Gold Price Reacts To Jackson Hole

Strengths

- The best performing precious metal for the week was gold, closely followed by silver, up in tandem 0.56 percent and 0.47 percent, respectively, after a see-saw week in price action for the metals. Prices have been choppy over the last seven trading sessions but have held onto recent gains.

- As reported by ZeroHedge, the price of gold started moving up on Friday after Dallas Federal Reserve Bank President Robert Kaplan spoke on Bloomberg TV. Kaplan, who shared his thoughts ahead of Janet Yellen’s speech, said that a market correction wouldn’t necessarily hurt the economy, but instead could be healthy. The dollar also headed lower Friday after Yellen’s speech that left the possibility of a rate hike up to interpretation.

- Some investors have been pulling money from ETFs betting on gold, but hedge funds are flocking to gold, reports the Financial Times. According to the article, buying of gold futures contracts by hedge funds and other speculators has surged a record $19 billion or 474 tonnes over the past month. Analysts say this movement is spurred by concern over “lofty equity market valuations and geopolitical tensions.” Just prior to Yellen’s speech on Friday, futures contracts representing 2 million ounces of gold crossed hands, keeping the trend alive.

Weaknesses

- The worst performing precious metal for the week was platinum, down just 0.44 percent on little price-moving news over the course of the week.

- Tahoe Resources took another leg down, about 19 percent of Friday, as news from a Guatemalan Constitutional Court issued a decision to uphold the lower court’s preliminary decision to suspend mining at its Escobal Mine.

- Gold prices fell lower on Thursday as investors awaited signs on interest rates from the Jackson Hole Economic Summit, along with pressure from a firmer dollar, reports Reuters. Gold failed to break through the top of its $1,200 - $1,300 range in April and June of this year as well, but with the threat from Trump of a government shutdown, there is still underlying support for the yellow metal.

Opportunities

- The president of Novo Resources has spent 13 years searching for clues that back a hunch, reports Bloomberg: that the world’s biggest gold resource has lost siblings elsewhere on the planet. Now Quinton Tood Hennigh thinks he may have found what he has been looking for near Australia’s northwest coast. In July, Novo zeroed in on a gold find that’s confounded geologists and sparked a 500-percent surge in the company’s share price, writes Bloomberg. Hennigh admits he isn’t 100 percent sure that this will turn into a mine, but the potential upside is seen by some as huge.

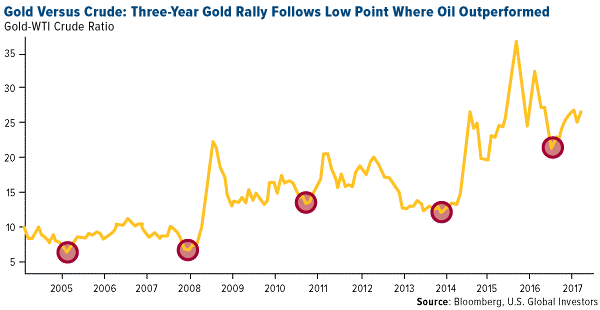

- Traders have pushed gold futures to near a nine-month high, reports Bloomberg, but if the history of gold’s relationship with oil is any guide, the surge in the yellow metal could last longer than the flare-up in geopolitical tension. Looking at the chart below, the current price divergence in oil and gold may still be going (meaning gold should continue to outperform oil before the roughly 34-month cycle ends).

- Bank of America Merrill Lynch has a bullish outlook on gold and believes the price could surge to $1,400 an ounce early next year, reports Kitco News. The bank’s global head of commodities research, Francisco Blanch, says one major catalyst for this could be the European Central Bank embarking on a tightening cycle. Nearer term, Trump’s threat to shut the government down, (unless Congress agrees to fund the border wall with Mexico) with the approaching debt ceiling coming into focus, could generate enough uncertainty to spark a convincing rally through $1,300 per ounce.

Threats

- More of China’s consumers “are giving up substance for style when it comes to gold,” reports The Asian Review. Happy to buy less-pure pieces if it means keeping up with the latest trends, sales of platinum and 18-karat gold pieces in China climbed 22 percent on the year for the April-June quarter. China is the world’s second-largest gold consumer, “but overall consumption of the yellow metal in China could start to dip if 18- and 22-karat jewelry gains traction,” the article continues.

- Investors have made a fortune on palladium this year; in fact, the metal surged 38 percent to its highest price since 2001, reports Bloomberg. That’s the good news. The bad news? ETFs that track the precious metal have lost more than $49 million as investors are cashing out. “The explanation for the outflows lies in part in the scarcity of physical palladium and a robust borrowing market that has developed among users and speculators,” the article reads.

- Is the Brazilian government trying to balance the books on the back of the Amazon jungle? Opening an area for mining known as Renca or the National Reserve of Copper and Associates, which was set aside by the military government three decades ago to safeguard resources and sovereignty, is drawing plenty of criticism from environmental groups. Belo Sun Mining has had its mining permits in limbo after indigenous groups got the company’s mining license suspended.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of