A Gold Tie Versus A Gold Stock

The US stock market is in “sleigh ride” mode against gold stocks.

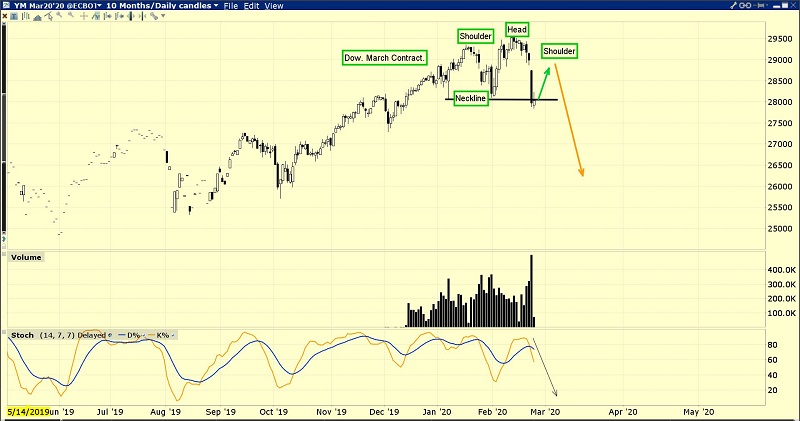

Yesterday was another day of disappointment, fear, and outright terror… for most investors who are locked in the Dow versus GDX sled.

The disintegration of the US stock market against GDX began long before Corona started, and it will likely continue long after a vaccine (real or purported) is announced.

While Trump’s “poster boy” stock market tumbled 1000 points yesterday, he wore a gold tie in India but said absolutely nothing about the need for investors to own the world’s greatest metal.

This, while Goldman analysts cut their US GDP growth forecasts for 2020 Q1 to 1%.

Indian government tariff taxes on gold have put millions of Indians on the bread line, destroyed hundreds of thousands of businesses, and ruined citizen morale.

Sadly, it’s unknown whether Trump is wearing a gold tie to show his appreciation for gold, or because he loves the Indian government’s barbaric tariff taxes on it.

What is known is that there is no US Treasury buy program for gold now, and none appears to be forthcoming.

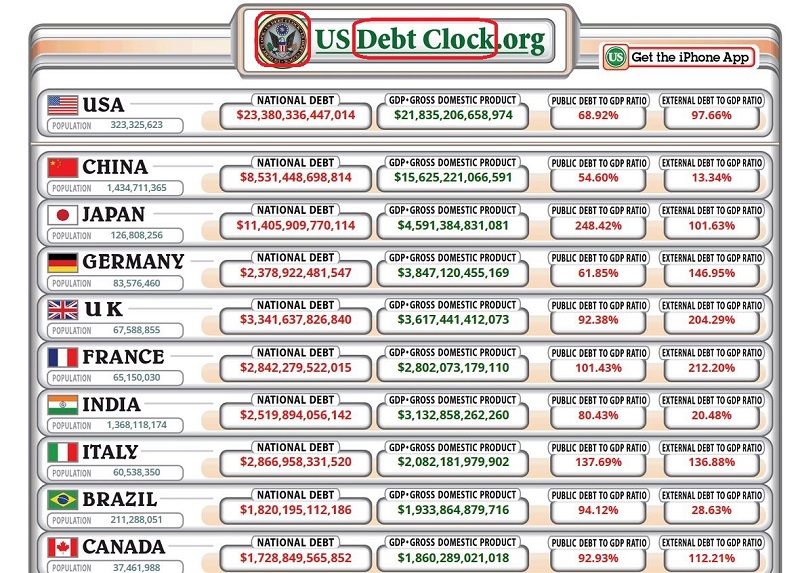

The hands on the debt clock have spun to $23.380 trillion as of this morning, yet none of the US presidential candidates show any interest in reducing the horrifying size of the government.

That debt and government size obsession is what has created the Dow versus GDX sleigh ride chart, and it’s creating an acceleration in downward momentum now.

Corona is simply a new problem that governments will try to solve… by adding even more debt to a gargantuan pile.

The spectacular GDX chart. This chart shows overnight trading in addition to the regular NYSE day trades.

A breakout would occur from an immense base pattern… with a weekly close over $32.

That close seems imminent, target the $50 price area, and it would be probably be accompanied by complete disintegration of the US stock market against gold stocks.

I issued a short-term sell signal for gold stocks at my https://guswinger.com leveraged ETF gold stock trading service early yesterday morning. Traders booked juicy profits and are hungry for more! As expected, by yesterday afternoon, gold stocks were in substantial “recoil mode”.

That’s only a focus for the short-term trader. Investors should be buyers of all pullbacks, in preparation for what should soon be a glorious breakout and surge to $50, and higher, for GDX.

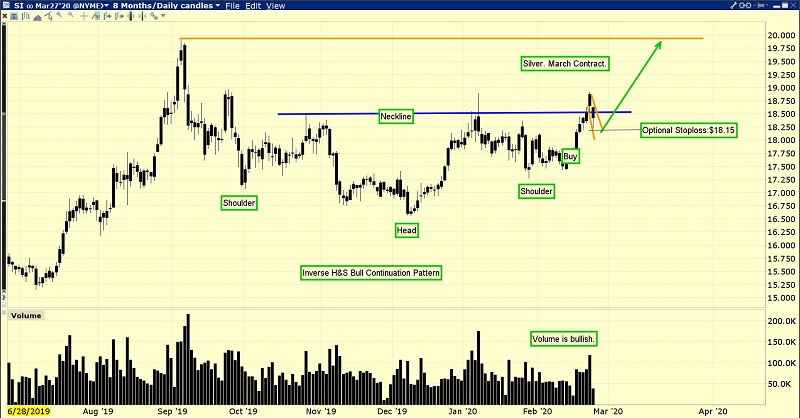

This may be the best looking chart in the world right now: silver.

Note the long tail on the current candlestick. That’s positive.

I urged investors to buy around the right shoulder low of this spectacular inverse H&S bull continuation pattern, with an optional stop at $17.15.

That stop could be raised to $18.15 now, and silver can be bought again today.

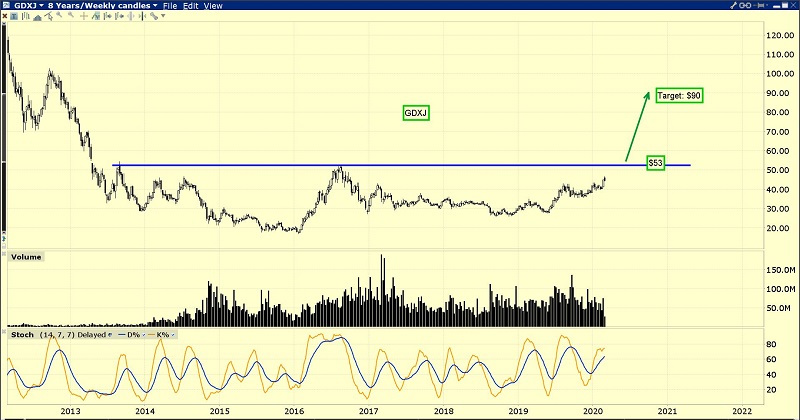

The weekly GDXJ chart.

GDXJ is called a junior gold stocks ETF, but it’s mainly comprised of intermediate producers, making it an ideal investment vehicle for a lot of gold bugs.

A weekly close over $53 would target the $90 price zone. Short-term traders can play it with JNUG, and investors can buy the ETF and/or some of its component stocks.

Like GDX, GDXJ is crushing the Dow. A breakout over $53 would probably create a scenario where a GDXJ elephant is stomping on a rancid US stock market tomato… but really, that’s already happening now!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “GDXJ Leaders Of The Pack!” report. I highlight leading component stocks of this key ETF, with money-making tactics for investors!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: