Gold SWOT: Kinross Gold Has Completed the Sale Of Its Russian Assets

Strengths

- The best performing precious metal for the week was silver, but still down 1.45%. Tom Palmer, CEO of Newmont Mining, the biggest gold producer, sees a higher floor forming under the gold market as years of stimulus devolve into a fight to contain inflation. Gold has held up much better than cryptocurrencies as the broader markets have pulled back. This week we saw several major crypto firms freeze customer withdrawals.

- Awalé Resources closed a private placement with Newmont Ventures, a wholly-owned subsidiary of Newmont Corporation. Awalé projects are in Côte d’Ivoire and Glen Parson is the CEO. Odienné is the main project and the agreement is staged such that Newmont could earn up to 75% of the project.

- Streaming transactions totaled $1.7 billion in 2021, the strongest year since 2015. The sector has booked $487 million year-to-date compared to $455 million by this time last year. Wheaton Precious Metals has again been the most active with $366 million in streams, followed by Osisko Gold Royalties with $110 million.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.06%. Sibanye-Stillwater said it has suspended operations at its Montana-based palladium and platinum mines after the area was hit by flooding that washed away access roads and bridges. The Johannesburg-based precious metals producer was forced to evacuate some workers from the Stillwater and East Boulder mines and will wait for the waters to subside before conducting an assessment, spokesman James Wellsted said by phone.

- Gold futures continue to consolidate in a bearish pattern as the precious metal is caught between a broad risk-off and strong dollar flow. There may be an eventual resumption of the medium-term downtrend if the market continues to trade below $1,889-$1,899 and $1,917-$1,927 resistance layers. Broader range support remains near $1,700.

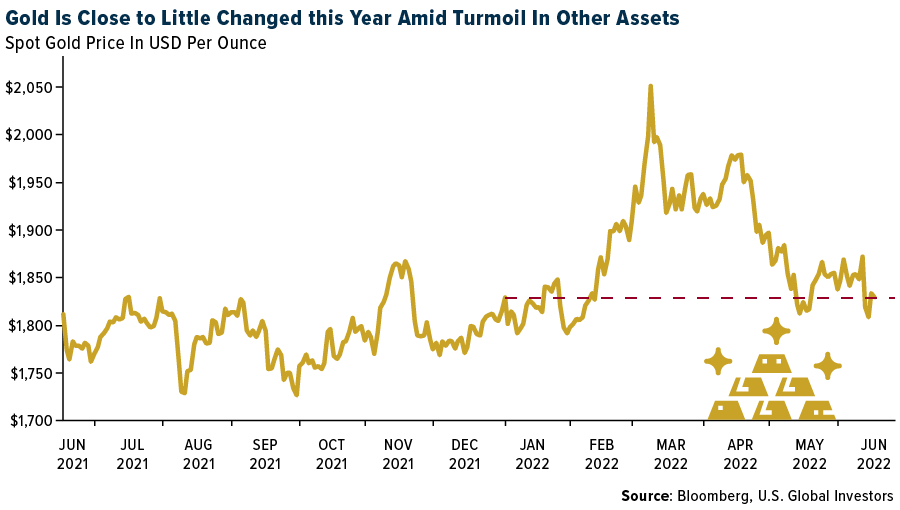

- Cost inflation continues to be a key theme for precious metals producers, and against that backdrop, the royalty names as a group outperformed in 2021, (down 4% on average versus the producers down 13% and gold 4%). So far in 2022, the royalty sector is down 2% on average against a flat gold price (up 1%), and while slightly lagging the senior producers they are outperforming the intermediate and junior gold producers, down 12% and 19%, respectively.

Opportunities

- Gold held much of its biggest gain in more than three months, reports Bloomberg, as shifting expectations of the speed of the Federal Reserve tightening helps the yellow metal rediscover its role as the ultimate haven asset. The resilience of bullion as the Fed announced its biggest interest-rate increase since 1994 is reminding investors of gold’s appeal, the article continues.

- Gold Fields has agreed to acquire Canada’s Yamana Gold for around $7 billion, reports Bloomberg. The deal provides greater geographic diversification but material EPS dilution. Under the terms of the agreed offer, 100% of Yamana outstanding shares will be purchased at a ratio of 0.6 of an ordinary Gold Fields share, valuing Yamana at $6.7 billion. The transaction is expected to close in the second half of the year. Yamana’s board has agreed to back the deal, which will require approval from both sets of shareholders.

- Orla Mining will acquire all of the issued and outstanding shares of Gold Standard by way of a court-approved plan of arrangement. Gold Standard's key asset is the 100%-owned South Railroad Project, a feasibility-stage, open-pit, heap leach project located on the prolific Carlin trend in Nevada. In February 2022, Gold Standard completed a robust feasibility study and permitting activities are currently underway. Gold Standard also owns the Lewis Project, a large, strategically located, prospective land package on the Battle Mountain trend in Nevada.

Threats

- Firmer inflation is historically bullish for gold prices. Now, however, it is being quickly counteracted by more aggressive pricing for a policy response from the Federal Reserve and other central banks. As such, there needs to be more signs that economic growth is cracking under the strain of higher inflation and tighter financial conditions, which would, in turn, support sustained safe-haven inflows into the precious metals sector.

- Dacian Gold announced it was suspending operations at Mt. Morgan, and open pit operations at Jupiter are to be suspended at the end of June. Over the past six months, Dacian noted it has seen a rapid change in the environment with significant inflationary cost pressures. Dacian will process existing stockpiles of ore and focus on

- exploration drilling below the Jupiter Pit.

- Renowned billionaire hedge fund manager Stanley Druckenmiller says that in an inflationary bull market, he wants to own Bitcoin more than gold “for sure.” However, he explained that in a bear market, he would prefer to own the yellow metal.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of