Inflation And Gold. What Gives?

In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the:

“…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.”

Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold community see this as a bullish sign.

By the way, we did not see any data about the prices paid on what dates, but the articles on December 1 mention a series of buys over a few months. Assuming a few means two, it looks like Ireland may have paid more than the current price.

The Different Theories on What Moves Gold and Silver Prices

Back to the common bullish view of Ireland’s wisdom, what of the opinions of the 64,300 people who sold their gold to Ireland (assuming the average seller sold an ounce)? Surely, these people believed the price will go down?

Famous and Anonymous Price Movers

There are two competing theories for how to interpret the conflicting views when one market participant is famous and the other is a bunch of anonymous people. One is the “famous buyer” theory, and the other is the “incompetent bureaucrat” theory. The latter was used to explain the sale of half of Britain’s gold between 1999 and 2002.

How could we have known that the UK government was foolish to sell back then, and the anonymous 12,699,250 buyers were right? Whereas today, the Irish bureaucrats are right, and the 64,300 sellers are wrong?

This is just a bias towards bullishness.

Obviously, some of the companies promoting these stories are just trying to sell gold (we are not in the business of selling gold, we pay interest on investors’ long-term gold holdings). However, we would observe that if people buy gold based on a mistake, they may be quick to sell when they realize their error. Nobody wins, and some of these folks may never return to the gold market again, having learned the wrong lesson.

Consumer Price Index, Useless Ingredients, and the Gold Price

Another theory of what drives the gold price is changes to the consumer price index, also known as inflation. Consumer prices have been skyrocketing. But the price of gold has not. So is this a bullish signal?

We will leave aside the obvious contradiction. If rising consumer prices cause the price of gold to rise, and consumer prices rose but the gold price did not, then the theory’s prediction has not come true. So there is no reason to expect it to become true in the future.

Whether rising prices are a signal for gold, depends on the cause of the rise in prices. If prices are going up due to nonmonetary forces such as tariffs, restrictions on energy production, and increasing number and cost of regulations (which we call useless ingredients), then why should that drive up the price of gold? There is no mechanical apparatus that connects the prices of consumer goods to the price of gold.

There are times when the prices of gold and consumer goods are rising together. But other times when one is moving up sharply, but not the other. For example, 2009-2011, the price of gold more than doubled. Or this year, consumer prices are up about 6.3% according to Bureau of Labor Statistics. The price of gold is down about 5%.

The Different Causes of Inflation

Consumer prices are up due to the nonmonetary factors we mention above, most especially whiplash from the lockdown imposed in response to Covid. Every business from retail to repair has learned that they cannot rely on products delivered promptly. So naturally, prices go up to ration the limited supply.

When economists say that “inflation is transitory”, they mean that logistics problems will be worked out, and then inventories will be replenished.

Unfortunately, they do not distinguish between different causes. If prices go up due to monetary debauchery, that is inflation. If prices go up to due to temporary shipping snafus, that is inflation also. And if prices go up due to laws that make everyone use more-expensive natural gas and laws that prohibit domestic production of natural gas, then that, too, is called inflation.

We need different words for these phenomena. Though that is not our point today. We merely draw attention to the cause of the rise in consumer prices and note this one does not directly affect gold.

Why Gold is Different

Gold is different from consumer goods, or even ordinary commodities. So far as we know, mankind has been mining it for at least 5,000 years. Virtually all of the gold mined during this time is still in human hands. Toys, Christmas trees, food, and even cars are produced to be consumed. With these goods, there is very little accumulated inventory. What is produced moves quickly (shipping delays now lengthen this time) into the hands of consumers. Who then consume them.

But gold is not consumed. It may be fashioned into jewelry, but this product is only a quick trip to a refiner away from bullion. No one throws gold jewelry into the garbage, obviously. There is a vast accumulated inventory of gold. It would take decades of mining at the current rate to produce that much gold.

This is why gold defies all the conventional methods of analysis, such as supply and demand. What is supply? It’s not just what comes from the miners and recyclers. What is demand? It is not just jewelry and certainly not just electronics.

Every ounce ever produced is potential supply. Everyone on this planet represents potential demand. At the right price, under the right conditions.

Gold Price Fundamental Analysis- Gold Basis

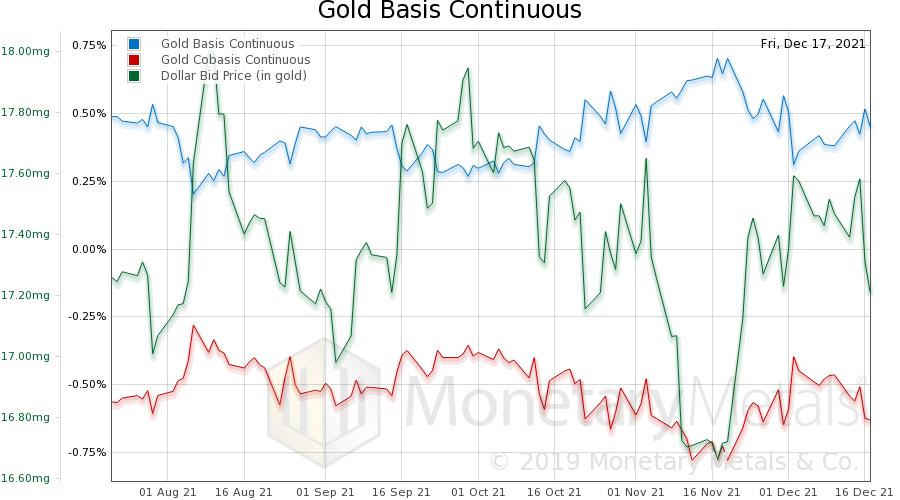

There are many potential factors, too many to analyze and too intangible to quantify. However, they all end up affecting the same thing: the gold basis. The basis is the price of gold in the futures market minus the price in the spot market. This is a good measure of the abundance of gold to the market (and the cobasis, spot - future) is a good measure of gold’s scarcity to the market.

By watching these indicators, and just as importantly how they move with changes in the gold price, we can see a clear picture of current supply and demand conditions in the gold market (silver too).

Here is the picture of the gold basis overlaid with the price of the dollar measured in gold (inverse of the price of gold measure in dollars).

Notice that there is a correlation between the cobasis and the price of the dollar. That is, as the dollar goes down (which most people think of as gold going up), gold becomes less scarce. What this means is that traders are buying gold futures with leverage. They drive up the price of futures contracts. The spot price follows, due to the actions of market makers, but not quite as much. Thus the cobasis, which is spot - futures, drops. This is a sign of speculation. If we saw the cobasis rising, when the price was rising, then we would know that the move was driven by buying of physical gold.

We have a model that calculates what the price would be, if the impact of speculators were removed. Here is a graph:

The absolute level of the fundamental price is not that important. Focus on the direction. Since early November, the fundamental has been moving sideways, along with the market price. In other words, there is not a lot to see in the gold market at this time.

Silver Fundamental Price Analysis- Silver Basis

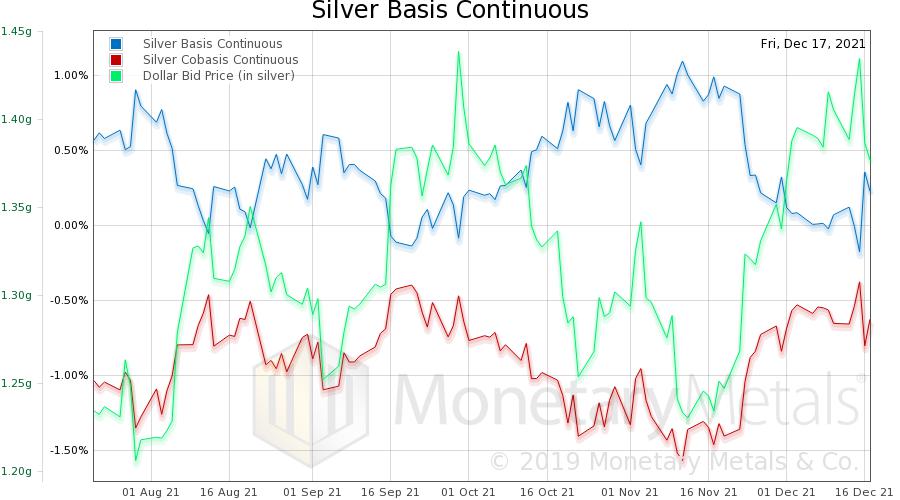

Here is the graph of the silver basis, overlaid with the price of the dollar in silver.

We see greater price volatility, and greater volatility in the basis and cobasis. However, there is the same kind of correlation as with gold.

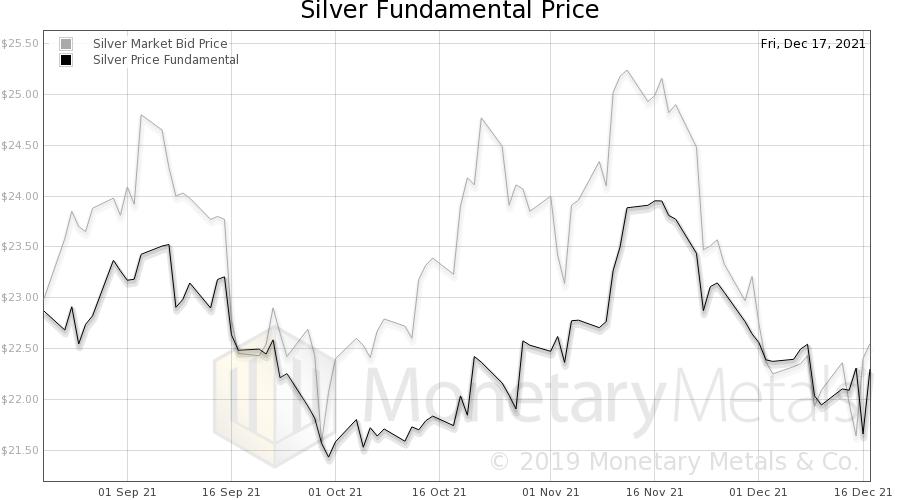

Here is the silver fundamental price graph.

This is telling a slightly different story than the gold chart. Although the silver cobasis is moving with the price of the dollar, it is not moving proportionately. So the fundamental price has dropped. This means that even though the price of silver has dropped, the stackers more than the speculators have been selling. Now, the model is predicting that the price of silver would be about at its current level, if speculation were removed from the market.

© 2021 Monetary Metals

********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the