Gold Price Notches A Second Weekly Gain

Strengths

-

The best performing precious metal for the week was palladium, up 11.14%. South African platinum stocks jumped as much as 4.4% on Tuesday after Norilsk Nickel, a top producer, reduced its forecast production from its Arctic mines due to flooding, reports Bloomberg. Palladium rose 4.3% on the news of tighter supply. RBC forecasts estimates that the Norilsk reductions would be the equivalent of 7.6% of global supply of palladium.

-

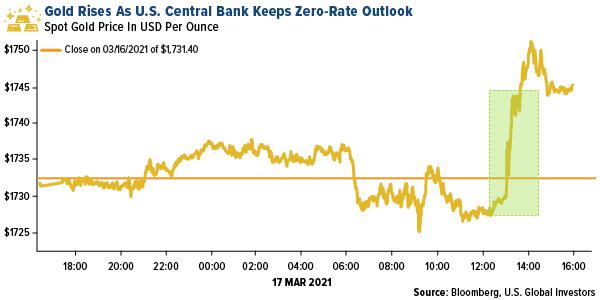

Gold had a second weekly gain despite higher Treasury yields thanks to a weaker U.S. dollar. The yellow metal rose on Wednesday directly following the Fed meeting where bankers kept a zero-rate outlook.

-

Poland’s central bank governor said it wants to buy at least 100 tons of gold in the coming years and store it locally. Since becoming governor in 2016, Adam Glapinski said Poland has transferred gold to Polish vaults, where there is already 229 tons.

Weaknesses

-

The worst performing precious metal for the week was platinum, down by just 0.66%. Platinum was up the prior week by 6.45%, so most of the gains held. The 10-year Treasury yield hit a 14-month high of 1.75% on Thursday. Fed Chair Jerome Powell remained dovish at the end of the Wednesday Fed meeting, despite upgrading the economic outlook. Bloomberg notes the dovish message only briefly stemmed the rise of bond rates.

-

Investors withdrew from commodity-focused ETFs for the sixth straight week. According to Bloomberg data, precious metals ETFs saw $585.8 million in outflows. However, the outflow was $1.12 billion less than the week prior.

-

As reported by Reuters, Mexico could revoke a concession held by Americas Gold and Silver Corporation, a Canadian miner, in northern Mexico if it does not accept its new trade union representation there, President Andres Manuel Lopez Obrador said on Wednesday. The President noted that the miner had rejected the outcome of a vote by workers at the mine to put labor representation under the control of trade union.

Opportunities

-

GV Gold PJSC, a Russian gold miner backed by BlackRock, is planning a $500 million IPO in Moscow. Bloomberg reports a group of shareholders plan to sell shares and are seeking a valuation of $1.8 billion. GV Gold is a top 10 Russian miner and operates several Siberian deposits.

-

Gran Colombia and Gold X are combining to form a new, mid-tier, Latin American-focused gold producer. All issued and outstanding Gold X shares will be acquired by Gran Colombia in exchange for Gran Colombia common shares on the basis of 0.6948 of a Gran Colombia share for each Gold X share. The combined company will have around $100 million in cash and financing support from Wheaton Precious Metals.

-

Sudan’s Mining Ministry said in a statement that it is deploying a team to restart production at a network of gold mines in Darfur that were previously linked to the family of the country’s most powerful militia leader. The mines were handed over to Sudan’s government recently after being held by members of militia chief Mohamed Hamdan’s family, reports Bloomberg. The transfer of mines is a step toward formalizing the gold mining sector, which is an alternative to oil. Sudan lost three quarters of its oil reserves in 2011 when South Sudan seceded.

Threats

-

Argentine President Alberto Fernandez faced environmental protesters this week who are against the government’s efforts to begin mining in Chubut. Argentina has large untapped deposits of lithium, copper, gold and silver. Bloomberg notes one of the major barriers to development is anti-mining sentiment sparked by three cyanide incidents in two years at a Barrick Gold mine in the San Juan province.

-

NatWest, a major U.K. bank, is facing landmark money laundering charges for failing to properly monitor a company’s account that received cash deposits totaling $365 million, reports Bloomberg. According to a court summary, the charges relate to the bank’s relationship with Fowler Oldfield, an England-based gold dealer.

-

Inflation fears are growing across the markets. Commodities tumbled on Thursday, with oil falling 7%, on concerns that the Fed will allow inflation to accelerate. The Bloomberg Commodity Spot Index fell 2.4%, the biggest drop since mid-September. “Treasury yields and the dollar are responding to the Fed, and that is currently having a negative impact on the commodities,” Arlan Suderman, chief commodities economist at StoneX, said in an email.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of