Gold's Fading Ember Into December

With the precious metals running out of puff deep into 2016, recall how they completely dominated our BEGOS Market Standings throughout the year's first two trimesters, (Oil also sneaking up there to appear on the podium in the Top Three). But with it all going wrong for Gold and Silver these past two months, 'tis "Black Gold" that has taken the top step as we see with a turn of the calendar's page, this year-to-date table encompassing 11 months plus 2 December days now being in the books:

Still, with the precious metals presently en route to posting their best annual gains of the past six years -- barring it all going even further wrong with but 19 trading days remaining in 2016 -- the "Yeah, But Dept." reminds us that Silver and Gold have been respectively up as much as 53% and 29% since New Year. "Doink!"

'Course, 'tis a mere pittance compared to the far more fiery tracks of the precious metals equities when measured from one full year ago-to-date. As they presently stand from 03 December last, NEM (Newmont Mining) is +79%, SIL (the popular exchange-traded fund of the Silver miners) is +77%, GDX (the prominent exchange-traded fund of the Gold miners) is +52%, FNV (Franco-Nevada) is +21%, and the more subtle sleeper for now -- corporately restructured GG (Goldcorp) -- is +12%. But look from what mid-summer heights they've fallen: live by their volatility, but nimbly attempt to circumvent one's demise as they dive. "Ouch!"

Specific to Gold from a year ago, let's next turn to the weekly bars. The declining red dots denoting now nine weeks of parabolic Short trend are catching up in number to the 11-week down run wherein we found Gold at this time a year ago (those left-most red dots). This is becoming a bit reminiscent of a scene from "The Man With The Golden Gun" (Eon Productions, '74) wherein one of the participants in a car chase blurts out "I can't find the brakes..." :

As for their once entwining pas de deux, Gold and the S&P 500 have quite obviously parted ways along their percentage tracks over these past 21 days, ahead of the interest rate raise:

However, clearly having rejoined ways are the S&P and Economic Barometer, both in rapt anticipation of the Federal Reserve Bank's nudging up of their targeted Funds rate from the 0.25%-0.50% zone to the 0.50%-0.75% zone come 14 December, practically the same date of a year ago:

But specific to the stock market, we wrote this past week as follows to an inquiring great friend and colleague: "...I’ve been expecting a stock market correction of some 35%-50% for several years. The 'faux' P/E ratio [of the S&P] bandied about by the FinMedia is nowhere near the truthful measure, which if you do the math, is presently 32.9x ... Bottom line: either earnings have to double without stock prices rising, else stock prices have to collapse. The rising interest rate scenario shall hasten this. Timing which quarter ‘twill occur is not as important as getting into cash right now. Better not to grow one’s wealth rather than lose it...." A word to the wise is sufficient. As is the Dollar foundationless without Gold, so is a stock market foundationless without earnings. Write it down.

And that brings us to this cool technical view: the below three-panel chart displays the last 21 trading days for the S&P ("Spoo" left), Gold (center) and Silver (right). As many of you readers know, the baby blue dots represent the consistency of the 21-day linear regression trends (diagonal lines). Note how these "Baby Blues" for the S&P have just begun to crack, whilst those for the precious metals just barely have begun to curl upward. The early bird really can get the worm, (assuming prudent cash management should the worm away squirm):

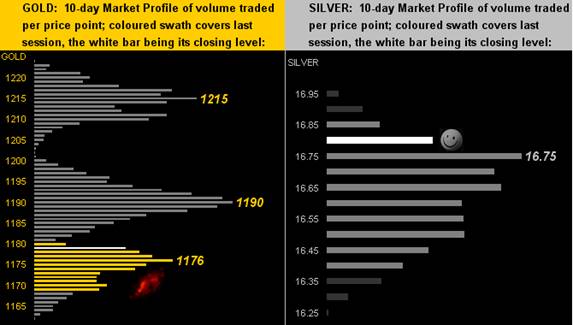

Given that near-term stealth nugget for both Gold and Silver, here next are their 10-Day Market Profiles. Note how Gold (left) has come off its lowest bars, as more notably has Silver (right). Is Gold's fading ember into December on the verge of getting reignited? (For more on that, we'll check in with our Italian friends at the foot of this missive):

So once again, it being now just past month's end, 'tis time to bring up Gold's structure in monthly bars with the defined strata. Yes, the little fellow "down there" is becoming quite exercised about it all. However: if Gold indeed can "find the brakes", 'twill again break the heart of the red zone's wee resident:

Now by the time many of you digest this, we'll be on the other side of Italy's Sunday constitutional referendum toward more parliamentary stability, for which a victory of "No!" could well produce an insolvency slide for several Italian banks, and even invigor inspirations for an eventual "Italexit", (which for you WestPalmBeacher intellects would mean a parting by Italy from the European Union). But specific to a ruined referendum, and potentially in turn a resigning Renzi, if not then short of an "Italexit" ... does Gold expect it? 'Twould be quite the Gold-positive..."Si?"

"Fratelli d'Italia, l'Italia s'è desta, dell'elmo di Scipio s'è cinta la testa..."(from the Italian National Anthem)

"Fratelli d'Italia, l'Italia s'è desta, dell'elmo di Scipio s'è cinta la testa..."(from the Italian National Anthem)

Arrivederci!