Gold SWOT: The Dollar and Treasury Yields Extended Declines Last Week, Pushing Gold Higher

Strengths

- The best performing precious metal for the week was palladium, up 0.77%, after holding the spot for worst performer in the prior week. Dacian Gold’s second quarter 2023 production of 12,000 ounces was 5% better than consensus, with ore coming entirely from stockpiles following the full suspension of mining. AISC of A$2,099 per ounce was in line with consensus.

- Turkey was the biggest buyer of gold among central banks last year, with households also rushing to buy the commodity to shield from geopolitical uncertainty and rampant inflation. The central bank’s gold reserves were at the highest level on record, the World Gold Council said in a report on Tuesday. The

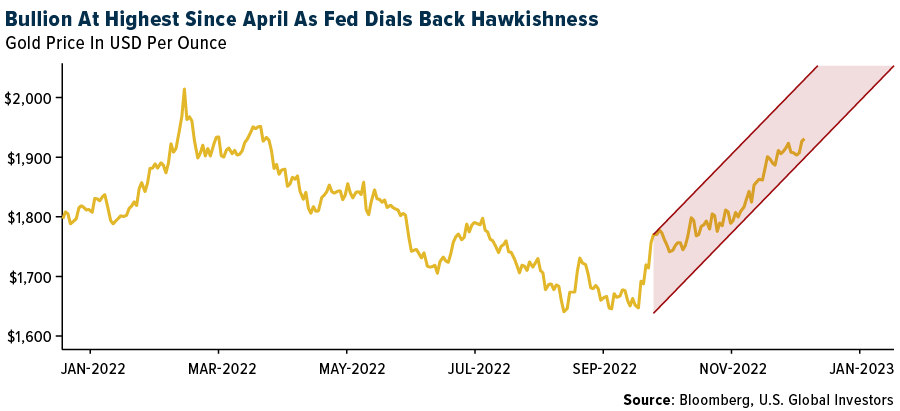

official figure was 542 tons, up by 148 tons. - Gold rose to a nine-month high after comments from the Federal Reserve suggested its aggressive cycle of rate hikes is coming to an end. Fed Chair Jerome Powell said policymakers expect to deliver a “couple” more interest-rate increases before putting their tightening campaign on hold as the central bank raised its key rate by a quarter point in a widely expected move. The dollar and Treasury yields extended declines on Thursday, pushing gold higher.

Weaknesses

- The worst performing precious metal for the week was silver, down 5.24%. Friday’s release on the change in non-farm payrolls (which rose an unexpected 518,000 in January versus expectations of just 188,000), sent precious metal prices down hard at the end of the week. The strong growth in employment likely means the Fed will not be cutting rates in the latter half of 2023, should this spike have any follow through in the coming weeks.

- South Africa’s worst ever power blackouts are threatening platinum and palladium supplies, both now and in the years ahead. Outages last year curbed output of the metals, and the power crisis that’s crimping the economy has worsened in recent months. The nation’s platinum-group metals production will likely fall this year, according to Impala Platinum Holdings Ltd.

- Silver Lake Resources had a weak second quarter result with gold production 11% below consensus and AISC 12% above consensus. Fiscal year 2023 gold sales guidance has been downgraded 3% to 260-275,000 ounces. This is at the lower half of original guidance. Fiscal year 2023 AISC guidance has moved 3% higher to A$1,950-$2,050 per ounce.

Opportunities

- Yamana Gold’s founder Peter Marrone commented that the gold sector will likely see more M&A as miners look to maintain margins in a higher cost and lower gold grade environment. Per the article: The “gold price today is roughly where it was in late 2020…but interestingly the margins have decreased quite substantially for almost all of the companies,” said Marrone. “It seems to me that we are going into universally lower grades, higher costs, inflationary impacts,” he continued, meaning “any form of consolidation is a smart one.”

- In November 2022, Morgan Stanley called for gold price support due to slowing rate hikes. The gold price has since rallied and is now trading at the upper bound of the trendline versus 10-year TIPS, but the group’s gold strategists still see potential upside. A regression analysis of the 10-year forecasts implies a gold price of $1,990-$2,200 per ounce.

- India's overall gold demand has remained resilient, witnessing a marginal decline of 2.92% in 2022 at 774 tons notwithstanding a sharp increase in prices, and the outlook for this year looks bullish, the World Gold Council (WGC) said in a report on Tuesday. The overall gold demand in 2021 stood at 797.3 tons,

according to the WGC's annual Gold Demand Trends report.

Threats

- According to BMO, updated mineral reserves and resource estimates for Fortuna Silver’s Yaramoko mine showed a decrease in contained ounces within the 55 Zone open pit area. A spatial discrepancy incorporated in the previous reserve estimate resulted in variation between drill holes, which reduced the amount of gold by 120,000 ounces.

- The Biden administration is set to ban the dumping of mining waste near Bristol Bay, Alaska, by issuing a decree that thwarts longstanding plans to extract gold, copper and molybdenum in the area because of its potential to harm the region’s thriving sockeye salmon industry.

- Hochschild Mining reported light fourth quarter production. Silver production was -6% versus consensus. Gold production was light versus consensus as well. Full year 2022 production marginally was below guidance due to significant local and national disruptions in Peru and associated logistical challenges.

**********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of