Gold's Gentle Price Correction

From a technical, fundamental and seasonal perspective, the current gold price correction is exactly what “the golden doctor has ordered”.

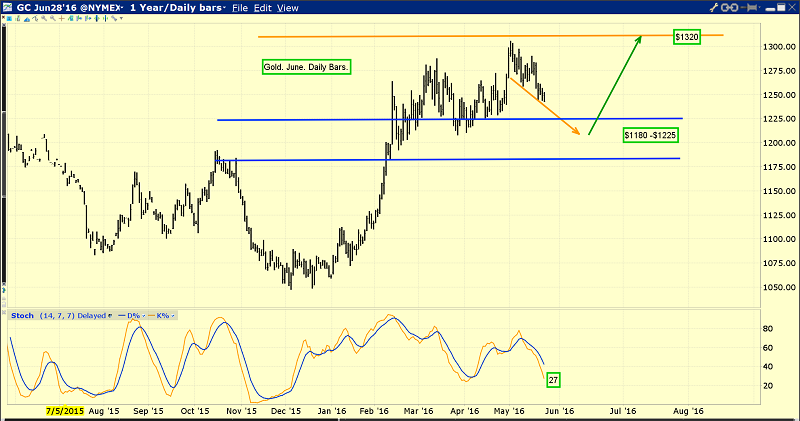

This is the beautiful gold daily chart.

Note the position of the Stochastics oscillator at the bottom of the chart. It’s nearing oversold territory, as the gold price meanders calmly down towards key support that begins near $1225.

The decline is not violent. It’s orderly and calm. I would call the price action idyllic.

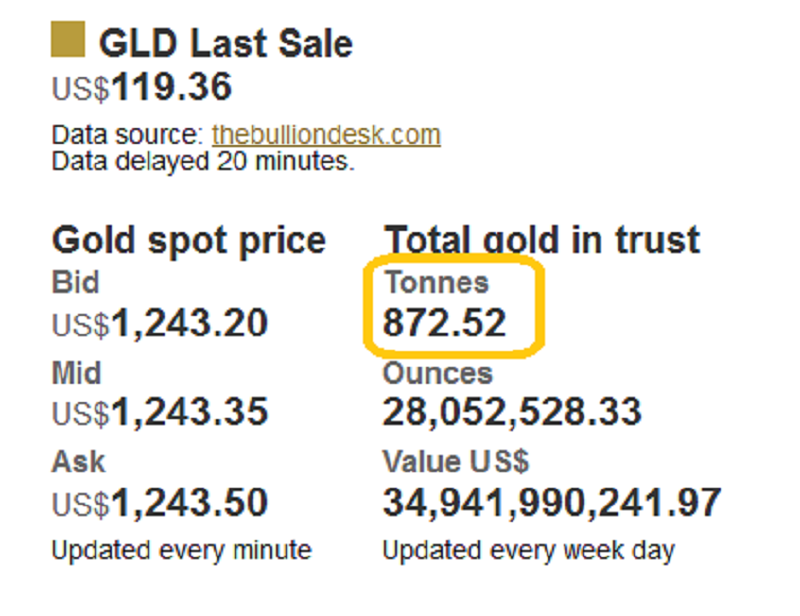

The SPDR fund (GLD-NYSE) tonnage rose again yesterday, to yet another multi-year high!

The price correction is being met with consistent institutional buying. I’ve predicted that gold will transition into an accepted asset for mainstream money managers.

That will reduce volatility for investors, and an atmosphere of confidence and happiness will quickly permeate most of the Western gold community.

This is the monthly gold chart. As gold declined towards the key $1228 - $1045 support zone in 2013, I labelled that zone as a massive buying area for gold investors.

Gold spent about two and a half years in that price area, and then it charged up towards the first key resistance at $1307 - $1320.

From a purely technical perspective, a pullback towards the $1228 support zone is absolutely healthy and expected at this point in time.

The SPDR fund tonnage would not be rising, and the price action would not be as gentle as it is, if major institutions were sellers now. They are buyers, and as the price drifts towards the $1228 area, I expect them to continue to buy, and so I expect the price action to continue to be calm and orderly.

Commerzbank reports that ETF holdings rose 19 of the past 20 days, and are up almost 90 tons just since the start of May.

Essentially, the orderly gold price decline is being created by a combination of soft demand in India versus strong Western buying.

Once the monsoon season arrives in India (in about a month), I expect the gold price to begin rising again, as buyers there return to the market with size that is large enough to send shock waves throughout the Western gold community.

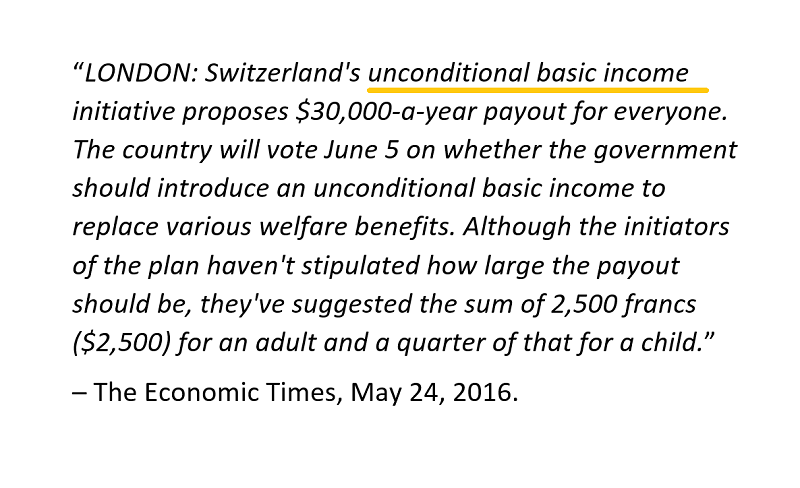

As robots replace human workers, governments are beginning to study the merits of a basic income for their citizens.

Many citizens are also clearly advocating the idea, and the idea is likely to involve a fair amount of money printing. That’s good news for gold.

It’s still early in the “basic income” game, but I’ve predicted that the failure of QE to stimulate inflation will bring government orchestrated wage inflation and moderate gold revaluation.

I’ve also argued that traditional central bank policy can’t work with the current levels of government size and debt.

The influential Barron’s business newspaper suggests that the Indian government may be looking to load the country’s central bank with money printers. If that happens, I expect Indian citizen gold demand to essentially do a “moon shot”.

This is the GDX weekly chart. The price action during this gold stock correction is as orderly as the bullion correction, and that’s very positive.

A light pullback is in play from the $27 area resistance zone. The uptrend line has been penetrated, but there hasn’t been any violent price action on the downside.

It’s important to remember that the gold sector rally caught most analysts in the gold community by surprise. The buying has come from very strong hands. That means they will engage in only light profit booking rallies, and buy aggressively on pullbacks.

For GDX, I’m predicting that enormous institutional buying will appear in the $20 area.

In the big picture, more governments are trying to turn their central banks into ATM machines. There are forecasts for bumper crops in India, due to a great monsoon season. Relentless institutional buying of gold stocks and bullion is in play. This price correction should be viewed as a spectacular buying opportunity!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stocks Performance!” report. I highlight ten GDXJ component gold and silver stocks that should handily outperform GDXJ itself, with key buy and sell points for each of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: