Monthly Charts Argue For Lower Prices In Precious Metals Complex

The trading month doesn’t always end on a Friday…but when it does we like to take a look at the monthly charts. Generally, I prefer daily and weekly charts, because they have more data points. However, monthly charts carry more significance than weekly charts which possess more significance than daily charts. You get the point. One good reason we expect the current correction to continue is the sector monthly charts.

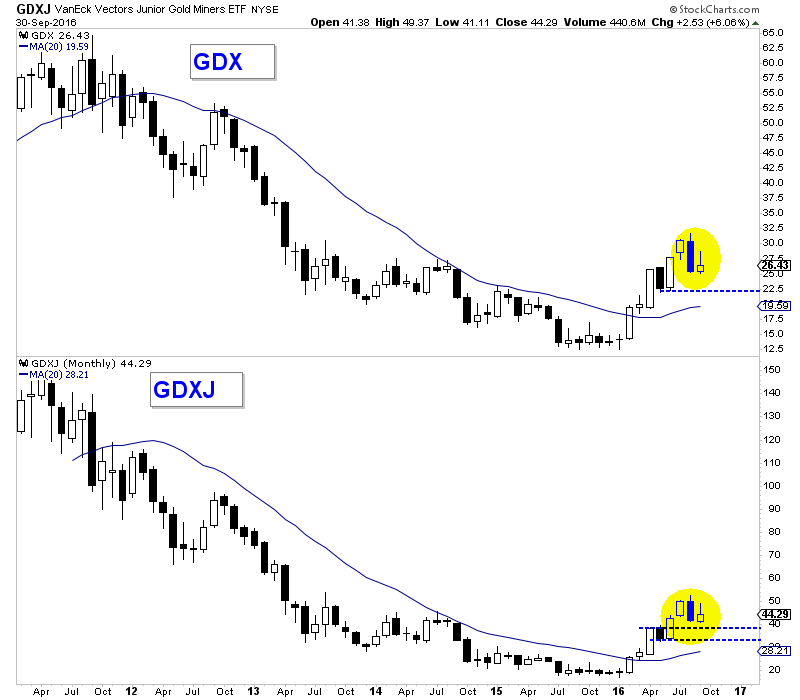

The chart below plots the monthly candle charts of GDX and GDXJ. Earlier this year the miners exploded above their 20-month moving averages and into a new bull market. They were trading at three year highs before a bearish reversal in August that reversed the entire gains from July. September saw a recovery…but failure to hold most of those gains. This tells us that selling pressure remains present and miners will likely see lower prices in October.

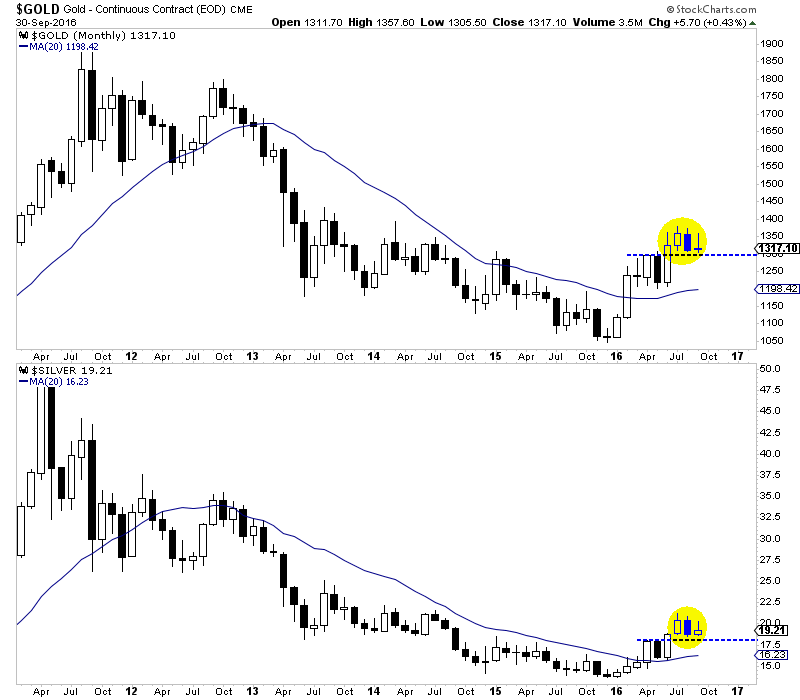

The metals show a similar picture. Markets moved well above their 20-month moving averages but the August candle engulfed July’s candle. In the same time period September recovered only to a small degree. This implies lower prices in October. Gold has support around $1290, while Silver has support near $18. Like the miners, the metals remain a healthy distance above their rising long-term moving averages.

The monthly charts and in particular the action of the past two months lead us to believe lower prices in October are more likely than not. The monthly charts obviously take more time to develop (we have to wait an entire month)…but they are the most significant. Time will tell, however, we see the potential for an important low in October. Traders and investors are advised to wait for lower prices and an oversold condition.

********

We will focus on opportunities scattered amongst individual companies. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017.

Jordan Roy-Byrne, CMT, MFTA