Gold SWOT: K9 Mining Reported Strong First Quarter Results

Strengths

- The best performing precious metal for the week was silver, up 3.25%. Steppe Gold Limited reported a significant boost to its year-over-year first quarter revenue this week, reports Proactive Investors, as the company ramps up production at its ATO mine in Mongolia. Revenue for quarter ended March 31, 2022, came in at $5.5 million. The company said it mined 69, 613 tonnes of ore and 192,680 tonnes of ore were stacked on the leach pad, with an average gold grade of o1.83 grams per tonne.

- K92 mining reported first quarter results this week, with strong quarterly gold equivalent production of 28,188 ounces (or 24,152 ounces of gold, 1.52 million pounds of copper and 28,142 ounces of silver). This is a 49% increase from the first quarter of 2021. The company also highlighted cash costs of $536 per ounce of gold and all-in sustaining costs of $788 per ounce of gold.

- Investors once again looked to gold as a haven asset to help protect their hard-earned cash in the first quarter of 2022 as record inflation pummeled other investment vehicles. Physical demand for gold jumped 34% year-over-year to 1,234 tons in the first three months of 2022, according to the World Gold Council, marking the highest quarterly demand increase the gold market has seen since 2018.

Weaknesses

- The worst performing precious metal for the week was steel, down 4.42%. The coming days could be pivotal for prices since significant technical levels have been broken. This could act as a brake on price declines in the near-term by offsetting some of the investor outflows which have weighed on the market recently, particularly if activity in China begins to rebound in the coming weeks after prolonged lockdowns have hampered demand.

- Equinox Gold Corp. has suspended operations at the RDM Mine in Brazil, according to a statement. It is withdrawing its 2022 production guidance for the RDM Mine until operations resume. The operation halt is due to delayed permits for the scheduled tailings storage facility raise. The company expects operations could restart as soon as two months from receiving regulatory approval, which is anticipated in the second quarter of this year.

- Exchange-traded funds cut 229,133 troy ounces of gold from their holdings in the last trading session, bringing this year's net purchases to 7.32 million ounces, according to data compiled by Bloomberg. This was the seventh straight day of declines. The sales were equivalent to $415.1 million at the previous spot price.

Opportunities

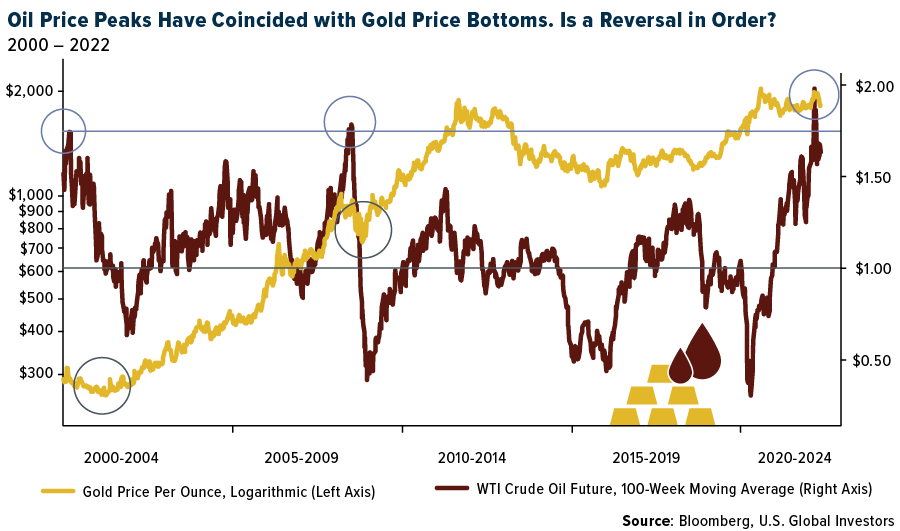

- The fact that the last two mean reversion periods in crude oil coincide with enduring bottoms in the price of gold may play out in 2022, writes Bloomberg. The crude peak in 2000 launched gold above $300 an ounce, the article explains, and when oil reverted from its all-time high at around $145 per barrel in 2008, the yellow metal formed a base around $800. Could a reversal be in store?

- Orezone Gold Corporation continues the development of the Bombore Gold Project, the largest undeveloped gold project in Burkina Faso, with a total resource of 6.2 million ounces at 0.68 grams per ton silver. As of March 31, 2022, overall construction progress was at 68.4% with the project remaining on schedule for its first gold pour in the third quarter 2022.

- Late last week, Orla Mining released its first quarter financials, and more importantly, its first quarterly release as a gold producer. Numbers came in as a solid beat (clean earnings per share of $0.08 per share ahead of consensus of $0.03 per share). This comes on better production (23,000 ounces of gold in the quarter, better than consensus of 21,600 ounces of gold).

Threats

- Small-scale miners near Endeavour Mining’s operation in Burkina Faso launched a protest on Tuesday after mine officials moved in to clear them from the surrounding area, according to Agence d’Information du Burkina. Artisanal miners stormed Endeavour’s Houndé project and set fire to its facilities, the state-run news agency said on its website. Neither Endeavour nor officials at the mining site could be immediately reached for a comment.

- Continued weakness in the junior gold space could begin to weigh on the GDXJ ETF, as companies at the lower end of the market cap scale begin to reach threshold for deletion. Over the past month, valuations have declined by 25% in parallel with the broader market sell-off, and analyst estimates show some junior gold miners now trade at $41 per ounce on an EV per ounce basis, in-line with levels last seen in mid-2019 at a gold price below $1,300 per ounce.

- The World Platinum Investment Council (WPIC) lowered its supply forecast for 2022 to 7.78 million ounces, as it expects lower output from South Africa and Russia. Additionally, the organization estimated supply at 8.18 million ounces earlier this year and major South African producers are all lowering guidance. The WPIC sees sanctions impacting Russian output and has reduced its platinum surplus outlook to 627,000 ounces from 652,000 ounces.

*******

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of