Gold's Squeaky Wheel Gets Some Oil

Over the past few decades, the decline of the fiat-oriented American empire has been accelerating.

The nation now looks a bit like an aging boxer who has become more of a punching bag than a fighter.

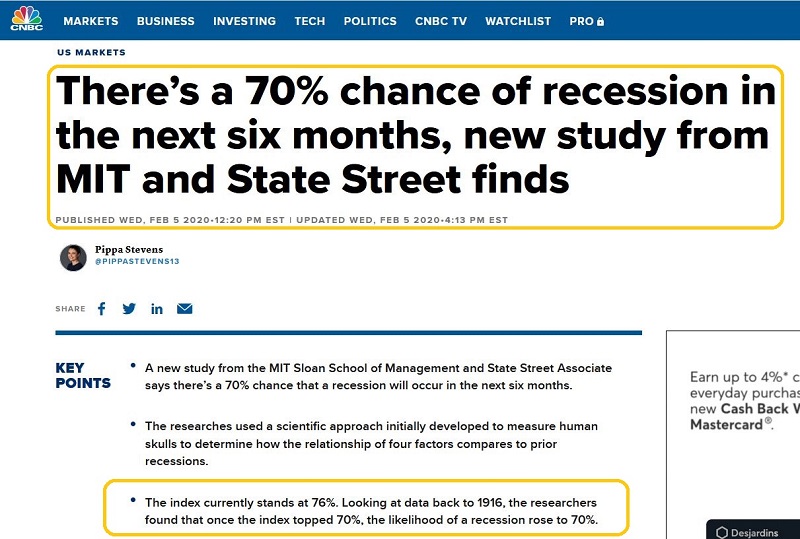

Debt, pestilence, money printing, failed trade and regime change schemes, QE, OTC derivatives mayhem… the list of horrors seems endless, and a potential recession could ice the rancid cake.

A nice bull wedge pattern appears to be in play on the daily gold chart.

A December or January upside breakout is highly likely.

Ahead of the Chinese New Year buying season, gold and silver investors require only modest patience.

For the child who never matures, government becomes their baby bottle and central banks function as diapers.

In contrast, for the sane adult, private money (gold, silver, and perhaps some crypto) is the logical choice.

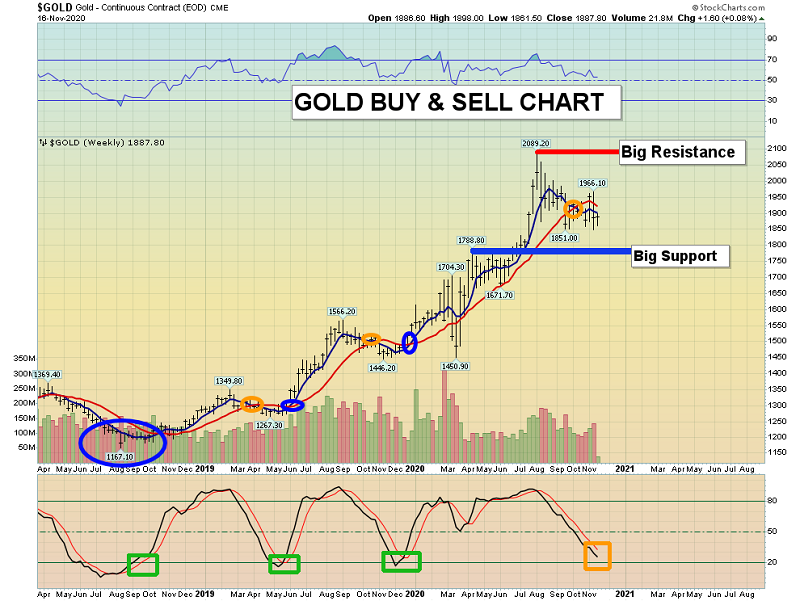

The fabulous weekly gold chart.

The technical action of my key 14,5,5 series Stochastics oscillator is in perfect sync with the approach of Chinese New Year.

My suggestion (which I’m acting on myself) is to be a light buyer of key mining stocks and ETFs like GDX, SIL, and GOAU right now.

If gold trades down towards $1800-$1750, investors should then buy with more size.

A looming recession might bring stagflation, but for now, this is a time to buy and 2021 Q1 and early Q2 should be a good time for profit booking.

The Bitcoin chart.Bitcoin has staged a magnificent rally… and it now trades at about eight times the price of gold!

I’m selling a modest amount of Bitcoin into the uptrend and allocating some of the fiat proceeds into key “alt” coins that sport positive chart patterns.

Investors who want to get in on the crypto action can check out my https://gublockchain.com newsletter.

The FXI “Chinese Dow” daily chart.

Some investors may feel guilty about being invested in the US stock market, because it often soars as Main Street swoons.

That’s because the American central bank pumps the market with socialist handouts on every dip, but calls it capitalism!Ironically, Asian markets may now offer investors less socialist sizzle and more capitalist steak.

Also, Chinese and Indian citizens buy gold to celebrate good times.That makes an ongoing rise in the FXI very good news for both stock and gold market investors.

The FCG natural gas ETF chart.There’s a fabulous bull wedge and upside breakout.

The speedy launch of the Corona vaccines is making oil & gas a “must buy” asset class.

Stoploss enthusiasts can take note of the low at $6.80 and place a stop just under there.

For myself, I’m a buying now and more on any dip, for both FCG (natural gas) and XLE (oil).I invite mining stock investors who may have a few squeaks in their portfolio to seriously consider… adding some oil!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold, Silver, & Oil!” report. I highlight metal and oil stocks that have gigantic base pattern breakouts in play. I include key buy and sell tactics for each stock.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: