Jay Powell & US Stocks: Santa Claus or Claws?

With inflation surging, QE headed to the scrapyard (for now), and imminent rate hikes taking the main markets stage, gold looks solid… and feels solid too.

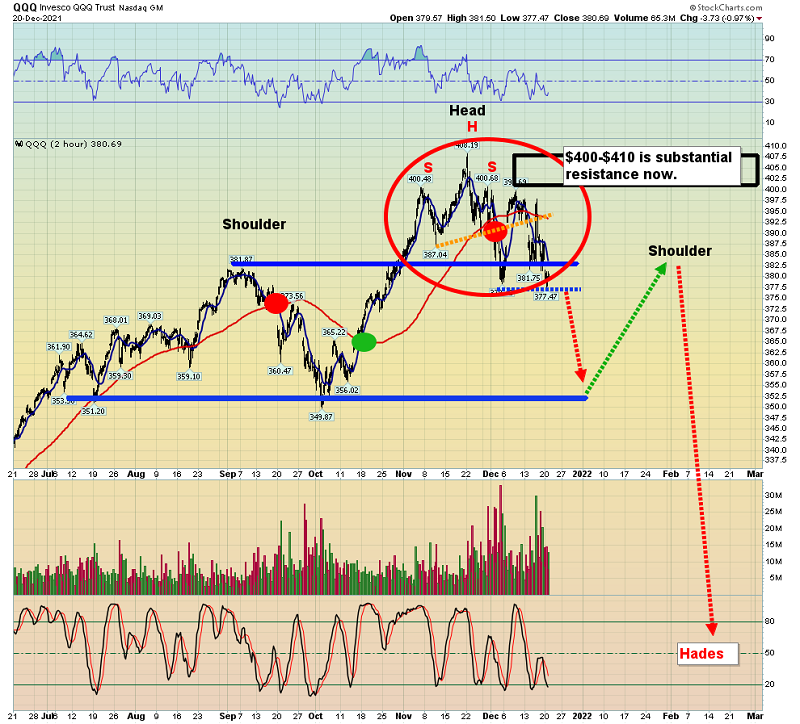

The US stock market chart. The technical action is concerning, and it’s in sync with the meltdown in market fundamentals.

The QQQ ETF needs to rally above $410 to void this ugly H&S top formation. With “Admiral Omicron” making a dramatic entrance onto the stage, that’s going to be a very difficult task.

The monthly chart for the Dow. Thirteen years ago, I was an outrageously aggressive buyer of the Dow at the 2008 lows, and I’ve been an aggressive seller of my long-term holdings into the current highs.

The bottom line: The QE welfare program for US stock market socialists was launched in 2008, and now it’s ending. Deflation reached its “momentum zenith” in 2008, and a long era of inflation is set to dominate the next phase of the American empire.

Fiat worshippers believe the words of their constitution, rather than gold money, can save their empire, but fiat is a form of debt, and an empire of debt, by definition, is doomed to fail.

The stock market investors believe the Fed will reverse course on the next stock market decline, restart QE, and push the market higher.

In contrast, I’ll suggest that the more things change, the more they… change. Official CPI is almost 7%, PPI is near 10%, and unofficial inflation numbers are much higher.

Going forward into 2022, stock market investors are likely to find that Jay Powell is nowhere near as accommodating during stock market declines as he has been in the past.

Here’s a recent picture of Jay. Investors need to consider the possibility that Jay will now act more as a stock market wrecking ball than a soup kitchen, and they need to consider that possibility immediately.

The mainstream market pundits seem to be suffering from a serious loss of sanity. They promised Omicron would create a huge “Santa Claus” rally in the stock market. What I see so far looks more like Santa Claws, and he’s pushing a sleigh full of lazy investors towards a very big cliff. This can’t end very well.

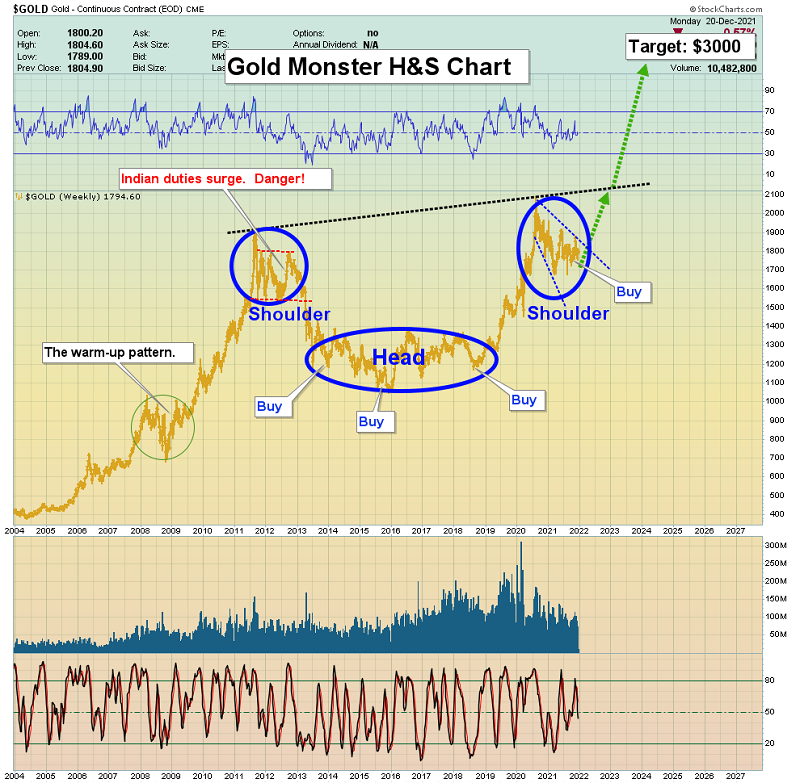

The inverse H&S bull continuation pattern on this long-term gold chart is arguably the most aesthetic chart pattern in the history of markets.

