Gold's Pullback: Expected, Normal And Healthy

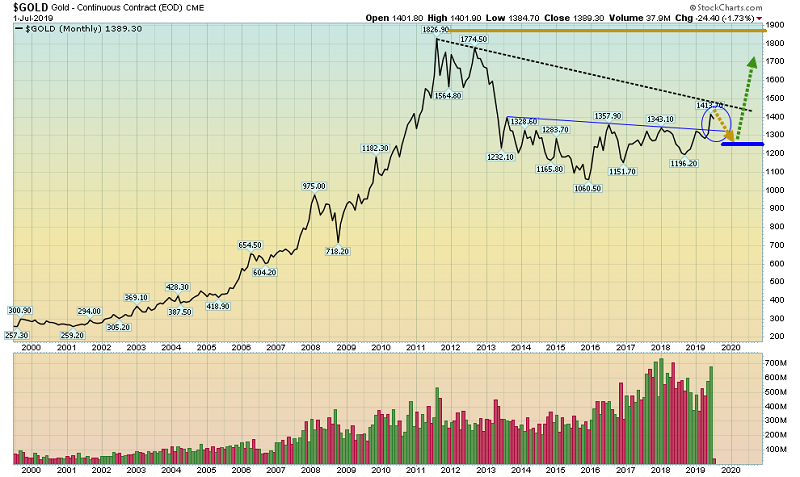

Major fundamental processes and events create the large chart patterns seen on the monthly charts. It’s important for gold and stock market investors to stay focused on the big picture, both technically and fundamentally.

The big technical picture for gold.

Since 2001, my proprietary weekly chart signals system has only generated five buy signals for gold bullion. Note the similarity of the latest one with the 2009 signal.

The current signal happens with India just days away (July 5) from a possible gold tariff tax cut as part of its new budget, and the July 31 Fed meeting only a month away.

I’ve put the odds of a gold tariff tax cut at about 50%. The Dow gave back most of its early morning gain yesterday, after rising on the news that Trump would temporarily halt his tariff tax bombing runs on the stock markets, corporations, and working class of America.

Over the long term, the only way for conservative governments to compete with handouts-focused liberals at the voting polls is with working class tax cuts. By refusing to cut income taxes for America’s working class, Trump risks losing the 2020 election.

He is now rumoured to be considering a capital gain tax cut (for stock market elitists) instead of an income tax cut for the poor. That’s going to drive more blue-collar voters towards the democrats.

With US corporate earnings and America’s working class now looking a lot like drowning passengers on the Titanic, gold is the obvious “choice of champions”.

Key big picture chart for this mighty asset.

After a major upside breakout from an enormous bullish chart pattern, a pullback is expected and normal. The bigger the chart pattern is, the bigger the pullback can be.

Gold could easily pull back to the $1320-$1250 price zone before roaring on towards my $1550 and $2000 price targets. That shouldn’t bother investors because this type of pullback action is typical after a major breakout.

Regardless, a shallow pullback would obviously be preferred by most gold market investors and that’s also a realistic scenario.

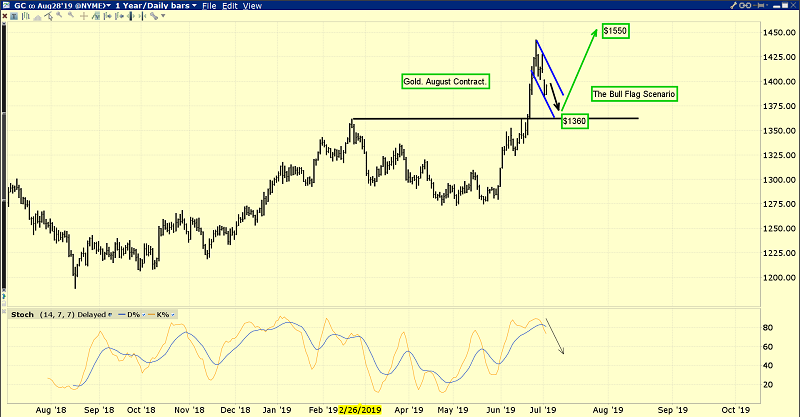

There is a bull flag in play on the daily gold chart.

A cut in India’s gold tariff tax on Friday would be the likely catalyst for an upside breakout from the flag pattern. If there is no cut, a deeper correction would likely ensue. In that scenario, gold would probably pull back to at least $1360, but more likely to $1320-$1250 by the July 31 Fed meet.

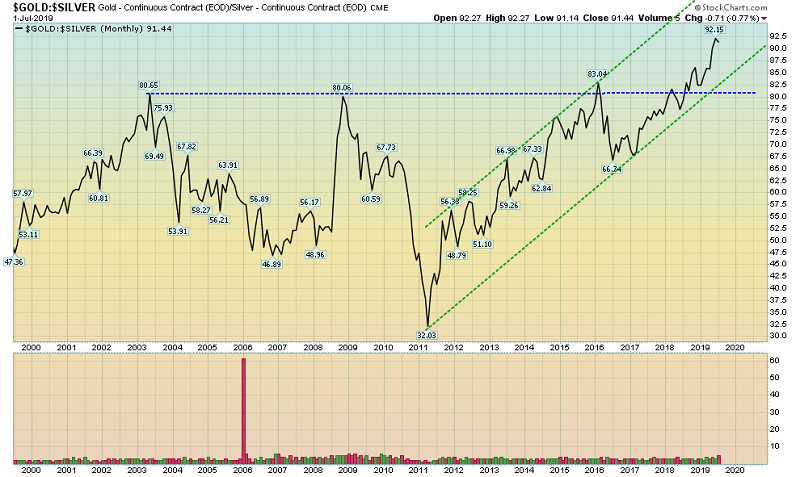

There’s a lot of talk about the gold versus silver ratio right now. Silver investors should exercise caution before racing in to buy silver just based on the level of the ratio. Here’s why:

If Trump blows the 2020 election, America could quickly become a socialist state. Stock markets would incinerate and silver (an industrial metal) could fall further against gold on the ratio chart until inflation became obvious.

Also, the monsoon season in India isn’t going well. It’s a mini-disaster now, and it could soon become a full disaster. If the crop harvest is horrific, Indian farmers won’t have additional money to buy physical silver bullion.

They will likely just buy the gold they need to meet their needs for religious festivals and weddings. That will put even more upside pressure on the gold/silver ratio.

US corn crops are also in trouble. The crop situation in both India and America is significant. It could produce food inflation, especially if the democrats win the US election. Regardless, silver investors should wait for inflation to appear rather than try to anticipate it.

The 80 area on the ratio chart could be support now. Silver can do well against the dollar, but investors should wait for silver to break down from the green uptrend channel I’ve highlighted on the chart before getting too excited about… silver versus gold.

Silver and mining stocks should be part of an overall allocation to the gold asset class. Amateur stock market investors need to be careful about trying to outperform the Dow with their own growth stocks portfolio. Growth stocks should be part of a US stock market portfolio. They are not a replacement for the Dow.

Likewise, gold market investors should be careful about owning only silver or mining stocks with the belief they will outperform gold bullion over the long run. That’s unlikely to happen. A well-diversified gold asset class portfolio includes bullion, ETFs, and individual miners. Simply put, to stand tall, own it all!

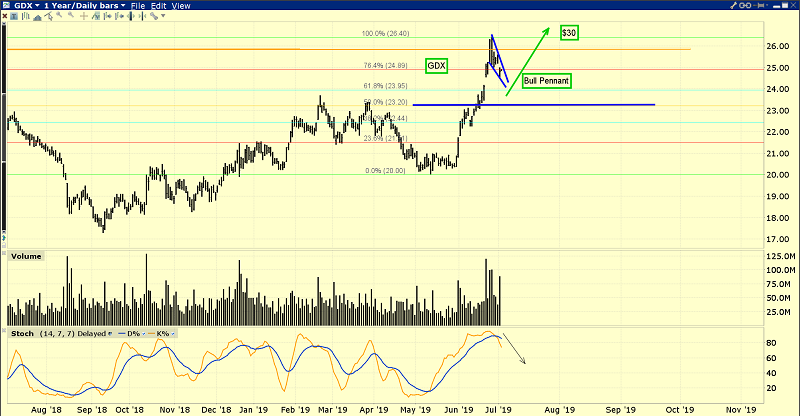

This is the spectacular GDX chart. Note the bullish pennant formation in play. GDX has barely retraced any of its recent near-vertical blast to the upside. The 50% Fibonacci line sits at about $23.20. Gold stock accumulators need to get toes in the water as this pullback plays out. Why? Well, perhaps because history favours the bold!

America could descend into a permanent socialist and stagflationary quagmire after the next election. This, while India’s first “semi-sane” finance minister in years could cut the gold import tax within just days. She is highly unlikely to unveil any new policy that is negative for gold. It’s obvious that for the world’s greatest asset and the companies that mine it, all major fundamental and technical lights are green!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “The Bold Go For The Gold!” report. I highlight outperforming miners in the gold price pullback zone, with key buy and sell points for eight of them!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: