Inflation — Running Out Of Road

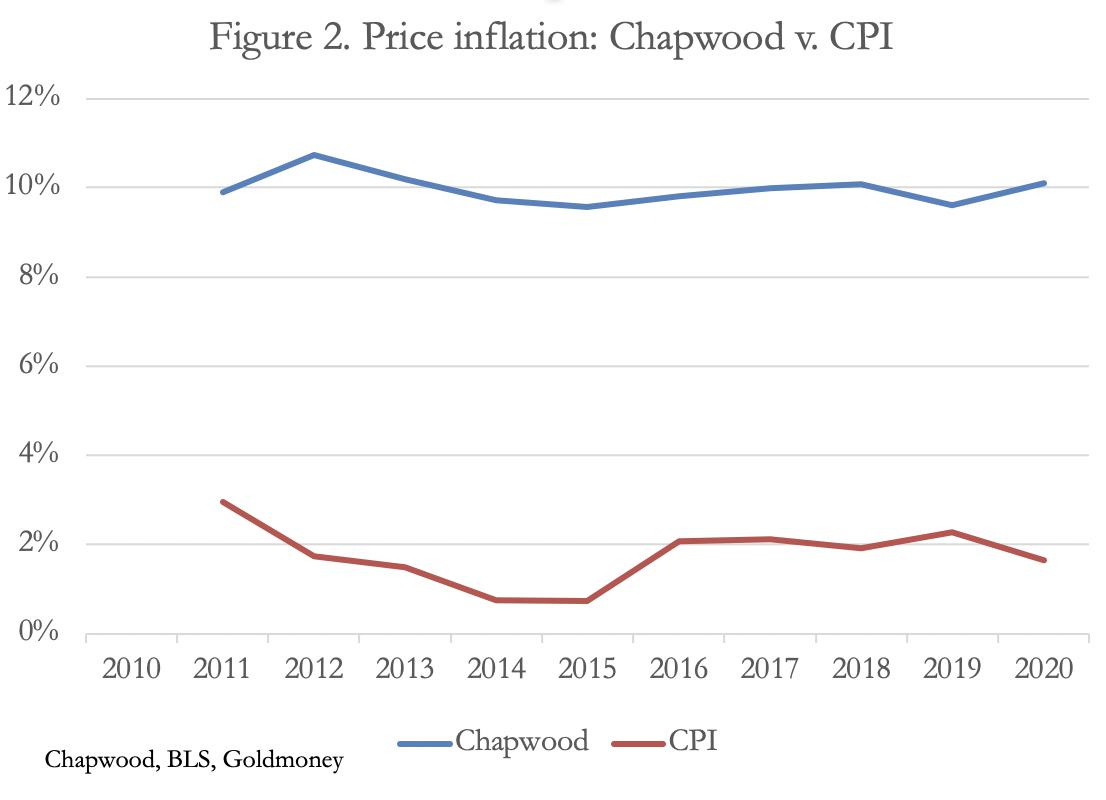

If you think that price inflation runs at about 1.6% you have fallen for the BLS’s CPI myth. Two independent analysts using different methods — the Chapwood Index and Shadowstats.com — prove that prices are rising at a far faster rate, more like 10% annually and have been doing so since 2010.

This article discusses the consequences of price inflation suppression, particularly in the light of Jerome Powell’s Jackson Hole speech when he downgraded the importance of price inflation in the Fed’s policy objectives in favour of targeting employment.

It concludes that the reconciliation between the BLS CPI figure and the true rate of price inflation is inevitable and will be catastrophic for the Fed’s policy of suppressing interest rates, its maximisation of the “wealth effect” of inflated financial asset prices, and for the dollar itself.

Monetary inflation takes off

Last week saw a virtual Jackson Hole conference, where Jerome Powell downgraded inflation targeting in favour of the other Fed mandate, employment. And Andrew Bailey, Governor of the Bank of England, claimed “We are not out of firepower by any means…. to be honest it looks from today’s vantage point that we were too cautious about our remaining firepower pre-Covid”.

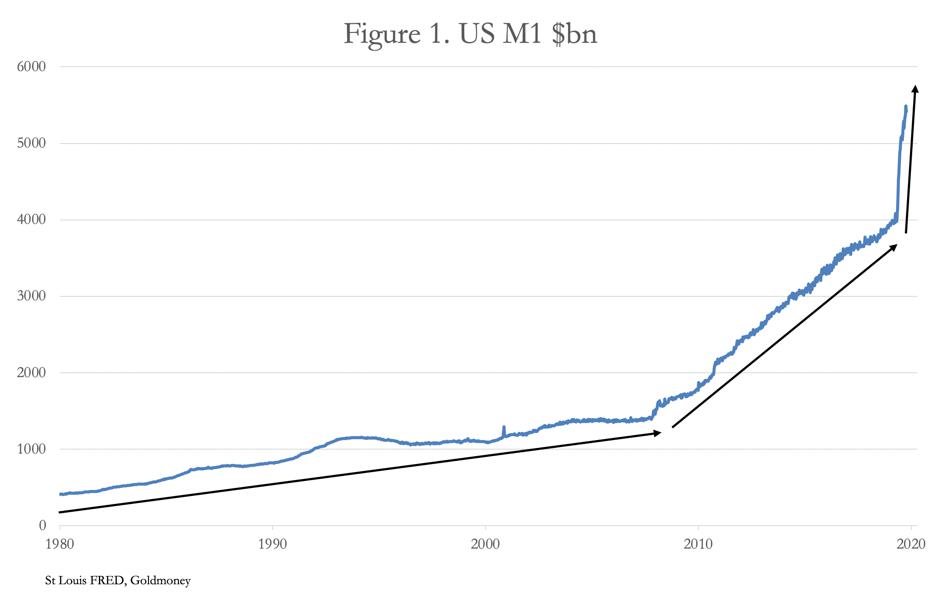

Both men were tearing up earlier scripts. Since they will likely tear up these as well there is little point in examining them further. For the fact is that all the major central banks are trapped in problems of their own making, and some time ago they lost control of their destinies. Figure 1 below encapsulates the problem.

M1 is the US narrow money indicator. Over 28 years from 1980, it grew at a simple average annual rate of 8.8% per annum. From 2008 to last February, following the Lehman crisis it grew at an average annual rate of 16.6%, From 24 February in six months it has grown by 34%, which is an average annual rate of 68%. What Powell effectively admitted at Jackson Hole was that M1 annualised growth of 68% was not enough to ensure the US economy would recover. He would have had to downplay the effect on prices to create leeway for further increases in the rate of monetary growth.

The Fed is evidently trapped by its inflationary policies. And the US Bureau of Labour Statistics, which calculates US consumer price indices, will have to work even harder to suppress the evidence of price inflation. Over the last ten years they have recorded an average annual rate of price inflation of 1.69% measured for US cities (CPI-U), and for the first half of 2020 they say it was 0.83%, or 1.66% annualised. To maintain this fiction has been a remarkable feat of statistical management, when compared with the unadulterated fifty city figures collected by the Chapwood Index. Figure 2 shows the gap between the BLS’s CPI and Chapwood’s unadulterated estimates.

It is not our purpose to imply that the Chapwood Index of prices is an accurate representation of price inflation. We can talk about the general level of prices in a theoretical sense, but in practice it cannot be measured because each consumer has a different price experience. It is only when one subscribes to the macroeconomics version of economics and talk of unworldly aggregates that a figure is calculated. But if you remove the changes in the BLS’s calculation methods since 1980, you end up with a similar rate of price inflation to that of the Chapwood index, which is confirmed by John Williams at Shadowstats.com.

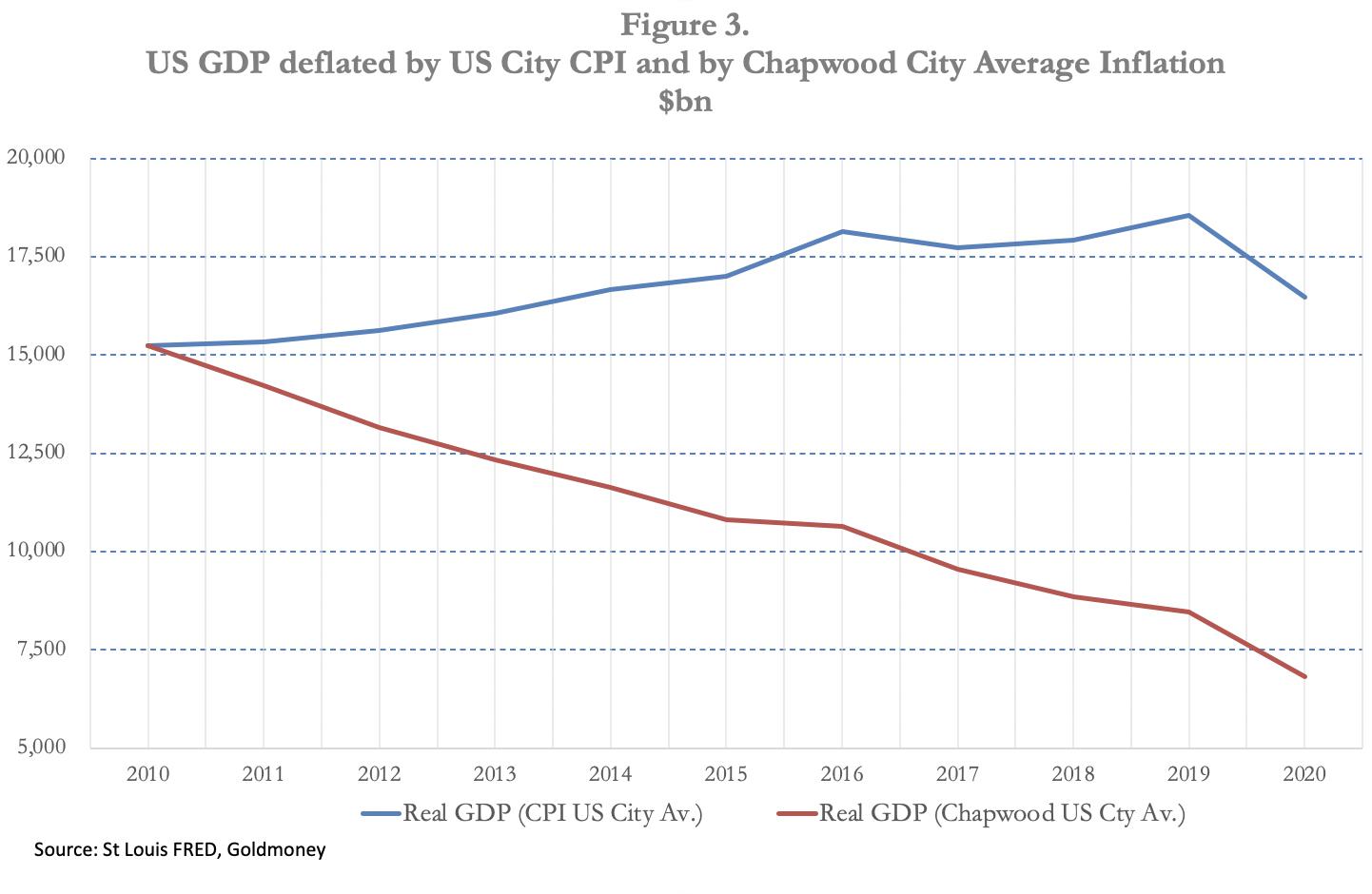

Now let us reconsider Jay Powell’s and Andrew Bailey’s Jackson Hole speeches in this light. Instead of an average rate of annual price inflation over the last ten years of 1.69%, Chapwood tells us that that average is 10.1%, varying between 13.4% in Sacramento and 7.1% in Albuquerque. It is against this background that Powell proposes to downgrade the Fed’s inflation mandate. Given M1 monetary inflation averaged 16% between the Lehman crisis and last February (see Figure 1) the price effect recorded by Chapwood is not surprising. But it gets worse for Powell. If we accept Chapwood’s numbers as being realistic and use them to deflate nominal GDP, we can see that the US economy has been in a slump for the last ten years: adjusted GDP has contracted by 65% since 2010. This is illustrated in Figure 3.

The only offset is the Fed’s much vaunted wealth effect that comes from speculating in financial assets. But that relief is only available to American investors and those employed in financial and related services, disadvantaging the poor and unemployed who inhabit Main Street, the non-financial economy. It is in this context, perhaps, that we should view the current civil unrest and racial strife in America.

Waking up to reality

Nobody in the investment and media mainstreams, let alone at the Fed, appears to understand the extent of statistical distortions and the consequences. We can count them all, including economics professors and senior figures in the investment game, among the 999,999 out of the proverbial million who don’t understand money and the consequences of its debasement.

The other side of the slump in real GDP illustrated in Figure 3 is the transfer of wealth from producers and consumers in the non-financial economy. If, as implied by a Chapwood GDP deflator, GDP has declined by 65% in real terms since the Lehman crisis, then we can say that gives us an approximation of the net wealth transfer through monetary inflation from producers and consumers to the state, the Fed, the commercial banks and their favoured customers.

If macroeconomists think that inflation stimulates demand, apart from initial artificial and final catastrophic effects perhaps, they are wrong: it kills it. The element of monetary debasement that ends up in government hands, taken from the productive non-financial sector along with all taxes, is wasted because a government produces little more than interference with an otherwise working economy. The true purpose of monetary inflation is not to improve our lives but to finance government deficits.

The element of bank credit inflation which ends up with the banking system’s favoured customers, comprised mainly of the large lumbering zombie corporations of yesteryear, disadvantages the more dynamic entrepreneurial businesses among the small and medium size sectors to the extent they are denied similar credit terms. The element of monetary inflation that ends up fuelling speculation in the financial economy is robbed from the liquidity balances and earnings of producers and consumers without their knowledge or consent. Monetary inflation is virtually impossible for the robbed to detect, not being revealed by accounting methods.

Despite M1 money supply accelerating, deflation remains a common fear, prompted doubtless by commercial banks being reluctant to extend credit at a time of increasing loan risk. But the Fed is already concerned that the commercial banks will not pass on its monetary policies, which is why it is bypassing them by buying corporate bonds and commercial mortgage backed securities through BlackRock. Other similar schemes are sure to follow. But it always amounts to supporting yesterday’s businesses, which the markets would otherwise likely judge to be today’s failures.

Clearly, any tendency for bank credit to contract will be countered by the Fed through further and appropriately aggressive expansion of narrow money, for which Powell was clearing the decks at Jackson Hole. It could lead to an even faster rate of M1 growth than the annualised 68% since February. Those who worry about the deflation of bank credit are therefore premature in their analysis and obviously believe in monetary inflation as an economic cure-all. But in real terms the US economy is already contracting because monetary inflation is leading to far faster price rises than is generally realised. Monetary inflation as a policy was only going to make things worse.

It is also a myth that monetary inflation is helpful to businesses. While an artificial and temporary cheapening of domestic manufacturing costs is lauded by neo-Keynesians, businesses need monetary stability in order to calculate the value of future payments: a healthy economy depends on business calculation which relies on the certainty of price stability. It is not good enough to say that suppressing interest rates benefit businesses: it is only true for over-indebted zombie businesses which with state aid can survive a little longer. But that is an artificial boost in their fortunes at the expense of a hidden inflation tax on everyone else. Not only does inflation coupled with the suppression of interest rates promote and sustain these commercial failures, but by doing so it also restricts the redistribution of all forms of capital into more productive use.

If the effects of monetary inflation become apparent to actors in the non-financial economy, they begin a process of reducing their monetary liquidity, knowing that money will buy less in the future than at the present. Until now, economic actors appear to place greater credence in the BLS’s inflation figures than from their own experience; but that cannot last. When the effect on prices of an annualised expansion of narrow M1 money of 68% becomes apparent it is likely to undermine widespread complacency. And when people realise that the general level of prices is rising despite the slump in economic activity, they will begin to dump all forms of dollar liquidity they possess in return for goods, driving price inflation even higher than increased money quantities would suggest. The transition from the false stability of prices as measured by government statistics into a final crack-up boom when money is dumped as worthless need not take long: all it needs is a trigger.

Shutting our eyes to this reality is nonsensical. The BLS’s CPI figures will prove to be defined by a vulgarity suggested by its own acronym. And when markets rumble it, the Fed will be unable to contain US Treasury yields at anything like current low levels. If we take the Chapwood price inflation figures for this year, then the current yield on the 10-year US Treasury bond is minus 9.45%, which must be close to a record in the annals of US monetary history.

