My Report Card for my 2025 Predictions

It’s time for a report card on my 2025 predictions. No sense moving ahead with where I see 2026 going until we see how 2025 went. I try to look back each year to see if I’m getting off track or still staying on course.

Let’s start off with one of my biggest predictions for 2025

I was pretty sure we were heading into a major stock-market crash, and covered that in two or three posts. In the past, my predictions for the stock market have been close to right for scale and very close in timing most of the time. For example, I noted when looking back at the start of 2025 …

The last time I said the stock market was this precariously poised to crash was in early 2020. A month later, the market dove headlong over a cliff, and it took all the king’s horses and all the king’s men to put the market and economy back together again….

That was followed by the biggest bailouts in the history of the world, which isn’t even slightly an exaggeration, by both the Fed and feds working in conjunction with all their strength. That by itself tells you how severe the market’s crash would have been without the biggest bailouts in history, since the Fed couldn’t (as I said would be the case) manage the save all on its own. Even with both the federal government and central banksters pulling together, the S&P plunged around 35%! (“Stock Market Crash in 2025! (Dec. 28, 2024))

The prediction for 2025 that followed that lead-in was not something I stated with as much conviction as I had in 2020 or my next one at the start of 2022, but I did say the following for 2025:

Now the stock market, by a number of measures, is even more precariously poised than it was back then, but we have no idea if anything will come along to break its dangerous overhang loose, though there are plenty of potential black swans circling….

For the record, the last two stock-market crashes I said looked imminent were the one in 2020, which I left at looking likely; while the one in 2022, I said month’s prior was a certainty that would begin in some indices in late 2021 due to the Fed’s tightening. Since then, I have not predicted a market crash, but I am leaning hard into the likelihood of one in 2025. I’m just not sure when.

Well, from March through April, it looked like we got the jarring that would break the precarious overhang loose when the president started his predictable tariff program. That was predictable because he promised it in his campaign, not that he lives up to all of his promises, but I was pretty certain he’d live up to that one. Still, the shelf did not completely break off the side of the mountain into the avalanche I thought was likely because he pulled back hard on his tariffs as the momentum of destruction built in order to arrest the fall. Then he reapplied them over a period of months, like pumping the brakes, and the stock market got more used to betting things up in spite of them. As a result, the year for stocks looked like this for the S&P 500:

The S&P 500 fell just short of 20%, from which it took four months to recover back to where the plunge began. Not quite a crash if you define the minimum amount necessary to call it a “crash” the 20% drop generally accepted as a move into a bear market. Even less of a crash if you look at how well the market did after that.

The NASDAQ did actually eke out the full polar-bear plunge last spring by dropping 23.5%:

So, the market crash kind of happened, kind of didn’t (depending on what index you look at). The prediction was a bit tentative on my end to begin with, compared to other years, so I’m not surprised it was marginal when it did happen, especially when you consider how it went right back to more of the same ludicrous (in my opinion) irrational exuberance.

One thing worth noting now is the same flattening out in the final two months of the year and the complete lack of a Santa Claus rally, which could certainly indicate that the exuberance is getting the wind knocked out of it now that tariffs continue and the economy starts showing signs of weakening under those tariffs and the national debt keeps going up at a phenomenal rate, even though DOGE did its best (or its worst, depending on how you look at both the approach taken and the results) and particularly as investors become more wary of a majority of AI-related companies that show no signs of profits likely to show up in 2026. The market usually ignores government shutdowns, but that probably didn’t help in those last months either.

So, we got an earthquake-sized crack in the market’s crust last spring, but it didn’t deliver a large-scale collapse.

As I warned on Dec. 28, 2024:

Whenever the market has been highly exuberant, let alone its most exuberant ever by several measures, the market has crashed.

I also noted in an earlier December Deeper dive …

“Some Predict a Major, MAJOR Stock Blow-off is Imminent”)… I wasn’t ready then to leap in with a market prediction of my own, but it looks like the melt-up is running out of steam.

In terms of position, companies are trading at the highest level of profits as a percentage of GDP on record, meaning it’s going to be very hard to substantiate a rise in the market in 2025 based on higher profits. That record goes all the way back to 1950. If those profits decline, the market is likely to reprice. You have to ask how these earnings will improve when they are already at their historic highest levels, relative to our typical measure of the economy.

One of the main indicators of a crash I gave for my tepid 2025 prediction was how high the Shiller Price-Earnings ratio was above the levels that proves historically to be a stupid reach into highly precarious territory:

We never had risen above the more normal-looking levels before without a MAJOR wipeout (1929, 2000 and 2021 being the only comparable levels to where we were in late December, 2024 when I warned of a likely and fairly imminent crash in 2025); yet, look at where we are now:

Even higher. The market is hell-bent on pressing toward stupidity like someone trying his hardest to ring the bell at the carnival by using his head as the mallet. While the market did register a big drop in the spring of 2025, it barely notched us down from the ridiculous level attained on the Shiller P/E ratio, and now we’ve pushed even higher. That, however, means the market (now flatlining for two months) is even more precariously overpriced by historic standards than it was before it fell in the spring of 2025.

I noted back when making my 2025 prediction,

So, we have NEVER been at or even near this level without a sizable stock market bubble bust, and usually it came quickly.

We experienced a breakdown, but not a really sizable bust. (The Dow, by the way, only dropped 16% last spring.) We never saw the revision to normal levels that I anticipated in any of the indices. In fact, what I said last December 28, looks to be the same situation this year, only a little worse now:

No wonder Santa … is huffing and puffing to drag his baggage of toys up the slope of the roof. Better pile in now IF you want the downhill sled ride of a lifetime! If that’s too much thrill, think again.

It wasn’t as big as what I thought it would be; so, if you were to ask me, what I’d predict for this year, well, I’ll say that further down.

Stocks and bonds

I also wrote last January that

The stock market’s story for 2025 is going to be the story of the bond market. And the story of the bond market is going to be the story of inflation. It’s a continuation of the same old story I’ve been telling; but it’s more complicated this time….

Well, it turned out to be worse than more complicated. It turned out to be more obfuscated because the government became more corrupt than ever in how it reports statistics and even chose to shut down in order to both avoid reporting statistics and avoid releasing the Epstein Files as Trump covered for corruption. (In fact, the latest Epstein File release included a previously undisclosed statement by Trump that he needed to protect his friends.)

So, both stock and bond investors are relying on increasingly unreliable data, which was never too good in the first place (especially with respect to inflation) but also jobs that have been long overstated and then revised downward when few are looking.

While the bond market faltered for a little bit last year, it didn’t do as badly in face of the monstrously growing debt as I believed it would. With increasingly faulty and obscure government, predictions based on data and trends become increasingly faulty, too.

My bond predictions were based partly on Fed tightening and what happened during previous tightening after long bouts of QE, but the Fed returned to easing interest rates again and tapered its QE sooner this time and even returned to QE in the past month. Still, as you’ll see in Monday’s headlines, we are back to teetering on the edge of a repo crisis, with the Fed having had to inject over a hundred-billion dollars into the repo market at the end of December so banks could balance out with loans. The end of the year is always one of the toughest patches for bank liquidity and the repo market, but this was one of the worst year ends for the repo market. That doesn’t mean ill-liquidity in the banking system will continue past the end-of-year rebalancing. If it does, then we have troubles brewing now.

Again, I think the situation for bonds is only worse as we lead into 2026, but I’m growing weary of trying to predict how long foolishness and blatant government dishonesty can continue as the foolish seem to want to lap up the dishonest reports in furtherance of the fools’ greed, just as Zahra Sethna states quite aptly in her commentary for the start of 2026.

As Sethna draws out in her short video, everything keeps moving toward collapse but at a glacial speed that tries one’s patience because one might rather get it over with and return to a normal world than slog through a world of growing turmoil, dishonesty, confusion and feelings of delirium for years.

The bottom line is that nothing has gotten better with respect to the economy or to government transparency or honesty over the past year (other than stocks climbing successfully back out of their spring hole.) We faced, for example, a bitter fight for the entire year to try to get the Epstein Files released, and while the files are FINALLY being released it is still only with massive redactions; and some of the redactions that hackers removed proved to have nothing under the blackouts that required redaction due to classified reasons, but just facts that were embarrassing for the Trump Admin. to deal with, exactly as nearly everyone feared.

In my mind, the smoke has never been more opaque, and the mirrors have never been this cracked; so, the ability to make economic predictions for the coming year is more fraught with peril for the predictor than ever before. I believe Trump will do ANYTHING he has to to hide bad news, and I believe the market, more greedy by many measures than all but one or two times in history, is more prone to accepting the coverups and the hype as facts because that is what most investors want to believe.

I could actually see that situation developing quickly last year, so I hedged my stock and bond bets based on the growing opacity:

I’m not certain enough of what stocks will do this time to bet all of my economic writing on it. [As I had done in the past.] This time is weirder, so all bets are off. However, I’m sure enough to lay out a prediction for stocks without such a bet … and risk looking like I finally don’t know what I’m saying if I’m wrong. (“THE DEEPER DIVE: Will the Stock Market Dive in ‘25?”)

With a prediction for stocks that was a near-hit but not good enough to satisfy me, I think I barely skirted the edge of looking like I finally don’t know what I’m saying. Some may say I fell over the edge, and they may be right! I’ll leave it up to each person to judge for themselves.

I summed up my stock market prediction for 2025 as follows:

You remember that in the last few weeks, I’ve said that stocks look perilously poised to crash once again, but I stopped short of predicting a crash.

Still, in the end, I finally came down in that article on the side of stocks and bonds both going for broke in synchronized style, partially on the basis that bond investors were back to acting like bond vigilantes, taking bond interest up due to continuing inflation even though the Fed was trying to lower interest rates, and most actual interest rates are pegged on US bonds. That showed the vigilantes did not believe the Fed could lower rates without pushing inflation even higher.

However, the vigilantes wimped out and gave up the fight during the year, and the Fed kept lowering rates, and the government got away with under-reporting inflation to where the inflation consumers and businesses complained they are experiencing looks nothing like what the government is reporting (when it reports at all). We could even have another convenient government closure this month over the same old argument as the budget question comes back up again, though I don’t think either side of congress has the stomach for that right now in a mid-term election year, as both sides know the majority of their electorate won’t be pleased with more of that nonsense.

Thus, my prediction for bonds and the Fed was DEAD WRONG:

The Fed will have to run after bonds further in the direction the bond vigilantes have already headed. It means the bond vigilantes are right. So, Fed interest cuts will grind to a halt….

Didn’t happen.

Inflation, up; bonds, flat

As I said in that Deeper Dive, tariffs are certainly not going to let inflation come down and are more than likely to drive it up. So, inflation pressures will also be increasing above what they already are somewhere down the road this year.

That did happen, but it was slow, as I said by early summer it would be when we saw how tariffs were removed and reinstalled, and inflation was well masked by poor-quality government reporting, or even no reporting so the following did not happen:

Bond investors know that, and will price it in more and more as they hear more about the realities of those tariffs.

Inflation has not come down. Even the faulty government metrics have not managed to show it coming down. It’s been the best the government could do to keep the rate of increase in inflation minimal. In fact, what we saw for inflation was a gradual small rise for 2025 (the tiny upward tail at the end of the following graph of monthly year-on-year inflation readings):

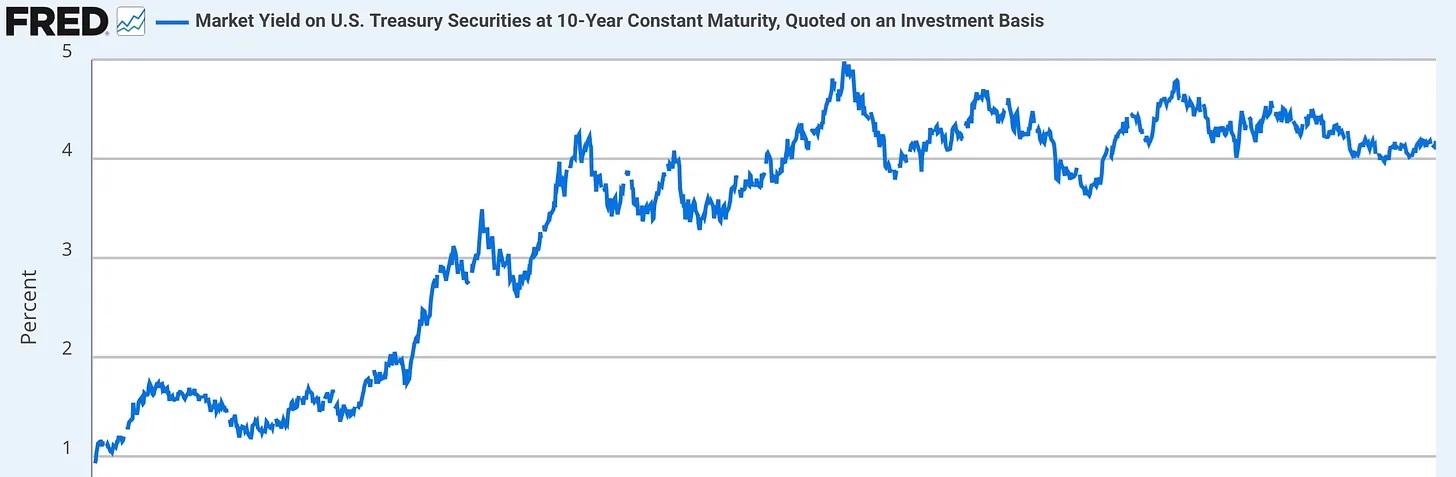

The government’s year-on-year inflation rate (the headline number) has squiggled upward almost every month since last May. So, I wasn’t wrong about inflation, but it has been so understated in these BLS statistics that it failed to capture the attention of bond vigilantes, and bond interest remained completely sanguine as you can see:

So, no bond shakeup. The line is about as non-volatile as it can be, albeit sustained at a higher level than it had been in ’21 and the first half of ’22, following massive the Fed easing that happened during Covid.

This week, I became fairly sure that the bond vigilantes are in this for the long haul; so with inflation highly unlikely to back off in a tariff-filled future, I think Treasury yields will rise until the 10YR crosses that that San Andres fault line for stocks of 5%.

Fail!

What does that mean for 2026?

I haven’t got a clue. No prediction on bonds, having failed completely last year. I think the government will continue to lie through its teeth about inflation to the fullest extent it can pull off. I just don’t know whether it will be able to pull that off all year. Will consumer inflation rise so much under tariffs that the government finally cannot continue the charade, or will retailers and others keeping absorbing the tariffs to the fullest extent they can?

It is clear businesses are saying tariffs are raising their business costs a lot. So, there has been major inflation in business costs as US businesses get hit with US tariffs, but they have not passed most of that on to the final consumers. They have, however, stated clearly that they intend to start passing more of that along to consumers, though they have not stated to what extent nor how soon. If they do it gradually enough, maybe the government can continue to keep a lid on the reported numbers like that upward squiggle at the end of the Bureau of Lying Statistics’ CPI graph.

It does not surprise me that I failed on my bond predictions or that I skirted the edge of failure in my stock predictions, unlike other years where I was largely correct, because I also predicted the likelihood of my failure:

I think 2025 will, in a large overarching sense, be a very unpredictable year because Trump will relish making it so. I think Trump loves creating chaos. It keeps his name in the news, and he can’t stand not seeing his name in the news everyday. So, he’ll create chaos just to stay there but also as a negotiating tactic (or so he claims, at least) to keep is rivals off their game and on their toes and just for the fun of loving a good fight.

Perhaps, instead of the Year of Chaos, I should call this one the Year of Unpredictability, which is its own kind of chaos.

Chaos

Chaos, remained my overarching prediction for 2025 in the express form of “unpredictability.” That couldn’t have proven to be more true, and it is not a prediction I had ever made as a caveat in my dozen or so years of writing on economics—even during Trump 1.0. Though the chaos did not arrive at the end of 2024, as I had originally predicted; it did, however, arrive in 2025 at a level beyond anything I’ve ever seen in government. So, only a couple of months late in arrival; yet, it arrived in every way fully up to scale once it did hit. 2025 was a train wreck for government.

My prediction for chaos in 2025 ran like this:

Expect the largest barrage of law suits you’ve ever seen!

So, expect social outrage to become seriously overheated.

Which means, yes, expect to discover that the chaos I forecasted a little early last year is finally and fully here like a storm that arrived a little later than forecast, but hit with all the fury predicted not long past its projected arrival! Trump is like a small-“g” god of chaos.

The last part of that was and still is, in my opinion of the world as it stands today, smashingly on. I’d have to say, I consider Trump to be the worst president we’ve ever had, and that is in spite of how much I truly could not stand Biden and constantly wrote against him as anyone can go back in this publication and see for themselves (unless they are lazy and would rather accuse me otherwise without taking the time and effort to avail themselves of the facts). I couldn’t stand Biden, and I still say Trump is worse!

Here is what that translates into for 2026:

I think we are only beginning to see how Trump is the master of chaos and just starting to see the costs that chaos and a severe lack of moral values at the top will have for businesses and society. Trump serves no higher calling than himself. I’ll go out on a limb here and predict that many who do not yet see that will start to see it pretty clearly in 2026.

We now even see outrage starting to grow and spread in very obvious ways within MAGA. Many of Trump’s BIGGEST and most influential supporters have turned against him. Granted, many others stay with him, but the divide has become abruptly apparent within less than one year of him being in office, especially as Trump’s lack of any moral code that backs and informs his ideology has become clear under the Epstain Files. That has been a line of demarcation for many in MAGA where the truth about this man’s character starts to emerge for them. (As I said above, Trump’s only ideology is what serves to aggrandize him.)

I predict 2026 will be a year when the chaos gets far worse as MAGA breaks down, and Democrats find some traction against Trump, breaking down his armlock over congress. Of course, the continuing breakdown of the economy under Trump Tariffs, which was not doing so well under Biden to begin with, will add to the social chaos.

Recession

I also predicted a recession for 2025:

Expect a rapidly developing recession due to mass layoffs and tariff wars in an economy that was already faltering on the edge of recession (if it was not fully in one during Biden’s term that was masked by fake statistics).

The first quarter of 2025 was actually reported halfway through the year as being recessionary (negative GDP growth). So, it showed up in data very quickly, but the economy, at least in the government metrics, rebounded in the second quarter and third. A lot of that was due to everyone front-running tariffs in a panic by building up as much of their own production inventory as possible while they could produce at lower prices, and building up their supply inventory.

The third quarter topped out beautifully in the latest revision, but we don’t really know how much of that was due to ramping up production in the summer while tariffs were still being considered and possibly with material inventory that was rushed through in purchases in the spring quarter. We also don’t know how much of those upward revisions to GDP were lying by a government that has shown it wants to bury inconvenient facts as deeply as possible.

In other words, there was a tremendous amount of incredibly anomalous activity during the second and third quarter as businesses admitted they were finding that trying to steer a path through tariffs was almost impossible to manage. So, we don’t really know in aggregate how they managed it or how well. We just know they pulled out all the stops because businesses everywhere were reporting they were doing everything they could think of to limit the impact.

We also know government was breaking down badly under DOGE. It confessed it failed to gather many facts months before the shutdown because it had fewer fact-finders and had to rely more on extrapolations. During the shutdown fact-gathering got far worse. It couldn’t provide enough air-traffic controllers to keep air travel running smoothly. It clearly over-reported jobs so that it had to hugely revise those numbers down, and yet it fired the top dog for being too negative. It’s a total mess, and all the blank spaces in data leave the possibility for lots of lying to fill in the gaps with extrapolations and “adjustments.” Many economists have stepped forward and said they no longer trust the data.

Tariffs were roughly settled into place by the fourth quarter, so we MAY get a better sense of where all of that stabilized—below the recession level or above. However, I doubt that we will. EVERYONE has been saying (even the Fed) that government statistics on jobs and inflation are terribly inaccurate now, and those are the two metrics that most affect determinations of recessions (inflation because it is used to adjust GDP growth or decline) and jobs as being more reflective of how the real economy is doing than anything as the numbers are not affected by inflation because, unlike GDP, they are not measured in dollars. Those are the two primary standards used by the NBER for officially determining a recession; and both metrics are totally messed up right now.

So, I doubt we will get a clear picture of where the economy is. Thus, I’m not going to call my prediction of a recession for 2025 a win or a fail because the year was so full of economic turmoil and data holes that I don’t think there is any clear reading on that. We started to enter recession in the first quarter; got bounced all over the place by efforts to get work done before tariffs hit full force in the second and third quarters; saw government get so busted up so chaotically by DOGE with its ham-fisted ways and then almost completely shut down in the fourth quarter to where I have no faith whatsoever in the government’s already bad statistics, and neither do many other observers.

Employment

I also predicted unemployment would rise rapidly and continually as we moved into spring. The unemployment rate rose very slowly at first, but did rise. However, the jobs numbers that undergird the reality in unemployment seriously turned down in the late summer. Worse still, in the summer, jobs were revised down by about a million from what had been reported over the last half Biden’s year and the first part of Trump’s. Thereafter, monthly job numbers that looked weak but still a bit above recession levels got revised down, and the new numbers went into full recession territory, eventually even turning so bad as to put in negative prints, not just numbers that were recessionary because they didn’t keep up with population growth, but numbers that were so bad that we were stripping jobs away (and those were just the non-government job numbers, so not DOGE-caused layoffs).

Immigration did as I later in the year said I would expect it to—causing a loss of jobs due to some business being unable to move forward, rather than an increase in employment for native-born people. That has particularly proven true in construction where higher-paying jobs in plumbing and electrical wiring have been stalled due to lack of cheap immigrant workers to install insulation, hang sheetrock and put on roofs, etc. (See this article posted earlier this week: “Construction can’t continue: South Texas builders say ICE arrests have upended industry.”)

When parts of a construction job cannot move forward that has sometimes stopped all construction for other workers as the whole job gets held up. US workers have not rushed into those low-paying jobs. (Look for the article on Monday under “Economania” that is all about that.) I said early in the year we’d see that on production lines, too, wherever production depended somewhat on cheap immigrant labor, as fleeing migrants would leave some lines without enough crew to function so whole lines would be shut down. I don’t know if we’ve seen that in production yet or not. We definitely are starting to see it in construction.

So, in all, I think the employment picture was accurate, and the unemployment rate finally started to turn upward at the end of the year, even though Trump came right out and said he fired the director of the department that assembles those statistics because she was reporting such bad results. That didn’t stop the bad results from getting even worse. That’s how bad they are.

Business deaths and bankruptcy

Both of these have seen an increase as the year went on. Nothing catastrophic but definitely worse than they were in the not-so-good Biden years. Two kinds of deaths I predicted:

Expect that we’ll find a lot of unintended business deaths under the rubble as we begin clearing away the debris in the months ahead. That may look like friends who lost their jobs who didn’t even work directly for the government but worked for businesses that ceased to exist as quickly as many restaurants did under the Covid lockdowns.

Then we’ll start to hear later in the year about human deaths due to unexpectedly terminated health programs and aid programs many were dependent on. That’s because some of the lost businesses, just mentioned, will be ones that were deeply invested in government contracts that were actually performing worthwhile functions, such as taking care of the elderly in nursing homes.

Fortunately, we did not see the latter. So, the human death toll was a fail as a prediction, which is good, but the loss of a lot of health care just happened as congress refused to pass on subsidies that were keeping a lot of healthcare going. We also saw that government contracts got seriously cut for private businesses, and we did see that some very large cuts by DOGE had to be hired back because departments could not function under those cuts. So, there will be a lot of losses of medical coverage coming through.

Along these lines of failures, I also predicted that we would see …

more homes and more commercial office buildings littering the landscape with foreclosure-sale signs as the frozen real-estate market gives way to forced sales

My summary report card

Inflation did continue up through the year, albeit very gradually in the flawed government statistics. It was much worse for American businesses who mostly absorbed their own direct tariff hits along with the higher prices they had to pay to other businesses for the parts and materials they used in their own manufacturing due to those businesses paying tariffs. The passthrough has been slow and certainly underreported by the government, but oncoming, and that will continue through 2026. (Successful prediction. At least a “B-”.)

Stocks crashed on the NASDAQ, but it wasn’t as big of a crash as I thought it would be. The plunge barely stopped short of a statistical crash on the S&P, but all recovered splendidly before the middle of the year and roared to new heights. (Partial success. Just a “C.”)

Bonds. (Fail. Period. “F.”)

Chaos and unpredictability. (Smashing success, so an “A+”, but also easy to predict with Trump being in charge and unleashed by having no hope of another term anyway. So, that may be a bit like scoring an “A+” in recess.)

Speaking of which, Recession began and then disappeared entirely beneath the foggy surface of chaos. (So, I can only grade that prediction as inconclusive.)

Employment going down. It didn’t hit in the early spring, but it hit with force in the summer and beyond. The unemployment rate didn’t budge much at first, but it is now rising, even after the department head got fired for “trying to make the president look bad.” “Job losses in one sector” perhaps did not “tip over into adjacent sectors” as predicted; but that is hard to evaluate, and it certainly looks like they are going to do so now. (So, a “B.”)

Business deaths and human deaths and real-estate deaths. Business deaths did increase, as did bankruptcies, but not at a catastrophic level so far (though I did not predict a catastrophic level for either). I’ll give myself a passing grade on that part since I clearly ran wild on the human death toll, but not on the failure of departments under DOGE. I think we may see some human death increase due to trouble in health care, but that will be almost impossible to quantify. We definitely saw the real-estate market begin to die off in terms of pricing and sales for housing (good, of course, for those wanting to buy a home), and we have seen a lot of major real-estate deaths in commercial real estate were the plunge in values continues even as vacancies remain very high. (Grade: C-)

Allowing for the “inconclusive” as not being included in the average, that leaves a grade-point average of about 2.25, or C+, not as good as most years, but I said it would be much more difficult to predict due to all the chaos and difficult to see how the predictions turned out. (Personally, I believe my recession prediction was right on as an “A,” which would bring the average up a good step, but there is no way to prove it.)

********