Klondex Continues to Find Opportunity

Strengths

- The best performing precious metal for the week was gold, up 0.25 percent. In the weekly survey of gold traders, Bloomberg reports the majority are bullish, for the first time in three weeks. The gold price has recovered from a one-month low.

- Bloomberg reports rising gold imports in many of the key markets. Swiss gold exports rose 39 percent month-over-month in May, with an increase of 40 percent to India and 70 percent more going to Hong Kong. The exports are the most since December 2016.

- Fed fund futures data show that traders are anticipating a 43 percent chance of a rate hike by December. The lower expectations for a rate hike reflect the dampening of the equity bull market, reflected by more assets going into gold. In addition, oil’s price decline to below $45 per barrel has correlated with gold demand. European equities have also dropped, spurring more haven demand for gold.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.13 percent, perhaps as weaker economic data indicates some loss of momentum. More notable perhaps is the gold-to-silver ratio, which is at the highest level in over a year. Gold hasn’t changed much in the second quarter, while the silver price has dropped 9 percent. Bloomberg reports that some traders look to this ratio as a sign to sell gold and buy silver, since the ratio of 75 is above the 10-year average of 62.5.

- Shareholders of the gold mining company formerly known as Peter Hambro Mining Plc (now Petropavlovsk Plc) have voted out the chairman and founder Peter Hambro, due to complaints of poor performance. Hambro, age 72, says he will still be in the mining business.

- An article posted by Seeking Alpha notes that IAMGold is overstating the economics of their Cote Gold project. The acquisition cost of the project was $508 million. However, none of the company’s published net present value (NPV) or internal rate of return (IRR) statements have taken into account this sunk cost. The author claims that the actual NPV and IRR are merely a fraction of what IAMGold is stating.

Opportunities

- The Hong Kong exchange is introducing gold futures, to be denominated in renminbi and the U.S. dollar, on July 10. The futures will be the first commodity futures that can be physically delivered in Hong Kong, differentiating them from other commodity futures. The Hong Kong exchange will waive the trading and settlement fees and exempt commission levies for the first six months of trading to promote the launch of the new products.

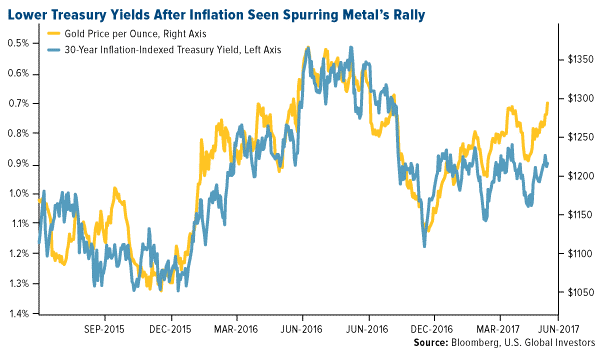

- Bloomberg reports that falling bond yields are fueling gold’s climb. Neil Dutta, head of U.S. economics at Renaissance Macro Research LLC, states, “The opportunity cost of holding a non-interest-bearing asset is lower.” Even with all the talk of interest rate hikes starting in December 2015, the price of gold has climbed 18 percent. And Georgette Boele, a currency strategist at ABM Amro Bank NV in Amsterdam, says that gold will edge higher toward $1,300 later in the year.

- Klondex is still finding silver linings in events of the recent months. The company reported just less than 300,000 ounces at 16.8 grams per tonne of initial gold resource at the Gloria zone of the Hollister mine. But investors are have higher interest in the Hatter Graben vein system, where drilling has just been initiated. Klondex’s stock price had been knocked down earlier this year after it was required to switch from IFRS accounting to U.S. GAAP, making the last quarter look like an earnings miss. And then later it was impacted again as a result of the dramatic rebalance of the GDXJ. Now the stock has rallied 23 percent over the last three weeks with the index rebalancing out of the way. Klondex still trades at roughly a 50 percent discount on 2018 P/CF at 4.0x vs. peers at 7.7x. Management has an excellent track record and is one of a small handful of gold stocks that have delivered a positive return on invested capital since going into to production.

Threats

- Central banks are watching oil’s decline. Bloomberg reports that weak crude oil and other commodity prices mean that inflation will continue to be weak. In this environment, the central banks will be less likely to raise rates; however, inflation is typically identified as a driver for gold prices.

- The situation in Tanzania is escalating, after President John Magufuli’s attempts to reform the mining industry, and accusations of tax evasion by Acacia Mining. More than 500 people, residents of the villages surrounding Acacia’s North Mara gold mine, invaded the mine and attempted to steal gold ore. Security forces arrested 66.

- Arvind Sanger, managing partner at Geosphere Capital, said that equities will continue to be favored in India over traditional stores of value like gold and real estate.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of