Metals’ Mania Mayhem!

“Got volatility??” Oh baby. “Maxed-out metals??” Oh maybe. “5546 still forecast??” Ah oui-oui, (a little local lingo there).

But hardly shall Gold get to 5546 in a straight line. For given today’s milieu of this metals’ mania mayhem, prices — both by valuation and technicals — look as having achieved a max … ’til ’tis onward to the next higher climax.

“So you’re saying now down, but then later back up to more highs, right mmb?”

Squire, ‘twould appear to be the case. In any market mania, be it over those silly “meme” stocks (or even over Gold and Silver as you’ll recall from “Gold Morphs into a Meme Stock” when penned away back on 26 April of last year), mayhem axiomatically reverts to valuation, in turn toward unwinding the excess of technicals.

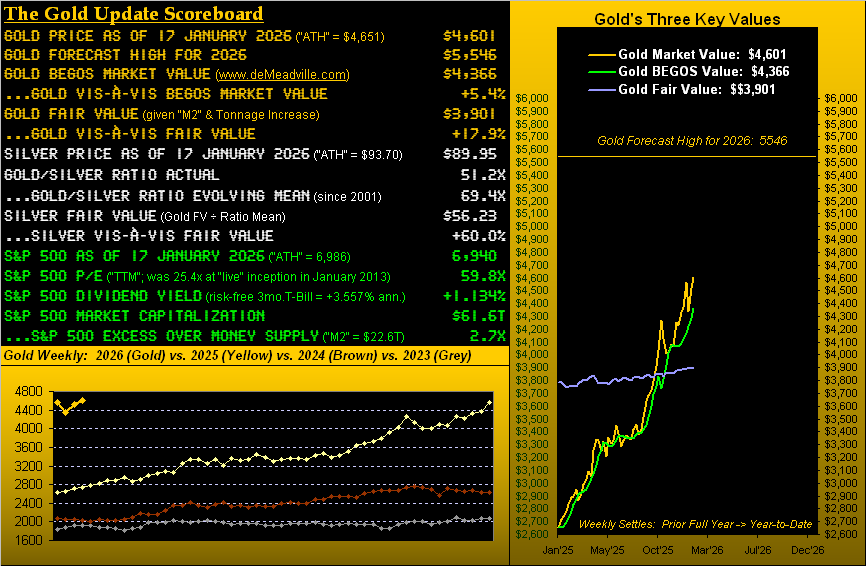

First let’s look at valuation. In drawing from the above Scoreboard, Gold’s settling yesterday (Friday) at 4601 is an All-Time Weekly Closing High; (the record intraday high came this past Wednesday at 4651). And as shown, 4601 is +5.4% above our BEGOS Market Value for Gold (4366 per price’s movement relative to those of the primary BEGOS components Bond / Euro / Gold / Oil / S&P 500). Further, ’tis +17.9% above Fair Value (price regressed to the U.S. Dollar across the past 46 years, throughout adjusted for the increase in Gold tonnage). And how about Sister Silver: now 89.95, she is a full +60.0% above her Fair Value (56.23). So yes, Virginia, as magnificent and enjoyable as has been the metals’ moves, priced to the present, they are ahead of themselves, (again, in no way precluding higher levels still, as the year and our 5546 forecast for Gold unfold).

Second let’s look at technicals. Those of you focused on this latest metals’ mania have now likely also sensed the escalating mayhem therein. The selling is becoming more frequent. The standard trading week for the metals’ futures contains 20 six-hour periods. For the week prior (ending 09 January), 13 six-hour periods were up and thus 7 were down. But for this past week — even as Gold recorded a net +1.8% gain — 10 six-hour periods were up and 10 were down. And intraday Friday, the price of Gold capitulated -75 points from 4622 to 4547 in a mere 17-minutes (15:18 GMT through 15:34 GMT). Blame it on the geo-polly follies? “Iran is ON! … no wait … Iran is OFF! … but hang on … yes, it’s Greenland!” Or to quote the late-beloved actor Jean-Paul Belmondo from Casino Royale –[Columbia, ’67]: “Zee French have arrived!”

Arriving next we’ve this three-panel chart of such six-hour technicals for each of Gold, Silver and Copper. The time frame is from the start of December-to-date. This most recent week is from the x-axis label “01/12” (January 12th). In all three cases:

- Price peaked and has since weakened;

- The blue parabolic dots have moved from below price to above it (a sell signal);

- And the MACD (“moving average convergence divergence”) has negatively crossed:

‘Course, technical analysis can struggle to pan out in the midst of mania. But hardly for all three metals would some further price pullbacks be untoward Either way, you regular readers well-know a pet caveat of ours that “Shorting Gold is a bad idea”. To be sure, the media are running rife with geo-political strife. But at the end of the day, as we’ve herein documented in recent years, geo-political price spikes in Gold are generally short-(no pun intended)-lived. For as ever, the broad valuation of Gold is by Dollar debasement, mitigated to an extent by an ever-increasing supply of the yellow metal. Gold’s otherwise wild price gesticulations eventually return from whence they came. (Or for you WestPalmBeachers down there, a word to the wise is sufficient).

“That’s an oxymoron for that bunch, mmb…”

Now let’s be nice, dear Squire. ‘Tis critical that we respect those who “take the other side of the trade”.

And as we go to Gold’s weekly bars from a year ago-to-date, the trend of the trade has basically been “Nuthin’ but UP!” But should the tide now ebb for a bit, ’tis good to know where the current blue-dotted parabolic trend would flip, which as noted for the ensuing week is 4154: ’tis -447 points below the present 4601 level. Gold’s expected weekly trading range? 189 points. Therefore in that vacuum, one can speculate a down week for Gold shan’t flip said trend. Or perhaps we’re higher still by next week’s end:

Nevertheless, we’ve mentioned “negativity” … near-term anyway … for the metals both by valuation and technicals. Now let’s turn to a possibly negative fundamental notion for Gold. We’re but a week-and-a-half away from the first Policy Statement of the year from the Federal Open Market Committee. And despite an apparent slowing in inflation — “Fed-favoured” Personal Consumption Expenditures data due next week — and still tepid job creation, venerable Reuters nonetheless reports via the CME FedWatch tool that “Traders are betting on a 97.2 per cent chance for the Fed to keep rates unchanged at its Jan. 27 to 28 meeting”. And given the recent strength that’s been pouring into our Economic Barometer, we concur. Have a look, (even as 27 StateSide government “shutdown” metrics remain missing):

Year-to-date, 37 data items (including some in “shutdown” arrears) have come into the Baro, of which only 12 were worse period-over-period. Hence the rise by this economic guise. Recall the ’90s gridlock-is-good “Goldilocks Economy” of President Clinton(D) astride that Congress(R)? Today’s politics aside, are we witnessing the return of Ms. Locks? Again, inflation has been reported as slowing, but jobs numbers need to come up a bit. Still, so far in 2026, the Econ Baro’s standout improved reports (much from Q4 2025 data) chronologically include Productivity, the Trade Deficit, the Unemployment Rate, Building Permits, the Current Account, Existing Home Sales, Initial Jobless Claims, both the Philly Fed and N.Y. Empire State Indices, and Capacity Utilization. Too, from the “Whew! Dept.”, the potential end-of-January “shutdown” shan’t come to pass … just in case you’re scoring at home.

Regardless, a less-benevolent Fed can retard Gold from getting further ahead.

However, herein we move instead to our two-panel display of daily bars from three months ago-to-date for Gold on the left and for Silver on the right. As noted in our prior two missives, the yellow metal’s baby blue dots of regression trend consistency already had been breaking down, even as price duly recovered to the latest 4651 record high. But the “Baby Blues” for the white metal have been holding firm. Still, should price decays further ensue, ’twill hit both sets of Blues, too:

As well in a two-panel shell are the 10-day Market Profiles for Gold (at left) and for Silver (at right). Because for both metals the respective trading ranges have been so vast these past two weeks, we’ve limited the number of labeled volume-dominant prices. And for the present, Gold and Silver are deeply mired in high-volume zones:

With all that in your metals’ pack, here’s the stack:

The Gold Stack (continuous contract pricing):

Gold’s All-Time Intra-Day High: 4651 (14 January 2026)

2026’s High: 4651 (14 January 2026)

10-Session directional range: up to 4651 (from 4356) = +295 points or +6.8%

Gold’s All-Time Closing High: 4634 (14 January 2026)

Trading Resistance: 4603 / 4621 / 4643

Gold Currently: 4601, (expected daily trading range [“EDTR”]: 86 points)

10-Session “volume-weighted” average price magnet: 4548

Trading Support: 4496 / 4471 / 4459

2026’s Low: 4319 (02 January)

The Weekly Parabolic Price to flip Short: 4154

Gold’s Fair Value per Dollar Debasement, (from our opening “Scoreboard”): 3901

The 300-Day Moving Average: 3401 and rising

The 2000’s Triple-Top: 2089 (07 Aug ’20); 2079 (08 Mar’22); 2085 (04 May ’23)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

On Maneuvers: 1750-1579

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr ’18 preceded by 1362 in Sep ’17

Neverland: The Whiny 1290s

The Box: 1280-1240

To wrap, in the midst of this metals’ mania mayhem, we ought not be put off by some degree of price retrenchment, especially with 5546 for our forecast high as the year goes by.

“And here’s a surprise, mmb! Copper’s sister Coppélia just sent us this!”

Now Squire, do behave out there. And indeed, folks, stay with your Gold and Silver!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********