Gold Price Will Likely Bottom This Week

US DOLLAR

US DOLLAR

Today we completed step one in the possible rollover scenario, with price making a confirmed high. Before we get too excited charts make confirmed highs/lows all the time, it just one step in a potential trend change or correction. The next step would be two sustained closes below the 10-day average and lastly a solid close below the previous 96.32 cycle low. Those actions would likely indicate a left translated cycle is in progress and a price drop toward the target box and 200-Day moving average.

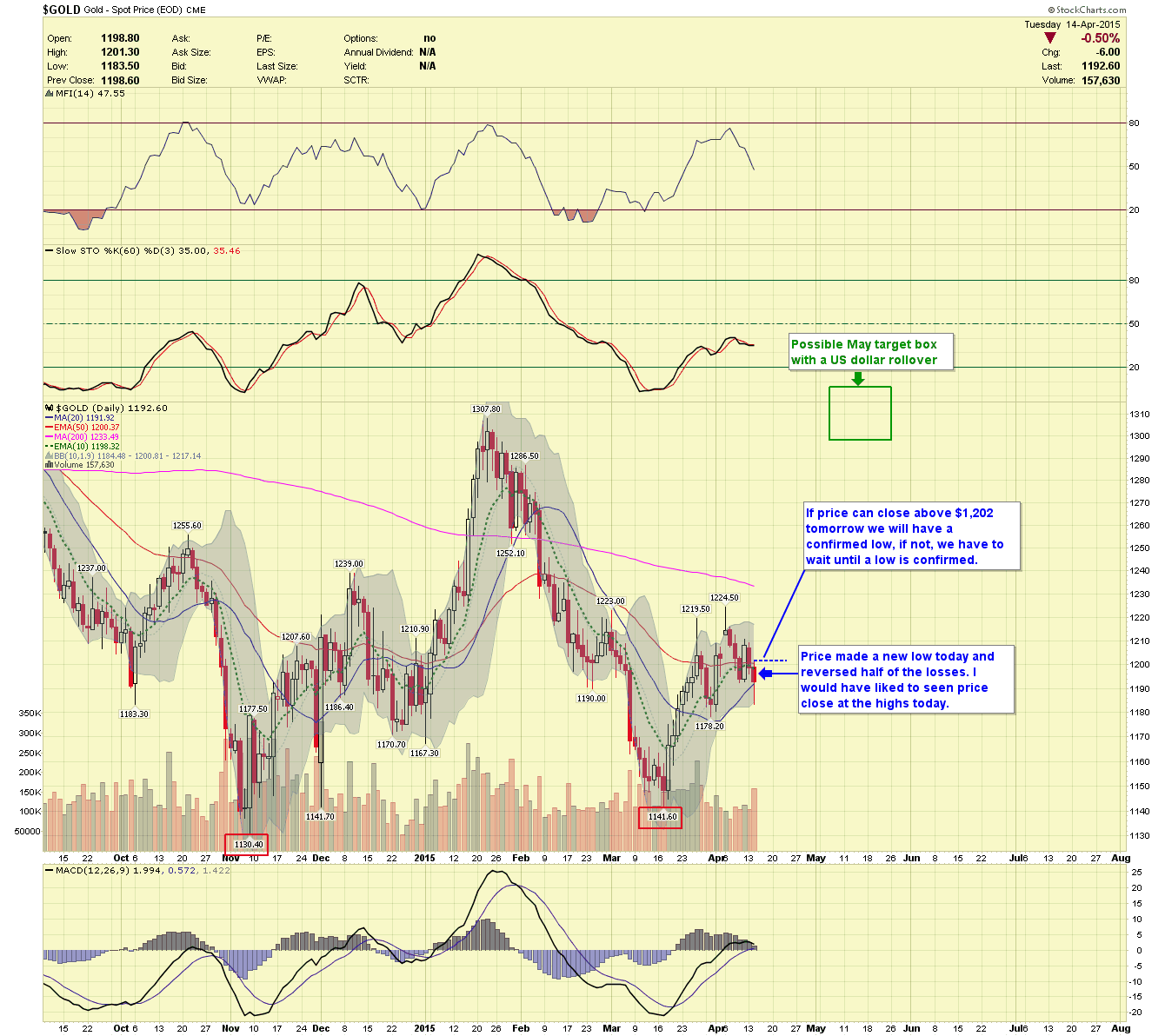

GOLD DAILY

The gold price made a new low today and was able to reverse most of the losses from earlier in the morning. I would have preferred the price to hold and close near the highs of the day but by closing where it did we got the second close below the 10-day average. If we get a close above $1,202, we will have a confirmed low and a possible common cycle low. If the US dollar rollover happens as illustrated, we will likely target $1,300 Gold by mid-May.

SILVER DAILY

The price of silver made somewhat of a reversal candle as well, a close above $16.35 tomorrow will give us our confirmed low and a good chance of a common cycle low.

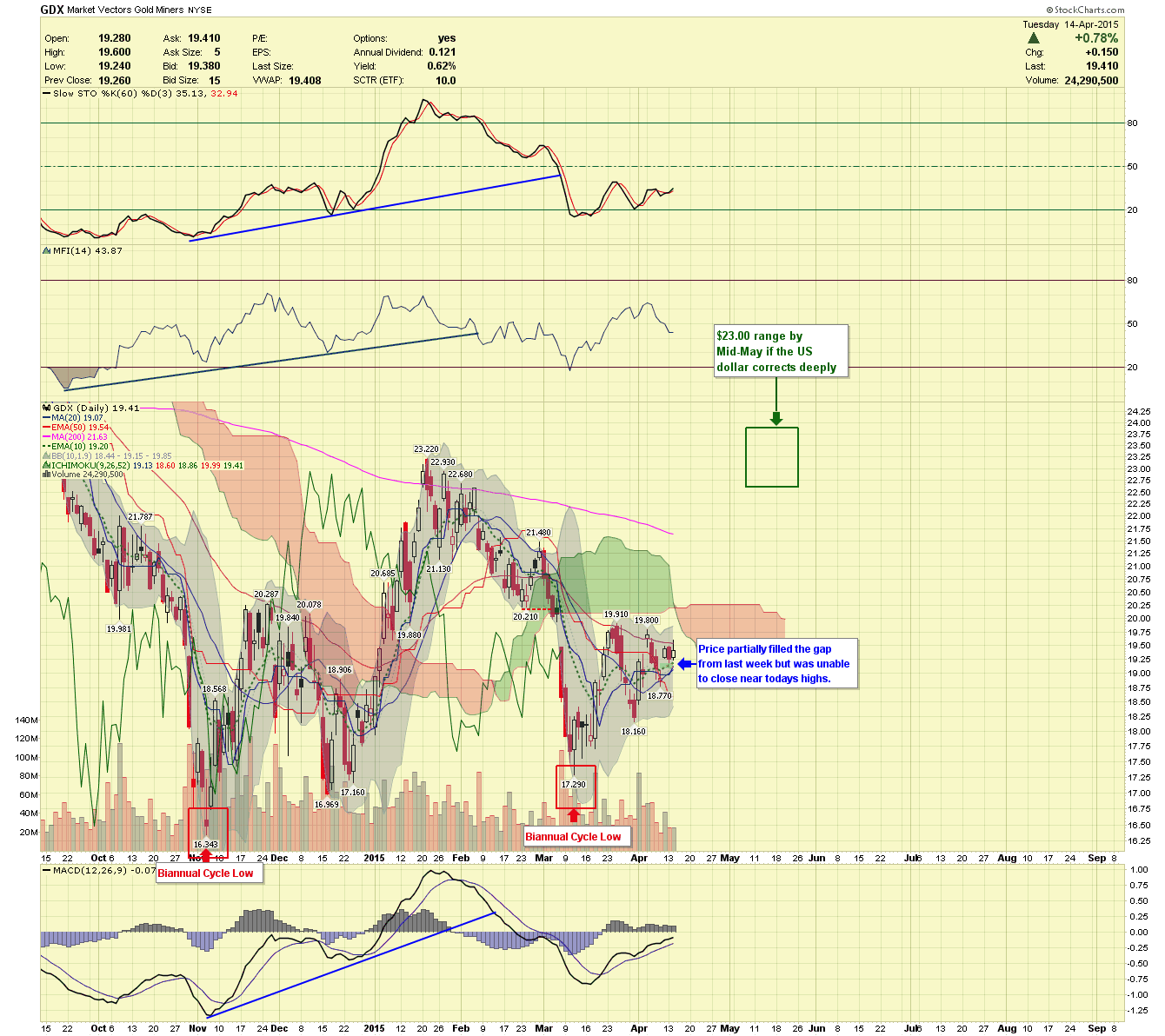

GDX DAILY

Price partially filled the gap from last week but was unable to close near the highs today. If the miners had closed near their highs today, I would be slightly more convinced of a cycle low today.

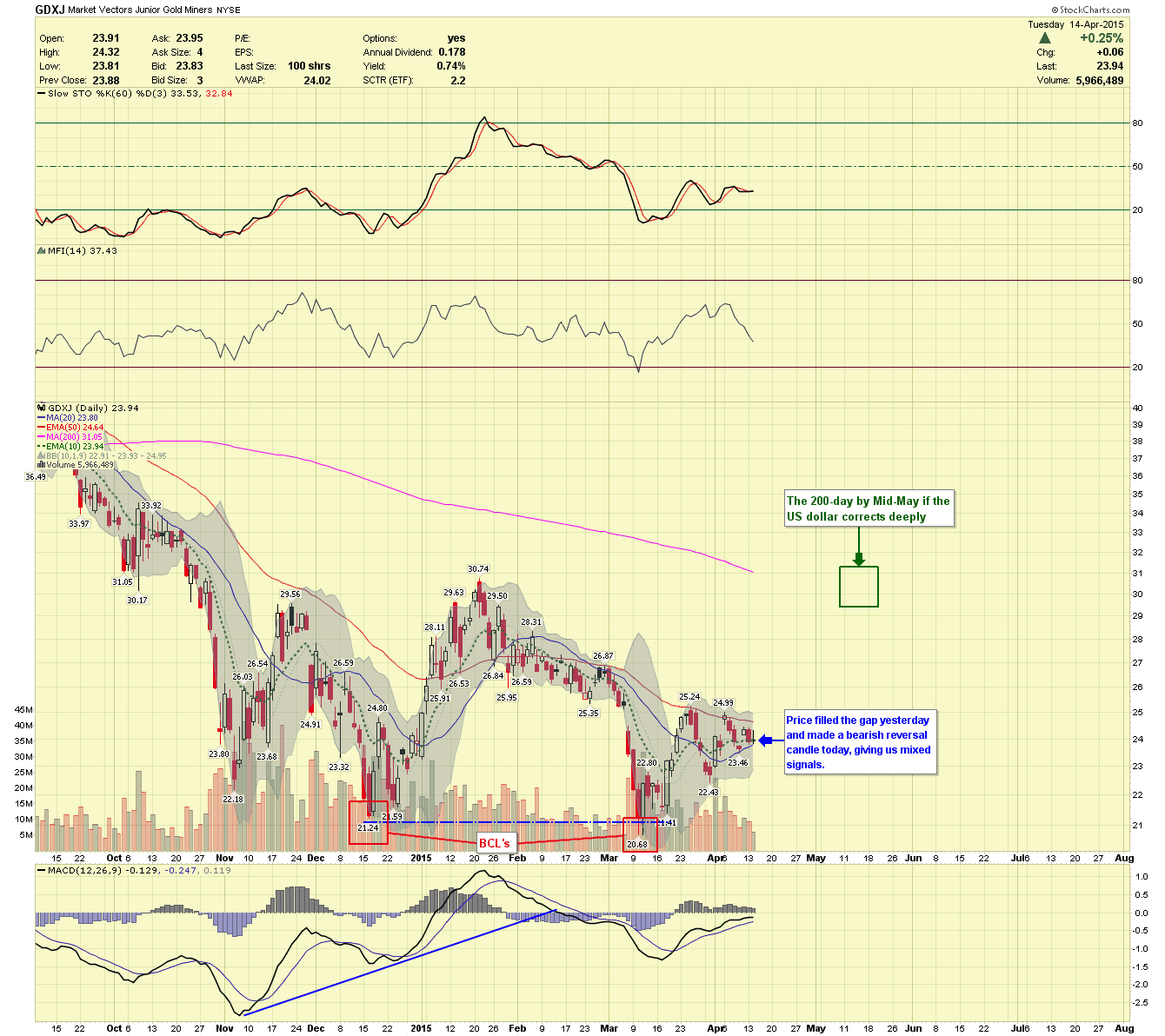

GDXJ DAILY

Price filled the gap from last week and formed a bearish reversal candle today, tomorrow’s action should better reveal where we stand.

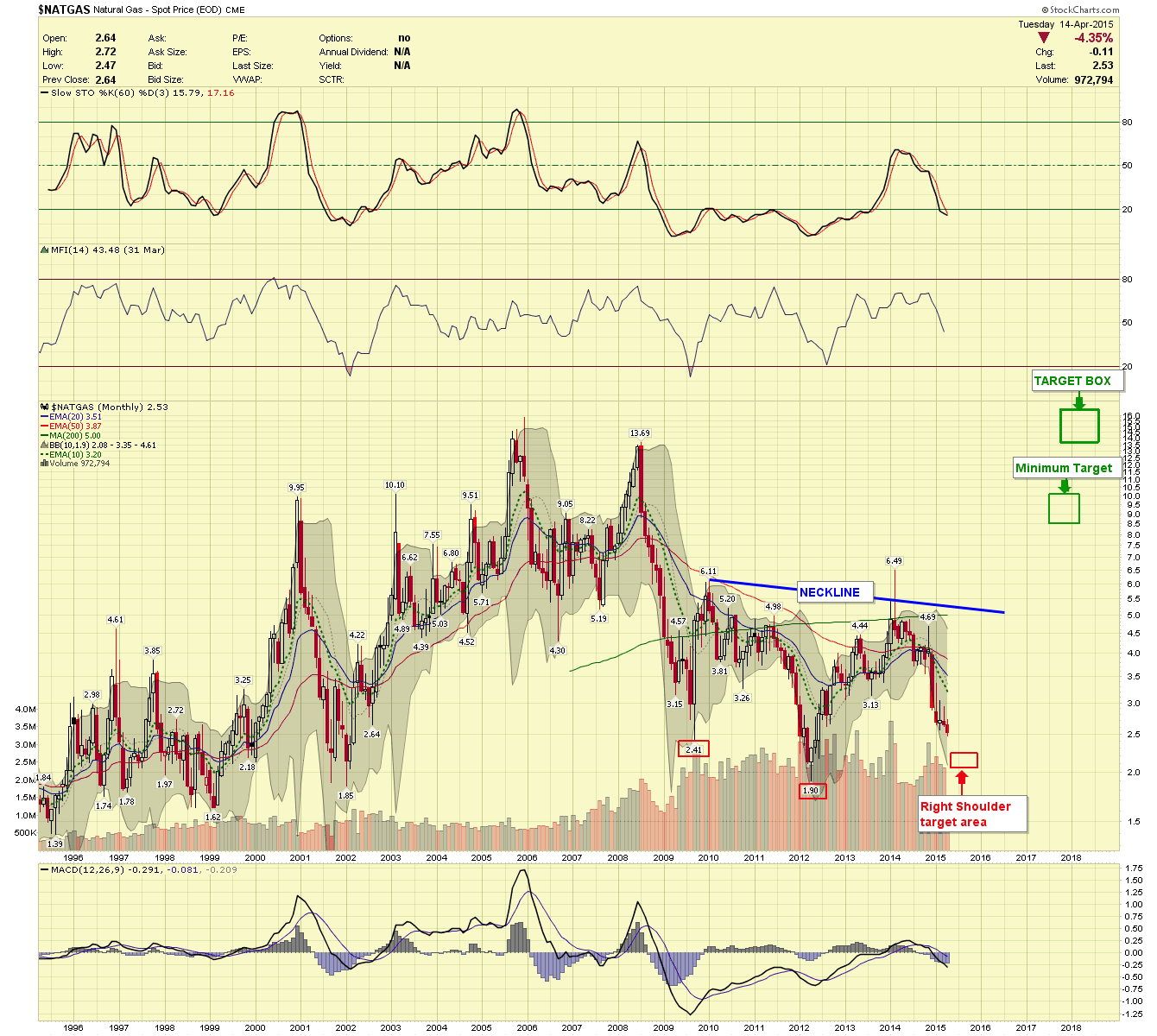

Lastly, I wanted to give you a preview of a possible setup I see coming in Natural gas. There is a definite 12-14 quarter cycle trend in Natural Gas, and we just started the 12th quarter this month. That means there is likely a good tradable bottom that should arrive in the not too distant future. If the price and chart fulfill an inverse head and shoulder pattern, the price could increase by 300%-500% by the end of 2017. We are watching the weekly markers for the signs of a bottom and will alert subscribers when they arrive. The Example Portfolios will likely take positions in select Natural Gas Stocks and Options at the perceived bottom.

For now the Example Portfolios are waiting for a confirmed low in both Gold and Silver before adding to positions.

********

Chartseek is offering 50% OFF our Basic Plus Newsletter service released three time each week, offer ends 4/16/2015 click here.