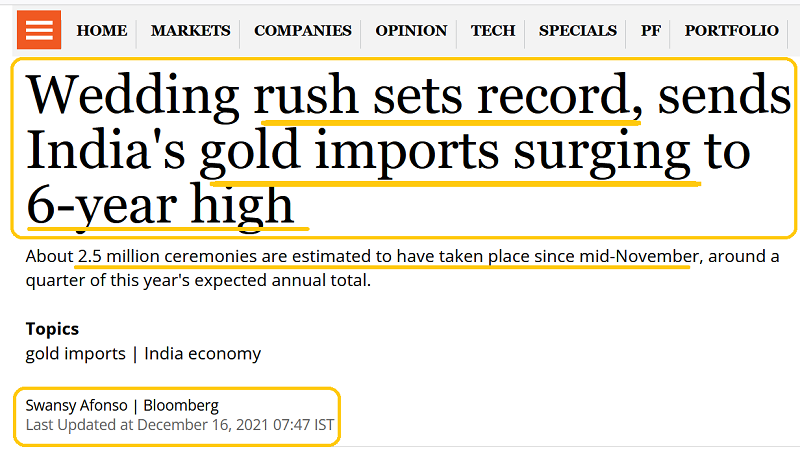

While the Western fear trade gets most of the press, most of what happens in gold price discovery is related to commercial LBMA and COMEX traders responding to Asian physical market demand.

Clearly, what is happening in the Asian physical market right now, especially India, is incredibly positive.

For the “big fear trade parabola” in the metals market that is every gold bug’s biggest dream, a situation needs to arise where the Fed is raising rates, and its rate hikes fail to tame inflation.

Money managers will pour out of the stock market and into the miners when this happens. Those hikes have yet to happen… so investor patience is required.

The shipping ETF chart.

Inflation enthusiasts have done well following my lead with this investment, and I think another significant opportunity may be at hand!

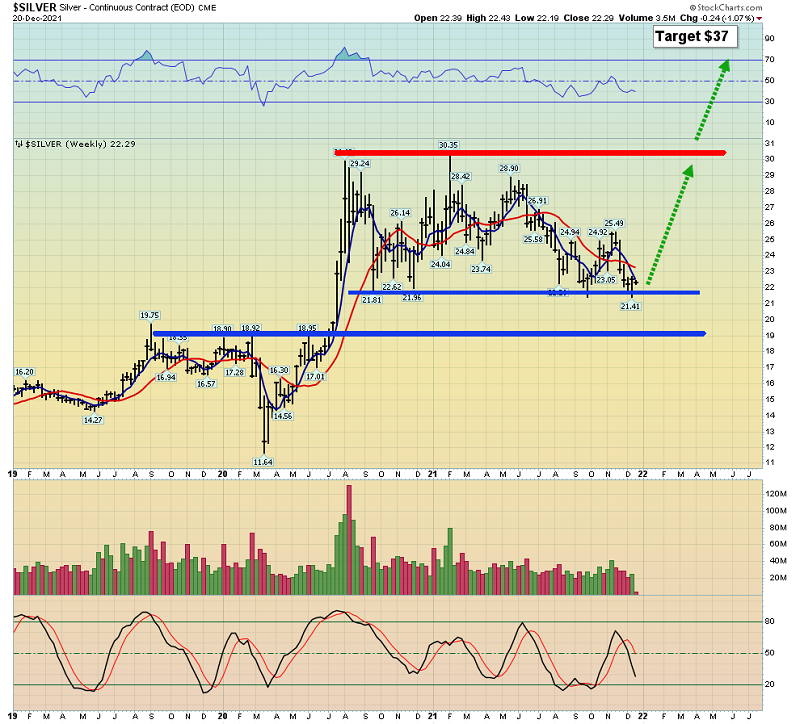

The weekly silver chart. While a dip to the $19 area is possible, silver should perform well (perhaps better than gold) against fiat as it becomes clear that the waves of inflation are getting bigger…

And harder to tame.

Gold stock enthusiasts who want leveraged trade action can check out my swing trade newsletter, where I trade TQQQ, SQQQ, NUGT, DUST, JNUG, and JDST.

JNUG looks particularly enticing right here.

The GOAU daily chart. The $20 sell-zone has come and gone.

The time is now, for investors to consider posturing themselves for a long-term era of inflation. GOAU and its component stocks should do very well. Stoploss enthusiasts can use the $15.75 price area to exit if the rally goes awry, but what looks more likely is that these miners… are set to fly!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stock Mistletoe!” report. I highlight ten key gold and silver miners that have “kissed” key support and are set for a big bounce higher! Investor tactics are included for each of these stocks.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: