Gold SWOT: China Raised Its Gold Reserves for a Third Straight Month

Strengths

- The best performing precious metal for the week was gold, but still off 0.06%. The merger of Newmont and Newcrest will be the largest gold company in the world, with a market cap of $57 billion, total gold reserves of 155 million ounces, total resources of 333 million ounces and a mine life of 17 years. The new company would also produce silver, zinc, lead and copper, and non-gold components would remain less than 20% of annual revenue over the next three years, according to Scotia.

- Burkina Faso’s military rulers are seeking to process more of its gold locally to ensure control over the country’s main source of revenue, writes Bloomberg, following a drop in output. Production sank 15% last year as the government battled a sprawling Islamist insurgency, with attacks increasingly targeting the mining industry. The West African nation, which exports most of its gold, is now looking to build a refinery to boost the value it gets from mining the commodity.

- China raised its gold reserves for a third straight month as central banks worldwide bolster their holdings of the safe-haven asset. The People’s Bank of China (PBOC) increased reserves by about 15 tons in January, according to data on its website on Tuesday, pushing its total to 2,025 tons. In the prior two months, it added a combined 62 tons.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.83%, following Nornickel’s forecast for just a 300,000-ounce deficit for 2023 versus its November forecast, which projected a deficit of 800,000 ounces. Impala Platinum's first half 2023 gross refined production declined 9% year-over-year to 1.48 million ounces and missed consensus by 5%. Key production misses came from Impala, Marula and Two Rivers, which were all down year-over-year and 5-8% below consensus.

- SSR Mining released production results for the fourth quarter that were below expectations, resulting in higher costs. Guidance for 2023 was within guidance, but costs for 2023 were higher than the Street too. The stock sold off as much as 10% intraday.

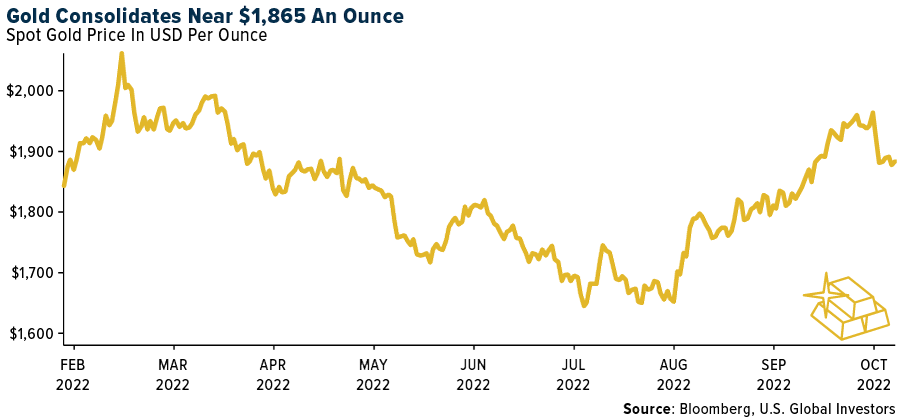

- Gold was steady near the lowest close in a month, reports Bloomberg, as poor risk sentiment in equity markets boosted the dollar. European stocks and U.S. futures dropped on Friday as the mood in markets turned bearish, the article explains, pushing up the dollar and capping gold.

Opportunities

- Canaccord remains bullish on gold in 2023. The group’s macro view hasn’t changed since it published its 2023 outlook. The Federal Open Market Committee’s (FOMC) 25-basis-point increase was in line with expectations, and the market continues to price-in a terminal rate of 5%. Despite the short-term pullback, Canaccord thinks gold and gold equities have more room to run ahead of a Fed pause with a non-trivial chance of a recession emerging.

- Speaking to Business Insider, David Rosenberg warned that the S&P 500 could tumble 30% to around 2,900 points, a U.S. recession is only starting and unemployment could surge. As a defensive move, Rosenberg suggested investors own gold, bonds and low-risk stocks to weather the downturn, but he ruled out Bitcoin and other crypto assets as sensible ways to preserve your assets.

- B2Gold Corp., a Canadian gold miner with assets in Africa and the Philippines, is looking to buy struggling smaller metals producers and distressed assets to expand and diversify operations. “We are very seriously looking at mergers and acquisitions and finding the next company to make a friendly offer to,” Chief Executive Officer Clive Johnson said in a Tuesday interview in Cape Town.

Threats

- UBS views Newmont as focused on executing its own portfolio of growth projects (Ahafo North, Tanami 2, Yanacocha, etc.) with limited interest in transformational M&A. Further, the debate around the company’s dividend, capex and cost guidance have not yet been settled. The NCM announcement adds another variable to the price/cost/free cash flow considerations they have been working on.

- Anglo American Platinum Ltd., the number one platinum miner by value, said investor payouts will drop as worsening power outages in South Africa curb output and push up costs. “Will our investors continue to get their returns? Yes, they will, but the size of returns will be slightly softer,” Chief Executive Officer Natascha Viljoen said in an interview.

- With the release of full-year financials, other gold company updates are often to be expected, including outlook updates for 2023 and beyond. Based on some early 2023 guidance updates and overall market sentiment, there is seemingly some fear that updated company outlooks will trend towards more negative than positive adjustments as companies continue to factor in further potential cost pressures.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of