The Modern Gold Bug Mariner

“Water, water everywhere and not a drop to drink.” – A famous line from Sam Coleridge’s “Rime of the Ancient Mariner”.

“Inflation, inflation everywhere and no higher gold or silver prices to drink!” – Rime of the Modern Gold Bug Mariner, July 12, 2022?

The long-term USDX chart. Sometimes the dollar rises as money pours into the US stock market from investors around the world.

That’s not the case now; money is pouring out of the stock market and into the dollar, as the Fed hikes rates to contain the inflation that has finally seeped out of the stock, bond, and real estate markets… and into the mainstream economy of America.

One of World War Two vet and Dow Theory master Richard Russell’s main mantras was, “Own lots of gold… and lots of cash!”

It’s a mantra I first learned while reading my father’s Harry Schultz newsletter in bed with a flashlight when I was eight years old, and it’s stuck with me like crazy glue. The bottom line is this:

All government money eventually fails completely against gold, and as it does, governments (and banks) become more reckless, but also more ruthless. In the medium term, that ruthlessness can temporarily push up the value of fiat against almost everything. Fiat is also needed to buy necessities; even though gold is money, governments don’t price goods in grams of gold.

The key US rates chart. The 3% zone for the ten-year bond is significant resistance, but more hikes from the Fed will eventually overwhelm the resistance.

The TBF bear bonds ETF chart. An uptrend line has broken, but the break likely ushers in nothing more than a simple consolidation… one that could end with a big July 27 rate hike from Jay.

I’m always adamant that gold bugs need to short bonds soon after the start of an inflation cycle because that’s when the central banks begin hiking. From the $2000 area high, gold has fallen about 15% while the TBF fund is up about 30%. I expect TBF to rise hundreds of percent before the end of the inflation cycle.

Amateur investors are trying to fight the Fed because they believe Jay et al will “blink” since US government debt is so enormous. They correctly believe that if the Fed were to hike to above the inflation rate like Volker did in the 1970s, the dollar, the bond market, real estate, and the stock market would all completely incinerate, and civil war would likely be an almost instantaneous event in America… the most citizen-armed nation in the world.

The Fed will probably blink, but not until 2023, and it won’t be much of a blink. If investors blink, they may miss it!

The long-term rate chart. The current war and Corona handouts-oriented inflation is not related to the vastly more ominous commodity super cycle inflation. That will begin in another two or three years.

Commodity super cycle inflation will likely drive US rates (and gold, silver, and miners) much higher… not just for a year or two, but for the next 20 to 30 years.

This commodity super cycle inflation is related to the growth of China and India (and Africa), as well as the long-term transition from oil/gas to clean energy.

The weekly gold chart. My 14,5,5 Stochastics oscillator is oversold, but flatling, and RSI is not quite fully oversold.

There’s some support at $1720, and more at $1675. The bottom line: Both gold and the dollar are behaving “about as expected”, given where inflation and Fed are in this cycle.

My flagship GU newsletter gives investors the big picture for the major markets of gold, commodities, bonds, and the stock market, and holding lots of gold and cash is a major mantra of the letter. At $199/year, the value is outstanding, and I am extending a special “Cash is trash, but I’m a happy trash collector!” offer this week of just $179/15mths. Click this link or send me an Email to get the special pricing. Thanks!

The commercial traders have been buying long positions on the COMEX into this substantial price sale. That’s not a sign of an “instant turnaround” or “parabolic rally”, but it’s positive action.

The daily chart for gold. Both RSI and Stochastics are oversold. As noted, I’m expecting some kind of “all the bad news is in” or “less inflation than expected” mainstream media take on tomorrow’s CPI report.

I’m positioned for profit with ETF’s like XME, GDX, SIL, etc. It’s time to buy key individual miners as well. Gold stock bugs who followed my recommendation to buy “fire insurance” GDX put options are emotionally stable in what is becoming an ever-more unstable world.

The cost of the insurance is minimal, and it’s never too late to buy some. I consider put option insurance essential for investors who have minimal cash and gold bullion, but heavy exposure to the miners.

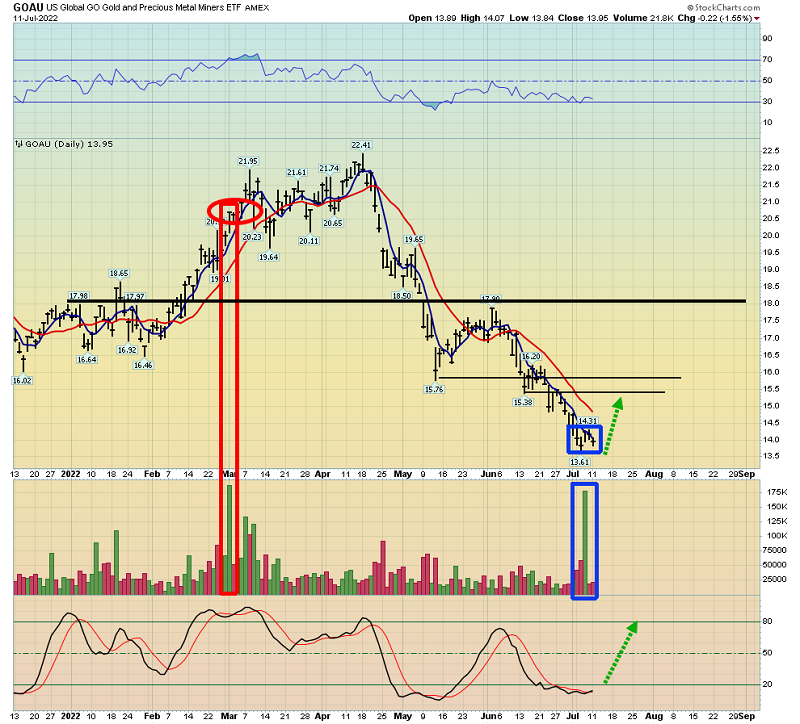

The GOAU ETF. There is “volume symmetry” in play. It looks like the pros who sold into the highs are on back on the buy.

The XME chart. I bought at $40, and I invited base and precious metal bugs to do so too!

A big blast of volume and a Goldilocks inflation report tomorrow likely mark a medium-term low for the miners. The modern gold bug mariner has lots of cash, lots of gold, put option fire insurance, and doesn’t leave home without it!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “CPI Golden Rockets Launch!” report. I highlight key junior, intermediate, and senior miners that should start to fly in July as the inflation report is released. Key investor tactics are included in the report!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: