How Will Gold Price Move Into 2018?

Strengths

-

The best performing precious metal for the week was palladium, off 1.44 percent for the week. Citigroup favors palladium in the short term, in response to pollution control, but says substitution risks prevent the bank from taking a more bullish view long term as the price of palladium is now higher than the price of platinum.

-

After the Indian government eased rules on gold purchases, the country’s demand for gold jewelry and branded coins appears to be better than the last quarter, according to P.R. Somasundaram, MD for India at the World Gold Council. The ensuing wedding season is the key for quarterly demand performance, Bloomberg reports, and with a good monsoon season, stable gold prices should encourage consumers.

-

In the month of September, Swiss gold exports doubled month-over-month to 148.4 metric tons, reports Bloomberg. In August, exports were only 72 tons, according to the Swiss Federal Customs Administration. Specifically, Swiss exports to China rose 21 percent and to Hong Kong rose 92 percent.

Weaknesses

-

The worst performing precious metal for the week was platinum, off 2.41 percent as palladium seems to be the more crowded trade.

-

September makes 11 months straight of China officially reporting a zero increase in the level of its gold reserves, writes Lawrie Williams. The only time in recent years that the Asian nation has published any month-by-month gold reserve accumulations was in the 16 months ahead of the yuan being accepted as an integral part of the International Monetary Fund’s (IMF) Special Drawing Rights basket of currencies, Williams continues. “We don’t think it coincidence that such month-by-month reporting effectively ceased once the yuan became part of the SDR, thus paving its way for acceptance as a reserve currency,” the article reads.

-

Barrick Gold and the Tanzanian government have been in talks for months to resolve a dispute that has hit Barrick’s operations in the country. The two sides announced that Barrick will give Tanzania a 16 percent stake in three gold mines, a 50 percent share in revenues from the mines and a one-off payment of US$300 million. Following a surge in shipments in recent months, India moved to curb gold-trade irregularities by preventing some trading houses from importing the metal, reports Bloomberg. This comes after a jump in purchases from overseas nations like South Korea and Indonesia—which have free-trade agreements with India—“as traders try to bring in gold at zero tax and avoid paying a 10 percent import duty,” the article continues.

Opportunities

-

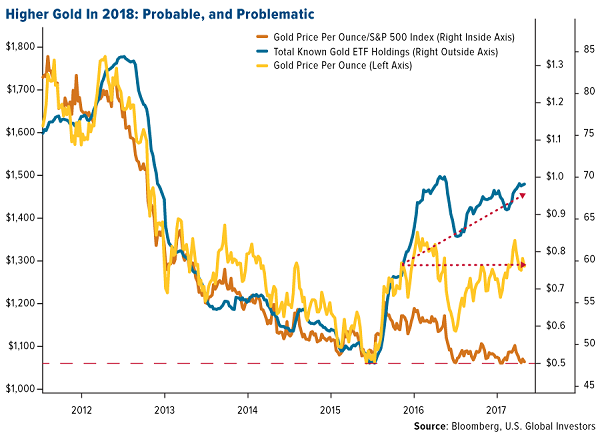

Up or down, the stock market may support gold, according to Bloomberg Intelligence. Gold is trading at half the price-to-value of the S&P 500 Index. “The first revisit near 0.50 in the XAU/SPX ratio in eight years coincide with the first Federal Reserve rate hike in December 2015,” the article notes. This marked not only a bottom for gold, but also in gold ETF holdings. Investors who are scared to sell strong-momentum stocks are buying more gold to diversify. In addition, according to a survey of attendees at the LBMA Precious Metals Conference in Barcelona this week, gold will be at $1,369 an ounce by this time next year.

-

Pierre Lassonde, chairman and co-founder of Franco-Nevada, has pioneered the royalty business model in the gold mining sector and is arguably one of the most successful individuals in the mining space, reports Zero Hedge. According to Lassonde, however, the gold industry hasn’t made any large discoveries for years. He points out in a recent interview that over the last 15 years, we have found no 50 million or 30 million-ounce deposits, and only very few 15 million-ounce deposits. In addition, Lassonde says that production is coming off, meaning the upward pressure on the gold price could be very intense. He continues with a discussion on funding and explains that investor risk appetite is gone, and juniors haven’t had any money for nearly 10 years, despite the fact that more than half of the new discoveries over the years have been made by junior companies. His thoughts end with his sentiment on the yellow metal despite all of this. “I think for an average investor, it should be the absolute rule to hold around 5 to 10 percent gold in your portfolio, like rule number one.”

-

Even though there are claims stating that Goldman Sachs has considered launching a bitcoin trading operation, the bank says that digital currencies “are not the ‘new gold’” and that gold is still the “best long-term store of value,” reports CNBC. This can be shown in a recent Bloomberg Intelligence article, which shows that precious metals is the only sector that consistently gains when stocks decline sharply—with gold leading the way. Gold is the “consistent diversifier.”

Threats

-

Even before new regulations come in, the average net daily volume of gold settled by London Precious Metals Clearing fell 12 percent in two months on London’s over-the-counter (OTC) market, to 18.5 million ounces in August, reports Bloomberg. In New York, London’s biggest rival, trading in gold contracts jumped more than 25 percent in the third quarter, specifically with activity during European hours surging 32 percent, the article continues. Traders are now scratching their heads over how changes to EU rules over transaction reporting could affect their costs in London. The issue is whether OTC trading of gold should count as derivative trading.

-

In Europe, registrations for cars over the last six months have only grown 1.57 percent year-over-year on average—that’s down from 8.02 percent growth during that same six months last year, reports Macro Strategy Partnership. This low growth suggests a substantial slowdown and could spell trouble for palladium.

-

A special science note: Business Insider reports this week that scientists who won a Nobel Prize for their discovery of gravitational waves announced the first-ever detection of the collision of two neuron stars on Monday. The team alerted astronomers worldwide, who helped them point telescopes directly at the crash scene. “These images revealed a radioactive soup giving birth to unfathomable amounts of platinum, gold and silver—not to mention the iodine in our bodies, uranium in nuclear weapons and bismuth in Pepto-Bismol—while blasting those materials deep into space,” the article reads. According to some estimates, this neutron star collision produced around 200 Earth masses of pure gold, and maybe 500 Earth masses of platinum. But at 130 million light years away, don’t count on getting your hands on this anytime soon.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of