Julius Stock Market Caesar & Gold

Will today’s key CPI report be a catalyst for gold $2200+, or will the world’s greatest metal and money finally take a bit of a breather?

The last CPI report was negative for gold, but the PPI and PCE were very positive.

It could play out the same way this time and the next PPI report is on Thursday!

The current gold price area is a light sell area for investors who bought mining stocks below $2000… but it’s not a “top call” zone.

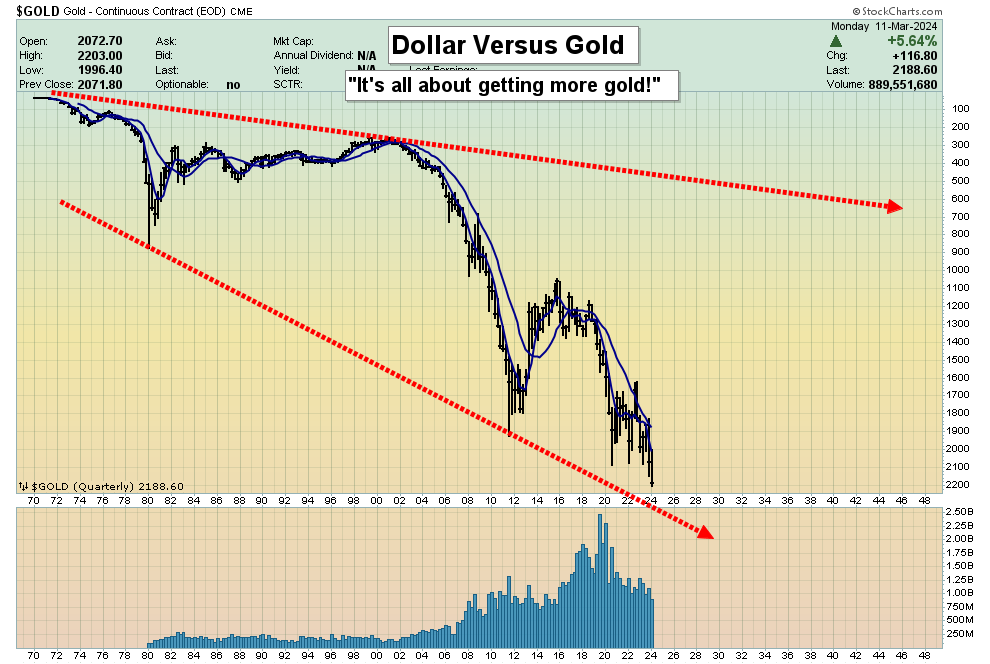

For the past 50+years, top calling gold to get more fiat (government funny money) has been a futile scheme. In China and India, it’s been futile for thousands of years.

If America lasts for another thousand years as a nation, and it might, US citizens will adopt the Chindian mindset (the mindset of champions), and focus on getting more gold instead of more silly government fiat.

It’s fiat that needs to be regularly top called, not gold, and I’ll dare to suggest investors should be prepared to make a lot more US fiat top calls in the decade ahead!

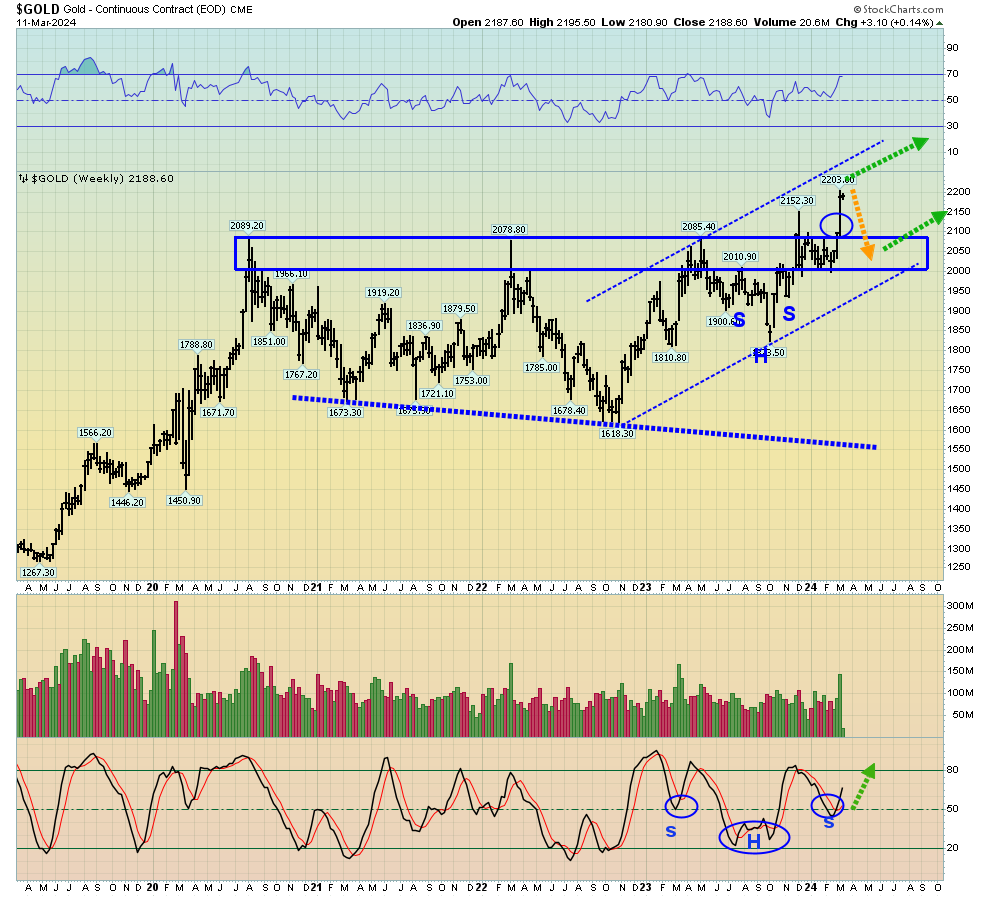

Here is the key weekly gold chart. Note the incredibly bullish posture of the Stochastics oscillator.

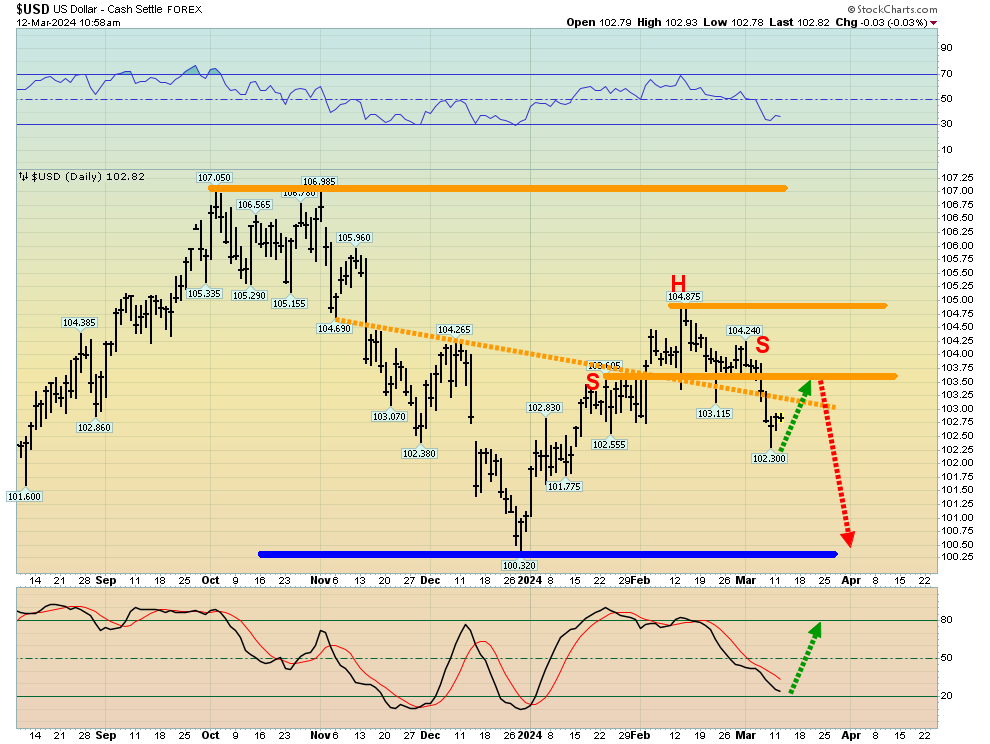

The dollar has only a bit of room to rally on the CPI report before it runs into H&S top resistance.

Double-click to enlarge this key US rates chart. There’s also minimal “wiggle room” for an interest rate rally right now.

For a look at the long-term US rates picture:

The current US inflation/stagflation era began at the March 2020 Corona crisis lows and the first significant pullback in rates is now in play.

Rates could drop to as low as 2% before the pullback ends. It likely plays out as a bull flag or high right shoulder of an inverse H&S bottom pattern.

Gold is likely to fare well during this period… and it could fare even better when rates begin rising again! That’s because the next rise could feature US money managers buying gold in a panic…

On the belief that inflation is resuming with a vengeance that will take down traditional assets like stocks, bonds, and real estate.

A daily focus on the big picture is critical for investors as stagflation, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week along with the key technical action in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

The Ides of March?

Double-click to enlarge. Julias Caesar was assassinated on March 15. Is the US stock market, aka Julius Stock Market Caesar, about to be financially assassinated by massive smart money selling and shorting?

It’s a plausible scenario, especially given the outrageous overvaluation of the market.

Both the Nasdaq and the Dow show a concerning divergence of the RSI oscillator with the price. The Dow has ominous H&S action as well and the next Fed rate decision is scheduled for March 20.

What about “Super Trumpy Man”, Donald Trump, can he stop America’s march into a stagflationary abyss? The good news is that he’s not a “debtaholic” or war worshipper like the current president obviously is, and he’s likely to (very temporarily) pause the ludicrous growth of US government debt.

More good news for gold bugs is that Trump likes inflationary tariff taxes. He also likes bitcoin… the same bitcoin that I’ve urged many gold bugs to use (starting when it was sub $1000/coin) to get more gold.

The bottom Trump line: If he likes bitcoin, he’s going to love gold! The rise of gold-oriented China and India will force him to take a hard look at the ultimate currency, and that of course is gold.

What about the miners? Well, to view the GDX daily chart:

There’s no question that miners are now overbought… in the short term. The COT report shows the smart money commercial traders adding significant short positions, so a pullback is expected and logical.

Tactics? I sold NUGT and other gambling positions, but I’m not selling GDX or unleveraged senior miners… and I’ve suggested investors may want to take the same approach to handling the daily chart situation, COT, the CPI, the PPI, Ides of March Friday, and FOMC day.

This is the GDX weekly chart. Note the stunningly bullish setup of the (14,5,5 series) Stochastics oscillator at the bottom of the chart. This is clearly a market to buy eagerly on dips!

To view what may be the most enticing chart in the world:

The weekly BPGDM sentiment index is still “sub 30”, and the Stochastics oscillator is breathtakingly bullish. The bottom line: Gold investors are about to get a blast of US financial reports, and when the smoke clears on March 21, phase two of the mightiest gold stocks rally in years should begin with another gold stocks short-covering blast, and continue into at least the month of July!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: