Gold Price Rubber Meets Indian Budget Road?"

Recent liquidity flows on the COMEX suggest the gold market may need to retrace some of the recent gains, before moving higher.

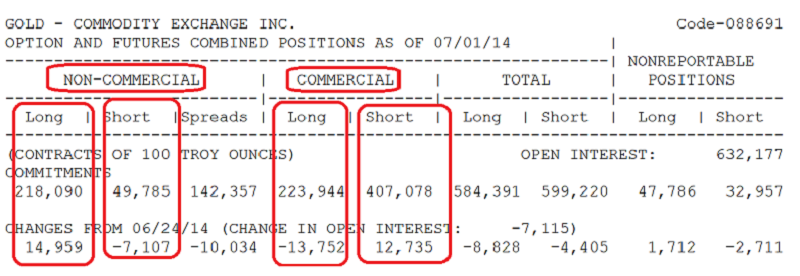

This snapshot of yesterday’s COT report for gold shows the powerful commercial traders (often referred to as “banksters” in the gold community) selling a lot of long positions and adding short positions.

This is the second week in a row that the COT report has shown this type of “bearish” liquidity flows.

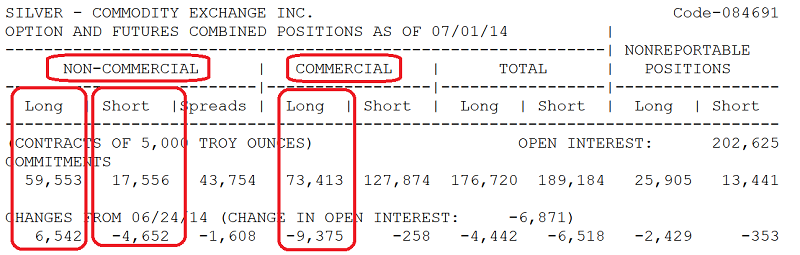

The COT report for silver shows a situation that is similar to gold.

The rally in June may have caused some gold community investors to become a bit complacent. It’s very difficult to build wealth in the market, and even more difficult to keep it. Investors should never feel complacent when banks are placing large bets against gold.

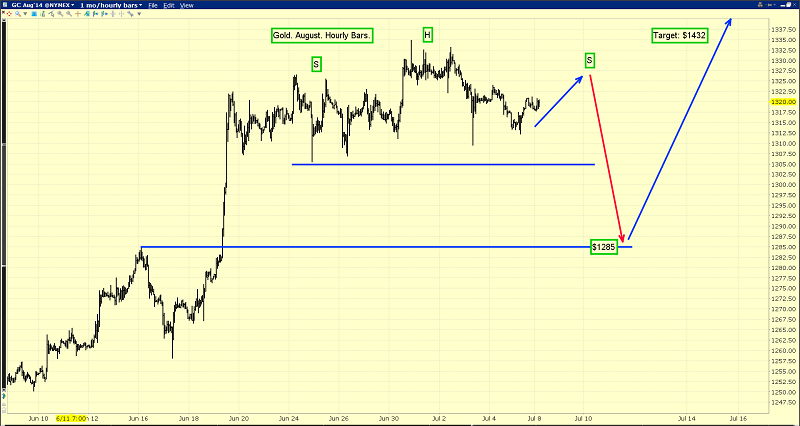

That’s the hourly bars gold chart. The FOMC minutes get released tomorrow at 2pm, and I expect the Fed could make a strong statement about future rate hikes. That could hurt gold in the short term.

The $1305 area offers decent support, but if bonds sell off significantly on the FOMC minutes, gold could decline towards $1285.

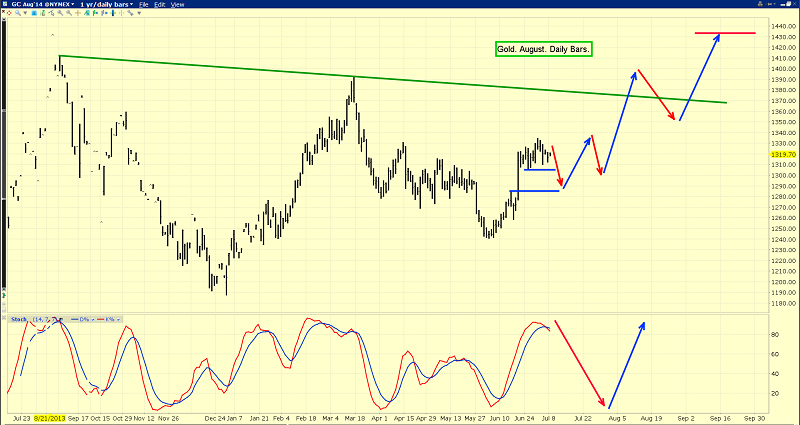

The 14,7,7 Stochastics series is flashing a sell signal on this daily gold chart. The picture here also suggests the FOMC minutes release could be negative for gold.

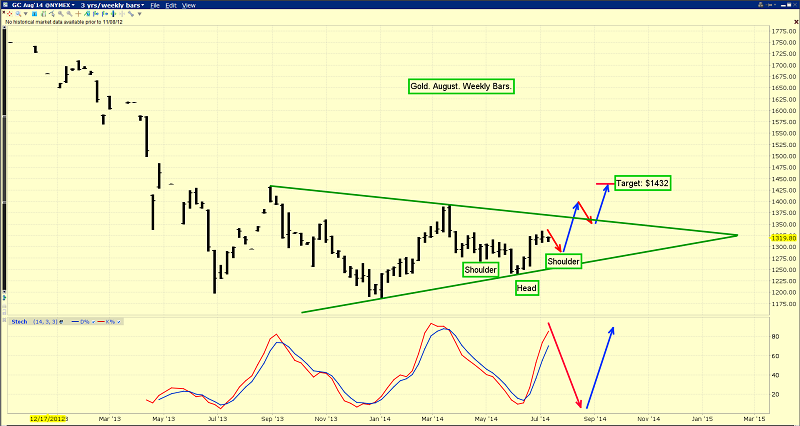

The weekly chart is also a bit “concerning”, but only in the short term. Like the tide of an ocean, oscillators rise and fall. The 14,3,3 series Stochastics now has a “nosebleed”, while commercial traders are piling on short positions.

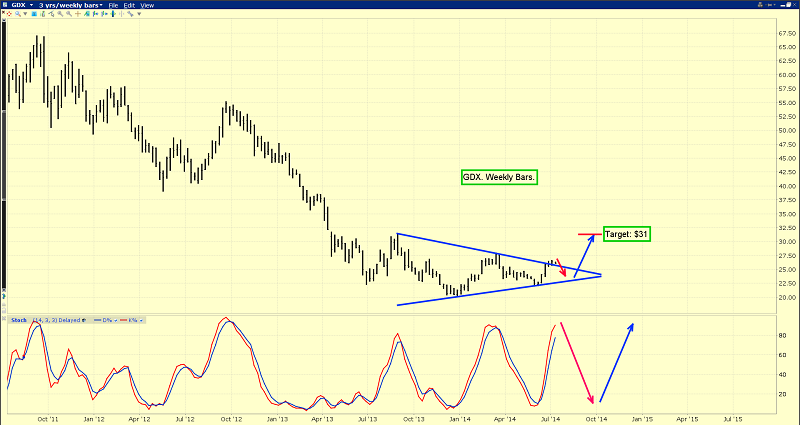

The bottom line is that investors in the gold community need to be prepared for a bit of short term pain. The good news is that there’s a massive symmetrical triangle in play for both gold and gold stocks. Gold stocks have already staged an upside breakout. That’s bullish for gold!

That’s the weekly GDX chart. A breakout from the triangle pattern has already occurred. Gold stocks are leading gold higher.

The FOMC minutes are very important, and most bank economists believe coming strength in the US economy will cause the Fed to raise interest rates sooner rather than later.

They feel that will put pressure on gold. Many bank technicians believe the triangle patterns in precious metals will be resolved to the downside.

There’s no question that if the US economy improves, that will put pressure on the Fed to raise rates. While some gold analysts argue that the economy won’t improve, I don’t think that’s the key issue at hand.

The main problem facing the gold bears is that this is 2014, not 1979. In the 1970s, the price of gold was “all in the dollar”. If the dollar rose strongly against other key Western currencies, gold fell. In 2014, gold is still “all in the dollar”, but it’s not the action of the dollar against the euro that is important, but the action of the dollar against the rupee and the yuan.

While the short and intermediate trends for gold are greatly influenced by Fed policy, events in China and India are now the key drivers of gold’s primary trend.

As important as tomorrow’s FOMC minutes are, on Thursday the Modi government releases its first budget. The most powerful gold dealers in the world are intensely focused on this budget. Gold’s next primary trend move could be determined by what happens in India on July 10.

Since the government there implemented draconian import duties and restrictions about a year ago, India’s gold jewellery industry has been crushed. That hurt demand for gold from Western mining companies, which sent mining stock prices sharply lower.

The Indian mafia is now involved in the gold industry. That has created added costs and danger, for the surviving jewellers. The Modi government is widely believed to have serious concerns about the dangers of letting mafia power grow.

Mainstream brokers like Merrill Lynch are predicting the government will cut the import duty only slightly on Thursday, while Indian jewellery associations are demanding a complete dismantling of all restrictions.

The government itself is extremely tight-lipped about what will happen, and that’s creating the potential for a violent gold price move to the upside or downside, as the budget is released.

It’s possible that the FOMC minutes create strong selling, but a gold-bullish budget from India quickly reverses that, and sends gold surging towards my target of $1432.

That’s the GDXJ chart. Like their senior brethren, junior gold stocks have already staged a tentative upside breakout from their symmetrical triangle pattern.

Regardless of what is in the FOMC minutes, the Fed can’t stop Indian jewellers from demanding massive amounts of gold from Western mining companies. What happens to that demand now, depends on the July 10 Indian budget. A gold-positive budget should create a surge in GDXJ, to above my $46 target. That price level would attract significant buying, by momentum-oriented hedge funds!

********

Special Offer For Gold-Eagle Readers: Please send me an email to [email protected] and I’ll send you my free “Goldilocks” report. The senior gold stocks are too sluggish for many investors, and the juniors carry a lot of risk. The intermediate-size producers provide a great combination of risk management and upside reward; a “Goldilocks” situation. I’ll show you the top five intermediate gold stocks I’m focused on right now, and why.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: