It's Hard Making Money In A Bull Market

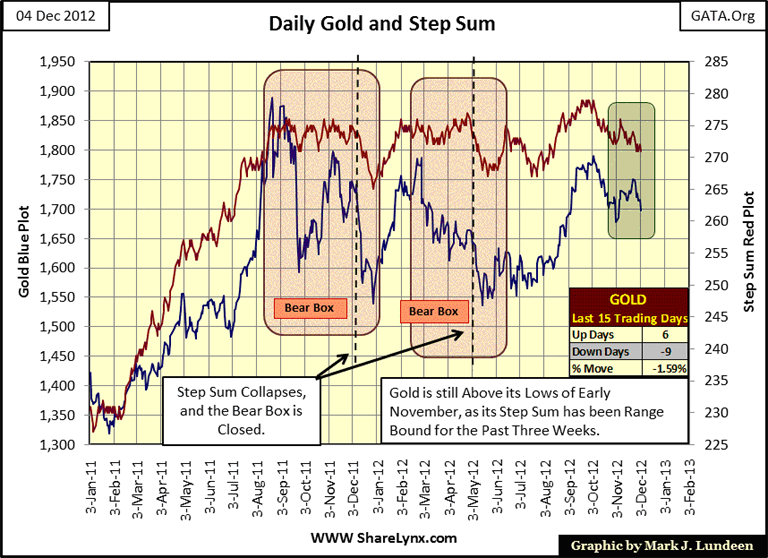

For all of the Big Bad Wolf's huffing and puffing for the past few months, gold and silver are holding on. Let's look at gold and silver's step sum charts to see how the metals are currently doing. Gold looks good, not great, but good; which is good for us. It's holding above its low of November 03, as it step sum stopped going down two weeks ago. It goes without saying that I would like to see gold do what it did in 2011 (see below), where it soared from 1325 to 1888 in only six months. But that isn't what's happening right now; right now gold is holding its own in a tough market - which is very good.

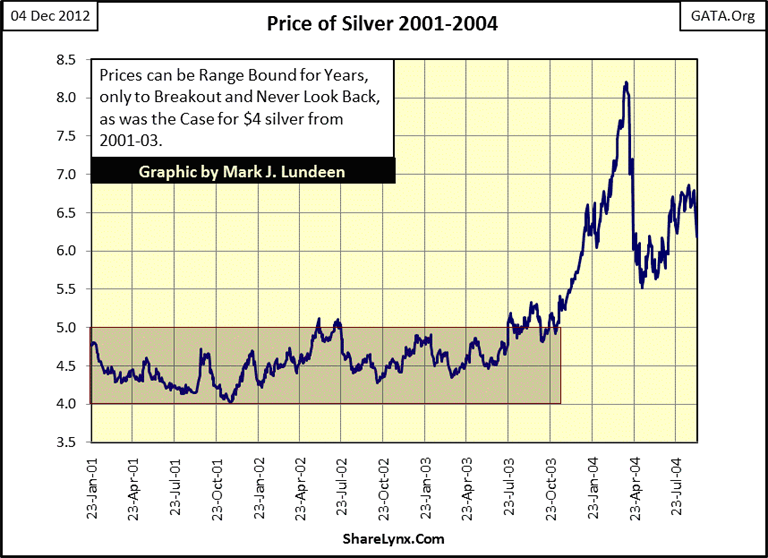

Silver, like gold, looks good too. Looking at the chart below, without doubt $35 silver has been a key price for the past two years. Current market sentiment (the Red Step Sum Plot) is bullish, and if the price of silver has found a short-term bottom, the market will begin to look really hard at that $35 silver line.

If silver can break forcefully above $35, we may never see $35 silver again as was the case for $4 silver a decade ago. Don't you wish you had bought silver when it was $4? Well plenty of people did in 2001-03, only to get frustrated with silver's inability to get above, and stay above $5. So they not only bought $4 silver, they also sold $4 silver, and they felt pretty stupid when silver broke above $5 for the last time in 2004, and never looked back.

Who knows how and when something is going to happen? I sure don't! But never doubt that silver, and gold are in a massive-bull market that has years, and tens-of-trillions of dollars in QE to go. This is the time to keep an iron hand on the tiller, as patience in a world gone mad with monetary inflation will prove to be profitable for gold and silver.

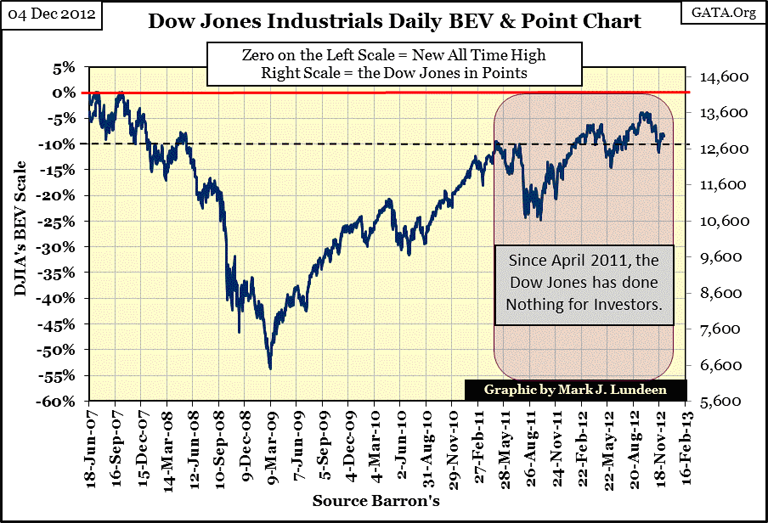

But patience doesn't always prove to be profitable, as has been the case for the Dow Jones since April 2011. So what makes the Dow Jones different from gold and silver? The Dow Jones hasn't seen a new all-time high since October 2007 (over five years!), as is painfully evident below.

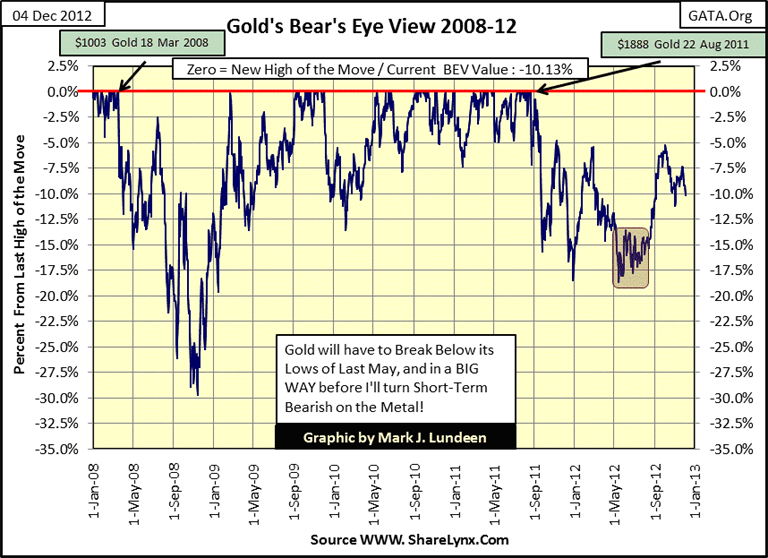

Gold's BEV chart below begins six months after the Dow Jones chart above. Unlike the Dow Jones above, gold has seen plenty of new all-time highs in the past five years, and now finds itself 70% above where it was in March 2008. Silver is up 96% from March 2008.

The point of all this is that it's not easy making money in a bull market. Most people don't because of the repeated days, weeks, and months spent fighting monotony as short-term expectations frequently are not met.

So be aware; during lulls in a bull market, idle hands and a high-speed Internet connection are Mr Bear's tools as he inspires anxiety and doubt in the hearts of investors. In trying times like these, if you believe now is the time to get out and stay out, the best thing to do is just go on with your life and forget following the markets on a daily basis, as I expect this bull market in precious metals will prove to be the most profitable bull market in our lifetime.

Mark J. Lundeen