Midas Touch Analysis Of Precious Metals

Gold is breaking out of its triangle formation -- and a first target at $1,237 is activated. The whole precious metals sector presents itself pretty bullish.

It´s still too early to call the end of the bear market but the picture continues to improve. Now Silver and Mining Stocks leading the sector higher which is exactly what you want to see in a new uptrend.

Buy the dips!!

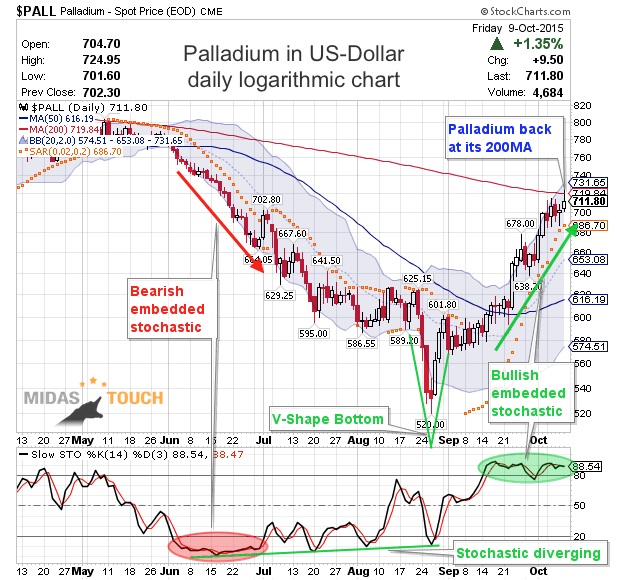

Palladium is leading the commodity sector higher. After a dramatic sellout end of august the metal has posted an impressive V-shaped recovery which is easy to spot on the chart.

I want to direct your attention to the powerful Slow Stochastic Oscillator. This indicator measures the momentum of a move and usually signals a trend change pretty early. Note that momentum always changes direction before price. But currently Palladium has an embedded stochastic! With both signal lines above 80 the uptrend is locked in. Short-term traders can use this rare situation to ride the current trend and use any drop through 80 as an exit signal. Obviously the 200MA is strong resistance. It will be interesting to observe whether the embedded Stochastic can carry Palladium higher or whether its time for a breather here (more likely). A drop below 80 will signal a consolidation or (worst case) a correction back to the 50MA (US$616.19).

Midas Touch Gold Model Summary

Despite the price drop 10 days ago my model remained bullish. Compared to last week we have the following changes:

New buy signals coming from the Gold USD-Daily Chart, the SPDR Gold Trust, Gold in Chinese Yuan and GDX Goldminers.

A new sell signal will appear for Gold Seasonality in mid of October. Also the Ratio Gold/Commodities has turned negative which means Gold currently is not driven by safe haven buying. Instead negative US Real Interest Rates will continue to be the main driver for Gold at the moment.

Overall the model is in Strong Buy/Bull mode.

Long-term personal believes

The return of the precious metals secular bull market is moving step by step closer and should lead to the final parabolic phase. A new bull market will probably begin in autumn 2015 and could last for 3-8 years or even longer.

Right now it´s not 100% clear whether the bear market is indeed over or whether we are just witnessing another multi month recovery. But it looks more and more evident that the bottom is in.

Long-term price target DowJones/Gold-Ratio remains around 1:1.

Long-term price target Gold/Silver-Ratio remains around 10:1 (for every ounce of gold there are 9 ounces of silver mined, historically the ratio was at 15:1 during the Roman Empire).

Long-term price target for Gold remains at US$5,000 to US$8,900 per ounce within the next 5-10 years.

Fundamentally, as soon as the current bear market is over Gold should start the final 3rd phase of this long-term secular bull market. 1st stage saw the miners closing their hedge books, the 2nd stage continuously presented us news about institutions and central banks buying or repatriating gold. The coming 3rd and finally parabolic stage will end in the distribution to small inexperienced new traders & investors who will be subject to blind greed and frenzied panic.

********

If you like to get regular updates on this model and gold you can subscribe to my free newsletter here: http://bit.ly/1EUdt2K

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: