Gold Stocks Already Suggest What’s Next

It’s the Fed interest rate decision day, and the markets are holding their breath, awaiting the uncertain. However, charts already suggest the answer.

Actually, the markets are quite “certain” of what the uncertain is going to be. 99.9% of market participants expect the rates to be raised by 25 bps, which means that when the Fed delivers this decision, nothing is likely to happen.

The markets could move based on what Powell says during the press conference, though, as that’s what’s likely to impact the market’s expectations. And markets – being forward-looking – move on expectations.

What Are the Current Expectations?

The current expectations are quite dovish, as the market expects the Fed to hike rates in March (by another 25 bps) and then keep them there – that’s what appears to be the most likely scenario based on the CME FedWatch Tool. And the market anticipates that rates will begin to fall in November.

Given that inflation remains high, it appears that the surprises will be on the hawkish side.

As far as the charts are concerned, we see only a little new development on the markets, as they pretty much nullified yesterday’s pre-session decline. Still, looking at the gold price and gold stocks and comparing where they both are provides us with bearish indications.

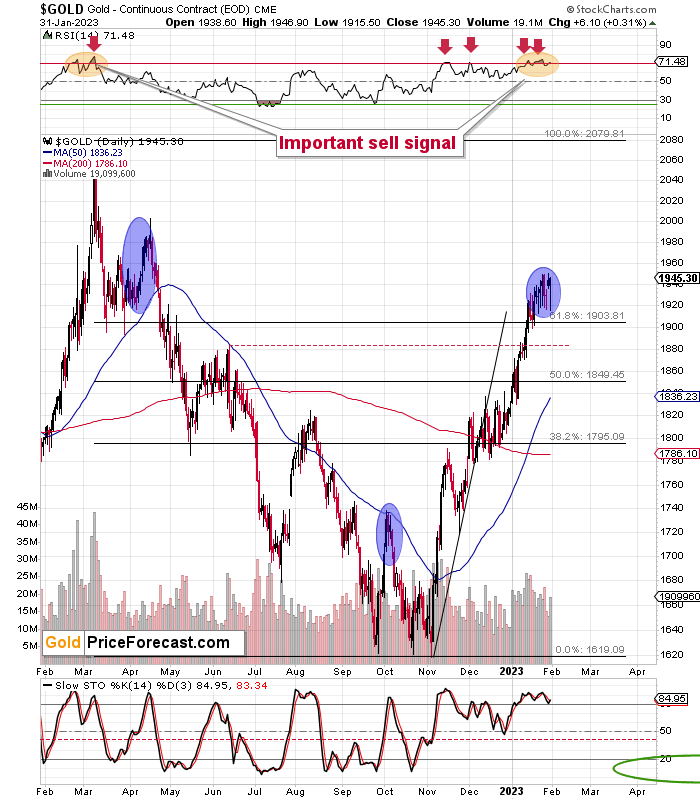

Even though gold futures invalidated a move above the 2011 high in intraday terms, they closed close to $1,945. This means that they remain near their recent highs.

Interestingly, the silver price has failed to move above the $24 level multiple times, and junior mining stocks are not at similarly high levels.

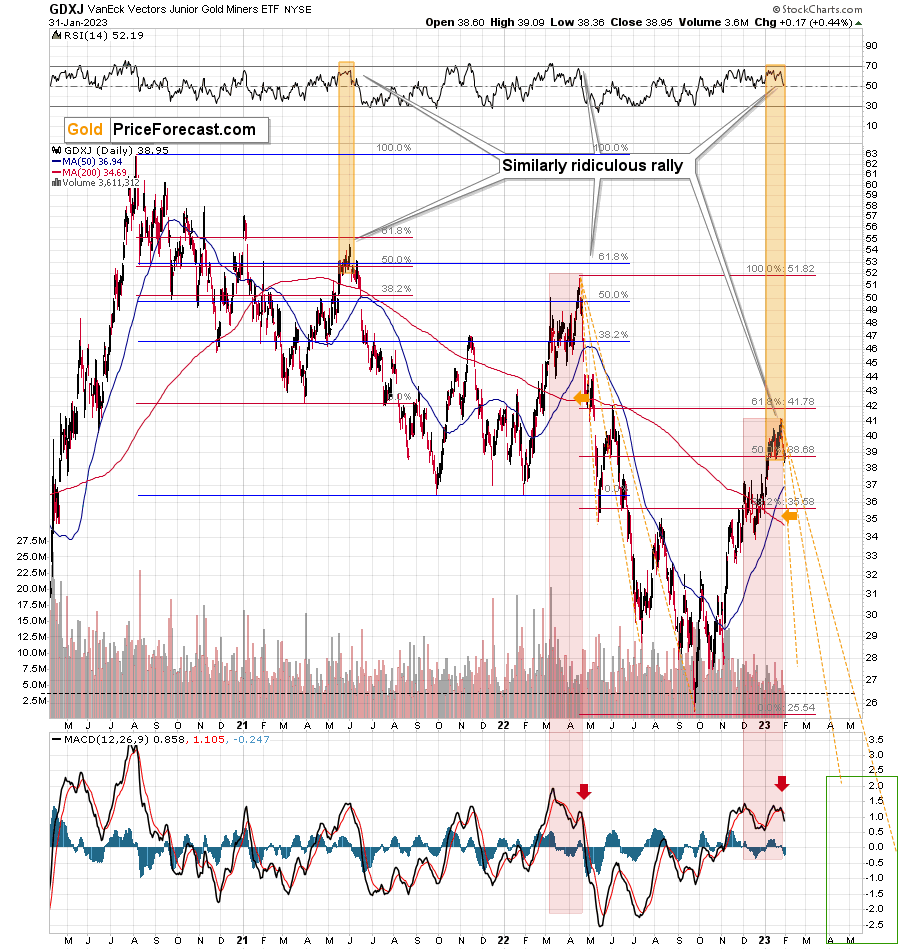

The GDXJ closed the day below the $39 level, which is well below its recent ~$41 high.

What Does the GDXJ Correction Indicate?

The mining stocks are therefore underperforming gold on a short-term basis as well as on a medium-term basis. After all, the GDXJ didn’t manage to correct 61.8% of its recent decline, while gold moved above its analogous retracement.

The above means that we saw a new bearish signal when taking both into account. However, there are equally bearish indications that we saw previously and that simply remain in place.

Gold’s RSI indicator is above 70, which is a classic signal, and the MACD based on the GDXJ (lower part of the chart) moved below its signal line, which is a sell indication. The same thing happened at the April 2022 top, by the way. Speaking of previous tops…

Even more importantly, the GDXJ’s correction of more than 50% but less than 61.8% of the preceding decline is something that ended two of the recent short-term but big corrections. The first one ended in June 2021, and the second one ended in April 2022. Now it seems that the current one ended in January 2023.

Each of those corrective upswings ended with the RSI near 70, and it’s been trading there for some time before moving much lower. History has a tendency to rhyme, and it appears that we are witnessing another bearish analogy at this time.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,