Gold Stocks: A Leisurely Uptrend

The US stock market and bullion swooned yesterday, but the GDX gold stocks ETF was up!

Gold stocks continue to perform impressively. Rallies look impulsive and corrections feel solid.

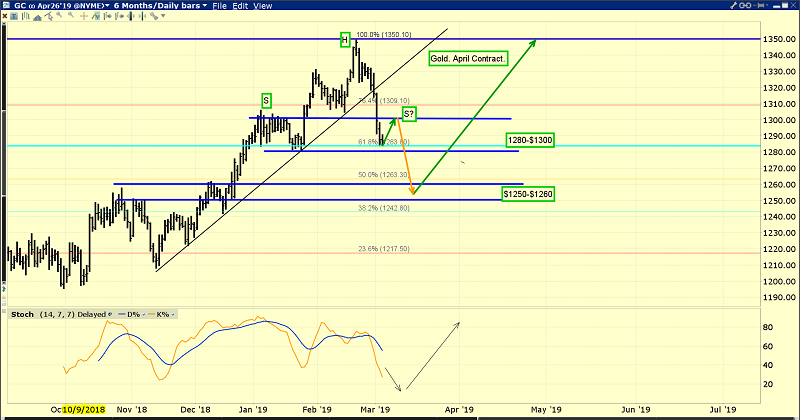

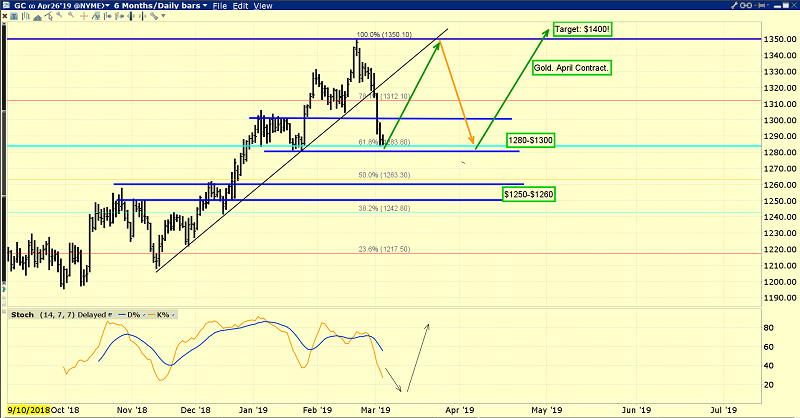

This is the daily gold chart. Gold has pulled back by about 30% after staging an enormous $170/ounce rally.

In the scenario shown on this chart, gold could trade down to the 50% retracement area and support zone at $1250-$1260.

From there, the rally would resume and gold should surge to my next $1400 target zone.

The next US jobs report is on Friday, and that report is likely to help indicate whether gold range trades or pulls back to $1260 or so before that rally to $1400 takes place.

My alternative scenario has the current area as the correction low, and a range trade between $1275 and $1350 would occur over the next few months.

Even though gold has corrected by about $70 from the $1350 zone, some individual miners have barely corrected at all. This is another sign of a very healthy market.

Over the weekend, some readers told me they were worried that Goldman Sachs’ influential analysts may be about to lower their $1425 gold price target back down to $1050.

With thanks to the forexLive team, I’d like to put that worry to rest. Not only are Goldman’s analysts still positive about gold…

They are raising their target prices!

The Western gold community can relax and enjoy this price pullback because there’s nothing to fear and everything is fundamentally solid.

There’s an important double bottom pattern in play on this FXI-NYSE Chinese stock market chart.

I’ll also note that it closed higher yesterday while the American Dow fell hard. Tariffs progress, government stimulus, and bigger weighting in international indexes should push the FXI higher.

In turn, that’s going to put Chinese citizens in a positive mood and make them eager to buy more gold.

This is the superb SIL silver stocks ETF chart.

All silver stock enthusiasts should feel confident and happy when looking at this chart. That’s because the slope of the current uptrend is solid and sustainable.

Violent rallies like the one in 2016 are not sustainable. They cause a lot of investor price chasing as they peak and tend to end very badly.

The fundamentals of this market are much different from 2016. That’s why key research analysts at firms like Goldman are so positive on gold. Where gold goes, silver tends to follow.

Silver can outperform gold without leading it. What I mean by that statement is that gold can be the first metal to make a new intermediate trend high, but the percentage gains for that move are bigger for silver. When silver leads gold, the market tends to be more speculative and that’s not healthy.

Gains that are sustained come from a market where gold leads the trending action, and that’s what is happening now.

Monster bank BMO says that the combination of falling mine supply and rising jewellery demand will provide a “tailwind” for the price of gold, propelling it higher into 2021.

Some bank analysts feel mine supply will decline, some see it static, and some see it rising, but only slightly, but almost all of them see demand bigger than supply. Government debt and de-dollarization are likely to become much more significant drivers of demand by 2021 than they are now. Both the fear trade and the love trade should be solid tailwinds for gold in the years ahead.

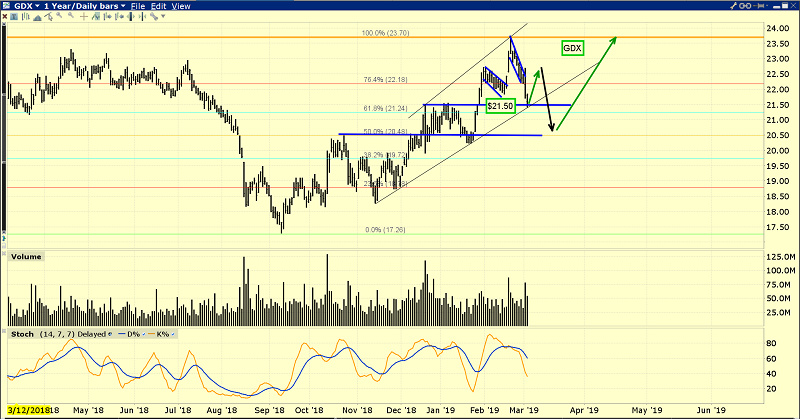

GDX bounced nicely off the $21.50 support zone yesterday. More gyration is likely, but I think GDX will rise above $24 before gold moves over $1350. This market is solid. Gold stocks look like tourists in a bus climbing up a mountain of fiat at a leisurely pace. My suggestion: Enjoy the ride!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my “Golden Ten Baggers!” report. I highlight key gold stocks trading under $10 that are poised for ten bagger gains as gold moves to $1400! I include buy and sell tactics to help investors manage the action professionally!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: