Gold Price: REAL Implications of Yen’s Strength

Something major happened to the USD/JPY (yen), and it triggered a sizable overnight rally in gold and silver. What’s really going on?

The “Real” Move on the Horizon

Junior miners declined yesterday, and they moved to a new monthly low. However, I bet that you are now most interested in what happened in today’s pre-market trading, why it happened, and what it implies.

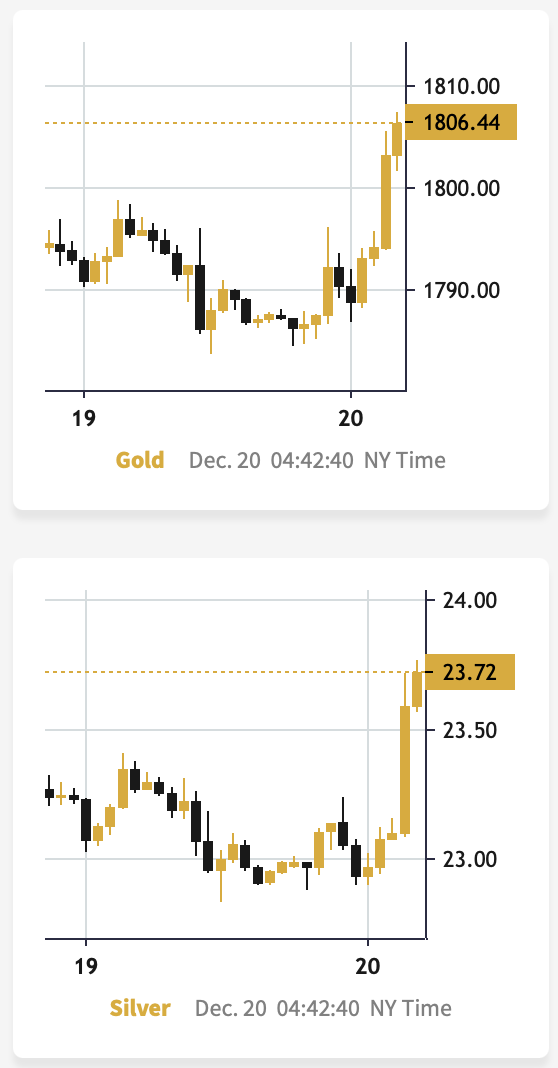

Gold moved higher, as did silver (chart courtesy of https://goldpriceforecast.com).

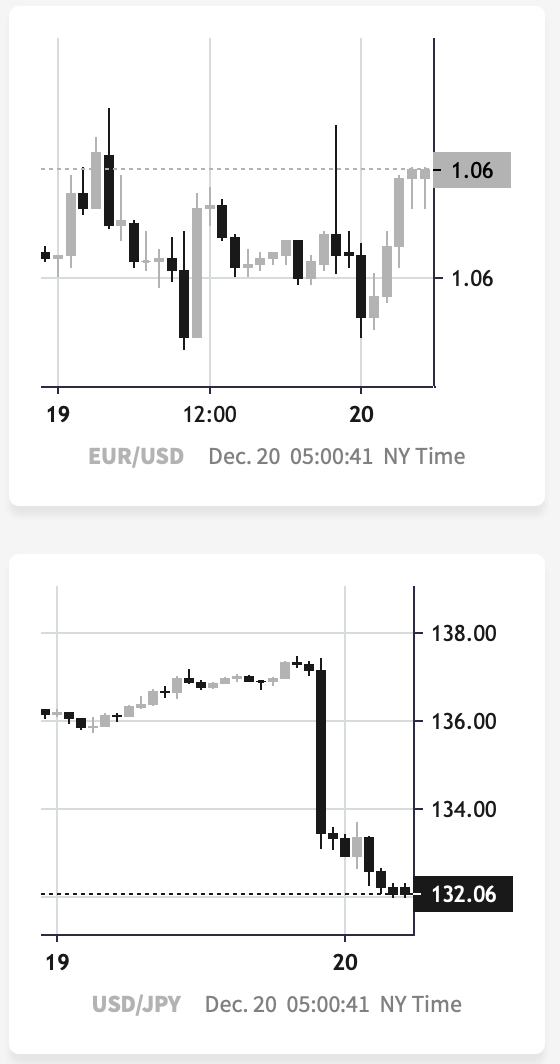

At the same time, the USD Index declined.

Looking at the above chart, we can see that these quick price movements are fairly normal, as most breakouts/breakdowns are followed by a correction - a confirmation of the breakout/breakdown. Consequently, the fact that we’re seeing it in the USD Index is currently quite normal. After all, it just broke above its declining resistance line a couple of days ago.

And since the precious metals sector is very strongly negatively correlated with the USD Index, the above means that today’s quick move higher in gold and silver is likely to end soon as well, and the “real” (= medium-term) move is likely to resume. In the case of the precious metals sector, this trend is down.

You know, one of the things that can tell us what’s real and what’s fake on the precious metals market is the performance of mining stocks. At the moment of writing these words, the markets are still closed in the U.S., so let’s take a look at what the GDXJ (a proxy for junior mining stocks) is doing in today’s London trading so far.

And there’s the thing.

It’s not doing anything (crude oil is more or less silent, too).

Ok, to be precise, the GDXJ did move a bit higher, but it’s a move higher by less than 1%, and it’s barely visible given the sizes of the recent price swings.

This further strengthens the above-mentioned scenario, in which the precious metals sector is simply verifying its breakdown yesterday.

But Why?

As always, it’s impossible to tell with 100% confidence what made a given market move, but today it seems clearer than on most days.

The Bank of Japan hinted at a hawkish twist in their approach, and the markets reacted, assuming that it was a major shift.

The currency moves that we have seen so far today appear to confirm that this is what the markets are focusing on right now (chart courtesy of https://silverpriceforecast.com).

The EUR/USD currency pair is moving sideways, while the USD/JPY pair truly plunged. What does it tell us? It tells us that whatever is happening on the currency market is not about the dollar per se – it’s about the yen.

This is more important than it seems at first glance. If the U.S. dollar’s weakness was the driving force behind the USD Index’s move lower, one could say that it’s really a bearish factor for gold. The USD, being viewed as a safe haven (whether we want to believe it or not, a large part of the world views the U.S. dollar as a safe/solid currency), would be losing appeal, and gold – being another safe haven – would be gaining it as an alternative.

However, it is not about the U.S. dollar’s weakness – it’s about the yen’s strength.

So, what is the real implication for gold?

It’s easier to understand the implication based on a counter-example. Remember when all the monetary authorities around the world were getting more and more dovish and they kept printing more and more money? That was bullish for gold, right?

Ok, so, now what we see is the opposite. The monetary authorities around the world are getting more and more hawkish, and the Bank of Japan appears to be finally joining the hawkish party, and that’s bearish for gold.

This remains true despite any short-term price movements caused by individual currency exchange rate changes. So, even if the yen continues to strengthen relative to the dollar for some time, gold might not be willing to react to it for much longer.

Why? Because in the short-term markets are particularly emotional. “OMG, USDX fell, let’s buy gold!” can dominate traders’ way of feeling/thinking (on a side note, “feenking” could be a new verb to describe the situation when one thinks that they are thinking about something, but actually they are just rationalizing their feelings).

Then, as the traders have some time to think about what’s really happening, they could sell gold as it becomes less and less appealing, given that fiat money can (at least for now…) provide more interest payments.

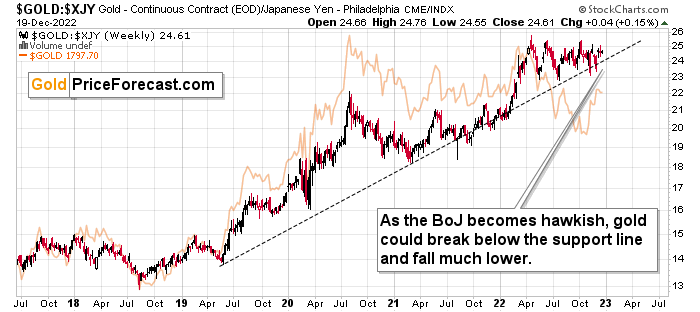

As you can see on the above chart, gold priced in the Japanese yen has been in a rather steady long-term uptrend for years. It’s close to the support line, though.

Based on the hawkish indications from the Bank of Japan, it seems that we might finally see a breakdown below this line, and when we do, the decline that could follow could be huge.

Please note that the price levels were rather steady throughout the year, even though gold fell substantially from a USD point of view. Consequently, it seems that the demand from the yen holders was quite strong, and if it now subsides… Things could get very unpleasant for gold permabulls. Also, for those who think that I’m always writing about lower gold prices, I would like to emphasize that so far this year, I have written about precisely 4 trades in junior mining stocks – two long and two short, and all of them were profitable. One position is still open (in my view, and it has the biggest potential).

Before summarizing, I have great news for you. If you’d like to get a LIVE follow-up on the above analysis (with the possibility to ask me questions) and see me talking about the top 3 gold trading techniques that I found to be working over and over again, then you’ll have a chance to get the above free of charge LIVE on Wednesday, Dec. 21 at 10 AM EST (4 PM CET) on our Youtube, Facebook, Twitter, and LinkedIn channels. If the above is not displayed as a link, just Google “Golden Meadow Radomski” and you’ll definitely find it. I hope to see you very soon :) And the easiest way to sign up is right here.

To summarize, despite today’s pre-market upswing in gold and silver, the outlook for the following weeks doesn’t look bullish at all. Conversely, as monetary authorities around the world get more hawkish, gold, silver, and mining stocks are likely to move lower.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,