Gold Price Targets And Why I Like Silver

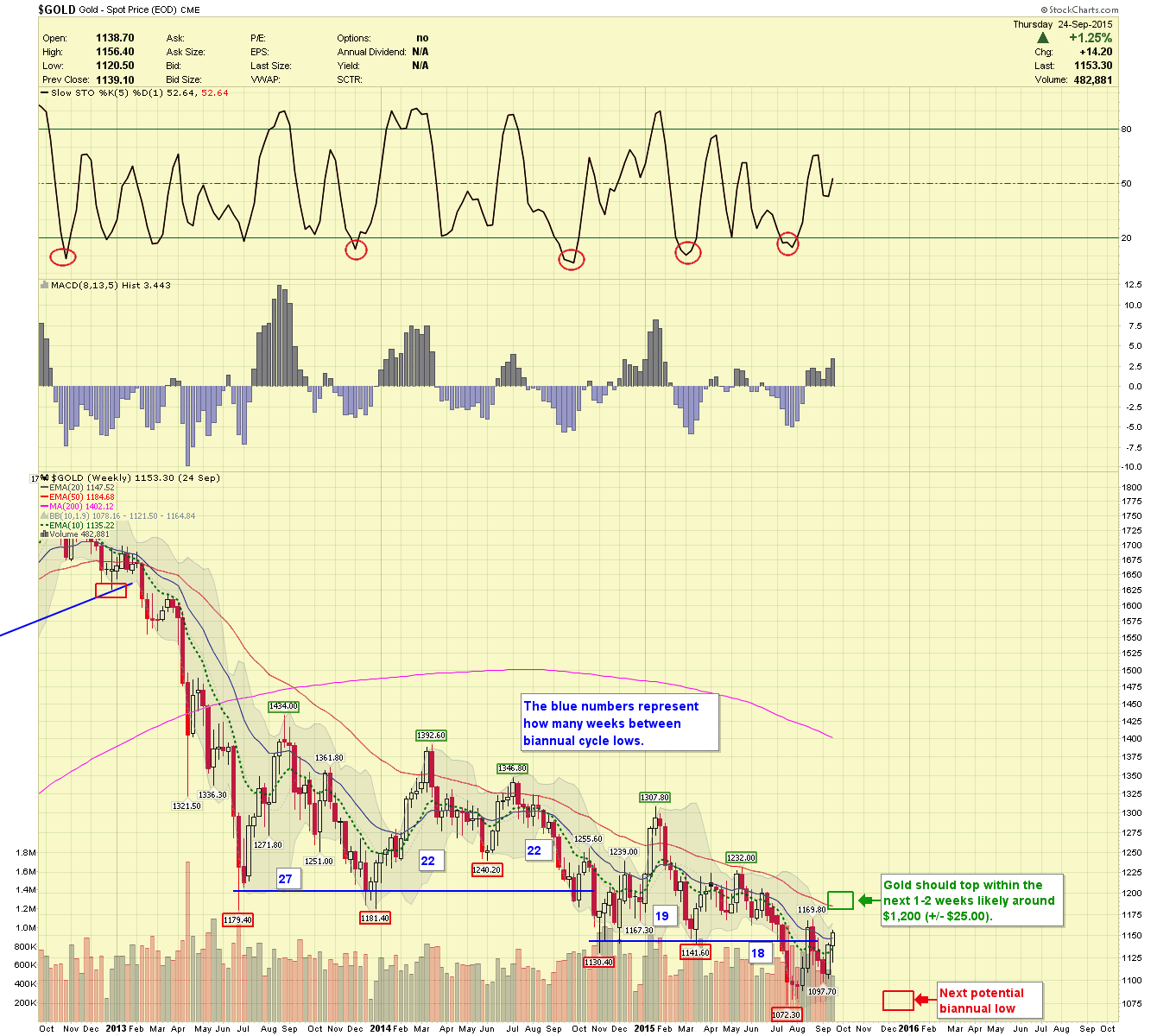

Over the years, I have found cycle analysis to be one of the most useful tools for helping me forecast both gold prices and silver prices. Gold and Silver cycles last topped in May, and I expected the biannual cycle lows to arrive during the July/August timeframe. Gold and GDXJ followed the cycles flawlessly bottoming in July, Silver bottomed in August and then GDX/HUI finally bottomed two weeks ago. The Fed uncertainty and stock market volatility distributed biannual cycle lows at differing times, but all appear to have now bottomed.

Over the years, I have found cycle analysis to be one of the most useful tools for helping me forecast both gold prices and silver prices. Gold and Silver cycles last topped in May, and I expected the biannual cycle lows to arrive during the July/August timeframe. Gold and GDXJ followed the cycles flawlessly bottoming in July, Silver bottomed in August and then GDX/HUI finally bottomed two weeks ago. The Fed uncertainty and stock market volatility distributed biannual cycle lows at differing times, but all appear to have now bottomed.

Where do we go from here? Our current analysis suggests gold prices are likely to top within the next 1-2 weeks around the $1,200 level. At which point they should head lower retesting the $1,080 level by year end. I’m sure that’s not what you wanted to hear, but the current trend is well established…and until it’s broken we must believe it to continue.

Gold Weekly Chart

Gold has been in a bear market for 4-years and counting. Unfortunately, the next Major cycle low (once every 8-years) won't arrive until 2016. When this upcoming low arrives, gold and silver will have their next opportunity to resurrect an even more powerful bull market. In the meantime, however, we are urging subscribers to wait patiently, minimize losses and make a list of gold and silver stocks they want to buy at next year’s low.

Once the Major bottom arrives, I believe Silver will have the greatest potential, as it holds both tremendous industrial demand and investment possibilities. This extended correction may also be creating what could become a perfect storm for higher silver prices. As prices continue lower more mining companies will go bankrupt, mines will shut down, and supply will diminish. Once supply decreases it takes several years for new supply to re-enter the market, building mines is expensive and permitting can take years to achieve.

The general public will eventually enter the precious metal sector. Social media and mobile technology will play major roles during the final stages of this great bull market. Average people will herd into precious metals, and as it becomes mainstream, gold will become unaffordable, and investors will gravitate towards silver. News travels faster than ever; the above silver supply conditions will likely result in a shortages. When this happens silver prices will begin a parabolic climb higher. Scrap silver will come into the market but the turnaround will lag, and prices could reach nearly unimaginable levels.

********

Check out buygoldprice.com for gold, silver and mining technical analysis.