Has Gold Really Bottomed?

“Gold prices are likely to moderate to 1,300/oz by the end of 2013 and then gradually decline to 1,100/oz by the end of 2014 as economic growth in major economies regain momentum as investors increase their demand for riskier assets, National Australia Bank says in a report.” – Dow Jones Commodity News, September 3, 2013.

I realize that most investors in the gold community probably believe that the June lows near $1180 are a “final” bottom. I think it’s a bit early to make such bold statements, and obviously the central bank of Australia feels the same way I do.

Regardless, there’s no question that the $1180 area is at or below the cost of production, for many mining companies. Value-oriented investors know that when gold trades in the “COP” (cost of production) zone, both gold and mining stocks should be accumulated, and held with very strong hands.

I issued a modest profit booking call in the $1411 - $1425 area last week, and took about 5% of my overall position off the table. Gold prices have softened since then. $1384 is a minor HSR (horizontal support & resistance) zone, and it could be bought by investors who feel they are missing out on the rally. Personally, I prefer the $1340 - $1350 area for short covering and new buying.

That’s the daily gold chart. There’s a beautiful uptrend channel in play. While my stokeillator is on a sell signal, that doesn’t mean the gold price has to fall.

Gold could just trade sideways within the channel for a few weeks, and work off the overbought condition of the stokeillator.

While light profits should be booked in the $1410 - $1425 price area, that’s not a “top call”. Gold, silver, platinum, and palladium can all move higher, before there’s a larger correction, or a move to new lows.

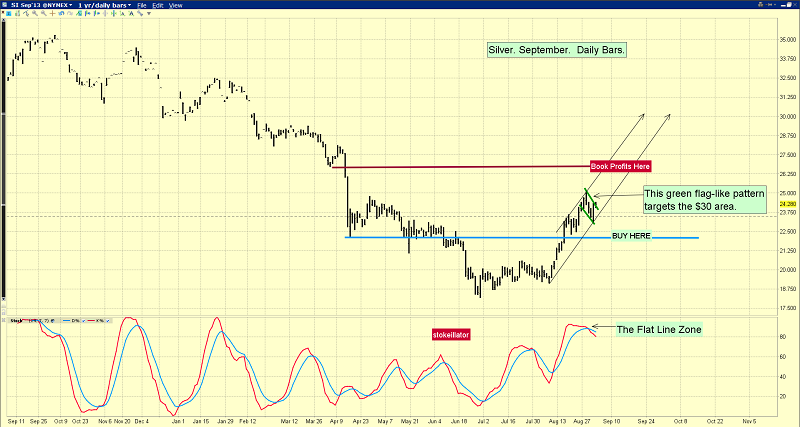

You are looking at the daily silver chart, and I’d like you to note the green flag-like pattern that has appeared.

There is substantial sell-side HSR in the $26 area, but a lot of bank economists believe silver is set to outperform gold over the next year or so. That could attract quite a bit of buying interest from their clients.

The flag-like pattern suggests that silver could stun the current top callers, and rise to the $30 area.

Let’s take a closer look at that flag-like entity. That’s the hourly bars chart for silver. Note the potential breakout from the pattern, to the upside.

Oscillators like my stokeillator (14,7,7 Stochastics series) can stay overbought during momentum-based moves, rather than declining. Breakouts from flag patterns can be followed by that surging price and “flat lining” oscillator action.

Regardless, technical breakouts should only be bought by gamblers, using very limited risk capital. Long term investors should focus their buying on the COP (cost of production) zone.

An argument can be made that the end of QE could actually be bullish for gold. As QE is tapered, the US government may find that it has to pay higher interest rates on its bonds, to attract buyers.

With the Fed fading from the demand side of the picture, only a huge stock market tumble would attract substantial T-bond buying from institutional investors.

With the Fed fading from the demand side of the picture, only a huge stock market tumble would attract substantial T-bond buying from institutional investors.

Rising interest rates mean higher borrowing costs for corporations, and these costs tend to be passed on to consumers in the form of higher prices.

Institutional investors could become concerned about the financial situation of the US government, because higher borrowing costs would mean the government would have to borrow even more money. Rating agencies could begin to downgrade US bonds in that situation.

Against a backdrop of the ongoing industrialization of India, growing demand from China, and a price of gold that is near the cost of production, the gold community may find that institutional money managers become very interested in owning… a lot more gold than they hold now.

There are two key fundamental events this week. First, there is the G20 meeting in Russia. Second, the jobs report will be released on Friday. Gold often sells off going into the jobs report, and then surges higher after it is released.

Leveraged traders should go to the sidelines fairly quickly, rather than trying to predict the outcome of these key events.

Longer term investors should not be concerned. Focus on buying gold, silver, and metal stocks, if gold goes to $1350. If these two reports turn out to be bullish, book more light profits in the $1470 area.

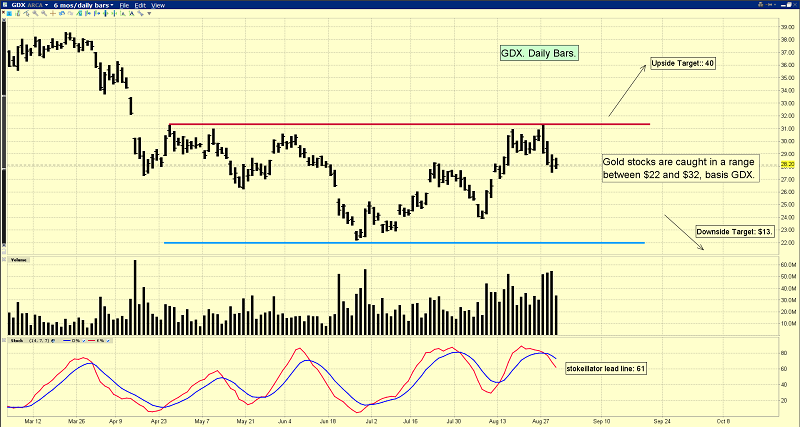

Much ado about nothing? A lot of analysts seem to be working hard to call a bottom for gold stocks here…and are predicting an upside parabolic event. Others believe another giant decline is coming.

Does it really matter if gold has bottomed? Focus on value that is offered in the cost of production (COP) zone, and the ultimate bottom will look after itself. Gold stocks are likely in a range, defined by the GDX $22 - $32 price area. Until GDX trades well above $32, or well below $22, I don’t think anyone can answer the question of what’s next for gold stocks.

You are looking at the daily GDX chart. Bullish technicians see a Head & Shoulders bottom formation in play on many gold stock charts.

If GDX does falter here, I think it’s important to buy the $22 area, and vastly more important to be a buyer below there, as uncomfortable as that might be. Cheer for GDX to blast above $32, but be ready to buy under $22, if it happens!

********

Special Offer For Gold-Eagle readers: Send me an Email to [email protected] and I’ll send you my free “Explorers With Volume!” report. Even if there is a correction in the general precious metals market, many individual stocks could power higher anyways! I’ll show you the ones I’m looking at right now.

Email: [email protected]

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: