Hold On As Gold Prices Are About To Move

Current Precious Metals Outlook

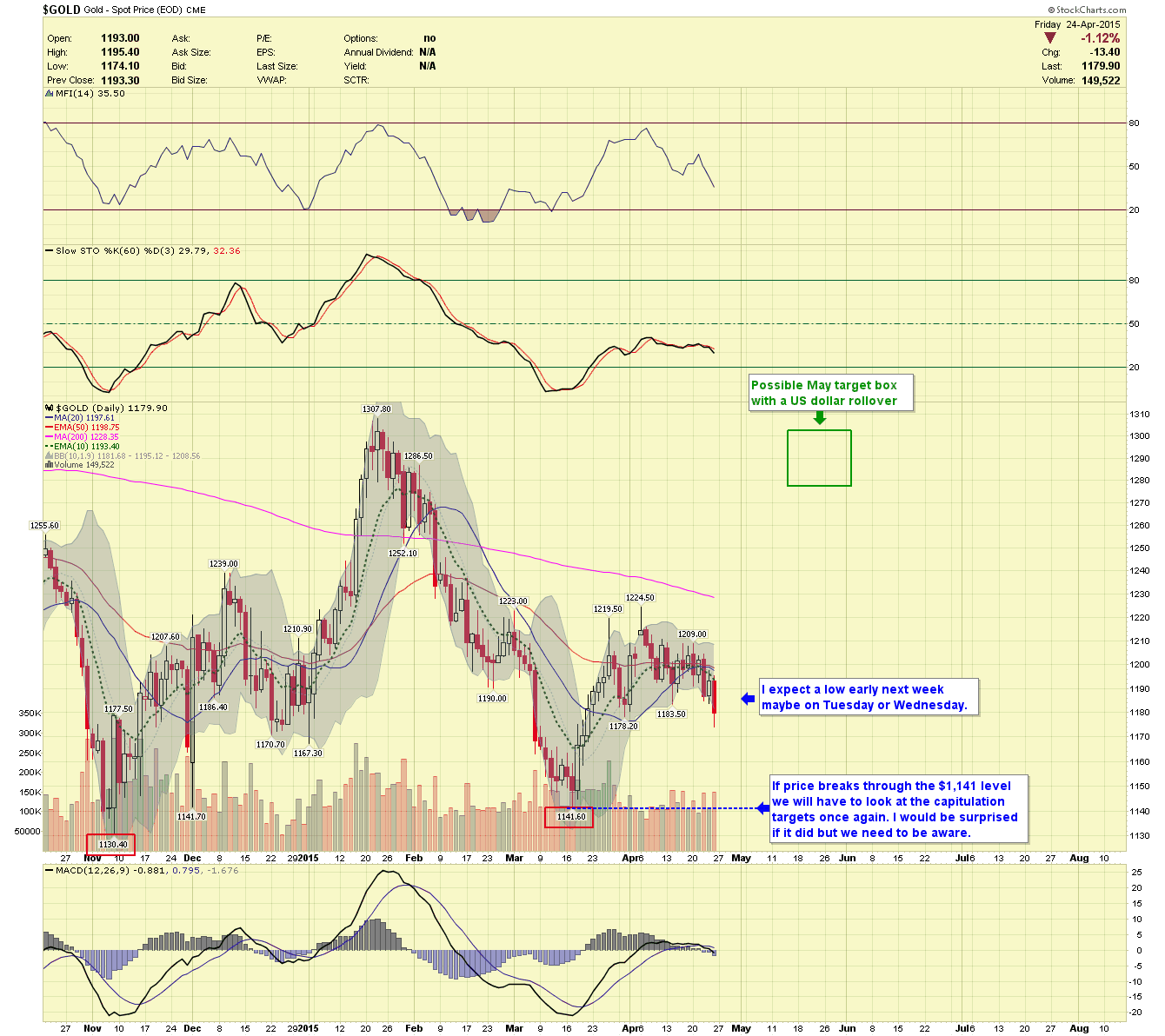

Both gold prices and silver prices have corrected longer and deeper than we initially anticipated. Gold is starting the sixth week of its current Biannual Cycle (average 20+ weeks) and is only $40 above the $1,141 Biannual Cycle Low. The US Dollar should break below key support this week and in doing so may ignite a sharp rally in Precious Metal, targets labeled in charts below (double click charts for a better look)

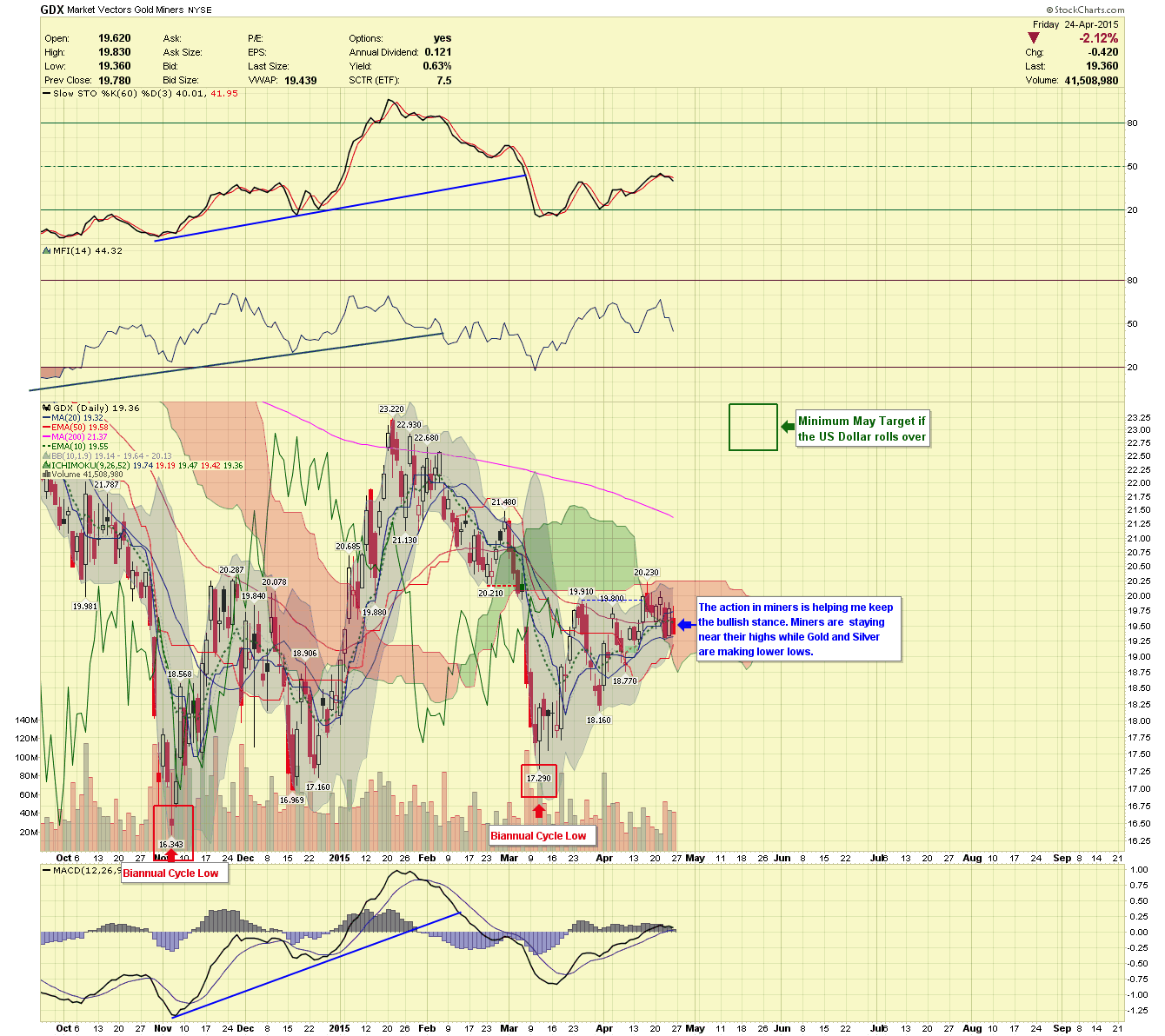

The Gold Miners are often seen as a leading indicator, they are hinting that precious metals could head higher soon, potentially reaching our original targets in just a few weeks.

