Gold SWOT: Barrick Gold Ends up on Barron’s Favorite 10 Stocks for 2024

Strengths

- The best performing precious metal for the week was palladium, up 24.32%. Palladium headed for its biggest gain since March 2020 as the United Kingdom government targeted Russian metals — but not palladium — with new sanctions. The metal, mainly used in catalytic converters, surged as much as 12% on Thursday after the UK published measures that ban British citizens and entities from buying certain Russian metals. Palladium is still down 38% this year, with manufacturers using the cheaper platinum as a substitute.

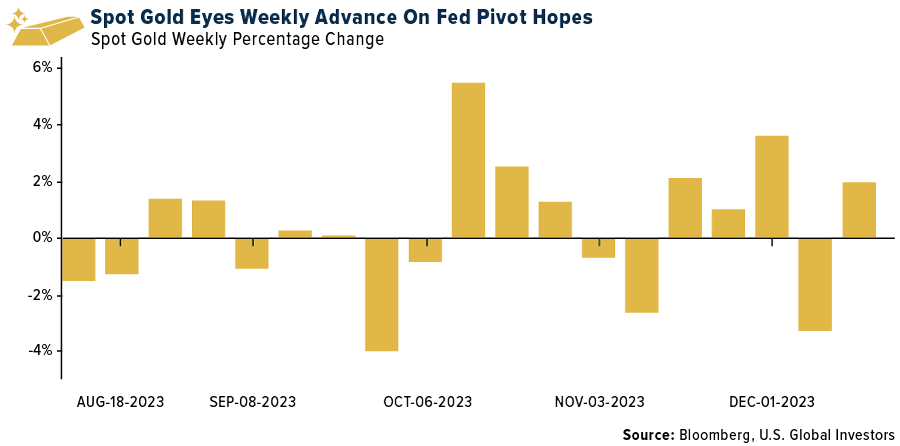

- Gold headed for a weekly gain in a market dominated by the Federal Reserve’s strongest indications yet that it will pivot to easing monetary policy next year. The precious metal surged 2.4% on Wednesday when officials at the U.S. central bank indicated they expect to cut interest rates by 75 basis points next year, which would be positive for the non-interest-bearing metal. Economists at some of Wall Street’s biggest banks are now calling for the Fed to ease policy earlier and faster.

- Loncor Gold announced it has entered into an agreement for the sale of Loncor's Makapela property for CDN$13.5 million cash. The agreement calls for the sale price to be paid in a series of progress payments beginning with a deposit of $2 million. The balance of the progress payments, totaling $11.5 million, will be paid upon completion of the transfer of title to Makapela, which is expected to occur before the end of February 2024. Makapela was a noncore asset, and now Loncor is funded for 2024.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.92%. Workers at a South African platinum mine returned to the surface after almost three days underground following what the company called an illegal sit-in. Employees at Wesizwe Platinum’s Bakubung operation northeast of Johannesburg resurfaced following discussions between management and union leadership, the company said, without elaborating on the content of the discussion.

- Petra Diamonds has entered into a non-binding term sheet on an exclusive basis with an interested party for the potential sale of its South African Koffiefontein Mine. There is the risk that the price may be less than expected as diamond prices and volumes are declining. The share price of Petra Diamonds is off slightly more than 40% year-to-date.

- The value of polished stone exports from India—a proxy for demand—was down 13% year-over-year, while volumes decreased by 7% YoY, implying aggregate prices remained increased by 2% month-over-month, but down by 6% year-over-year. The Indian diamond industry ended its voluntary suspension of rough diamond import this past Friday, as there as signs of stability emerging but need further confirmation on an improvement in market condition.

Opportunities

- According to Bank of America, gold remains a trade on rates. Thus, once the Fed announces a decisive end to the hiking cycle, expected in the second quarter 2024, new buyers should come into the market. If the Fed cuts earlier, gold could end the year at $2,400 per ounce versus spot around $1,980. The bank’s gold price model factors in changes in gold prices, rates and the U.S. dollar, not levels. The bottom line: rates and the dollar matter, with changes in direction more important than the actual levels. As such, Bank of America expects the next leg higher for the gold price will come when the Fed cuts rate, likely in 2024.

- Shares in Compania de Minas Buenaventura surged after Chilean copper producer Antofagasta unveiled a stake in the Peruvian miner, in an apparent move to diversify geographically away from Chile and add gold and silver exposure. Peru’s top publicly traded precious metals producer jumped as much as 27% in New York trading Friday. Antofagasta, the London-listed company controlled by Chile’s richest family, said it acquired a 19% stake and entered into discussions with Buenaventura to develop “a framework of collaboration,” including joining its board. “Our investment demonstrates the significant potential we see in Buenaventura’s asset portfolio,” Chairman Jean-Paul Luksic said in a statement.

- Cited on Barron’s favorite 10 stocks for 2024 is Barrick Gold. Gold mining stocks haven't been able to keep up with gold prices, but 2024 may be the year that changes for Barrick. Gold miners are thought of as leveraged plays on the metal, yet Barrick shares are up just 3% this year while gold is up more than 10% to $2,036 an ounce. The company has some of the world's best mines in spots like Nevada and the Dominican Republic, and it's the top gold producer in Africa. It aims to boost its gold and to a lesser extent copper by 30% by the end of the decade. It has the industry's most effective leader in CEO Mark Bristow, a hands-on manager who visits each major mine at least three times a year. He also has a knack for handling delicate relations with host countries in the developing world. "Barrick probably has the best management in the mining business, an excellent balance sheet with virtually no net debt, and a well-covered 2.3% dividend yield," says independent analyst Keith Trauner. The stock trades for about 16 times next year's projected earnings.

Threats

- Platinum group metals (PGM) prices have been under pressure, partially because palladium and platinum are key in auto catalysts, so the two metals are heavily exposed to cars with a combustion engine; under the technology status quo, palladium is one of the first commodities impacted by the energy transition. Anglo American notes that "The (platinum-group metals) basket price is now firmly into the cost curve, with sector returns at the lowest point seen in the last 30 years.” It remains to be seen how long these prices persist and its effect on several producers.

- Although gold finished the week up, profit taking at the end of the week on Friday trimmed the gains for the week as the Fed’s John Williams says talks of a rate cut in March are premature, tempering some of the enthusiasm the market has priced in. This lifted the dollar about 60 bp higher for the day but the 10-year yield displayed only a muted lift higher. Not a clear signal for the next direction in gold.

- Russian gold miners Highland Gold Mining, GV Gold, Trans-Siberian Gold and Kamchatka Gold were sanctioned by the U.S. government. The U.S. didn’t give any reason for the sanctions against the mining companies in an accompanying press release, but in February warned that any company or individual operating in the Russian metals and mining sector could be subject to sanctions.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of