Gold Speculators Sharply Drop Their Bullish Bets Again This Past Week

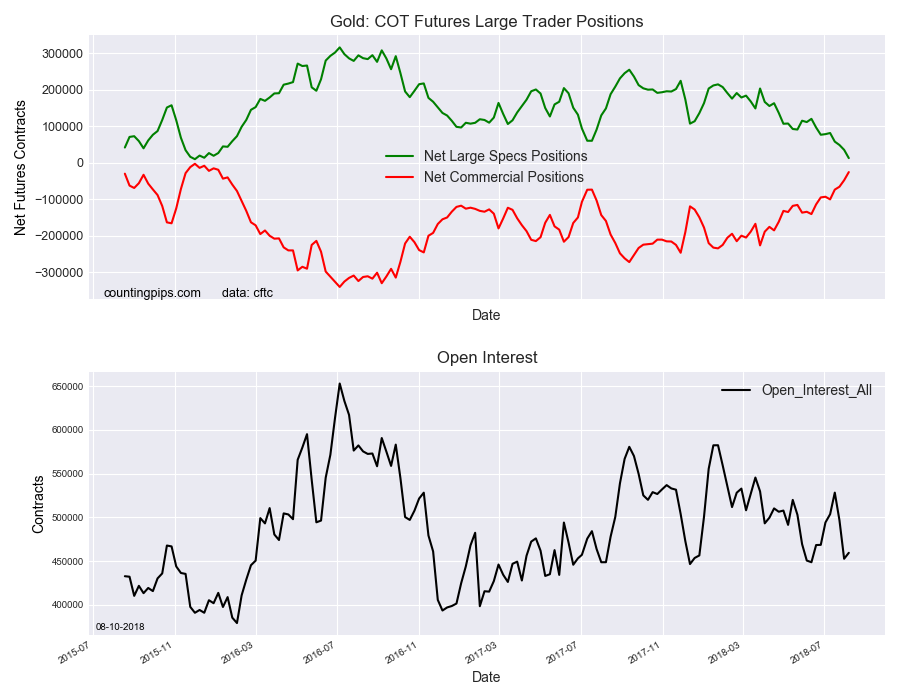

Gold COT Futures Large Trader Positions

Gold Futures Non-Commercial Speculator Positions:

Large precious metals speculators lowered their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 12,688 contracts in the data reported through Tuesday August 7th. This was a weekly decline of -22,649 contracts from the previous week which had a total of 35,337 net contracts.

The speculative bullish position declined for a fourth consecutive week this week and has fallen by a total of -68,746 contracts over that time-frame. The overall net position standing is now at the lowest bullish level since December 1st of 2015 when the net position totaled just 9,750 contracts.

Gold Commercial Positions:

The commercial traders’ position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -25,609 contracts on the week. This was a weekly rise of 22,309 contracts from the total net of -47,918 contracts reported the previous week.

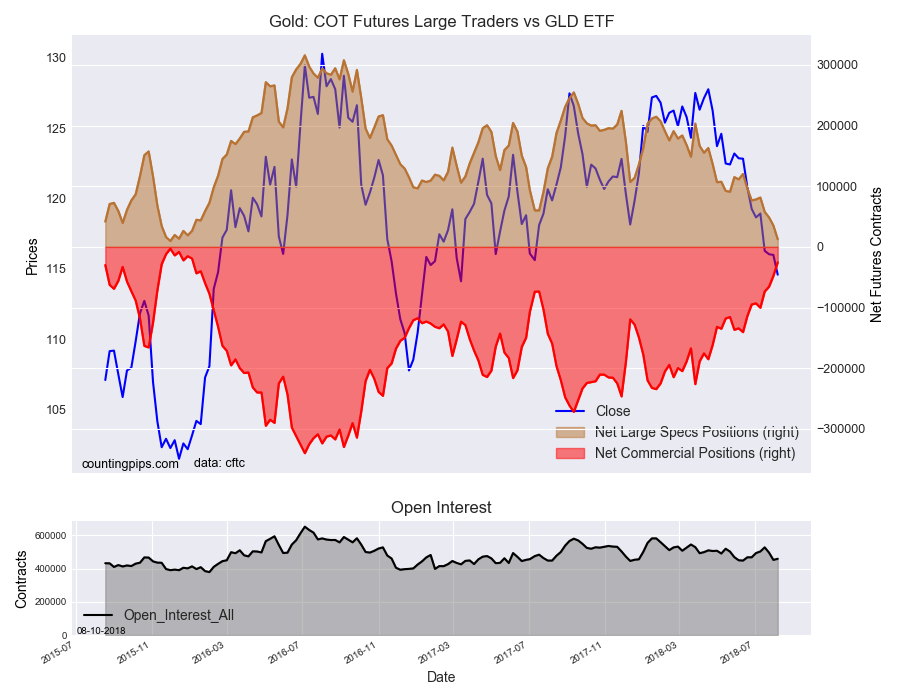

Gold COT Futures Large Trader Vs GLD ETF

SPDR Gold Shares (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $114.59 which was a shortfall of $-1.40 from the previous close of $115.99, according to unofficial market data.