I Be A Bear On The Stock Market

This week, the Dow Jones closed between its last all-time high of last January 4th, and its double-digit BEV lows of last month. In other words, nothing much has changed in the stock market since last week. But, as a zero-heart beat EKG in a hospital tells the doctors something about their patient, this steady-state trend in the Dow Jones tells us something about the stock market too.

Exactly what I don’t know. Maybe, that the bears are catatonic, gripped in a state of terror for fear the bulls are soon going on another “liquidity” fueled stampede into market history?

Yea, that could be.

More likely, all the big market players are getting phone calls from their Federal Regulators, and /or Biden’s Justice Department. In extreme cases by the Department of Defense, warning all not to do anything “foolish” or “ill-advised.” Such as attempting to make a big exit from the stock and bond markets as the FOMC is raising interest rates * AND * draining “liquidity” from the financial system.

In America’s “regulated markets”, that’s how one goes about such things.

In the Dow Jones’ daily bar chart below, the market pattern of declining peaks and lows continues since the Dow Jones last all-time high of January 4th. We have to ask ourselves; what is to come next? If you’re bullish, in the next couple of weeks you’ll want the Dow Jones to break above its highs of late March.

But the bears are looking at the red line at 32,600. If the Dow Jones breaks below that level, it’s not good, especially should the Dow Jones do so with authority.

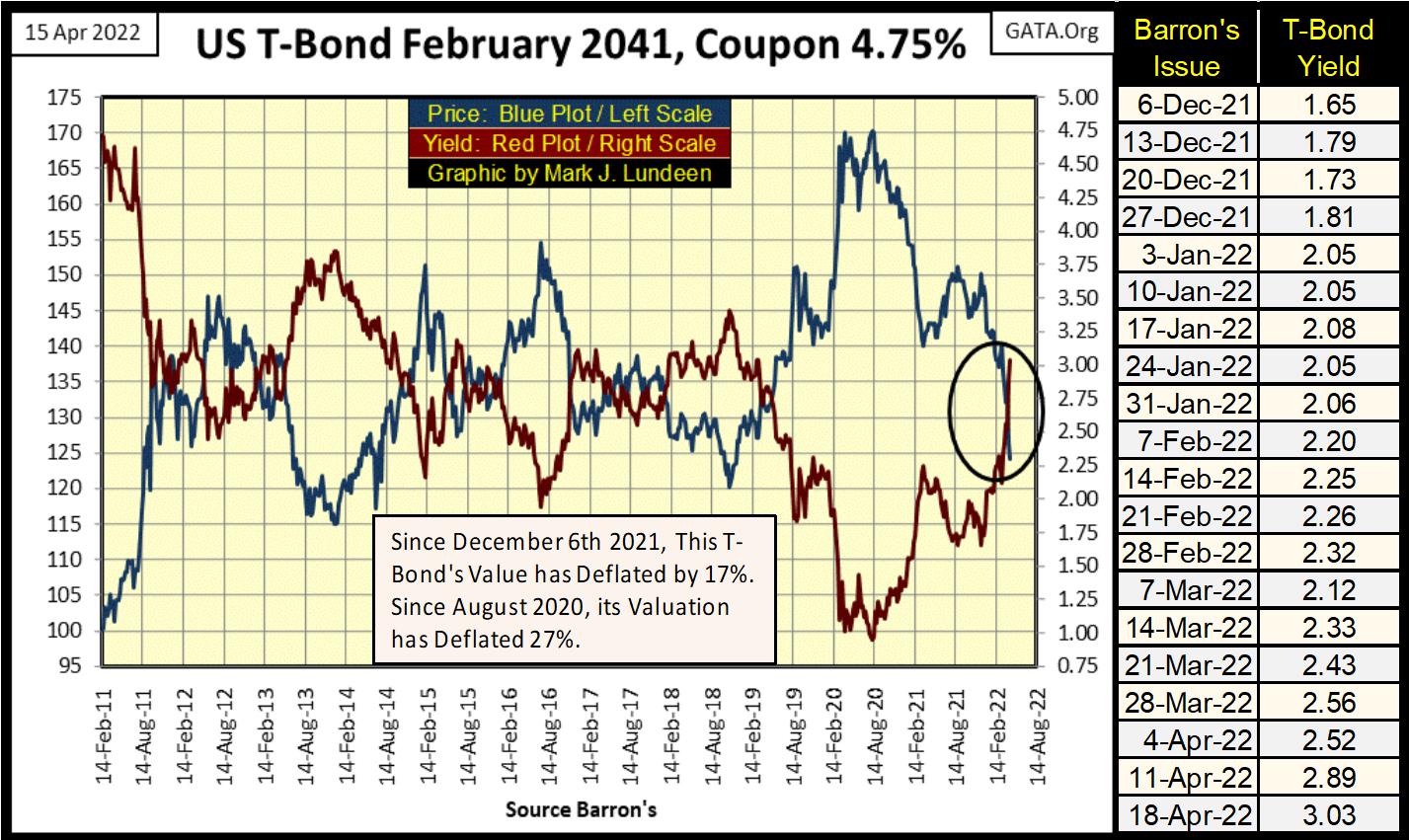

So, what be I on this market; be I a bull or bear? I be a bear. My reasoning, as the English used in the two prior sentences is simple enough – bond yields (Red Plot Below) are rising incredibly fast, as seen in the following chart of a T-bond. In Barron’s 06 Dec 2021 issue, this T-bond was yielding 1.65%. At the close of this week, it now yields 3.03%, resulting in a four-month 17% loss of market value in this T-bond.

Any way you look at it, for someone to have owned, or purchased this, or any other Treasury bond since early last December, the then 1.65% (taxable) current yield in no way compensated its owners for their principle loss of 17%.

Since August of 2020, when T-bonds’ yield bottomed and valuations peaked, this T-bond’s market valuation has deflated by 27%. After a haircut like that, since August 2020 the owners are left with less than 75% of their invested funds.

The Treasury market is supposed to be where widows and orphans go to keep their nest eggs safe; but not anymore. It will become worse as time goes by, as our rising CPI inflation will drive bond yields to much higher levels than those we see today. And if CPI inflation becomes double-digit, you can count on this, and all other Treasury bond’s yields to rise to double-digit too.

That is one of the reasons why the US Department of Labor chronically underestimates CPI inflation; for fear of what the truth would do to the yields in the debt markets.

The other reason is to keep Federal pension and Social Security payments from getting out of hand.

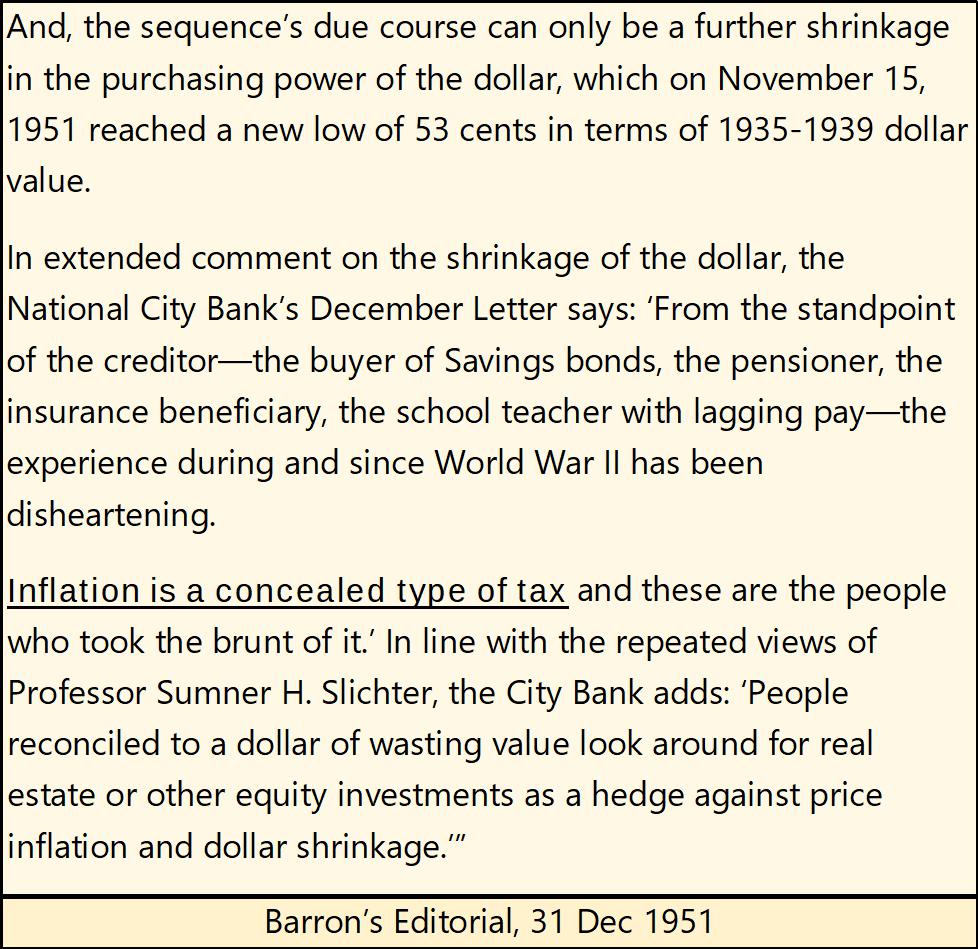

Keep in mind, monetary inflation is a hidden tax on all holders of what ever currency is being inflated. The “monetary authorities” issue new currency (monetary inflation) as ordered by their political masters, who then spend it. Money for politicians without taxing on the taxpayer.

The taxpayers pay their inflation tax in rising consumer prices in the following years, as politicians and bureaucrats appear on television, dumbstruck by why CPI inflation has gotten so out of hand.

Taxing people via monetary inflation was the entire point of getting the US dollar off the Bretton Woods’ $35 gold peg in August 1971. Inflation is an old trick, played on the productive members of society again and again. Read all about it in the below Barron’s 1951 Editorial.

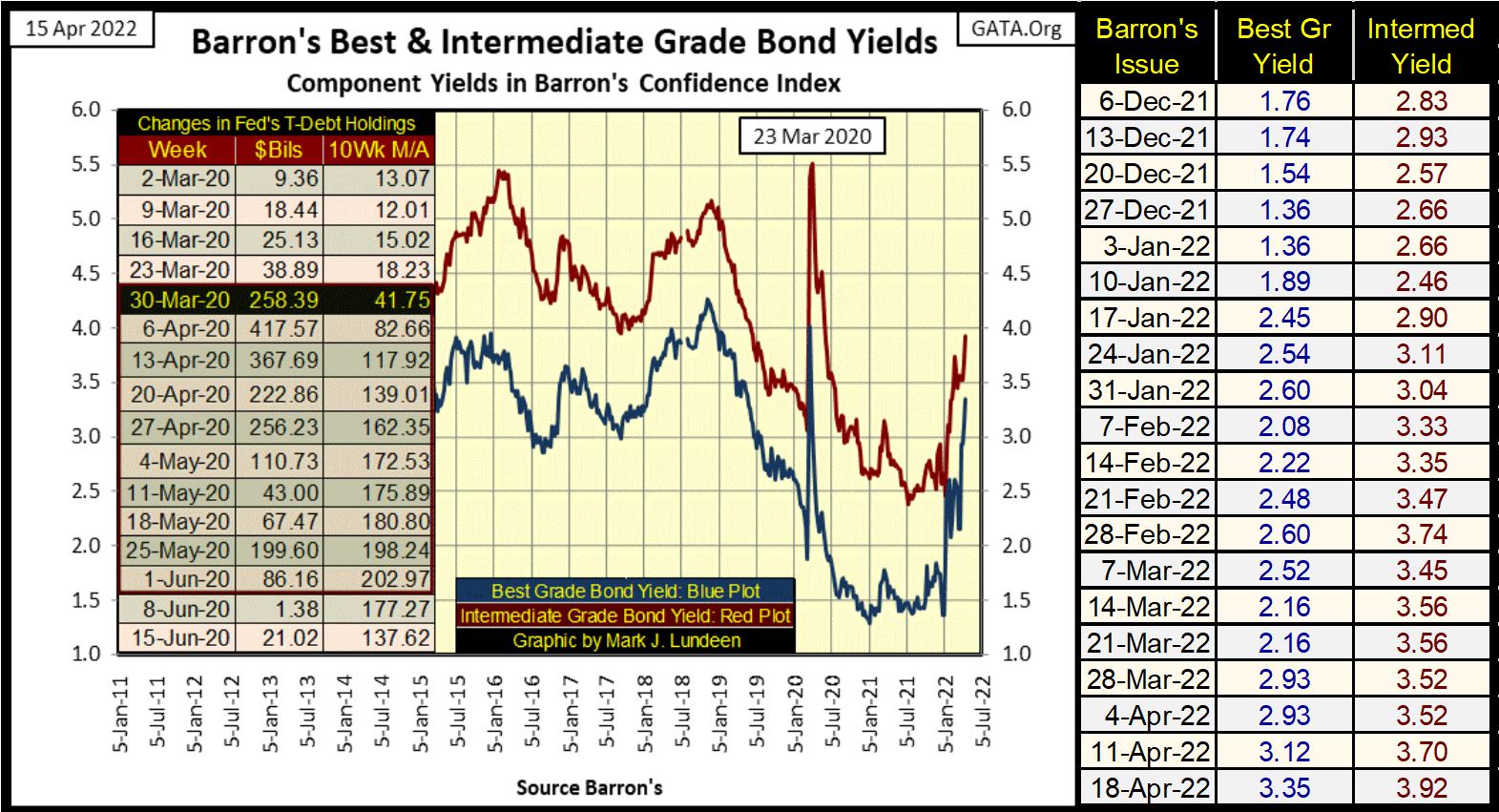

The problems resulting from the FOMC’s interminable “injections of liquidity” into the financial system isn’t limited to the Treasury market. In the chart below plotting Barron’s Best and Intermediate Bond Yields, since the first of the year, corporate bond yields have spiked upwards. Take a moment and look at the spiking corporate bond yields in the chart below. Be afraid, be very afraid should these yield spikes continue.

I don’t spend much time following the main-stream financial media, but I suspect they don’t spend much time following the rising yields in the bond market. I understand; no reason to disturb the peace of mind of their audience with distressing news of the massive valuation deflation currently taking place in the American bond markets. It’s just not done!

However, if the yields in the bond market continue rising aggressively, as the FOMC “drains liquidity” from the financial system, the stock market is set up for a crash sometime in the not too distance future.

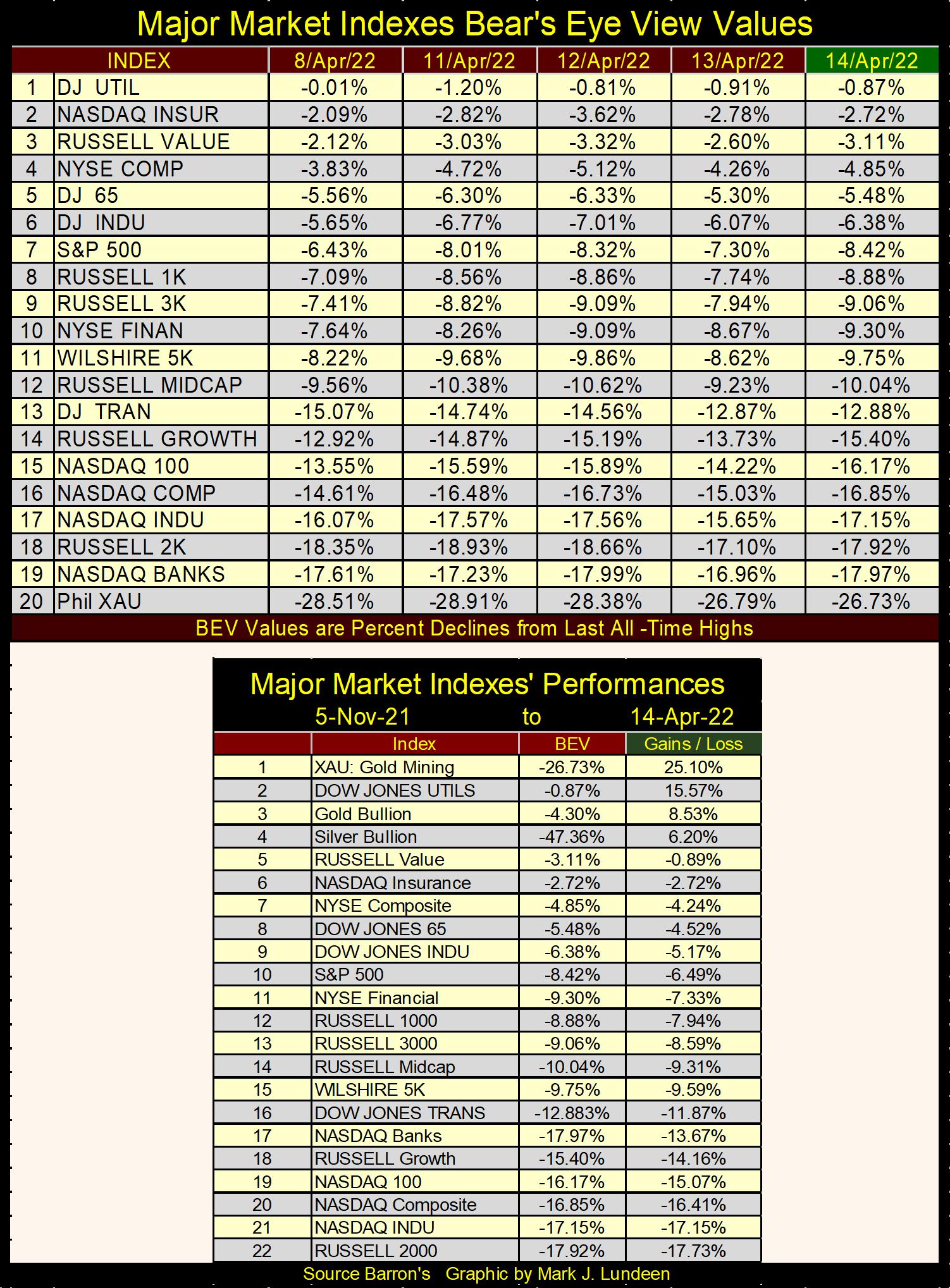

In the major market indexes BEV values table below, this week the market saw no new all-time highs (0.00%) in these indexes, though the Dow Jones Utilities Average has seen eight BEV Zeros, and remained close to one since early March.

