Gold Speculators Boost Bullish Bets After Recent Sentiment Slide

Gold Non-Commercial Speculator Positions

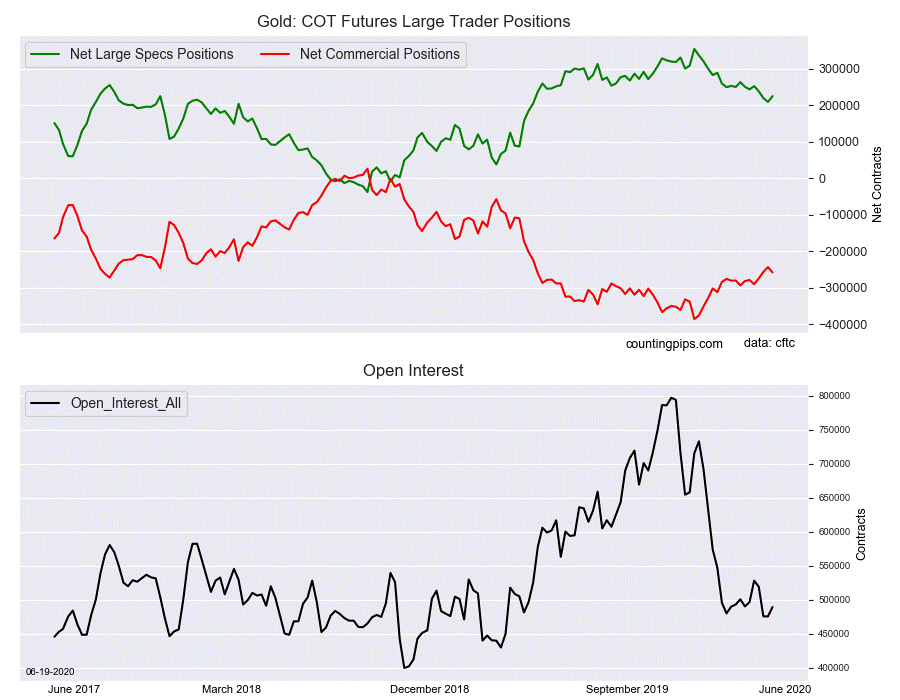

Gold COT Futures Large Trader Positions

Large precious metals speculators raised their bullish net positions in the gold futures markets this week following a recent slide in the speculator sentiment, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 224,348 contracts in the data reported through Tuesday June 16th. This was a weekly gain of 15,735 net contracts from the previous week which had a total of 208,613 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 13,423 contracts (to a weekly total of 277,395 contracts) while the gross bearish position (shorts) fell by -2,312 contracts for the week (to a total of 53,047 contracts).

Gold speculative bets rose for the first time in four weeks and after a decline of -43,175 contracts in the past three weeks combined. Gold speculator positions have been shedding bullish bets in the past three or four months after reaching an all-time bullish record high on February 18th with a total of +353,649 contracts. Since then, speculator bets have declined in twelve out of the past seventeen weeks and by a total of -129,301 contracts in that time-frame. This week’s rebound marked the largest one-week gain in the past seventeen weeks, dating back to February 18th.

Gold Commercial Positions

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -258,020 contracts on the week. This was a weekly fall of -14,563 contracts from the total net of -243,457 contracts reported the previous week.

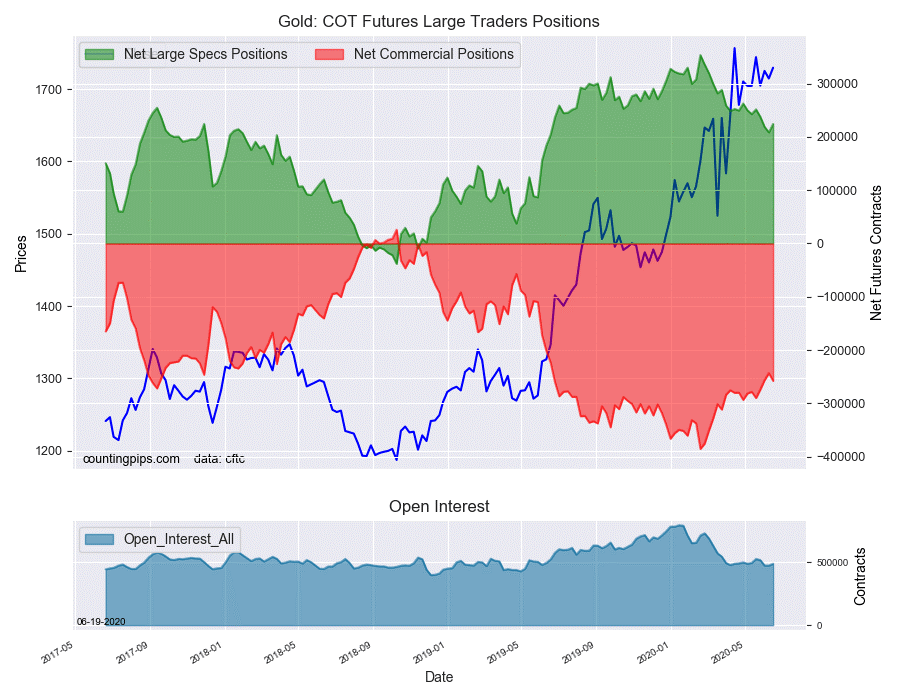

Gold COT Futures Large Trader Positions

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1729.60 which was an uptick of $14.90 from the previous close of $1714.70, according to unofficial market data.

*********