Gold Snapped Three Days of Declines To Close Out Last Week

Strengths

- The best performing precious metal for the week was gold, up 0.36%. Silver has continued to outperform gold, up 10% over the last three months driving the gold/silver ratio down to 80:1, closer to the historical average (76:1). Precious metals prices have seen a lift from a lower U.S. dollar, moderating real rates, and more dovish indications from central banks. Gold snapped three days of declines, reports Bloomberg, as U.S. data gave a mixed picture of the economy, providing little clarity on the outlook for Federal Reserve rate hikes.

- Orla Mining reported fourth quarter 2022 production of 32,000 ounces, 11% above the 29,000-ounce estimate. AISC guidance of $600-$700 per ounce for 2022 was maintained. In addition, the company provided 2023 guidance, with a production range of 100,000–110,000 ounces, in line with the 105,000-ounce estimate.

- IAG Gold announced fourth quarter 2022 production of 185,000 ounces versus consensus of 166,000 ounces. Sales were 183,000 ounces versus consensus of 163,000 ounces. For 2022, production of 713,000 ounces was higher than the 650,000–705,000-ounce guidance range. IAG reiterated that costs for the year are expected to be at the lower end of 2022 guidance ranges.

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.21%. El Dorado Gold (ELD) announced fourth-quarter gold production of 128,500 ounces, which resulted in full-year production missing guidance at 453,900 ounces. Weaker-than-expected performance at Kisladag (Turkey) and Olympias (Greece) ultimately led to the production miss, although it was somewhat offset by a strong fourth quarter at Lamaque (Canada).

- According to BMO, Petra Diamonds announced the first half 2023 operational results with diamond production missing estimates due to group-wide operational challenges. The company has also revised guidance downward for fiscal year 2023 and fiscal year 2024, while fiscal year 2025 guidance remains unchanged.

- Barrick Gold reported attributable gold production 1,120 thousand ounces, below Visible Alpha consensus expectation of 1,162 thousand ounces and attributable sales 1,111 thousand ounces, below consensus of 1,195 thousand ounces.

Opportunities

- Canaccord Genuity Technical analyst Javed Mirza noted that Kinross Gold has a very strong value factor score on his proprietary quantitative model, Quest, reinforcing the attractive valuation at current levels. In addition, the stock has scored a multi-week close above a key technical level at the 40-week moving average, currently 5.22. This confirms the intermediate-term trend is now up, a strong technical positive.

- Dundee Precious Metals announced an updated mineral reserve estimate and mine plan for Ada Tepe, Bulgaria. Ada Tepe accounts for 34% of the company’s gold production (2022 estimate) and 25% of base-case asset NPV. The LOM plan resulted in additional gold production of 66,000 ounces (versus the 2020 mine plan) over the remaining mine life until 2026, thus improving the asset’s cash flow.

- RBC views potential for more robust M&A activity in 2023 following a muted year, particularly if recent strength is sustained. Since 1990, historical M&A activity has shown a relatively strong correlation (0.50) with the gold price, suggesting that companies are more willing to transact in a positive price environment.

Threats

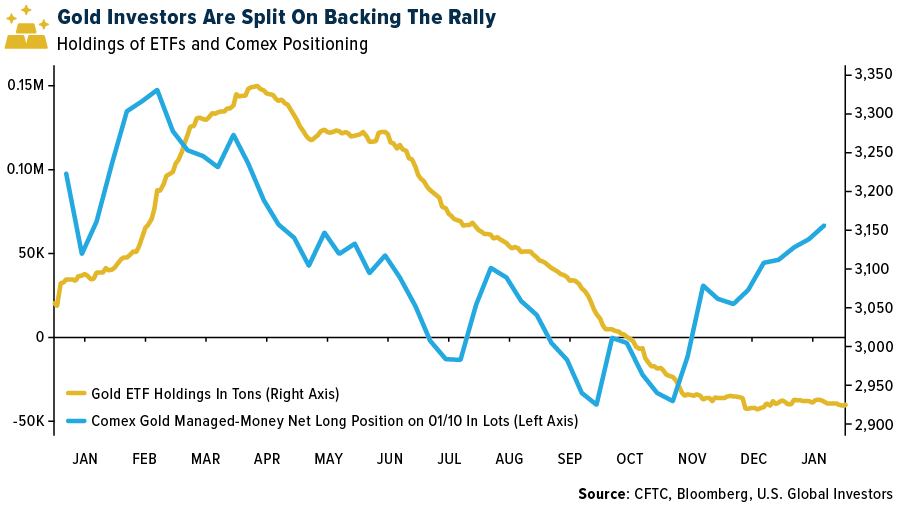

- According to RBC, gold sentiment has quickly shifted with recent outperformance backed by robust precious metal fund flows totaling over $8 billion in December amidst a broader commodity sell-off. RBC remains cautious given the risk that higher levels are fully priced into recent equity outperformance and look to whether flows will continue to support the move beyond the current seasonally strong period.

- Mining company Lucara Diamond has called on the European Union (EU) to impose sanctions on Russian diamonds after the bloc reversed plans to hit gemstone exports. Eira Thomas, chief executive of the Canadian mining group that operates mainly in Botswana, told the Financial Times her personal view was that diamonds of Russian origin “should be sanctioned.”

- While operating and cost risks may well have subsided from mid-2023, recent stock price appreciation is adding downside risk through the second quarter reporting period. While this does bring the golds in-line with historical norms of >1x multiples, given sharp stock appreciations, there are heightened short-term downside risks for any weak second quarter results.

To learn more and get the Gold SWOT directly to your inbox, subscribe to the Investor Alert newsletter for FREE by clicking here.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of