Gold SWOT: Gold Climbed Higher After Weaker-Than-Expected Jobs Data Was Released

Strengths

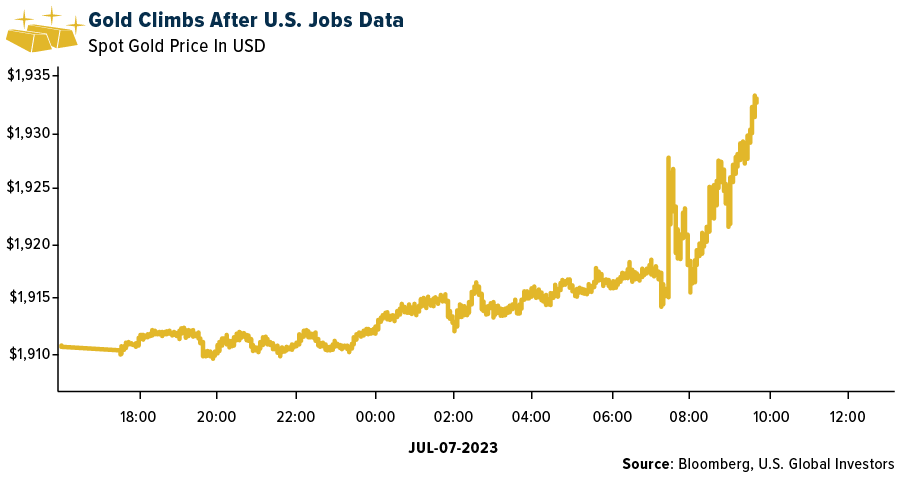

- The best performing precious metal for the week was palladium, up 2.25%, despite hedge funds boosting their net bearish positioning to a record high going back to 2009, according to Bloomberg. Gold caught a break on Friday with the weaker-than-expected change in nonfarm payrolls, perhaps taking some pressure off the Federal Reserve to hike rates again. China, for an eighth consecutive month, has added to its gold reserves. Holdings rose by 680,000 ounces or about 23 tons. Since the country’s buying resumed in November of last year, it has added approximately 183 tons to the total stockpile of 2,330 tons.

- Following the sale of the Boungou and Wahgnion mines, Endeavour Mining updated its 2023 full-year production and AISC guidance to adjust for the assets sales, decreasing production to 1,060 – 1,135k ounces from 1,325-1,425k ounces with AISC improving by $45 per ounce to $895 – $950 per ounce.

- Silver Lake’s gold sales of 83,500 ounces were 13% above consensus and 33% higher quarter-over-quarter. This was enough for full year 2023 guidance to be met with 260,400 ounces. Higher grades drove the beat.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.09%. Osisko Gold Royalties announced the surprise departure of President and CEO Sandeep Singh, effective immediately. Paul Martin will step into the role as the interim CEO while the board undertakes a search for a new permanent President and CEO. This will create some near-term uncertainty, particularly given the relatively limited associated details.

- Security issues in Mexico have likely erased as much as 10% of the value of mineral production at many mining projects in the area, Reuters reported, citing Jaime Gutiérrez, the president of CAMIMEX, the country's main mining chamber.

- Freeport Indonesia, a unit of Freeport-McMoRan, said this week that it has not yet obtained a government permit to continue exporting its materials, reports Reuters. This risks overcapacity at its storage facilities in the eastern region of Papua.

Opportunities

- De Beers (Anglo's diamond subsidiary and 11% of Anglo NPV) struck a new agreement with the Government of Botswana (GoB) after three years of delays. Up to now, the GoB has directly sold 25% of the output of (De Beers' Botswana diamond subsidiary) Debswana; with De Beers selling the remaining 75%. Under the new agreement, the GoB will sell 30% of Debswana's output, rising by 2% a year to 50% at the end of the 10-year agreement.

- Changes to solar panel technology are accelerating demand for silver, a phenomenon that is widening a supply deficit for the metal with little additional mine production on the horizon. Silver, in paste form, provides a conductive layer on the front and the back of silicon solar cells. But the industry is now beginning to make more efficient versions of cells that use a lot more of the metal, which is set to boost already-increasing consumption. Solar is still a small part of overall silver demand, but it is growing. It is forecast to make up 14% of consumption this year, up from around 5% in 2014, according to a report from The Silver Institute, an industry association.

- Goldman expects ongoing interest in Australian gold assets following recent activity, with increasing focus on emerging, high-margin mid-caps or synergistic opportunities as broader industry consolidation continues. This comes with favorable near-term FCF yields (10%) and valuations more fairly priced (1x NAV) on its $1,700 per ounces LT gold price.

Threats

- Talks this week between Newmont management and workers at Mexico’s biggest gold mine failed to resolve a strike that has lasted nearly a month. Company and union representatives sat down on Monday without settling a dispute over a profit-sharing arrangement, Newmont’s Peñasquito mine posted on its Facebook account, citing unrealistic union demands. The union sought a 16% share of profit to workers, lower than the 20% initial demand, which was double the percentage in a contract signed last year, Newmont said.

- Mali’s military leader Assimi Goita appointed Amadou Keita as minister of mines in a government reshuffle on Saturday, according to a presidential decree. Keita replaces Alousseni Sanou, who is also finance minister and who stood in for former mines and energy minister Lamine Traore after he resigned on May 31. Traore stepped down after power cuts in the West African nation fueled discontent and hampered businesses. Mali is one of Africa’s top gold producers and home to mines operated by companies including Barrick Gold, B2Gold Corp,

Resolute Mining and AngloGold Ashanti. - Hedge funds are lining up to short palladium as weak global demand points to a potential oversupply of the precious metal. Money managers’ net positioning in the palladium futures and options market was the most bearish on record last week, according to data from the Commodity Futures Trading Commission

going back to 2009. The driver was a 14% increase in short selling by the funds from the week before.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of