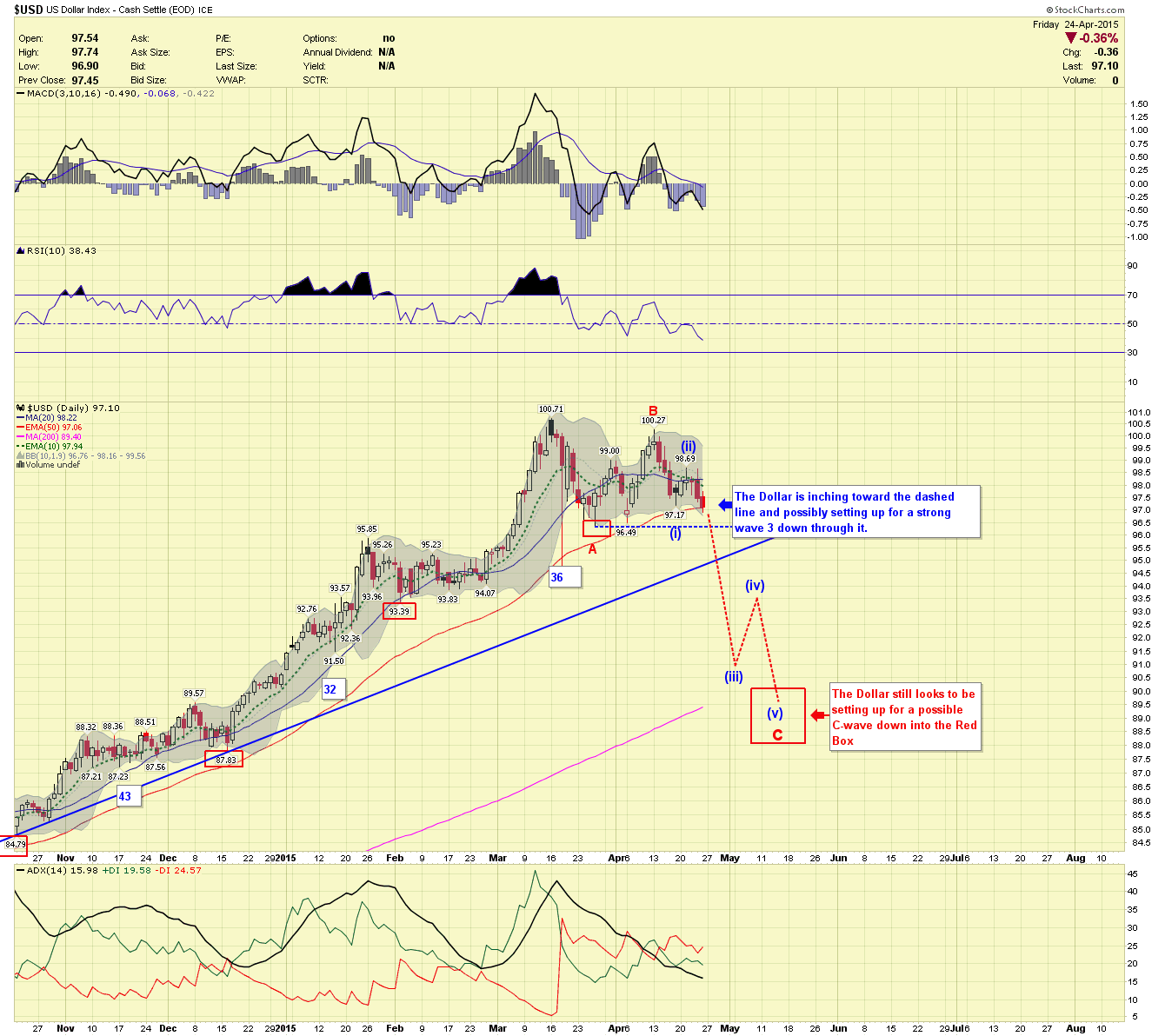

US Dollar

I wanted to start with the US Dollar as it will likely dictate the action of next week. Price has been setting up a possible ABC correction with the strongest part of a C-Wave yet remaining, the price could break hard down through the dashed line next week in a wave-3 fashion. Between this chart and the Mining charts, I have remained Bullish keeping active our May price targets.

Gold Daily Chart

I expect gold prices to make a low early next week, but the price action a day or so after the announcement will likely be the market's true direction. If we get a Bullish candle pattern next week, I will add to my personal Gold and Mining holdings in anticipation of a strong move higher into Mid-Late May.

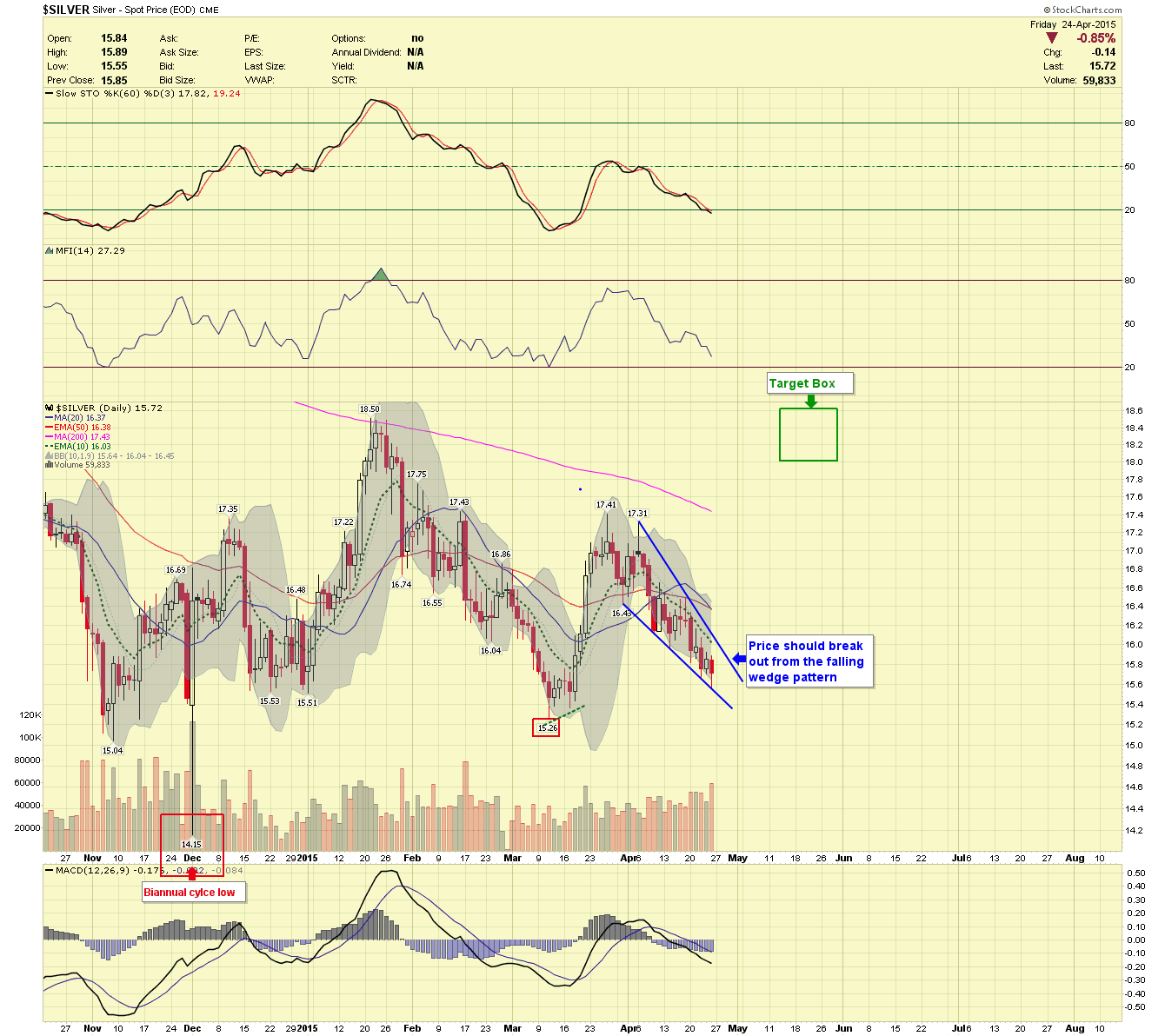

Silver Daily Chart

The silver price has corrected much deeper than I would have otherwise thought, there should be a strong move upward out of the falling wedge pattern.

GDX Daily Chart

Price is only .55 cents from the $19.91 March high and acting like somewhat of a leading indicator, the Miners may still meet or exceed our target boxes in May.

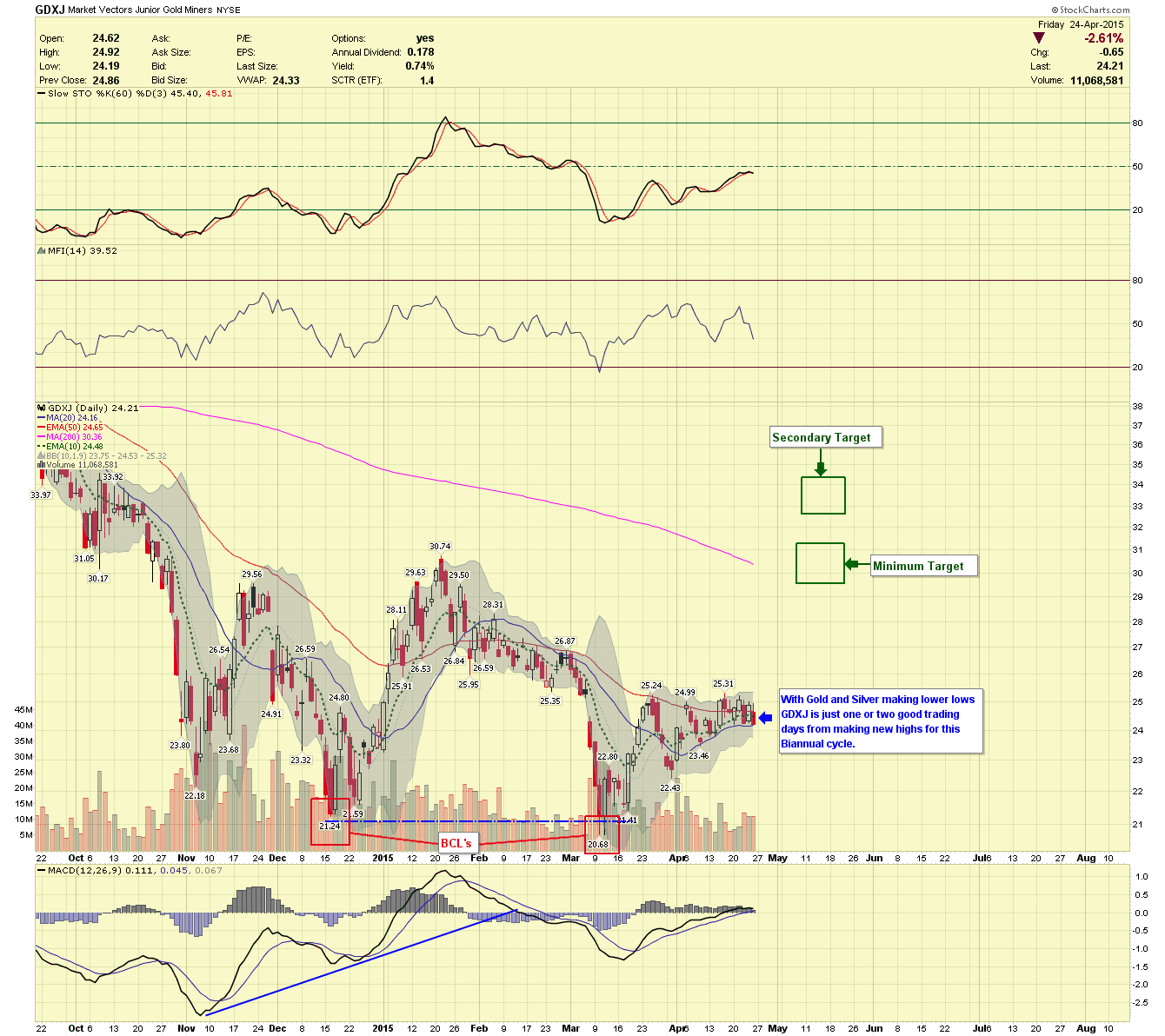

GDXJ Daily Chart

GDXJ is also just one or two positive trading days away from new highs, It may be setting up for a breakout move surpassing the $25.31 high in a prompt fashion.

PREMIUM NEWSLETTER CONTENT BELOW

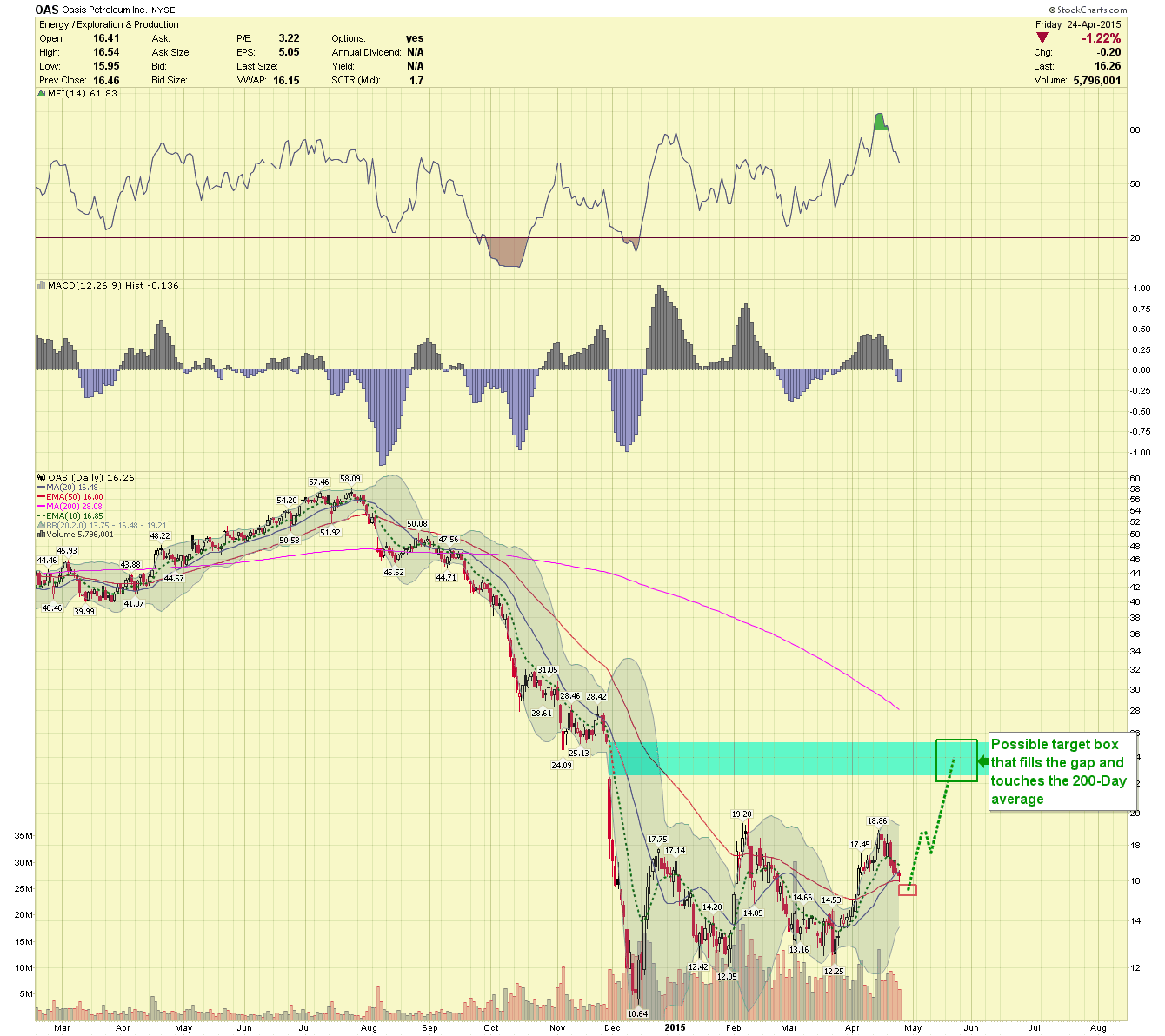

There have been a few questions regarding the difference between the Chartseek.com Plus and Premium Newsletter services. The main difference is Premium Members receive additional charts like the “OAS” chart given below. Such charts are not recommendations, they are meant for educational purposes only. Premium members receive approximately 2-4 attractive charts like this per Month.

OAS DAILY

Here is another oil stock with a similar setup to the others I’ve been monitoring in the OIL sector, again this is not a recommendation but just an illustration. If price finishes the correction, turning higher, there is a defined target in the $24.00 - $25.00 range.

********

We will update paying members all week if necessary. Click here to see Newsletter Prices and Terms