Greater Chance Of Rate Cut Boosts Gold’s Appeal

Strengths

- The best performing precious metal for the week was silver. Silver trades at a much more volatile spread than gold, thus its over 10-percent price reaction this week, its biggest weekly gain in 15 months (due to the fallout in Europe over Brittan voting to leave the EU), is refreshing to see.

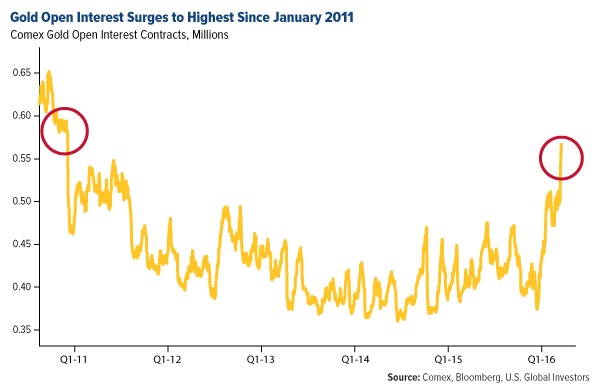

- Market turmoil following the U.K.’s decision to leave the EU is causing more investors to turn to gold and Treasuries, reports Bloomberg. The yellow metal rallied more in the first half of the year than in any other year since 1974, with prices pushed up 24 percent. In addition, traders are now pricing in greater chances of a rate cut than a rate hike in September, pushing Treasury yields lower and boosting the appeal of gold.

- Imports of gold to mainland China from Hong Kong were up 68 percent month-on-month in May, reports S&P Global Platts, totaling 115 mt and reaching the highest level since December. This figure was up 63 percent year-on-year from 70.7 mt in May of 2015.

Weaknesses

- The worst performing precious metal for the week ironically was gold, still up around 1.99 percent. Perhaps not too surprising since this was a page-one story. As central bankers assured the markets that they were ready to act, if needed, equities climbed higher and this became a headwind for further momentum in gold prices.

- Elvira Nabiullina, chair of the Russian central bank, commented on gold reserves during an interview with a local newspaper this week, according to one Reuters headline. Nabiullina said she sees no possibility of increasing Russia’s gold and FX reserves in the near future.

- A surge in gold prices could cut Indian demand for the precious metal to the lowest in seven years, reports Bloomberg. “Price is a very important factor for Indians and if it remains at these levels then I don’t see much recovery in demand,” said Bachhraj Bamalwa, a director at the All India Gems & Jewelry Trade Federation. Weak demand since the start of 2016 has forced dealers to sell gold at a discount to clear inventories.

Opportunities

- Turnover in China’s top exchange-traded fund backed by bullion, the Huaan Yifu Gold ETF, jumped to a record $191 million last Friday following Britain’s vote. Outstanding shares of the fund also jumped five-fold from the start of the year to 1.6 billion, according to David Xu, managing director at Huaan Asset Management. Similarly, a decline of the Chinese real estate market moved billions into the country’s stock market. If Chinese investors sour on stocks and decide gold’s historic value looks tempting, this could mean the next boom for the metal, reports Bloomberg Intelligence analyst Kenneth Hoffman. Currently the ETF only holds 16 tonnes of metal, but the creators of the fund expect it to grow to 500 tonnes in the next three to five years.

- According to consensus data from June 28, economists are raising the probability of U.S. interest rate cuts, rather than hikes, over the next 18 months, reports Bloomberg. A hike is seen only from February 2017. Overseas, initial shock following Brexit is easing. Economists are expecting the Bank of England to add more stimulus and Japan’s central bank chief Haruhiko Kuroda said this week that more funds could be injected into markets should they be required, reports Bloomberg.

- Citing updated commodity forecasts, Credit Suisse analysts Anita Soni and Ralph Profiti believe the price of gold could hit $1,500 an ounce by early 2017. Goldman and Morgan Stanley are among other banks increasing their price outlooks. On Thursday, Australia & New Zealand Banking Group Ltd. reported that it sees bullion rallying to as much as $1,400 an ounce over the next 12 months. If the Brexit vote spurs the world’s central banks to step up easing, currencies will be hurt and gold could be favored even further.

Threats

- Temp jobs are the first to go in a downturn and serve as a predictor of general job trends, according to a report from BMO Private Bank. And since December, this sector has shed 27,400 jobs, reversing a five-year trend that saw it grow five times faster than overall employment, the bank writes. Compounding the trend, there has been a pickup in initial jobless claims.

- According to a new poll by Marketplace and Edison Research, 71 percent of Americans believe the U.S. economic system is “rigged in favor of certain groups,” reports CNN Money. On this note, JPMorgan Chase & Co won the dismissal of three private antitrust lawsuits on Wednesday, reports Reuters, accusing the bank of rigging a market for silver futures contracts traded on COMEX. U.S. District Judge Paul Engelmayer said the plaintiffs did not show JPMorgan made “uneconomic” bids, or intended to rig the market at counterparties’ expense, the article continues. Engelmayer’s dismissal was with prejudice, meaning the lawsuits cannot be brought again. This follows a 2014 court victory by JPMorgan where plaintiffs nationwide accused the bank of trying to drive down the silver price.

- Gold miner Asanko Gold Inc. has come under attack from a Toronto-based hedge fund, reports the Financial Post, claiming the company’s stock price could plummet 90 percent. K2 Associates Investment Management alleges that Asanko’s gold resources “don’t add up” and appears to be over-inflated by a factor of two. Asanko rejected all allegations by K2.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of