Metals’ Reversals, Lower Prices And Our Precious Profits

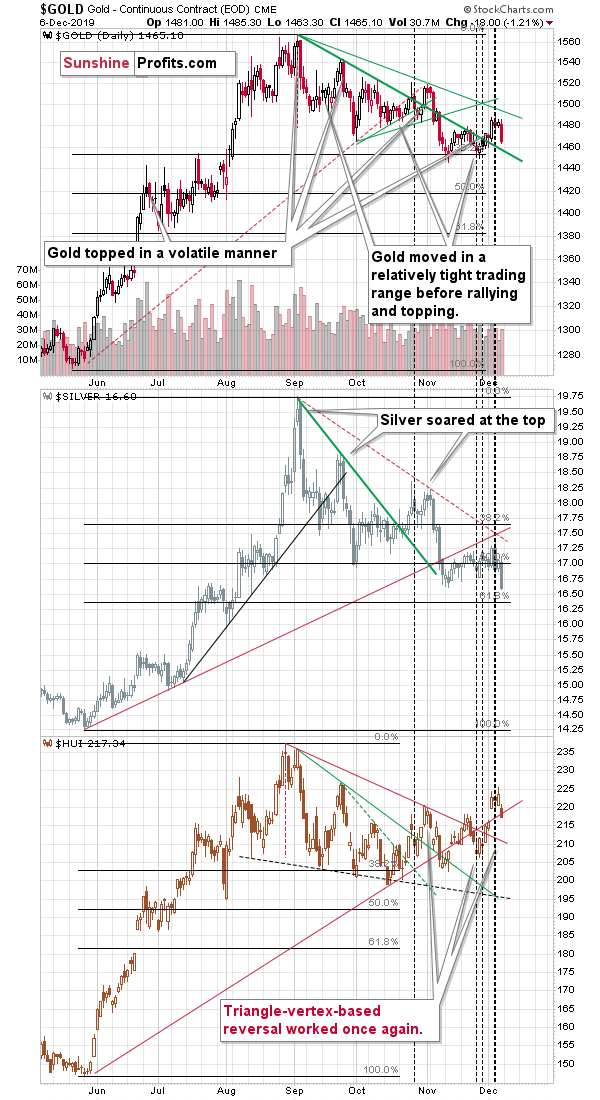

Gold, silver, and mining stocks reversed practically exactly at their double triangle reversal point and the short positions that we opened along with taking profits off the table from the previous long positions, became profitable almost instantly. There’s quite a decline to catch here, and it seems that only a small part thereof had already taken place.

PMs Reversing

The above chart clearly shows how important the triangle reversals were recently. The two first reversals were local bottoms before the final part of the upswing, and the third one – confirmed by two separate reversals from silver and miners – marked the rally’s final top. This is likely the case with gold, crystal clear with silver, and it might not seem to be the case yet in case of the miners.

In fact, at first sight it may appear that the outlook for gold, silver, and mining stocks is bullish, because the decline in mining stocks is not very big and thus miners are actually showing strength. This is not necessarily the case.

It’s not one of the most popular gold trading techniques, but the mining stocks can have this tendency to show a kind of stillness (stiffness if you will) after the top, but they get back to their normal behavior shortly. Please note what happened on September 5th – on the first day of the September decline. Gold and silver took a big dive, but miners declined visibly less. Did it change anything? No. That was still a major top, and when silver’s initial slide turned then into a pause, miners caught up with the pace at which the metals had declined previously. Similar action is likely to follow also this time.

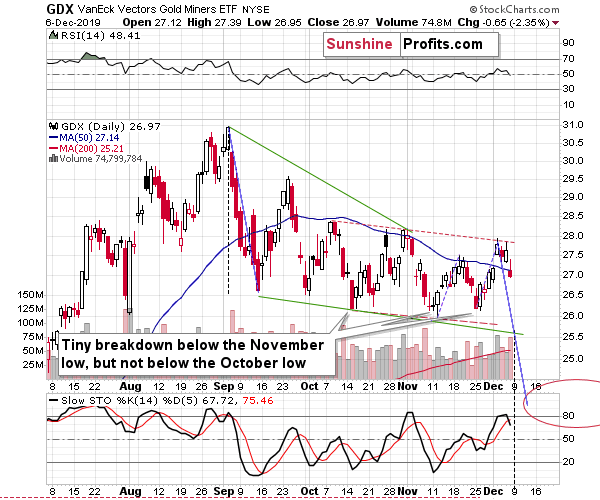

The GDX ETF declined back below the 50-day moving average and we saw a sell signal from the Stochastic indicator shortly after it reached above 80. That’s what confirmed both the early-November and the early-September tops. Moreover, please note that GDX’s Friday’s decline took place on big volume, which further validates the theory that the top for the recent decline is already in.

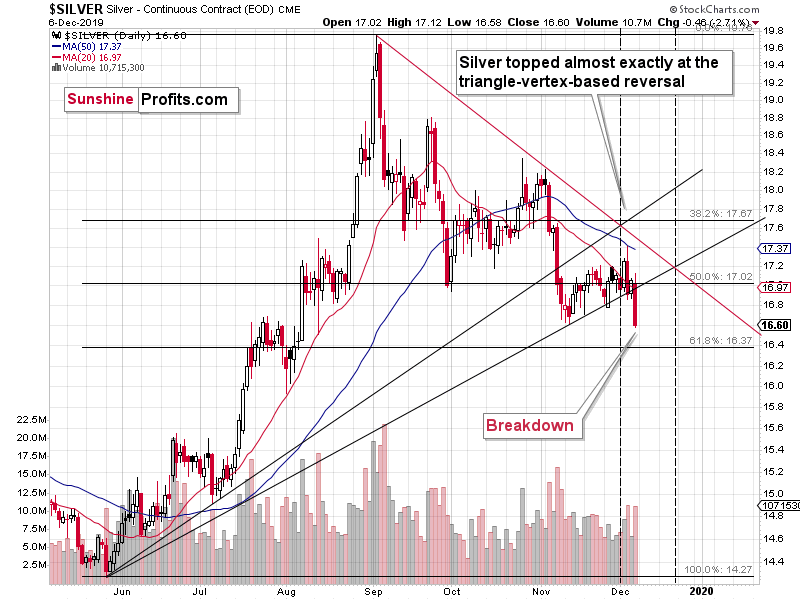

Moving to silver, please note that it ended the previous week at a price level that we haven’t seen since August.

Silver Also Hints at the Upcoming Decline

The breakdown below the November lows is confirmed by the weekly close and significant volume, but not yet by three consecutive daily closes. Still, given the fact that silver reversed almost exactly at its triangle-based reversal and after touching its 50-day moving average make the confirmation of breakdown very likely.

The nearest support levels are the intraday mid-August low, and the 61.8% Fibonacci retracement based on May – September rally. However, the decline to these levels would be relatively small. Too small. The two short-term declines that we saw in September and in November are at least twice as big as what we saw recently, and this means that if this rally is only to be “normal”, the move lower should be much bigger.

This means that silver is likely to decline further – likely below $16.

There’s a good reason to believe that this decline will be more than just twice of what it’s been so far.

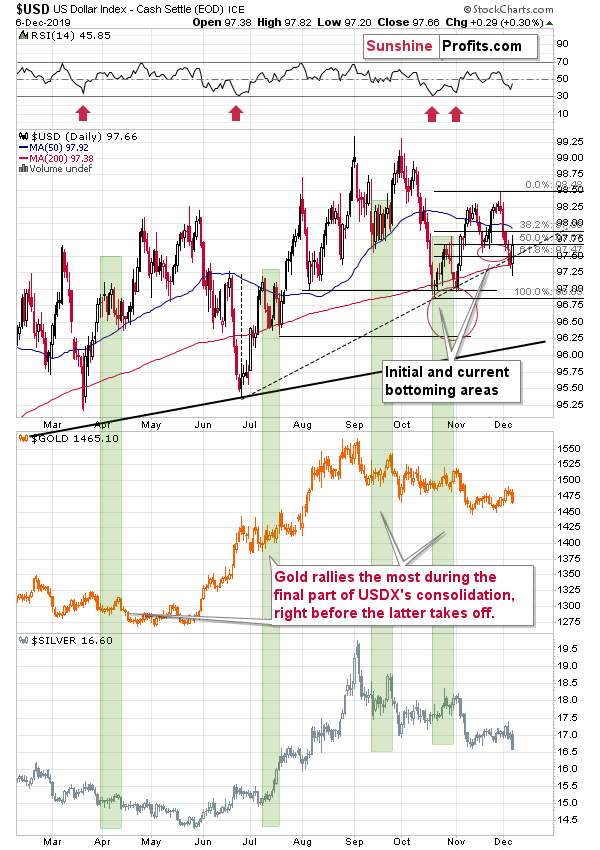

The USD Index Throws Its Weight Behind the Coming Decline Too

Gold and silver plunged in early November in response to soaring USD Index. Since that time, the USDX declined and moved relatively close to its early-November low. Neither gold, nor silver moved close to their early-November highs. All they did was to correct part of their November decline. It took just one daily upswing in the USD Index from the short-term lows to make silver break below its own November low.

The link between precious metals and the USDX strongly favors the continuation of metals’ weakness. If it wasn’t for the late-November and early-December decline in the USDX, both gold and silver would have probably already been trading at much lower price levels. USD’s pullback triggered a pause in the decline, which at the same time prepared the PMs for the next big downswing.

Gold and – especially – silver are already magnifying the bearish signs from the USDX, and it seems that they will get much more of them in the following day(s).

The USDX bottomed slightly below our target area (just one daily close below it) and it invalidated the breakdown below its rising support. Invalidations of breakdowns are strong bullish signs. We previously wrote that the invalidation of breakout that we saw in late-November was a bearish sign for the short term and indeed, a quick slide followed. We now saw something quite the opposite. The difference is that this time, the support that was not broken, is stronger. This means that this bullish invalidation is also more important than the previous bearish invalidation.

With soaring USD Index and the gold-silver-USD link in place that magnifies USD’s signals, the short-term outlook for the precious metals market looks very bearish. And it’s not too late to take advantage of it

Our profitable long precious metals position has been closed last week, and we’ve entered another trade immediately. This time, on the short side of the market, and it’s going profitable again. The full version of this analysis features the full details and targets of the already-profitable short, adjusted for current gold seasonality and long-term turning points with the supports ahead. Join us and profit along!

The above article is a small sample of what our subscribers enjoy on a daily basis. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,