Jack And The Golden Bean Stalk

Most analysts in both the gold and mainstream investment communities seem to be in “summer doldrums” mode. They are nervous about stock markets because of rate hikes and the late stage of the business cycle. That’s understandable.

Unfortunately, they also seem to be unaware of the fabulous uptrends developing in many gold stocks.

In contrast, I’m extremely excited by the price action in a wide array of gold stocks, silver stocks, and blockchain currencies. I have predicted that the upside fun will continue and is poised to accelerate quite dramatically in the second half of this year.

Western governments focus on regime change in Mid-East while China takes another step forwards in what I call the gold bull era.

Morgan Stanley’s stock market indexes are a institutional benchmark, and China’s gold demand growth is strongly correlated with income growth, stock market performance, and overall GDP growth.

In terms of goods and services produced and consumed, China is by far the world’s largest economy. Soon it will become the richest as well, leaving demographically-impaired and debt-obsessed America in its wake.

Gold investors in the West can choose to live in an emotional state of doldrums and boredom, or they can feel great comfort as they watch China put a relentlessly rising floor under the gold price.

I choose to enjoy the mild excitement and great comfort generated by the gold bull era.

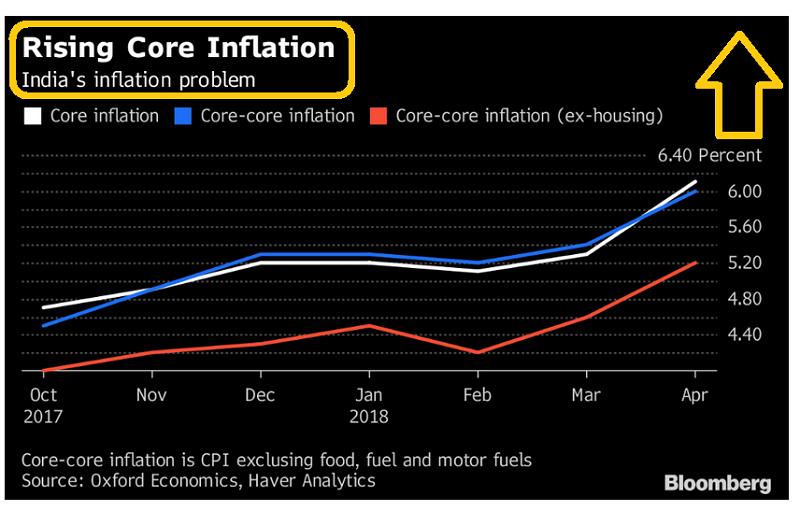

While China expands its gold-oriented influence, India is functioning like a gold-oriented starship attached to a Chinese locomotive train with a gigantic rubber band.

As the strong season for gold in India begins in the summer, inflation has suddenly started a nasty turn to the upside. Indians and Germans are the global citizens most concerned with inflation.

As inflation begins to stun most observers with the power of its surge over the next eighteen months, I expect Indian gold demand to begin a historic leg higher. Germans will join the fun, and institutional money managers around the world will commit to substantial gold stock buy programs as that happens.

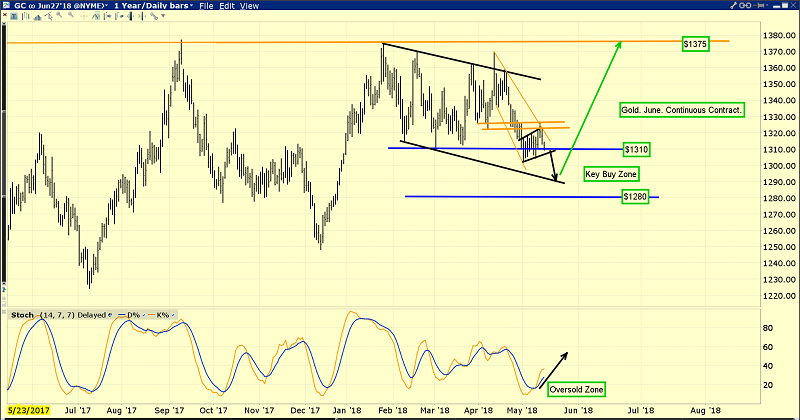

There are only four to six weeks before the strong demand season for gold begins, and does so against the background of more rate hikes, QT, a fading US business cycle, and inflation that could grow like “Jack And The Bean Stalk”.

There’s not much time to get positioned in my key $1310 - $1280 buy zone before the strong season and rising inflation raise the gold price floor above $1400 and keep it there for decades.

Nervous accumulators can mitigate their nervousness with a put options strategy, but even if bullion pulls down to $1280, I expect many miners to keep rallying!

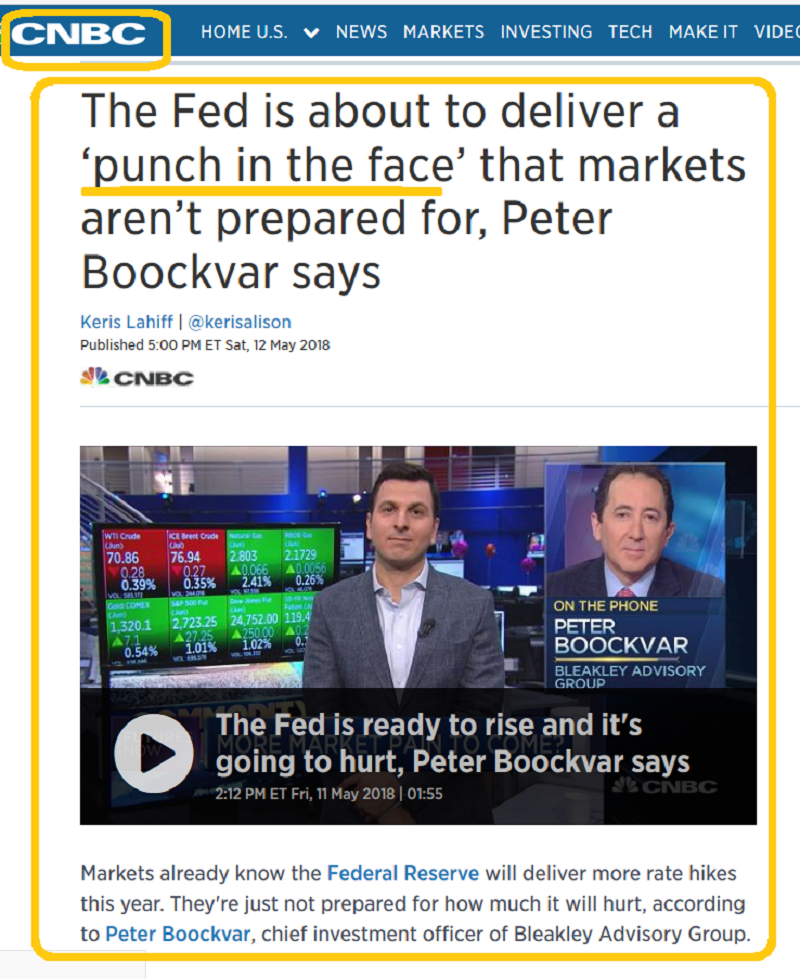

I’m in absolute agreement with Pete Boockvar, and I’ll take his views a step further and suggest that in the current environment QT and rate hikes are going to make inflation grow like Jack and the golden beanstalk!

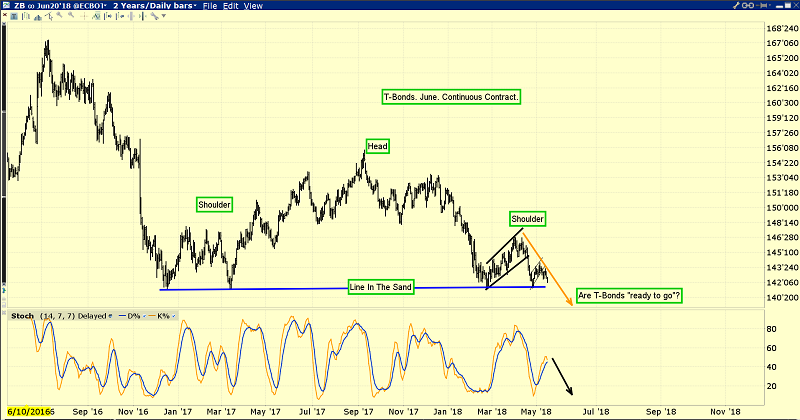

My “line in the sand” head and shoulders top neckline for US T-bonds looks ready to break. There could be some hesitation but I think a June rate hike and accelerated QT from Powell will seal this deal.

That could create an equity market panic and more concern about real estate mortgages. Previous Fed hikes have coincided with the start of significant gold price rallies, and this one could turn into a real barnburner.

PLACE ST6 CHART HERE

London’s biggest metals dealer has announced bitcoin and gold trading. There’s a growing synergy between the blockchain and gold community.

I expect that to intensify quite dramatically as miners like Agnico and Goldcorp get more involved with the technology.

PLACE ST7 CHART HERE

The excitement being generated by the blockchain currency assets is incredible. ZCASH is a key currency and it has surged 40% just in the past twenty-four hours. The Gemini exchange run by the Winklevoss billionaires just received regulatory approval for institutional and retail trading of more great blockchain currencies like ZCASH!

For bitcoin itself, I have an eighteen-month target of $50,000 a coin, and an ultimate target of $500,000.

I’m a miner myself, and I’m installing a lot of solar panels to ensure I have more than enough juice to power my joyous blockchain era upside ride! Investors who want to get richer with blockchain currency action can subscribe to my maverick www.gublockchain.com newsletter.

PLACE ST8 CHART HERE

This important GDX chart. Some individual component stocks of the GDX ETF are going to keep rising in the uptrend and others will pull back a bit before blasting higher.

At this point it’s simply unknown which route GDX follows before global inflation begins to grow faster than what I’ll call Jack and his bull era bean stalk! What is known is that I want all gold community investors to be comfortably invested in key gold stocks so they build maximum wealth as the bean stalk of inflation begins to grow… and grow… and grow!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Explorers On The Move!” report. I highlight ten key gold exploration stocks that are already in uptrends, and poised to stage even more aggressive upside performance. I include key buy and sell tactics for each stock!

*********

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: