The Modi Man & Gold Tonnage

Many gold analysts believe that Janet Yellen is bullish for gold. Others note that gold sold off as she was confirmed as the next head of the US central bank. That’s bearish.

To add to the confusion, the recent US jobs report was deemed bearish for gold, but then Ben Bernanke gave a press conference, and he was quite emphatic that the declining employment participation rate is a serious concern.

Gold has been drifting sideways since April. The bulls have argued that the recovery is too weak to taper quantitative easing, and the bears say tapering is inevitable.

Regardless, I think that a trending move will begin very soon, and it will be substantial.

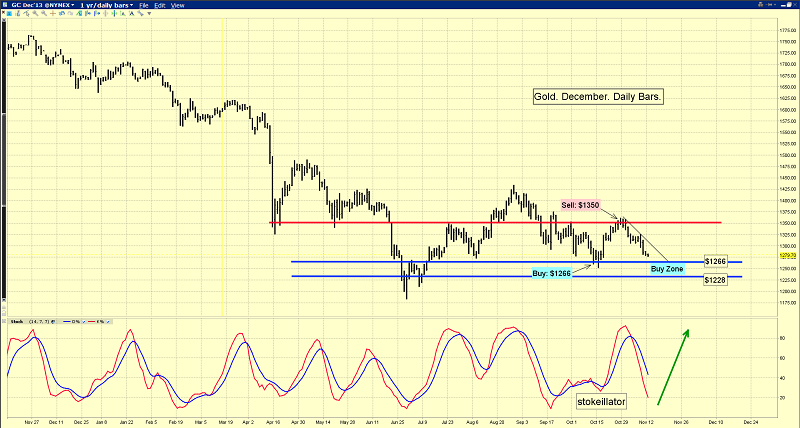

That’s the daily gold chart, and I’ve highlighted an enormous symmetrical triangle pattern. I call it the “Indian Tonnage Triangle”, which may surprise gold analysts who believe the recent price action was caused by “taper caper” talk.

To understand why I’ve given it that label, please click here now. In one of his famous movies, Clint Eastwood says, “A man’s got to know his limitations.” Unfortunately, I don’t think American gold bulls and bears understand their limitations, in regards to affecting the price of gold.

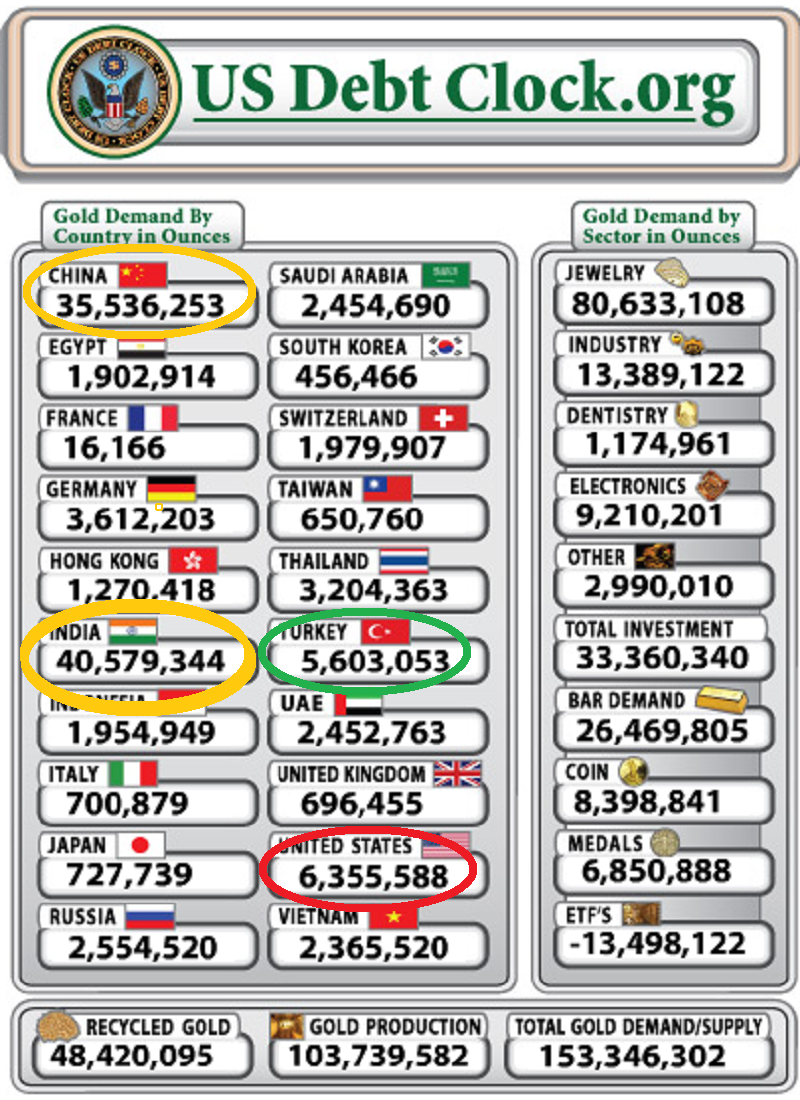

You are viewing a gold demand statistics table, courtesy of US Debt Clock.org. You can see that gold demand from Turkey is beginning to rival American gold demand, but the demand from both nations is relatively small. China and India are the “elephants in the gold room”.

CP Chidambaram is the finance minister of India, and he has successfully implemented draconian measures to reduce Indian gold imports.

Many Indian jewellery businesses have closed, and jewellery stock charts look like the Dow did in 1929. I don’t believe the actions or words of any Western entity are more relevant to gold right now than Indian tonnage numbers.

When an empire grows, the citizens of that empire get a feeling of great importance. When the empire dies, the citizens can believe the death of that empire must also be equally important. That’s not necessarily true.

The citizens of a dying empire may need to ask themselves some key questions. What happens if the death of the American empire is not that important to the price of gold anymore? What happens if the death of the American empire is becoming… irrelevant?

If an American fiat tree falls in an Asian physical gold forest, does it really make a sound?

If America is really becoming irrelevant to the price of gold, and India and China are now the key price drivers, the immediate question on every gold investor’s mind must be, “What can restore Indian gold imports to levels that push the price higher?”

Very few Indian politicians have made the cover of Time magazine, and Narendra Modi is one of them.

Indian national elections are scheduled to begin in May of 2014. Mr. Modi oversees the state of Gujarat. It has a population of 60 million, a 1% unemployment rate, a 10% GDP growth rate, a standard of living equal to Germany, and equity analysts in India have labelled the current Indian stock market price surge, the “the Modi rally”. They believe he will win the national election.

His home state of Gujarat is recognized as one of only two states in India where government corruption has been virtually eliminated.

Many Indians believe that Mr. Modi is a devout Hindu who views gold as a sacred metal. Regardless, if elected, the “Modi Man” has promised to dramatically reduce government corruption, which could open the door to an epic increase in foreign investment. That should eliminate India’s current account deficit surprisingly quickly.

Also, CP Chidambaram is getting old, and he has publicly stated that perhaps it is time for the old guard to retire.

Whether gold’s next big intermediate trend move is to $980 or $1680 should not be a concern for long term investors. Focus on the sizable and consistent growth of the middle class of India and China.

In the shorter term, liquidity flows on US futures markets will likely continue to be a key minor trend price driver. That’s another look at the daily gold chart, highlighting my key buy and sell zones.

I’ve recommended buying the $1266 area, and selling into $1350. That’s worked out pretty well. Note the superb position of my “stokeillator” (14,7,7 Stochastics series). The lead line is now at 20, which is bullish. A crossover buy signal seems to be imminent.

You are viewing the daily chart for XME-NYSE (SPDR SP Metals and Mining ETF). Its holdings include a number of the world’s biggest base metal mining companies. I expect some profits to be booked by institutional money managers, and those profits could flow to the more undervalued precious metal stocks. The strength of gold stocks over the past few trading sessions, compared to gold, suggests that process is underway now.

In China, the government is working hard to increase reform. Two hundred million Chinese citizens exist on wages of about one dollar a day. Despite all the growth so far, there is room for much more. As their wages rise, many will become eager gold buyers.

That gold is found and produced by Western mining companies. QE might get tapered, but does the Chinese and Indian middle class really care? They’re hungry for gold, and getting hungrier all the time!

********

Special Offer For Gold-Eagle Readers: Send an Email to [email protected] and I'll send you my free “Top 3 Takeovers” report! I'll show which 3 junior gold stocks I believe are most likely to be taken over by a larger company, which could create an enormous price surge in these stocks.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: