Gold Speculators Bullish Positions Dipped

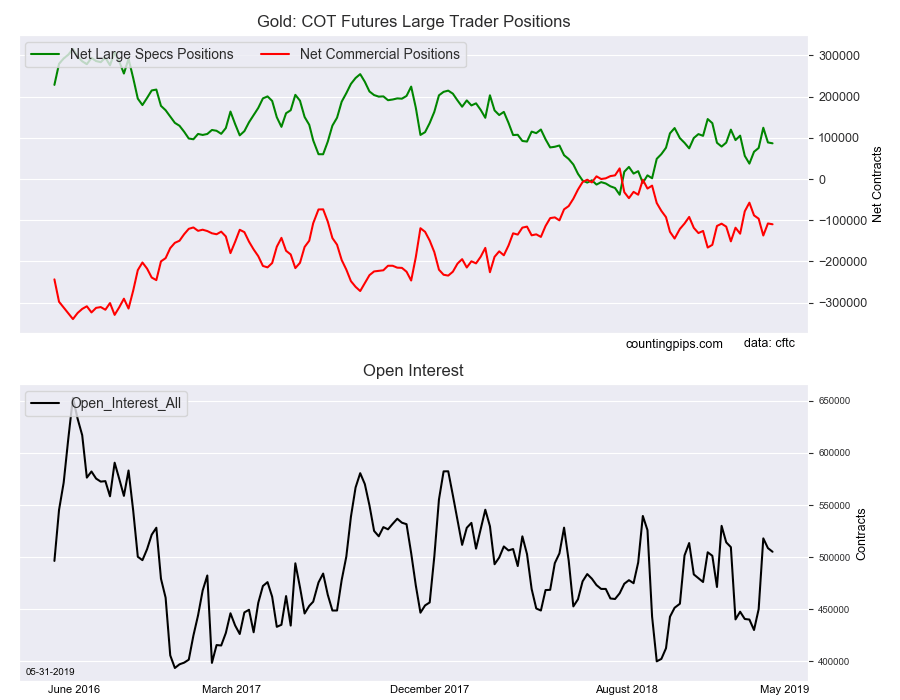

Gold COT Futures Large Trader Positions

Gold Non-Commercial Speculator Positions

Large precious metals speculators lowered their bullish net positions in the gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 86,688 contracts in the data reported through Tuesday, May 28th. This was a weekly change of -2,117 net contracts from the previous week which had a total of 88,805 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -9,165 contracts (to a weekly total of 194,463 contracts) while the gross bearish position (shorts) declined by -7,048 contracts for the week (to a total of 107,775 contracts).

The net speculative position slid lower for a second straight week after dropping by -35,731 contracts last week. Gold positions had been on a nice bullish streak and reached an eleven-week high on May 14th before turning lower. Currently, the speculator standing remains in a modest bullish level although under the +100,000 contract level for a second week.

Gold Commercial Positions

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -109,954 contracts on the week. This was a weekly decline of -2,016 contracts from the total net of -107,938 contracts reported the previous week.

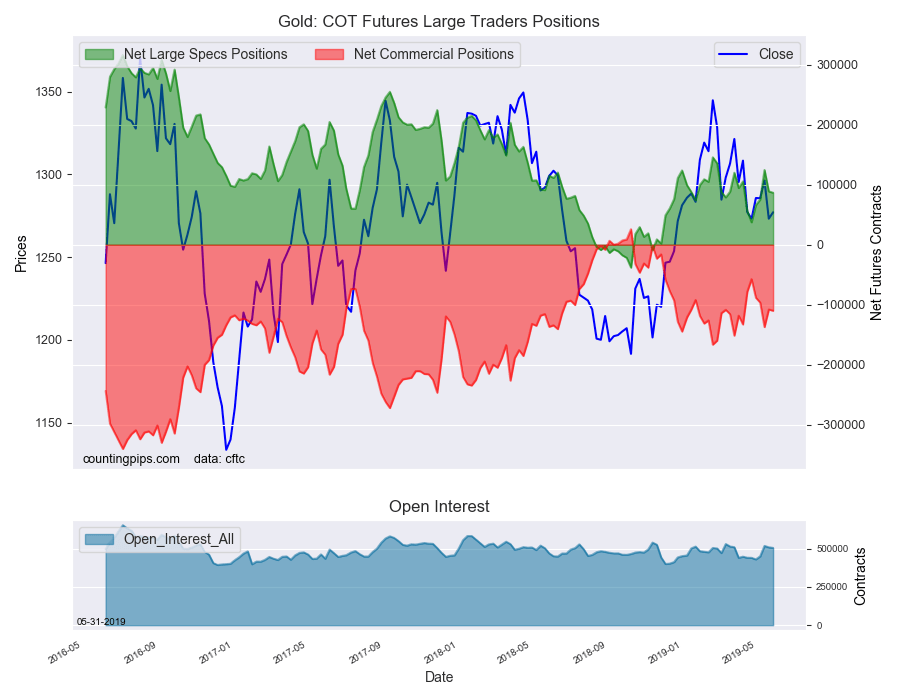

Gold COT Futures Large Trader Positions

Gold Futures

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1277.10 which was an uptick of $3.90 from the previous close of $1273.20, according to unofficial market data.

*********