It Keeps Holding Gold Back

I have written about this for almost a decade now.

But it’s even more pressing now that perhaps Gold has run as far as it can outside a secular bull market. It is trading very close to very significant resistance.

It isn’t easy to envision a huge move higher in the precious metals sector if the stock market continues to run.

Let me explain with a history lesson.

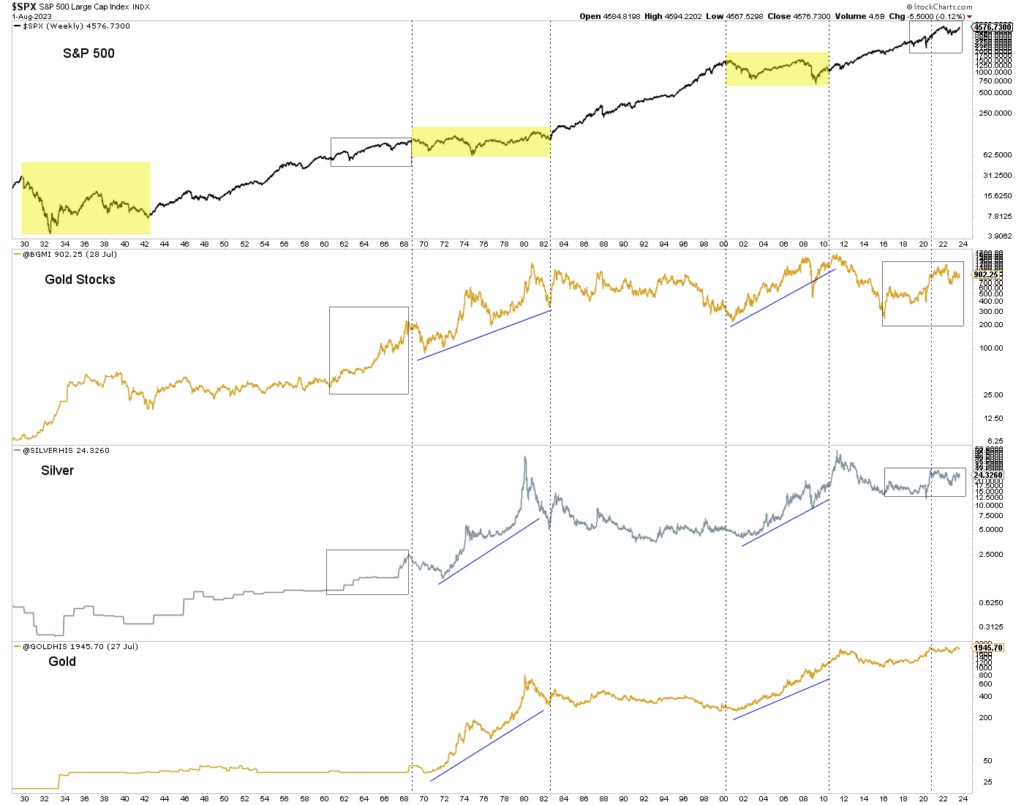

As you can see in the chart below, the biggest moves in the entire precious metals sector occurred during the twin secular bear markets in US equities: 1968-1982 and 2000-2011.

The exception is the mid-1960s, which shares some micro and macro similarities to today.

But that aside, note the vertical line when precious metals peaked three years ago. (The Barron’s Gold Mining Index is great historically, but today’s relevant indices peaked three years ago).

The S&P 500 is on the cusp of making another higher high for the second time since precious metals peaked three years ago.

One thing that triggered the end of the secular bull market of the 1950s and 1960s was the sharp rise in bond yields after 1965. The 10-year yield moved from 4.1% in July 1965 to almost 6.0% by the end of 1967.

In the video below, I discuss the historical impact of the move in yields and how the stock market peaked near the end of the first wave of inflation.

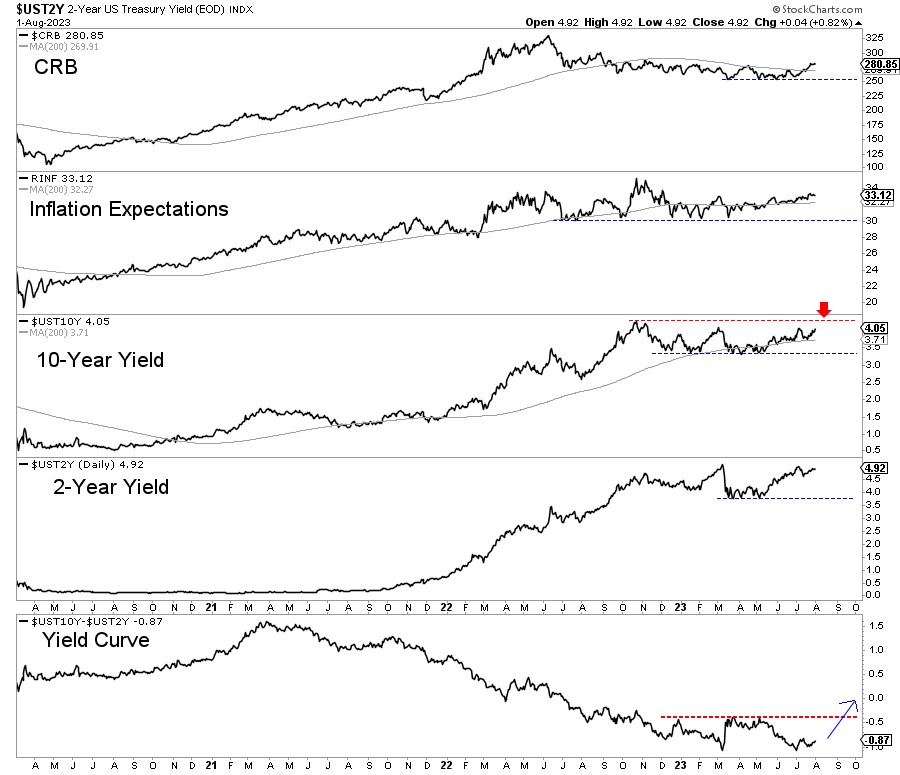

Circling back to Gold, if there is no recession for another 9 to 12 months, then Gold needs a breakout in long-term bond yields and an inflationary steepening of the yield curve.

That means the 10-year yield breaks resistance and rises faster than the 2-year yield. Note the bottom right corner of the chart and the blue arrow. If that happens, it is bullish for Gold.

With the recession avoided or postponed, one would think Gold should be trading lower. It has held up reasonably well, perhaps due to the coming end of rate hikes and the threat of a resurgence in inflation into 2024.

Gold would benefit if the worry about a rebound in inflation gains traction over the months ahead and the yield curve steepens. In addition, a sustained breakout and move higher in the 10-year yield could begin to cause problems for the stock market, as it did in the second half of the 1960s.

This is a time to research companies poised to benefit from the inevitable breakout in Gold.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

**********