Gold, Silver And Platinum: Key Tactics Now

The traditional Chinese New Year “firecracker rally” for gold may be a dud this year, but investors who followed my “buy into $1788 and sell some into $1966” recommendation are in great shape.

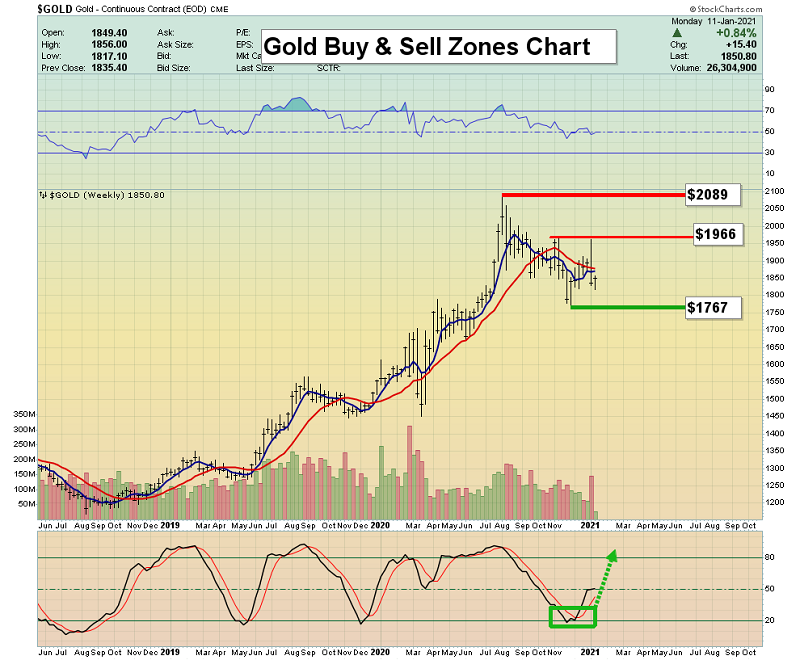

The weekly buy and sell zones chart. The $1767 low and the $2089 high should be the new zones of interest for gold investors.

Gold could decline to $1767 or even $1671. If that happens, I will urge all investors to take buy-side action with physical market gold, silver…and the miners.

What are the odds that it actually does happen? Well, Chinese gold prices have gone to a premium over London as of this morning, US election mayhem continues, and Goldman Sachs analyst Jeff Currie is predicting gold hits $2300 this spring and holds its ground.

Also, Corona is still a problem. The vaccines appear to be cash cows for the drug companies, but only a short-term fix for the citizens. Mutation may be a new concern.

So, I lean towards $2089 rather than $1767 as the next “order of gold price business”, but I want investors prepared to handle all potential outcomes on the gold market gridlines.

2021 will be the year of the ox for China, and that should also be the theme for the gold price; some volatility as democrat and republican combatants settle their views on the election with violence, but then new and bigger money printed handouts bring some calm to the storm.

Because the calm will be oriented around more debt and money printing, gold should hold most of its gains. It did that in 2020, but I think 2021 will see even more “ox-like” action for the world’s mightiest metal.

When gold is in an “air pocket” between the key buy and sell zones, as it is now between $1767 and $2089, there’s not a lot to do, and investors can use the time to look at other important markets.

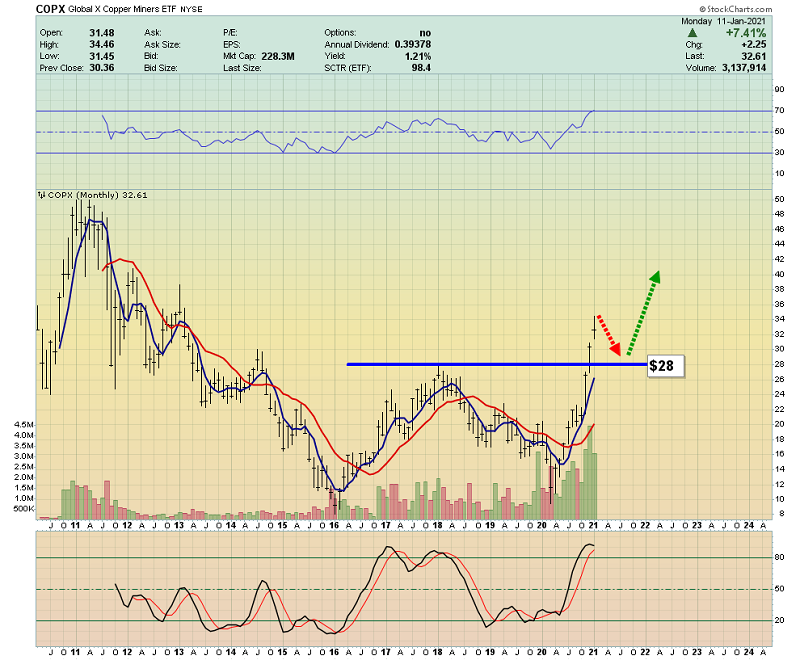

The COPX copper stocks ETF chart.

“Doctor Copper” is probably due for a pullback against the dollar, and so is the stock market, but that pullback can be bought in anticipation of (initial) “growthflation” from the government handouts.

