Gold SWOT: The Global Silver Market Is Set to Record a Physical Deficit in 2024

Strengths

- The best performing precious metal for the week was silver, but still down 3.56%. According to JPMorgan, Harmony published its first quarter 2025 operating update: 422,000 ounces of production is a beat and AISC is a beat (R1,026,137/kg). The company reiterated its fiscal year 2025 guidance across all metrics (production, AISC & grade). "We are well-positioned to execute our various life-of-mine extension projects and take our transformational international copper-gold projects up the value curve," it said.

- The Silver Institute notes that, “The global silver market is set to record a physical deficit in 2024 for the fourth consecutive year. Record industrial demand and a recovery in jewelry and silverware will lift demand to 1.21 billion ounces in 2024, while mine supply will rise by just 1%.” The report went on to explain that exchange-traded products are on track for their first annual inflows in three years as expectations of Fed rate cuts, periods of dollar weakness and falling yields have raised silver’s investment appeal.

- Newcore Gold reported that it intersected 204 g/t over 1-meter, the highest-grade interval to date, and a second intercept of 3.36 g/t over 28 meters at its Enchi Gold Project in Ghana. There is currently a 10,000-meter program underway. The drill program will move inferred to indicated resources and likely expand the footprint of the deposit. Ghana and Cote d’Ivoire are two of the most favorable West African mining jurisdictions.

Weaknesses

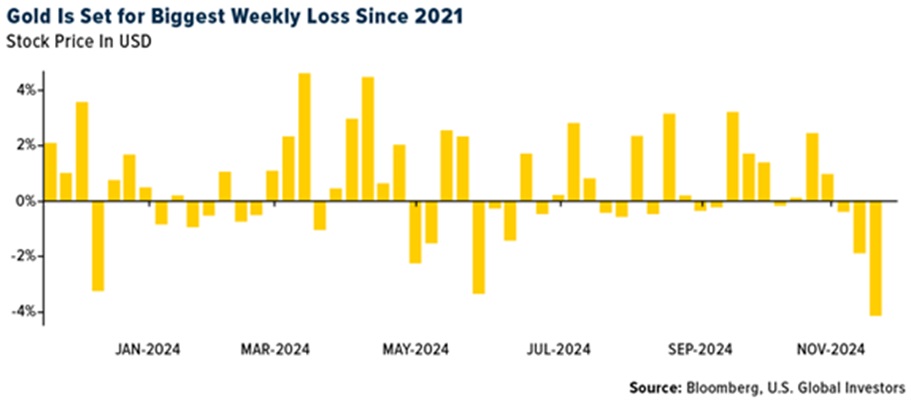

- The worst performing precious metal for the week was palladium, down 4.51%. The world’s largest gold-backed ETF recorded its biggest weekly outflow in more than two years last week as Donald Trump’s decisive election win prompted traders to book profits. SPDR Gold Shares (GLD) saw an outflow of over $1 billion, the largest weekly fund outflow since July 2022, according to data compiled by Bloomberg.

- Despite the cut in interest rates last week, gold still slid back again this week on the comments from Jerome Powell that the Fed will be in no rush to cut rates given the strong performance of the economy. According to JPMorgan, COMEX Non-Commercial Gold positioning has fallen to 255,000 lots net long, which is the lowest since early August. Longs fell by 30,000 lots this week while shorts also moderated slightly.

- According to the Financial Times, shares of gold producer Resolute Mining plunged more than 30% on Monday after the company announced its chief executive Terence Holohan and two other employees had been detained in Mali. The executives were in the capital Bamako to discuss with officials “open claims made against Resolute” that the group “maintains are unsubstantiated,” said Resolute, which is listed in Sydney and London. $160 million dollars to resolve the tax dispute is the number that seems to be the price of their “bail.”

Opportunities

- Canaccord notes that following Trump’s 2016 win, the gold price corrected 12% in the first 45 days after the election, before going on to gain 68% over the remainder of his term (41% before COVID started). This next month-and-a-half or so is likely to present the market with a new entry point into gold, as the new Trump administration begins to implement policies that likely will disrupt the economic plans of some industries that are reliant upon imports and could heighten the inflation risks for the U.S.

- Silver was the best performer of the precious metals this week but still down. The silver market is expected to experience its fourth year of deficit production, but demand is still expected to grow. China started generating power from its first gigawatt-level offshore solar project. The project is about 5 miles off the coast of Shandong. By the end of 2025, Shandong plans to add more than 11 gigawatts of offshore solar with a goal of 42 gigawatts of ultimate capacity.

- Westgold Resources has materially increased its Starlight Mine Resource by 91%, including declaring a maiden open pit Resource. The increase has the potential to lift both: 1) the sustainable rate of site production, and 2) substantially extend mine life beyond five years, according to RBC.

Threats

- China’s Zijin Mining says the Buritica gold mine in Colombia suffers losses due to illegal mining, according to a statement. The losses are estimated to be around 3.2 tons of gold, valued around $200 million. The perpetrator of this seizure has been chalked up as the “Gulf Clan” – armed Colombian drug cartel. On another continent, the South African government has said it will not help thousands of illegal miners inside a closed mine. The illegal miners are said to be running out of food, water and supplies after local police closed off entrances that were used to transport these necessities forcing them to come to surface and be apprehended.

- Fresnillo shares dropped after the gold and silver miner warned the Sabinas mine is experiencing “operational difficulties” that are affecting production. Analysts note this is likely to lead to a lower contribution from the Silverstream agreement, which entitles Fresnillo to a portion of the mine’s silver output from its owner Industrias Peñoles, according to Bloomberg.

- The rise of electric vehicles is poised to shake up demand for platinum group metals that are used in auto catalysts to reduce pollutants from car exhaust fumes. Palladium will be the hardest hit among the PGMs as catalytic converters are its main demand driver. Given its limited applications beyond transport, palladium is expected to start to see surplus volumes in the market beyond 2030, according to Bloomberg NEF analysis.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of