much anything. It can slide, and it can rally.

We don’t agree with the storage argument against gold. Gold, and even silver (which is bulkier) can easily be stored almost anywhere, not only in banks. Crude oil takes up a lot of space, while gold or silver don’t. Besides, almost all gold that has ever been mined in history still remains in one way or the other, while crude oil and silver are used up.

If people expect that the value of their currency will be worth significantly less next year and they have already bought enough food (that won’t spoil) for months, then protecting their assets (and cash) will be a very urgent need. And gold will become very appealing not only for the millionaires from our previous example. Gold won’t provide rent or dividend itself, but it might save one’s capital against depreciation better than real estate or stocks. Real estate to some extent as well, but gold is likely to not just preserve ones wealth during very inflationary periods – it’s also likely to increase it. Especially, in case of stagflationary environments, and we think that we’re heading toward this kind of environment fast.

Still… the above question provides a very good insight into why gold might decline temporarily not only due to technical reasons.

Summary

There’s a strong case to be made that the worst in the coronavirus pandemic isn’t over just yet, both in the US and around the world at large. Yet the calls for reopening are mounting, and when the perceived optimism meets the deteriorating situation on the ground (economically speaking as well), it’s likely that the yellow metal will take it on the chin initially. Supported by the breakdown from the rising wedge against the euro, gold is about to move profoundly in the coming days – to the surprise of those on the long side.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,