There’s a real danger that growthflation becomes stagflation by 2022, and that would see copper hold most of its gains, like gold.

The key silver chart.

There is quite a big difference between the gold price action and the silver price action, and I will suggest that is because of imminent inflation.

Gold has made a new all-time high against the dollar and broke out of a big H&S bull continuation pattern back in 2019. That’s because gold does well in both inflationary and deflationary times.

In contrast, silver shines brightest when inflation becomes a real possibility. This awesome metal has only recently broken out from its base formation, and I think the breakout is mainly related to potential inflation.

Silver also sits far below both its 2011 and 1980 highs and thus offers investors tremendous leverage to gold.

In the inflationary environment that I am predicting begins this year, the price action for silver may look a lot like that for… platinum.

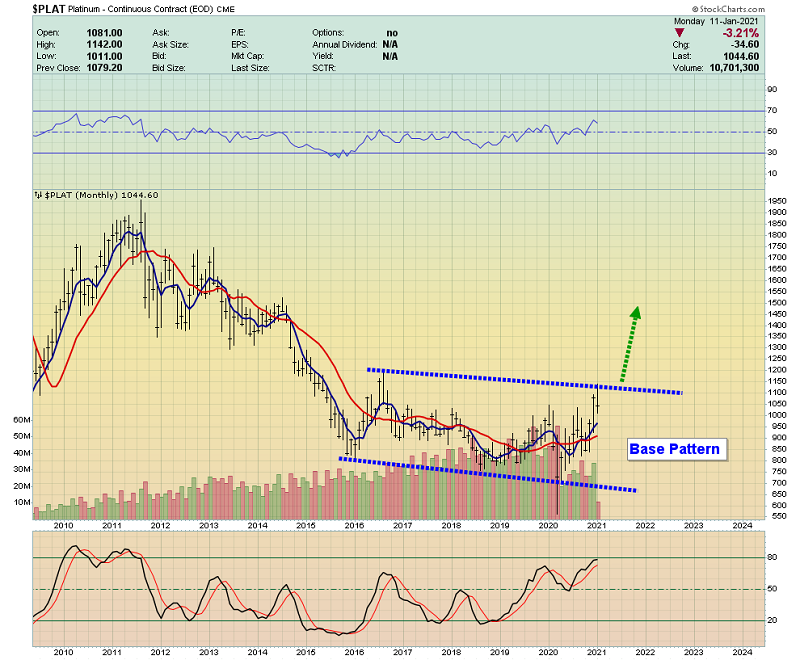

Like silver, there is a big base pattern in play for platinum on the monthly chart. A breakout to the upside appears imminent.

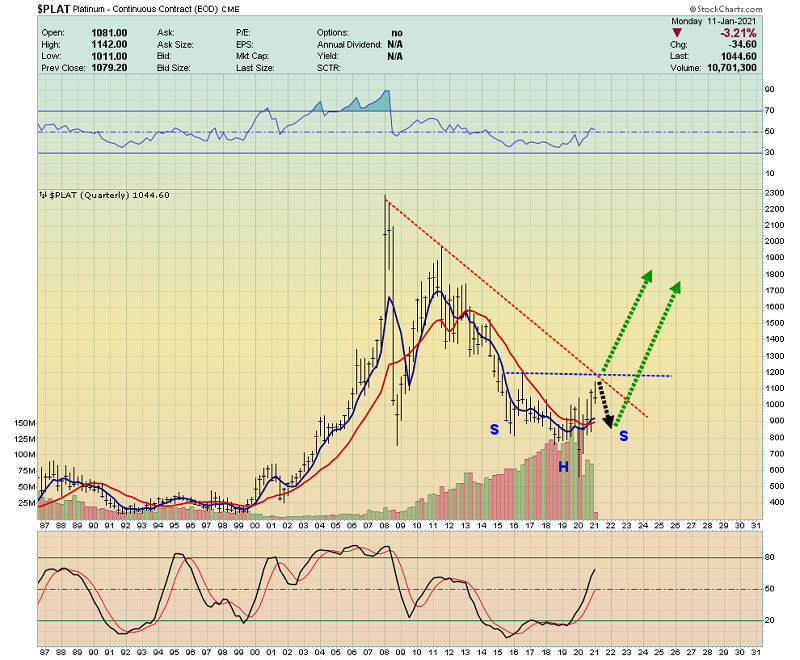

This is another look at platinum, using a quarterly bars long-term chart.

A dip in the stock market could see platinum dip lower and form the right shoulder of an inverse H&S bottom pattern. Whether that happens or not, the key number to watch is $1200. A breakout above there ignites the upside fun!

I like owning both physical metal and the ETFs. In the case of platinum, the PPLT Aberdeen ETF that I highlight here has decent trading volume, and it trades on the NYSE.

Stoploss enthusiasts who want to buy right now can use $92 as their short-term line in the sand, but I suggest holding some positions with no stop at all.

Buy more on any price dip, in anticipation of higher prices ahead!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “If It’s Gold Or Silver, Gimme It All!” report. I highlight key junior miners that look technically awesome, and look ready to start fresh legs higher… with winning tactics for each great stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: