Gold SWOT: The Silver Market Has Been In A Deficit Position For The last Two Years

Strengths

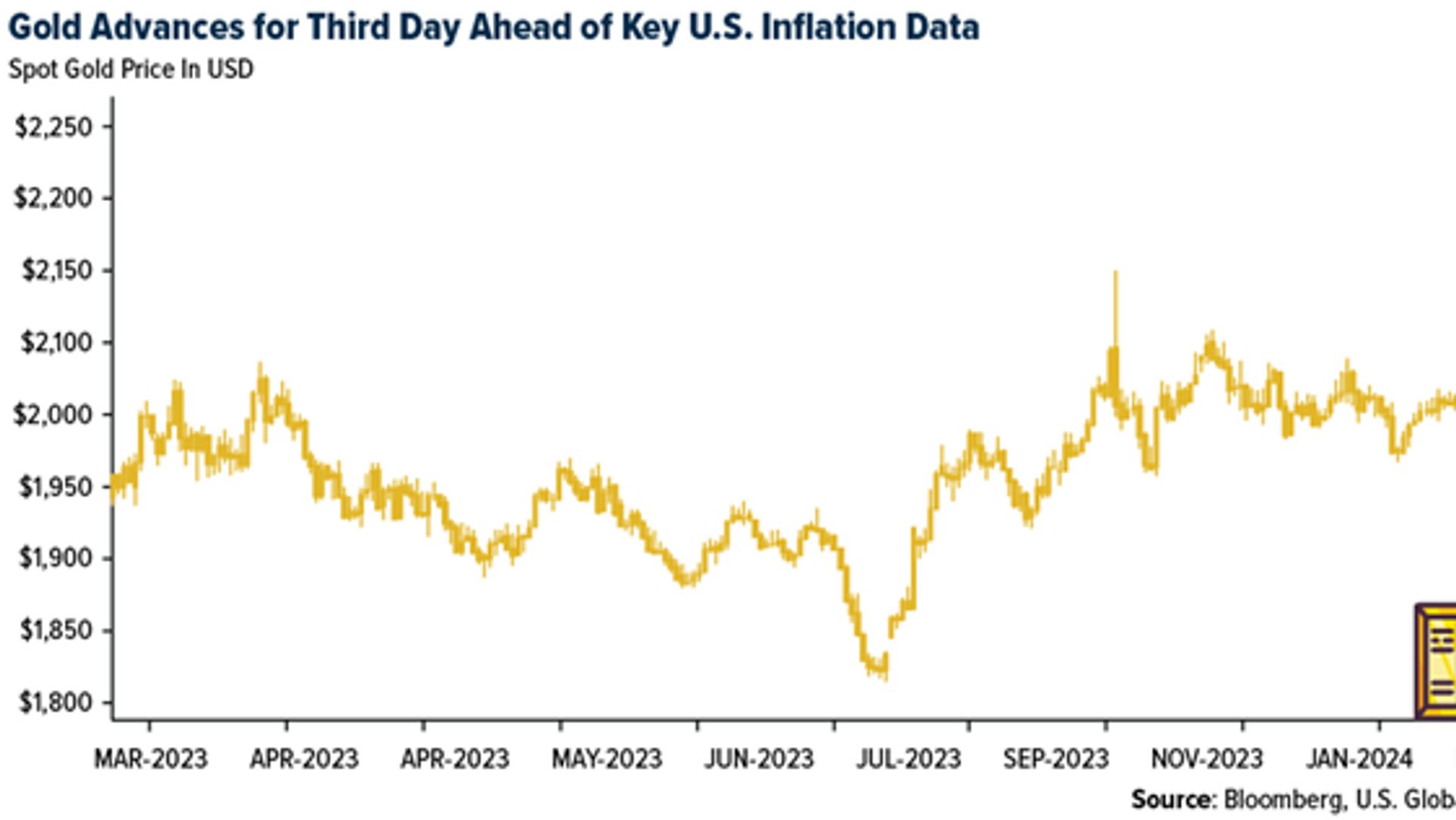

- The best performing precious metal for the holiday shortened week was gold, up 2.79%. According to Bloomberg, gold was steady ahead of a slew of inflation reports that may offer more clarity on when central banks will start cutting interest rates. The Federal Reserve’s preferred measure of underlying inflation — the core personal consumption expenditures index, which excludes food and energy costs — is due Friday.

- The Silver Institute notes that the physical silver market has been in a deficit position for the last two years with another deficit forecast for 2024. Silver had been lagging gold earlier this year this year but in the last month, silver has gained 9.44% while gold is up 8.55%. Silver is likely to be well supported with expanding solar cell production.

- According to Bank of America, China boosting imports of gold for nonmonetary use by 51% to 367 tons in January and February; to put that number into context, the global annual physical gold market is usually around 4000 tons. The purchases have been driven by a confluence of factors, including somewhat constrained domestic investment options, with the health of equity markets and housing a continued concern.

Weaknesses

- The worst performing precious metal for the holiday shortened week was silver, but still up 0.63%. According to BMO, Silvercorp’s off-market takeover offer for OreCorp has expired with the company not achieving the minimum 50.1% acceptance condition. The company will not match a competing offer to acquire OreCorp. Companies are remaining disciplined on transaction as Ramelius Resources walked away from pursuing an offer to acquire Karora Resources.

- Zimbabwe’s platinum miners are asking the government to help reduce their electricity tariffs and fiscal charges where they are paying 50% more than last year and PGM prices have also fallen and are expected to remain soft to weaker.

- According to Scotia, Endeavour Mining reported Q4/23 financial results with adjusted earnings per share (EPS) from continuing operations of $0.17 (versus consensus of $0.27). The earnings miss was driven mostly by higher income tax expense, royalties and depreciation, offset slightly by lower exploration and G&A expenses. M&A appears to not be off the table versus focusing on execution.

Opportunities

- According to MarketWatch, “gold-mining stocks look set to outperform physical gold.” Gold bullion has outperformed gold mining company shares over the past three years by one of the largest margins in decades. Gold recently hit a new all-time high above $2,200 an ounce, while the Philadelphia Gold and Silver Index is below where it stood three years ago. The lag in performance reflects the failure of profit margins to materialize while gold prices rose yet due to rising input costs and wages. Input costs have stabilized, yet wages are still an issue for some operators. If the Fed does start cutting rates and gold lifts, investors will be keen to watch for margin expansion.

- Alamos Gold announced an agreement to acquire Argonaut Gold for a total consideration of C$0.40 per share, a 34% premium to yesterday's closing prices. The consideration consists of C$0.34/share of Alamos shares and a SpinCo holding Argonaut's assets in Mexico valued at C$0.06/share. Shares of Alamos jumped 7% on the news as this deal does have true synergies with Argonaut’s in construction Magino Mine now being able to share Alamos’s production facilities at their nearby Island Gold Mine.

- According to BMO, for MAG Silver in their view the most significant impact of the new technical report is to remove the previous uncertainty that was driven by an outdated technical report. With the market now having more visibility on Juanicipio’s expected performance based on the technical report, they expect the increased confidence in Juanicipio to translate into strong performance for MAG shares.

Threats

- According to Bloomberg, lawmakers in South Africa’s National Assembly passed the Gold and Foreign Contingency Reserve Bill Tuesday, enabling the government to tap a portion of funds in the account held by the central bank to pay down its debt.

- Orezone Gold provided 2024 guidance that is below CIBC’s expectations, and despite connection to the Burkina Faso national grid, all-in sustaining costs (AISC) are expected to be higher year-over-year. Also, the company reported that it is negotiating a bridge loan with its Burkinabe lender as it expects to access higher-grade ore at Siga East in H2/24.

- Scotiabank says it is awaiting an update from the Government of Canada on the timeframe for implementation of the global minimum tax (GMT). The Canadian federal budget is scheduled to be presented on April 16, which makes it unlikely that the GMT will be enacted before the end of this quarter. This is expected to impact the earnings of some royalty companies, depending on their corporate structure.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of