Let us assume, for a moment, that financial markets adjust to price inflation rates closer to the Chapwood figures, which have already accelerated from an annual average of 9.6% for 2019 to 10.1% in the first half of 2020. US Treasury yields would initially rise at the short end of the curve to reflect that figure, perhaps with a margin over it. With the government’s budget deficit sure to exceed $3 trillion in the current fiscal year (to October) and perhaps double that next, the 2019 interest bill of $383bn on existing debt and the higher rate for US Treasury bond roll-overs plus the interest on new debt, total annual funding costs are likely to rapidly approach a trillion dollars . It is a debt trap sprung firmly shut and investors will take that into account.

An out of control budget deficit will continue to be funded through quantitative easing — there’s no other way. But a rise in bond yields will also have a catastrophic effect on equities, on their valuations as financial assets, on the cost of new and rolled-over corporate debt, and on valuations for loan collateral. The much-vaunted wealth effect, which has concealed the collapse in real GDP since the Lehman crisis, will quickly evaporate. Because the Fed has gone all in on using monetary inflation to sustain a financial bubble, it has also tied the dollar’s future to it, so its bursting is bound to have a profoundly negative effect on the dollar’s purchasing power.

The inflation problem is about to get worse

We have now established that the Fed is committed to accelerating the increase in the money quantity. We have also established that its monetary policies combined with statistical price manipulation has had the opposite effect of that intended, so much so that since the Lehman crisis the US economy has contracted in real terms by more than half, which any competent sociologist will tell you leads to civil unrest — plainly evidenced today. We have reached a high point in macroeconomic madness.

It’s about to get worse.

Despite the post-Lehman acceleration of money supply, last September the repo market blew up on the day when Deutsche Bank sold its prime brokerage to BNP, the French global systemically important bank — a G-SIB. It may or may not have been the trigger for ongoing problems in the repo market, but clearly, there were liquidity issues in the US’s financial and banking system at that time.

It came on top of last year’s contraction in international trade, due in large measure to trade tensions between America and China with knock-on effects for China’s trading partners, such as Germany. Non-banks, principally insurance companies, pension funds and hedge funds acting directly or through agencies had accumulated large positions in fx swaps, ripping out interest differentials between euros and yen on one side, and a rising dollar on the other. The G-SIBs, particularly JPMorgan, had no excess reserves available to finance further non-bank speculation in this market. The turn of the cycle of bank credit expansion was upon us due to these liquidity issues, instead of the normal end of cycle problem of over-geared bank balance sheets facing escalating lending risk. However, thanks to covid-19 lending risk is now rising rapidly.

The S&P500 index crashed by fully one-third between mid-February and 23 March, as institutional investors suddenly realised the deflationary consequences of liquidity shortages in the banking system. It took the Fed’s cut in its funds rate from 1% to 0% on 16 March and its statement on 23 March, when it promised new QE and infinite monetary support for businesses and households, to relieve the liquidity problem.

At the same time came the covid-19 lockdowns. China had imposed lockdowns in Hubei Province in January, but from early March the rest of the world started to go into lockdown, with the UK going into lockdown on 23 March. In the US a number of states announced lockdowns from 17 March, with New York locking down on 22 March. The Fed’s actions, cutting its funds rate on 16 March and announcing infinite QE on 23 March were both timely and a financial watershed.

In all the mayhem of lockdowns it is easy to forget that the collapse of overnight liquidity was already a six-month old evolving crisis, marking a cyclical turning point in the expansion of bank credit. Unlike Lehman, which reflected a cycle of excessive property speculation, this one has its roots in a downturn in global and now domestic trade, as well as a global currency imbalance in favour of the dollar. According to US Treasury TIC figures, at end-June 2019, which are the most recent available estimates, foreigners owned $20,534 bn of US securities. To this must be added bills and cash, which on the most recent TIC report (June 2020) totalled a further $6,227 bn. Therefore, putting to one side the different dates of record and higher equity valuations today, foreign ownership of dollars is roughly $27 trillion, which equates to 125% of US GDP in 2019.

Foreign ownership amounts to such a large figure relative to GDP due to the dollar’s reserve status, foreign participation in funding US budget deficits and anticipation of an expansion of future trade. But as we have seen, global trade began to contract in 2019, which if continued, reduces the need to hold dollars. And we can be certain that if foreign holders take the view that the US economy is in a slump, beyond their requirements for marginal liquidity there is no reason for them to hold dollars at all because they can always buy them when actually needed.

Consequently, the US is vulnerable to foreign liquidation of securities, comprised of US Treasuries and other bonds, together with portfolio investments amounting to 20% of total US long-term securities extant. So far, on a net basis foreigners appear to have stopped or slowed their net buying of US securities and cash dollars. Some positions will have been unwound by US hedge funds and other entities operating in the fx swap market rather than foreigners, driving the dollar’s trade weighted lower by about ten per cent so far from its 23 March high. But foreigners appear to have not yet began to sell dollars in meaningful quantities. When they do, they will be selling US Treasury and corporate bonds and liquidating equity portfolios as well. And if they do so at a time when there are insufficient domestic buyers to absorb their selling, these markets will crash along the dollar, which will be sold as well.

In the short-term, the course of financial asset prices and of the dollar’s exchange value will in large measure be determined by non-Americans. [As a side note, the last time a currency and financial assets became so intertwined was in the Mississippi bubble. The Irish-French banker, Richard Cantillon, made his second fortune in the latter part of 1719 by shorting the livre currency before the peak in the shares in late-February 1720. A similar pattern could be emerging today in the relationship between fiat money and financial assets, with the dollar weakening before US financial assets]

Pricking the bubble

We know that the two versions of price inflation, that of the BLS and Chapwood (which accords with Shadowstats) are far apart. The finance sector is pricing financial assets on the basis of the BLS’s CPI and therefore accepts the Fed’s monetary policy of keeping short-term interest rates close to the zero bound. But rising prices for metallic money, gold and silver, indicate that the policies of suppressing apparent price inflation and interest rates are running into trouble.

We know, therefore, that the financial asset bubble itself is on a last hurrah, and its imploding deflation, driven initially perhaps by a resolving of the tension between the BLS’s CPI and the true rate of price inflation, is only a matter of time. We can identify a few key reasons likely to trigger the bursting of the financial asset bubble:

-

A growing realisation that the covid-19 shutdowns are additional to the credit cycle and liquidity problems that surfaced in September 2019 and that a post-covid-19 recovery will be followed by a deeper and more intractable slump.

-

Liquidity problems in the banking system and for its non-financial customers, together with the escalation of bad debts are leading towards bank failures. Fortunately, US banks are generally less leveraged than those elsewhere. But Eurozone, Japanese, Chinese and some UK G-SIB banks pose exceptional systemic risks, making their continued survival as independent commercial banks unlikely beyond the near term.

-

Foreign selling of US financial assets and the repatriation of their funds.

The first two bullet points will simply guarantee a further escalation in the rate of monetary inflation as the partnership of central banks and state treasury departments desperately attempt to contain a deteriorating situation. But foreign repatriation of funds will hit the dollar hardest, making it lose purchasing power against other currencies as financial asset values collapse. The euro, yen and Chinese yuan will appear perversely strong for a brief period, with their central banks desperate to contain the rises in their own currencies in the belief they are deflationary.

The sheer scale of dollar inflation will also mean that global commodity and raw material prices will rise, signalling that the dollar’s purchasing power is falling.

Empirical evidence in these situations indicates that an inflating currency is hit first in the foreign exchanges, before the domestic population discovers what is happening to their money. There is then followed by a growing panic among domestic users to dump money. In the best documented monetary collapses, such as Germany’s of 1923, cash was increasingly demanded in order to be spent as soon as possible, and evidence from Venezuela suggests this is still true today. However, more sophisticated financial systems have eliminated cash for most transactions, replacing it with credit and debit cards as well as other forms of electronic money. Internet banking and shopping further speeds up the process of turning money into goods.

This has the effect of speeding up the spending process significantly, leading to a more rapid loss of purchasing power compared with a currency whose users first make a trip to their bank to encash their deposits before heading for the shops. Additionally, a generation of cryptocurrency-savvy millennials have been forewarned of the consequences of fiat money inflation and stand prepared to ditch currencies earlier than their equivalents would have been in the past.

Taking these factors into account, the collapse in purchasing power of a currency which has been deployed to save financial assets and failed, once the general public finally understands the consequences, will likely be surprisingly rapid. In 1923 Germany, the final collapse took roughly six months. In 2020 America it could take as little as a few weeks.

Other currencies that refer to the dollar for their relative values are sure to suffer the same fate, not helped by the fact that their central banks have been pursuing similar monetary policies and will likely cooperate with each other to the bitter end.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

********