Also, this week there were only three of the indexes remaining in scoring position (BEVs of -0.01% to -4.99%). The other indexes, from last Friday to Thursday this Passover / Easter week, slowly deflated a few percent. But none broke below their psychologically important BEV -20% levels; not this week anyway.

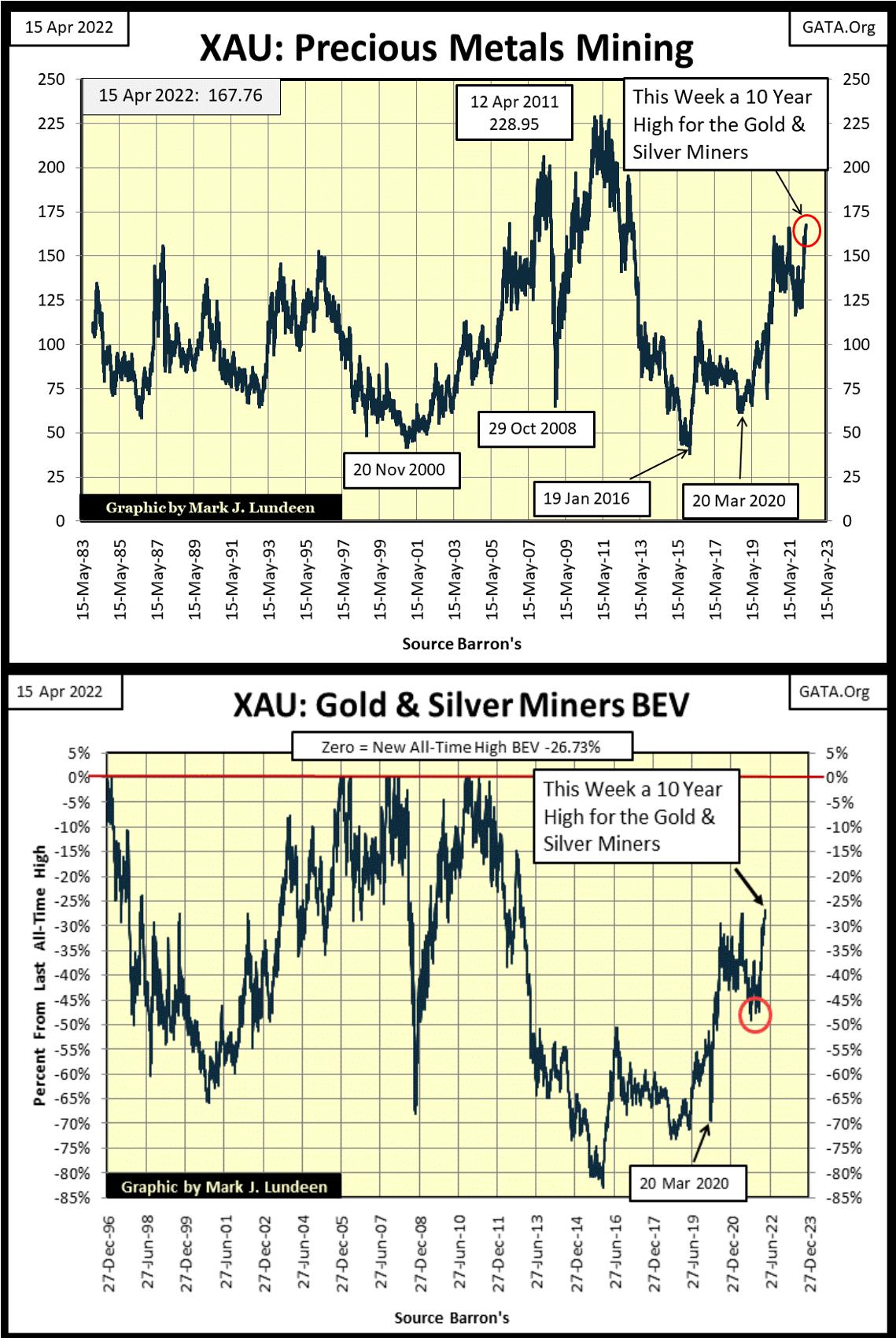

All and all, this is less than desirable market action. But of course, I’m not talking about the gold and silver miners that comprise the XAU, #20 on the table below. The XAU, whose Thursday’s BEV of -26.73%, was actually a ten-year high for the precious metal miners.

Looking at the market performance of these indexes, along with gold and silver bullion in the table above, since November 5th of 2021, the XAU, with its BEV of -26.73%, is the best performing major market index I follow. Except for the DJ Utilities (#2), every other major market index has lost valuation since last November 5th.

Why last November 5th? What’s important about early last November? A quick look at * that week’s * major market index table below shows what is so important about the week of November 5th. It was what I believe to be an important market top for these indexes, a week where these indexes, out of 100 possible, made 63 new all-time highs. Look at all those BEV Zeros (0.00%) during those five days in early last November! And except for the XAU and the DJ Utilities, if an index didn’t close with a BEV Zero, it closed well within in scoring position.

Since early last November, 18 of these 20 indexes have slowly been losing ground. Now go back up to this week’s table for these major market indexes (above), and take a look. The market has seen big changes since early November.

The bulls may say that the current decline is simply a correction in the stock market, with good things to soon follow.

But we, that be bearish on the market say; the rising bond yields seen above, and promises from the idiot savants at the FOMC that beginning in May (next month) they’ll be draining $95 billion a month, month after month from the financial system. And not just that. The idiots also say they plan to aggressively raise their Fed Funds Rate, in fifty basis points increments, multiple times in 2022.

How anyone could be bullish on the stock market in a “monetary environment” like this is a mystery to me.

Moving to the November 5th performance table above (lower table in the graphic above), the gains these indexes saw off their lows of March 2020 are amazing. But these gains were only possible because of the massive “injections of liquidity” from the FOMC’s Not QE #4 seen below.

Recently the FOMC has promised to initiate a second round of QT. And it appears in the chart above (Red Circle) they’ve already begun their preparations for “draining liquidity” from the financial system. In the table above, the 10Wk M/A for the past two weeks (Red Box) have been in the single digits. This monetary metric hasn’t seen a single digit datapoint since Barron’s 09 December 2019 issue, almost a year and a half ago.

Looking at the plot above of this 10Wk M/A, and seeing what the FOMC’s idiot savant’s have done within the red circle, this decline should be warning to all that the idiots are about to crash the financial markets by “draining liquidity” from the financial system. I know I’m being repetitive on this point, but it’s a point deserving repetition.

Now, the first week this 10Wk M/A actually goes negative for the first time since the last QT, may actually be a good week in the market. That may also be true for the first few months after this 10Wk M/A goes negative. That was true for their QT seen above, so it could also be true for Chairman Powell’s “Not QT #2.”

But in April 2022, these major market indexes, as a group, have been deflating since last November. In their current weakened state, “draining liquidity” from the financial system could push them into the abyss, sooner than anyone expects.

What is a retail (average Joe) investor to do? Let’s take a deeper look into the post November 2021 star index seen above and below; the XAU, the index that this week made a 10-year high.

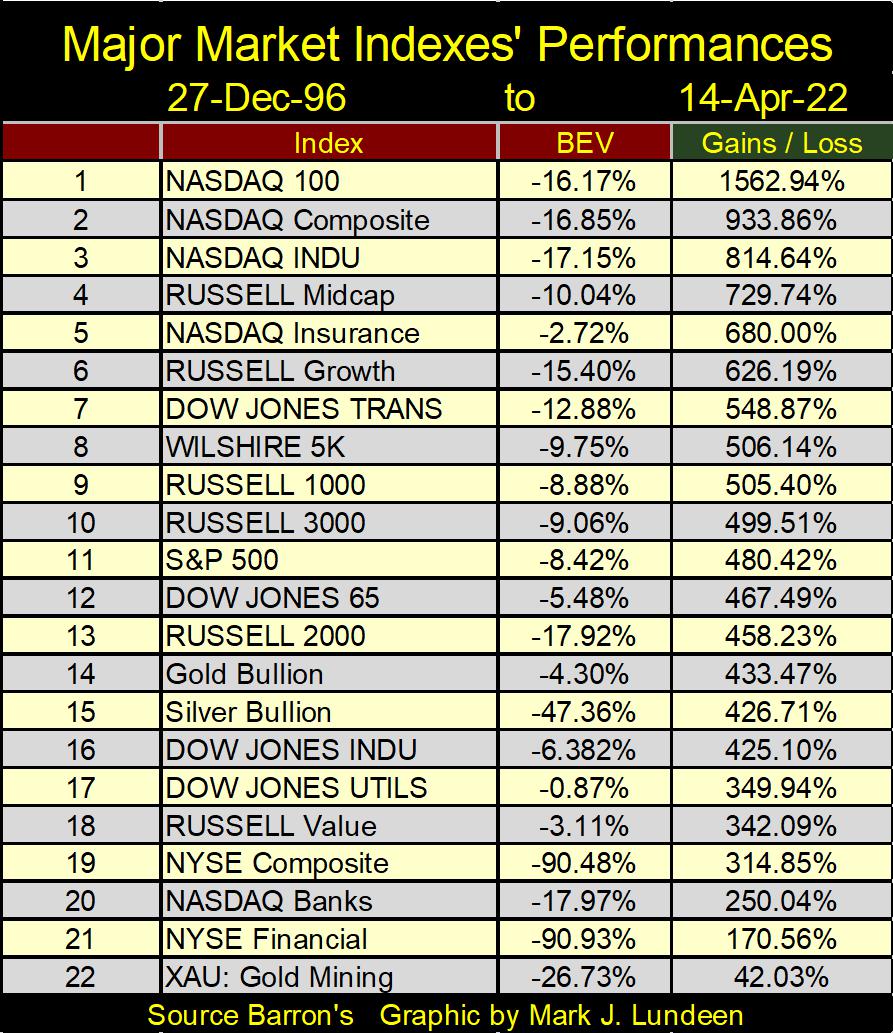

Let me tell you something about massive-deflation potentials in a market, any market. They are proportional to the * Previous Inflation * that market has received. In our markets, received from the FOMC. If you want to see the potential for deflation for the major market indexes I follow, you need only look at the inflationary gains they’ve received in the table below.

Note that gold and silver bullion (#14 & 15) below have outperformed the Dow Jones (#16) these past twenty-six years. But due to the persistent market manipulation of these metals at the COMEX for many decades, I do not consider the old monetary metals as overvalued.

Heck, since December 1996, the XAU’s valuation (#22) has inflated by only 42.03%! To my way of understanding markets, this means the currently unloved gold and silver miners aren’t subject to any pending deflation, come what may in the foreseeable future.

If I were a widow or orphan, established precious metal miners, that pay a dividend, is where I would want to be to keep my nest egg safe. For those with a larger tolerance of risk, the mid-tier miners, and exposure (5% to 15%) to precious-metals exploration companies (like my Eskay Mining) is the place to be.

Above is the Bear’s Eye View of the XAU. This chart clearly shows the XAU is coming off the bottom of an 80% bear market (January 2016). That is a massive deflationary bear market, such as the Dow Jones saw during the Great Depression. The XAU’s last BEV Zero (all-time high) was eleven years ago in April 2011. To even think the XAU is overvalued in today’s market, and ripe for a massive selloff, is ridiculous.

Should (when) Mr Bear comes to take down the financial markets, there will be trillions of dollars fleeing deflation at the NYSE, NASDAQ and debt markets. I find it hard to believe that gold and silver bullion, and the companies that mine these precious metals, won’t become a primary destination of these flows of refugee dollars seeking safety from the storm.

The gains in precious metal assets could be astounding. The gold and silver miners are a tiny market sector. What would the panic buying of a few trillion dollars do their market valuation? I don’t know. But I want to find out!

Here is gold’s BEV chart. Gold closed the week with a BEV of -4.30%. The Dow Jones closed the week with a BEV of -6.38%. So, gold closed the week a full 2% closer to its last all-time high than did the Dow Jones. We haven’t seen that for a while.

This being the Passover / Easter weekend, I thought I’d spend some time commentating on this holy occasion, as well as on some secular history the skeptically minded will find interesting. Go ahead, read it to the end. You’ll like it whoever ye be!

People, as well as life are complicated. France’s King Louis XIV was Europe’s biggest supporter of the Roman-Catholic Church in the 17th century. Untold thousands of Protestants, and Jews were burned at the stake is testimony of his loyalty to the Pope. But there is reason believing King Louis was at best an agnostic.

He once asked Blaise Pascal:

“What proof do you have there is a God?”

To which Pascal replied:

“The Jews your Majesty, the Jews!”

Pascal’s reasoning was simple enough; since the Children of Israel departed Egypt, innumerable kings and nations attempted to “kill them all.” Yet, after 3500 years, this weekend the Jews are still here, celebrating Passover as God ordered them to do at Mount Sinai.

Today, and every day, the Iranian mullahs shout “death to Israel.” They’ll be no more successful than the Edomites or Nazis were, for the same reason Pascal pointed out to King Louis; God’s promise to protect the Jewish people, if not individual Jews, to the end of time.

Where are the Babylonians, the Assyrians today? Rome was once the greatest city and military power on Earth. In 70AD they destroyed Jerusalem, and expelled the Jews from the Holy Lands. By the time Christopher Columbus discovered America, the eternal city, Rome, was in ruins, uncared for rubble where Jupiter hadn’t been worshiped for a thousand years. Instead, all of the old Roman Empire now worshipped Jesus Christ, a humble Jew from Galilee.

The greatest gift the Jews have passed along to the gentiles is their Bible, a truly unique book. How so? Take for example Plutarch’s Lives, a book of notable individuals of antiquity, written by a Greek Historian who lived during the time of Caesar Augustus. Include too Homer’s Iliad and Odyssey into this standard; literary masterpieces where heroes are heroes who perform amazing deeds, and the villains, who excel only at being bums, worthy of eradication. This is how kings and their nobles, the patrons of historical chronicles, insist their scribes document their lives, and the lives of the villains who opposed them.

The one exception to this genre of history I’m aware of is Plutarch’s life of Mark Antony. The Antony who supported Julius Caesar, was a hero who errored little. The Antony who opposed Augustus, was a villain who errored much. It’s easy seeing who Plutarch wanted to please – the winner of this war; his patron the Roman Emperor Augustus.

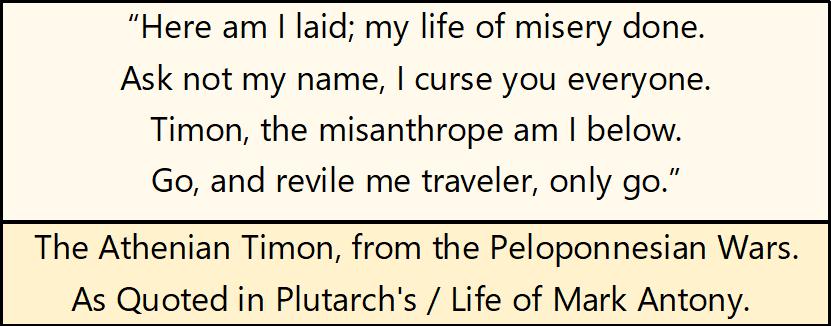

When Antony was coming to his end, after all he attempted with Cleopatra fell apart, and he saw his once glorious life in ruins, he visited the grave of Timon of Athens, who had a then famous epitaph.

Whether Timon’s epitaph cheered Antony up or not, Plutarch doesn’t say. I suspect it didn’t. Maybe his epitaph is more uplifting in the original Greek.

The Jewish Bible is completely different, as it tells all; both the good and the bad of the people who lived in ancient Israel. The pagan histories primarily focus on glorious deeds of kings and their mighty men of war. The Bible does too, noting when Israel’s Kings were assisted or thwarted by God. But uniquely, a significant proportion of the Bible’s commentary is on the little people, who very often are as corrupt as their leaders, and their society suffered for it.

Did you know Moses was a murderer? He murdered an Egyptian, and was forced to flee Egypt for his crime.

King David was a murderer too. David took the wife of Uriah the Hittite into his bed, one of his mighty men of war when Uriah was fighting the Ammonites for David. Bathsheba became pregnant with David’s child. David ordered Uriah to visit his wife, intending to hide his crime with a night of passion between the husband and his wife.

That didn’t work. Uriah refused to sleep anywhere but outside his house, alone under the stars, until he defeated the Ammonites for David. So loyal was Uriah to David, David had no choice but to send Uriah back to the front, and ordered his commanding general to make sure Uriah died in battle.

Dear reader; this is how political leaders and their minions were; as they are now. They betray and abuse us, then tell us, “their citizens,” it was all for our own good.

The Bible is relentless in telling the truth of the people covered in its pages. The good and bad of political leaders, priests, and the mass of humanity they hold power over. These people from long ago are no different than those we have today, so there is much to learn from reading the Bible.

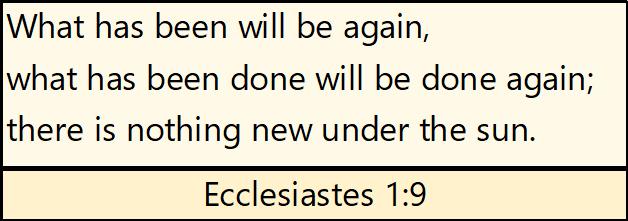

There are people who chuckle when believers say the Bible was inspired by God. That once was me. But no historical chronicle written by humans reads like the Bible, like the 3000-year-old warning from Ecclesiastics below.

America, Canada, Mexico, and Christendom’s birthplace; Europe are decaying for want of God’s moral guidance from the Bible. Our elite rather have chosen “science” for their moral compass. A 21st Century “science” that is confused about how many genders humanity has. This is so sad. Life on Earth doesn’t have to be this way. But the choices we make, or refuse to make all have consequences.

I remember a line from an old Frank Zappa song:

Do you love it? Do you hate it? Here it is the way you made it.

As this weekend is Easter, I wanted to praise Jesus for all he did for us on the cross. He was the willing sacrificial lamb who took away the sins of the world. That’s not saying people don’t sin anymore – oh they do. But Christ’s death on the cross Paid in Full the penalty of our sins – eternal death. His resurrection from the grave is his promise to those, who believe and love him, will share eternity with him. That sounds good to me.

Here's a good song for Easter; Ain't No Grave (LIVE) - Bethel Music & Molly Skaggs.

https://www.youtube.com/watch?v=nGncW_ueyHA

That wraps it up, see you next week.

Mark J. Lundeen

15 April 2022

********